Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

January 5, 2024

SHARE

Leverage and Margin in Trading: A Double-Edged Sword

Are you curious about how to maximize profits wisely? Most traders utilize

leverage and margin techniques to reach their financial objectives.

Through this article, we will discover the basics, benefits, and risks of

practicing leverage and margin trading. We’ll also see how starting gradually with a conservative approach and

developing strict risk management practices can help achieve trading

success.

As you keep reading further, you’ll also understand the importance of

staying updated and maintaining emotional control. Let’s get started.

What is Leverage in Trading?

Leverage in trading provides an opportunity for traders to maximize their

exposure to the market using a smaller amount of capital. However, it

requires careful risk management to navigate the heightened volatility and

potential downsides associated with amplified positions. Let’s delve deeper.

The Basics of Leverage

Leverage allows investors to control larger positions with a smaller amount

of capital. It magnifies the potential returns and risks associated with a

trade. Now, let’s break down the basics of leverage and understand how it

works through a simple example.

The Meaning

Leverage is the ability to use borrowed funds to increase the size of a

trading position beyond what would be possible with one’s capital alone.

This technique amplifies both potential profits and losses.

How it Works

Let’s understand the workings of leverage through a hypothetical example.

-

You have $1,000 in your trading account.

-

You wish to take a position in a stock.

-

Without leverage, you could only buy stocks worth $1,000.

-

However, with leverage, you will be able to control a much larger

position. -

Assume that your broker offers a leverage ratio of 1:10.

-

This means for every $1 you have in your account; you can control

$10 in the market. -

With your $1,000, you can now control a position size of $10,000

($1,000 x 10).

The Magnified Profit

|

Without Leverage |

With 1:10 Leverage |

|

You have $1,000 and don’t use leverage. |

You use leverage to control a position worth $10,000. |

|

You buy 10 shares of a stock priced at $100 each. |

You buy 100 shares of a stock priced at $100 each. |

|

The stock moves up 5% and you make a $50 profit ($100 x |

The stock moves up 5%, and you make a $500 profit ($100 |

The Loss Potential

While leverage magnifies your profit in this example, it’s crucial to

understand that it works both ways. If the stock had moved against you, the

losses would have been magnified as well. This amplification of both gains

and losses makes leverage a double-edged sword. Thus, traders need to use it

judiciously after considering their risk tolerance and market conditions.

Benefits of Leverage

One of the primary benefits of leverage in trading is its ability to amplify

profits. By using borrowed funds to control larger positions, traders can

potentially increase their returns on investment. Let’s explore this concept

with an example of a successful leveraged trade:

-

A trader has a corpus of $1,000.

-

They believe that a certain stock, currently valued at $20, will

experience a significant price increase. -

Without leverage, the trader could only purchase a limited number of

shares with their available capital. -

However, with leverage, they can control a larger position.

Read the table below to understand the two scenarios:

|

Scenario I: Without Leverage |

Scenario II: With Leverage of 1:5 |

|

Trader has $1,000 |

Trader uses leverage to control a position worth $5,000. |

|

Buys 50 shares of the stock at $20 each. |

Buys 250 shares of the stock at $20 each. |

|

Stock price increases by 10%, resulting in a profit of |

Stock price increases by 10%, resulting in a profit of |

In this example,

-

The trader using leverage was able to generate a higher profit

compared to that made without using leverage. -

Leverage allowed them to control a larger position and, which as a

result, magnified their gains.

How Leverage Helps Traders Gain Access to Markets with Limited Capital

Another significant benefit of leverage is that it enables traders with

limited capital to access markets that would otherwise be out of their

reach. Without leverage, some traders cannot participate in certain

financial markets, such as futures or forex.

For instance, a trader interested in the foreign exchange market may find it challenging to trade large positions with a limited amount of capital.

Leverage allows them to:

-

Control more significant positions and

-

Participate in markets that require a substantial amount of capital

to trade effectively

Risks Associated with Leverage

While leverage can enhance potential profits, it comes with the inherent

risk of amplifying losses. Let’s have a closer look at the risks associated

with leverage through examples:

1. The Fall of Long-Term Capital Management (LTCM):

-

In the late 1990s, LTCM, a hedge fund led by Nobel laureates and

financial experts, collapsed due to excessive leverage. -

LTCM used high levels of leverage to amplify returns by betting on

converging bond spreads. -

When the Russian financial crisis hit in 1998, it triggered massive

losses for LTCM. -

Eventually, LTCM was bailed out by major financial institutions to

prevent a systemic collapse.

2. Retail Trader “Blow-Up” Events:

Usually, individual retail traders face significant losses due to aggressive

use of leverage, especially in volatile markets.

Let’s explore this situation through a hypothetical example:

-

A trader with $5,000 in their account uses 50:1 leverage to control

a $250,000 position in the forex market. -

If the market moves against them by just 2%, they could lose their

entire initial investment. -

This scenario demonstrates the rapid and drastic impact of excessive

leverage.

What is Margin Trading?

When practiced following the right approach, margin trading can magnify

profits. However, the same magnification that increases potential profits

also amplifies potential losses. Risk management strategies are essential to

mitigate these risks and ensure responsible use of margin accounts. Here’s a

detailed exploration.

Understanding Margin

Margin trading is a practice where investors borrow funds from a broker to

trade financial instruments, leveraging their buying power. In a margin

trade, a trader uses their existing capital alongside borrowed funds to take

larger positions in the market.

What is a Margin Account?

-

A margin account is a specialized brokerage account that allows

traders to borrow money to increase their position size. -

It is different from a cash account, where trades are executed only

with the trader’s capital. -

In a margin account, a trader can execute trades using both own

capital and borrowed funds.

What are some Typical Margin Requirements?

Margin requirements represent the minimum amount of capital that must be

maintained in a margin account. It acts as a security to cover potential

losses. These requirements can vary between brokers and market conditions.

Commonly expressed as a percentage, margin requirements range from 25% to

50% or even more. For example, if a trader wants to buy $10,000 worth of

stock with a 50% margin requirement, they will need to have $5,000 in their

account. The broker would lend them the remaining $5,000.

The margin percentage usually depends on the asset’s:

-

Class and

-

Volatility

The Advantages of Margin Trading

One of the key advantages of margin trading is the ability to increase

buying power. Traders can control larger positions in the market with a

relatively smaller amount of capital. This amplification allows for

potentially higher profits, as gains are calculated on the total position

size.

Let’s understand through an example:

-

A trader has $5,000 in a margin account with a 2:1 leverage ratio.

-

This means they can control a position worth $10,000 (2 times their

capital). -

Without leverage, their buying power would be limited to $5,000.

-

If the trader uses leverage to buy $10,000 worth of stock and the

stock appreciates by 10%, their profit would be $1,000 ($10,000 x

10%).

Furthermore, flexibility is another advantage offered by margin accounts.

Traders can not only go long (buy) on assets but also short sell. This

flexibility provides opportunities to profit in both rising and falling

markets.

What is Short Selling?

-

Short selling involves selling an asset at the current market price

without having a long position in it. -

Later, the same asset is repurchased at a lower price.

-

The short seller thereby profits from a decline in the asset’s

value.

Risks of Margin Trading

Margin trading introduces a significant level of risk. Understanding the

concept of a margin call is crucial for any trader involved in leveraging

their positions. Here’s a complete breakdown of this concept.

What is a Margin Call?

-

A margin call occurs when the value of an investor’s margin account

falls below the broker’s required amount, known as the maintenance

margin. -

This happens when the losses on the leveraged positions result in a

deficit in the account. -

In response, the broker demands that:

-

The investor deposits additional funds or

-

Sell some of the assets held in the account

-

-

This demand is made to restore the account balance to the required

level.

How a Margin Call Gets Triggered

|

Events |

Explanation |

|

Initial Position |

A trader opens a position using borrowed funds in a |

|

Market Movement |

If the market moves against the trader and the value of |

|

Maintenance Margin Breach |

When the account balance falls below the maintenance |

|

Broker’s Demand |

The broker requests the trader to deposit additional |

What are the Risks of Margin Trading?

While margin trading can amplify profits, it equally magnifies losses. If a

trade goes against the trader, the losses will be proportionally larger, and

they may even exceed the initial investment.

Further,

-

In volatile markets, prices can experience rapid and unpredictable

fluctuations. This increased volatility can lead to more frequent

and severe margin calls. -

Borrowed funds in margin trading come with interest costs. If the

trades are held for an extended period, interest payments can

accumulate, eating into potential profits.

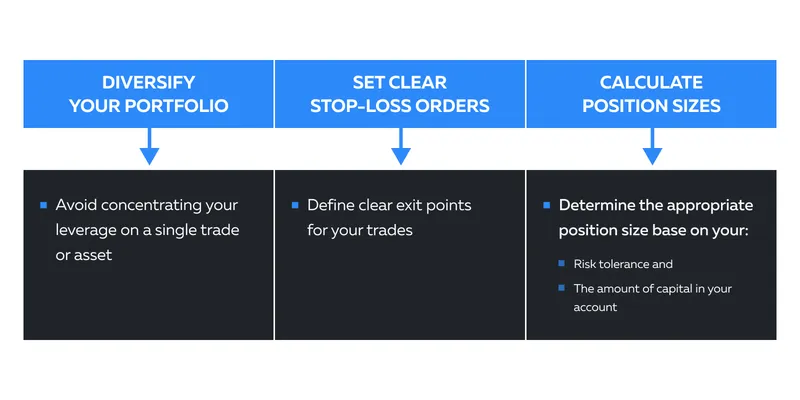

Strategies for Using Leverage and Margin Wisely

By incorporating certain best practices into your trading approach, you can

use leverage and margin as effective tools without exposing yourself to

unnecessary risks. Responsible use and strict risk management are key to

long-term success in the world of leveraged trading. Let’s explore the

strategies in depth.

Best Practices

Additionally, traders can also use advanced market analysis tools like

Bookmap. These help in margin trading and leverage by providing various

tools and features that allow traders to understand and manage their

positions effectively.

For instance, Bookmap offers:

-

Real-time heatmap

-

Transparent order flow visualization, and

-

Adaptability to evolving market dynamics

These features can help traders make more informed decisions and understand

market trends with precision.

Responsible Use of Leverage and Margin:

Follow these tips to responsibly use leverage and margin:

|

Tips |

Explanation |

|

Start Small |

|

|

Gradually Increase Leverage |

If you choose to use leverage, start with a conservative |

|

Understand the Market Conditions |

|

|

Regularly Review and Adjust |

|

|

Monitor Margin Levels |

|

|

Be Disciplined |

|

Avoiding Common Pitfalls

Having unrealistic “get rich quick” expectations and assuming that leverage

is a shortcut to quick wealth can lead to reckless decision-making. The

traders must acknowledge that trading involves risks, and success often

comes from disciplined, well-informed decisions over time rather than

instant riches.

Hence, efforts must be made to:

-

Understand the mechanics of leverage thoroughly.

-

Realize that while leverage can amplify profits, it equally

magnifies losses. -

Gain a realistic understanding of the dynamics of leverage.

One of the biggest pitfalls of leverage trading is not knowing how to use

leverage. Let’s understand this statement through the table below:

|

Pitfalls |

Meaning |

Avoidance Strategy |

|

Over-leveraging |

Employing leverage beyond the account size. |

Set Maximum Leverage Ratio:

|

|

Ignoring Margin Requirements |

Failing to understand or disregard margin requirements. |

Monitor Margin Regularly:

|

|

Neglecting Stop-Loss Orders |

Failing to set stop-loss orders, exposes the trader to |

Implement Stop-Loss:

|

|

Underestimating Market Volatility |

Underestimating the speed at which market conditions can |

Stay Informed

|

|

Lack of a Comprehensive Risk Management Plan |

Trading without a well-defined risk management strategy. |

Develop a Plan

|

|

Psychological Pressure of Leverage and Margin |

The pressure of trading with borrowed money can lead to |

Practice Discipline:

|

Conclusion

Margin and leverage trading can let you control a bigger position size with

a small amount of capital. However, to fully gain its benefits, traders

require a strong foundation of knowledge, discipline, and cautious strategy.

All novice traders should start with small amounts and gradually increase as

their experience grows. Further, they must follow rigorous risk management,

including well-defined plans for leverage, and use margin with caution.

Now that you’re equipped with knowledge about leverage and margin, take the

next step in refining your trading skills by understanding common money

management mistakes. Explore our insightful guide, ‘Top 4 Money Management

Mistakes,’ to enhance your overall trading strategy and avoid pitfalls that

could affect your financial success.

Learn About Money Management Mistakes.