Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

January 5, 2024

SHARE

Market Cycles: The Key to Timely Trading Decisions

Are you aware of the rhythmic patterns that guide financial markets? These

patterns, also called ‘market cycles’, occur during times of growth and

decline.

Understanding these cycles helps in spotting emerging market trends and

making smarter investment decisions. Through this article, we will

understand the strategies for each phase after considering the principles of

adaptability, diversification, and risk management.

Whether you’re a seasoned trader or just starting, this article lets you

know the secrets of market cycles and makes you a better market participant.

The Types of Market Cycles

Understanding economic cycles is crucial for investors. By recognizing the

different phases of a market cycle, investors can:

-

Adjust their portfolios to align with the prevailing economic

conditions and -

Potentially capitalize on opportunities while mitigating risks.

Let’s break it down and explore it in detail.

Economic Cycles

Economic cycles (alternatively called ‘business cycles’) are recurring

fluctuations in economic activity characterized by the following phases:

-

Expansion

-

Peak

-

Contraction, and

-

Trough phases

These cycles have a profound impact on various financial instruments,

including stocks, bonds, and commodities. Read the table below to understand

the different phases of the market cycle:

|

Phase |

Explanation |

Investor Action |

|

Expansion Phase |

During the expansion phase, the economy experiences

|

Investors favor riskier assets, such as stocks, and |

|

Peak |

The peak represents the height of economic activity,

|

Investors closely monitor economic indicators to gauge |

|

Contraction Phase |

Contractions, also known as recessions, follow the peak

|

Investors turn to safer assets like bonds as they seek |

|

Trough |

The trough marks the lowest point of the economic cycle,

|

Investors start looking for opportunities in the stock |

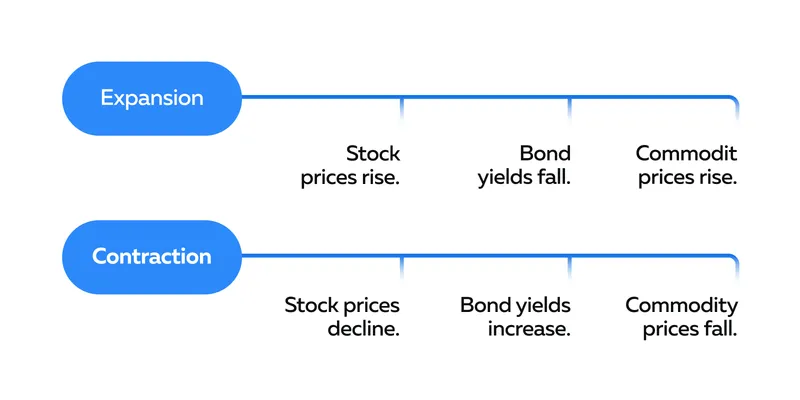

How Do Phases Impact Financial Instruments?

Market cycles affect stocks, bonds, and commodities in various ways during

their different stages:

-

Stocks:

-

In the expansion phase, stocks perform well as companies

generate higher profits. -

During contractions, stock prices decline, but selective

investments may offer value during the trough.

-

-

Bonds:

-

Bonds are considered safer investments during contractions as

interest rates often decline. -

Investors seek the relative stability and fixed income that

bonds provide in uncertain economic times.

-

-

Commodities:

-

During expansions, demand for commodities rises, leading to

higher prices. -

In contractions, commodity prices decline due to reduced demand.

-

Seasonal Cycles

Seasonal cycles refer to predictable patterns that occur during specific

times of the year. These cycles are visible in the commodities and retail

sectors and are influenced by the following factors:

-

Weather

-

Holidays, and

-

Consumer behavior.

Let’s understand this concept in-depth.

The Major Commodities

|

Agriculture Commodities |

Energy-based Commodities |

|

Spring Planting:

|

Summer Driving Season:

|

|

Harvest Season

|

Winter Heating Season

|

The Retail Stocks

-

Holiday Season:

-

Pre-Holiday:

-

Retail stocks experience a boost in anticipation of

increased consumer spending during the holiday season. -

Investors choose to buy retail stocks before this period,

expecting a rise in sales and stock prices.

-

-

Post-Holiday Sales:

-

After the holiday season, some retail stocks experienced a

dip. -

Investors explore buying opportunities as companies may

recover through post-holiday sales and promotions.

-

-

-

Back-to-School Season:

-

Investors put money in retail companies that sell school

supplies before the back-to-school season. -

They anticipate a surge in consumer spending during this time.

-

How Weather Impacts Prices

Let’s explore how weather influences crude oil and retail clothing to grasp

this concept.

|

Crude Oil |

Retail Clothing |

|

|

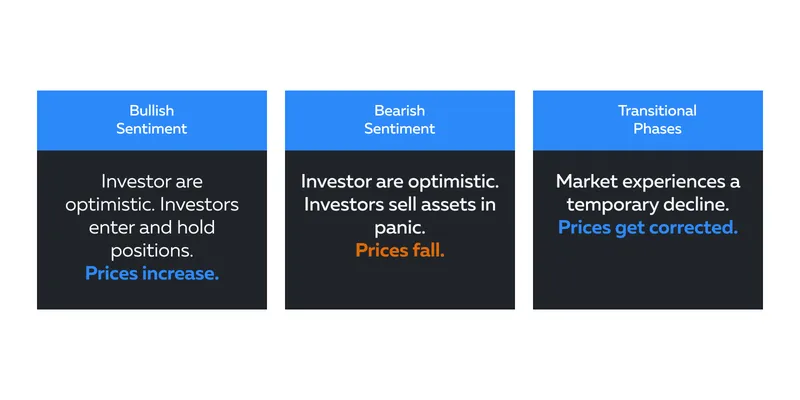

Sentiment Cycles

Sentiment cycles refer to the fluctuating emotions of market participants, which influences their perceptions of the financial

markets. These cycles play a crucial role in:

-

Shaping market trends and

-

Providing valuable insights

By understanding sentiment cycles, investors understand and respond to

shifts in market sentiment.

How Do Sentiments Impact Market Trends?

-

Bullish Sentiment:

-

During periods of bullish sentiment, investors are optimistic

about the market’s prospects. -

This optimism leads to rising stock prices.

-

More market participants buy and hold securities, anticipating

further gains.

-

-

Bearish Sentiment:

-

This sentiment reflects a pessimistic outlook on the market.

-

In this phase, investors sell off assets due to fear and

uncertainty. -

This bulk sale leads to a decline in prices.

-

-

Transitional Phases:

-

Sentiment cycles also include transitional phases, such as

corrections. -

During this period, the market experienced a temporary decline

before resuming its previous trend. -

Identifying these phases is crucial for investors to

differentiate between a:-

Short-term correction and

-

More prolonged trend reversal.

-

-

How to Identify Shifts in Market Sentiments

To identify the prevailing market sentiments, investors can perform the

following actions:

-

Monitor news headlines, significant news events, economic data

releases, or geopolitical developments. -

Track social media platforms, forums, and online communities. These

act as sentiment indicators. -

Perform technical analysis using tools, like Bookmap, to identify shifts in sentiments.

-

Chase economic indicators, especially those related to consumer

sentiment to valuable information. For example, a decline in

consumer confidence may signal a potential shift towards bearish

sentiment.

Analyzing and Responding to Market Cycles

To gain trading success, understanding and responding to market cycles is

pivotal. This involves analyzing recurring patterns to make informed

decisions that align with the evolving phases of growth, stagnation, and

decline. Let’s start by exploring how to identify different phases.

Identifying the Phase of a Market Cycle

Investors can use various techniques and indicators to identify where the

market stands in its cyclical pattern.

Economic Indicators:

-

GDP Growth:

-

Monitoring Gross Domestic Product (GDP) growth rates provide

insights into the economic cycle. -

High GDP growth often indicates an expansion phase, while a

decline may signal a contraction.

-

-

Employment Data:

-

Low unemployment rates are associated with expansion while

rising unemployment signals contraction.

-

Technical Analysis:

-

Moving Averages:

-

Using moving averages, such as the 200-day moving average,

identifies trends and potential turning points in the market

cycle. -

Crossovers and deviations from these averages signal changes in

momentum.

-

-

Relative Strength Index (RSI):

-

RSI indicates whether a market is overbought or oversold.

-

This indicator provides insights into potential trend reversals.

-

Sentiment Analysis:

-

Contrarian indicators:

-

These represent the ratio of bulls to bears in investor surveys

and signal potential reversals. -

Extreme bullish sentiments precede market peaks, while extreme

bearish sentiments indicate potential buying opportunities.

-

Some Common Case Studies and Hypothetical Examples

Read the table below to understand how techniques have been used effectively

in the past.

|

Case Study |

Indicators |

Investor Response |

|

2008 Financial Crisis |

Leading up to the 2008 financial crisis, indicators such |

Investors who recognized these signals:

|

|

Technological Bubble Burst (2000): |

During the late 1990s, the technology sector experienced

Indicators like extreme overvaluation of tech stocks |

Investors identifying these signs:

|

Adjusting Trading Strategies for Market Cycles

Investors need to adjust their trading styles to respond effectively to the

various phases of market cycles. Let’s understand the ideal strategies

below:

Expansion Phase

-

Focus on Growth Stocks:

-

In the expansion phase, growth stocks tend to outperform.

-

Allocate a portion of the portfolio to technology and consumer

discretionary sectors.

-

-

Cyclical Sectors Emphasis:

-

Allocate resources to cyclical sectors like industrials and

materials. -

These sectors benefit from increased economic activity and

infrastructure development during expansion.

-

-

Maintain a Higher Risk Appetite:

-

Given the optimistic market sentiment, most investors consider

taking on slightly more risk, such as investing in small-cap

stocks or high-beta equities.

-

Recession Phase Strategy

-

Defensive Stocks:

-

Defensive stocks are less sensitive to economic downturns.

-

Allocate a significant portion of the portfolio to defensive

sectors like utilities and healthcare.

-

-

Quality Dividend Stocks:

-

Invest in companies with a history of consistent dividends.

-

These stocks offer income during recessions and provide a buffer

against market volatility.

-

-

Safe-Haven Assets:

-

Consider allocating a portion of the portfolio to safe-haven

assets like gold and treasury bonds. -

These assets perform well during economic uncertainties.

-

How to Diversify? – Top 3 Tips

Diversifying investments across different sectors, geographies, and asset

types allows investors to lower their risk and optimize their portfolios for better risk management. Let’s understand the most followed diversification strategies:

|

Sector Diversification |

Asset Class Diversification |

Geographical Diversification |

|

|

|

How to Implement Risk Management

To optimize returns and minimize potential downsides, investors must develop

rigorous risk management strategies. They can do the following:

-

Set Stop-Loss Orders

-

Implement stop-loss orders to limit potential losses.

-

During market volatility, these orders automatically sell a

position if it reaches a predetermined price. -

Such an automatic execution protects profits or minimizes

losses.

-

-

Asset Allocation Rebalancing:

-

Periodically rebalance the portfolio to maintain the desired

asset allocation. -

This practice ensures that the portfolio aligns with the

investor’s risk tolerance and financial goals.

-

-

Stay Informed

-

Stay informed about economic indicators, news, and market

sentiment. -

Regularly assess the portfolio’s performance.

-

Adjust strategies based on evolving market conditions.

-

Common Mistakes and How to Avoid Them

By recognizing and actively addressing common mistakes related to market

cycles, traders can:

-

Enhance their decision-making processes and

-

Improve overall portfolio performance

Read the table below to understand some common mistakes made by traders and

the strategy to avoid them.

|

Common Mistakes |

Explanation |

Avoidance Strategy |

|

Misinterpretation of Economic Indicators |

Traders struggle to accurately identify the current |

|

|

Overreacting to Daily Volatility |

Traders overreact to short-term market fluctuations and |

|

|

Lack of Diversification |

Traders overconcentrate investments in a single sector |

|

Overreaction to Market Noise

Traders should be cautious about overreacting to short-term news or events

that do not necessarily signal a significant shift in the market cycle.

Thus, traders must verify the information from multiple sources.

Further, traders must establish a well-thought-out trading plan that

considers the long-term market cycle. They must avoid deviating from the

plan based on short-term market noise to prevent making impulsive and

suboptimal decisions.

Implementing Market Cycle Analysis in Trading

By incorporating market cycle analysis into trading plans, traders ensure

that the trading plan remains responsive to changing market conditions and

allows for timely adjustments. Read the guide below detailing the

step-by-step integration process.

Integrating Cycle Analysis into Your Trading Plan

Here’s the integration guide:

-

Step I: Expand Knowledge Base:

-

Understand the various phases of the market cycle.

-

Familiarize yourself with key economic indicators that signal

transitions.

-

-

Step II: Economic Indicator Alerts:

-

Utilize financial news platforms and economic calendars to set

up alerts for key indicators such as:-

GDP growth

-

Unemployment rates, and

-

Consumer confidence

-

-

These alerts notify you of potential shifts in the economic

cycle.

-

-

Step III: Use Sentiment Analysis Tools:

-

Incorporate tools like Bookmap to visualize market liquidity and

sentiment changes. -

Create custom visualizations to highlight:

-

Key support and resistance levels

-

Large order imbalances, or

-

Sudden shifts in sentiment.

-

-

-

Step IV: Real-Time Monitoring:

-

Regularly monitor Bookmap during trading sessions to stay

informed about evolving market dynamics. -

Pay attention to:

-

Order flow

-

Trading volumes, and

-

Liquidity changes.

-

-

-

Step V: Regularly Review Cycle Positioning:

-

Establish a routine for reviewing your portfolio’s positioning

in relation to the market cycle. -

During these reviews, evaluate the allocation of your portfolio

across different sectors and asset classes. -

Ensure that your positions align with the prevailing market

conditions and economic cycle phase.

-

Focus on Adaptability

Adapting in a trading plan is crucial as it allows traders to stay

responsive to ever-changing market conditions. Here’s how you can remain

adaptive:

-

Acknowledge the dynamic nature of market cycles and be prepared to

adapt your trading strategies. For example, shift focus between

growth and defensive stocks based on the economic outlook. -

Adjust risk management parameters based on the current phase of the

market cycle. In periods of heightened volatility or economic

uncertainty, consider tightening stop-loss levels to protect against

larger drawdowns. -

Be flexible in sector rotation based on economic indicators. If

leading indicators suggest an economic slowdown, consider rotating

into defensive sectors like utilities and healthcare. -

Modify asset class allocations as market conditions evolve. For

instance, during economic expansions, allocate more to equities,

while during contractions, increase exposure to fixed-income assets.

Conclusion

Understanding market cycles is vital for successful trading. Traders must

strategically adjust portfolios, by focusing on growth stocks during

expansions and defensive assets in recessions.

Diversification and effective risk management help traders to optimize

portfolios and achieve long-term success. Additionally, the usage of

advanced market analysis tools like Bookmap offers a competitive advantage

and an enhanced ability to spot emerging patterns via depth-of-market

visualization.

As you refine your approach to trading with market cycles, understanding

market correlations becomes increasingly important. Discover how different

markets and assets interact and influence each other in our in-depth guide,

‘Market Correlations: Why They Matter and How They Impact Your Trading

Journey.’ This resource will complement your knowledge of market cycles and

enhance your trading strategy.

Explore the Guide Here.