20% Off Just for Blog Readers — Until June 30

Use code BLOG20-JUNE at checkout to get 20% off your first month.

News & Announcements

May 5, 2025

SHARE

Mixed Signals: European Markets Hold Firm Amid Economic and Sector Shifts

The only constant in the market is change! European market trends in 2024 are proving just that. The latest developments indicate rising bond yields and geopolitical tensions. Thus, you must stay sharp to operate profitably as an investor or trader in such an environment.

Want to know how? This article will explore STOXX 600 performance, highlighting current sector winners (like energy and industrials) and sector strugglers (like consumer and healthcare stocks). We’ll also learn about macroeconomic factors, from inflation to bond yield movements, and discuss how sector rotation in European stocks influences investment strategies.

Do you want to position yourself wisely using economic indicators? Read this article till the end.

What’s Driving European Market Stability?

The European stock market is resilient in 2025, even as different sectors experience ups and downs. This stability is mainly due to:

- Investor confidence,

- Strong corporate earnings in key industries, and

- Macroeconomic trends.

Let’s understand these major factors in detail:

- The STOXX 600 Performance

One of the key indicators of European market trends in 2024 is the STOXX 600 index. It tracks 600 large, mid, and small-cap companies across Europe. Despite fluctuations in specific sectors, the index has remained relatively steady.

The stability of the index suggests that investors are still optimistic about the broader market. Even as some industries struggle, strong performance in others is helping to:

- Balance the market,

and

- Prevent sharp declines.

- Sector Influence

Sector rotation in European stocks is another major factor in market movements. In 2025, energy and industrial stocks are making substantial gains. They are supported by rising commodity prices and infrastructure investments.

On the other hand, healthcare and consumer staples (which traditionally offer stability) are facing challenges due to:

- Cost pressures,

and

- Changing consumer spending habits.

As an investor, you should shift your focus toward industries expected to perform well in the current economic environment.

- Macroeconomic Data

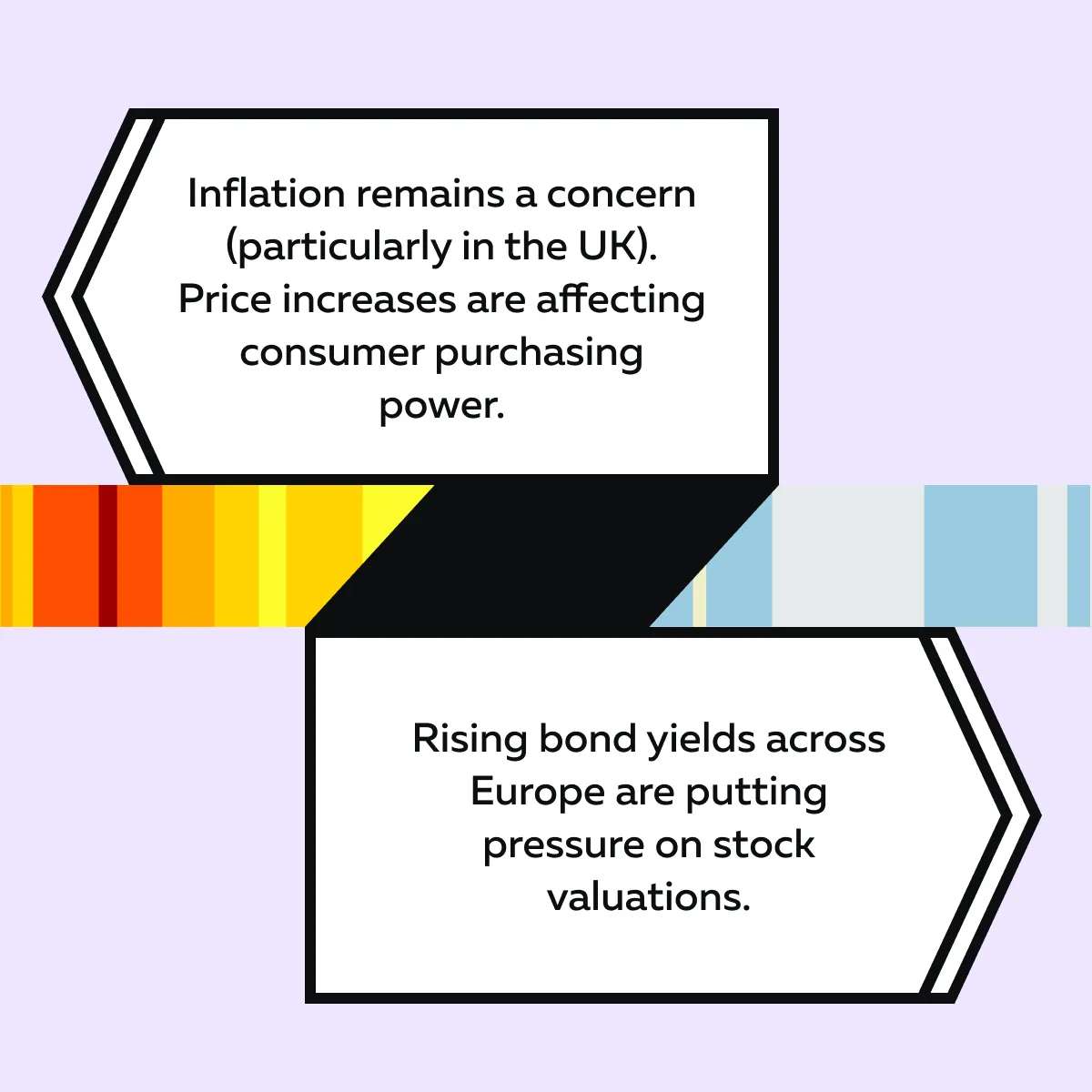

Broader economic factors also play a role in analyzing the European stock market. Check out the graphic below to learn how:

However, despite these challenges, the market has not experienced significant downturns. Strong corporate earnings and expectations of steady economic growth are supporting investor confidence.

The Crux

European market trends in 2024 suggest a balanced environment where some sectors outperform while others lag. As an investor, you must closely watch:

- Economic data,

- Central bank policies, and

- Corporate earnings.

Get ahead of market sentiment by analyzing price reactions across key European indices.

Key Economic Factors to Watch

In 2025, several economic factors will influence investor sentiment and sector performance. By keeping an eye on them, you can better understand European market trends in 2024 and smartly allocate your funds. Some common factors you can track are:

- Movements in bond yields,

- Inflation trends, and

- Corporate actions that affect specific industries.

Let’s understand them in detail:

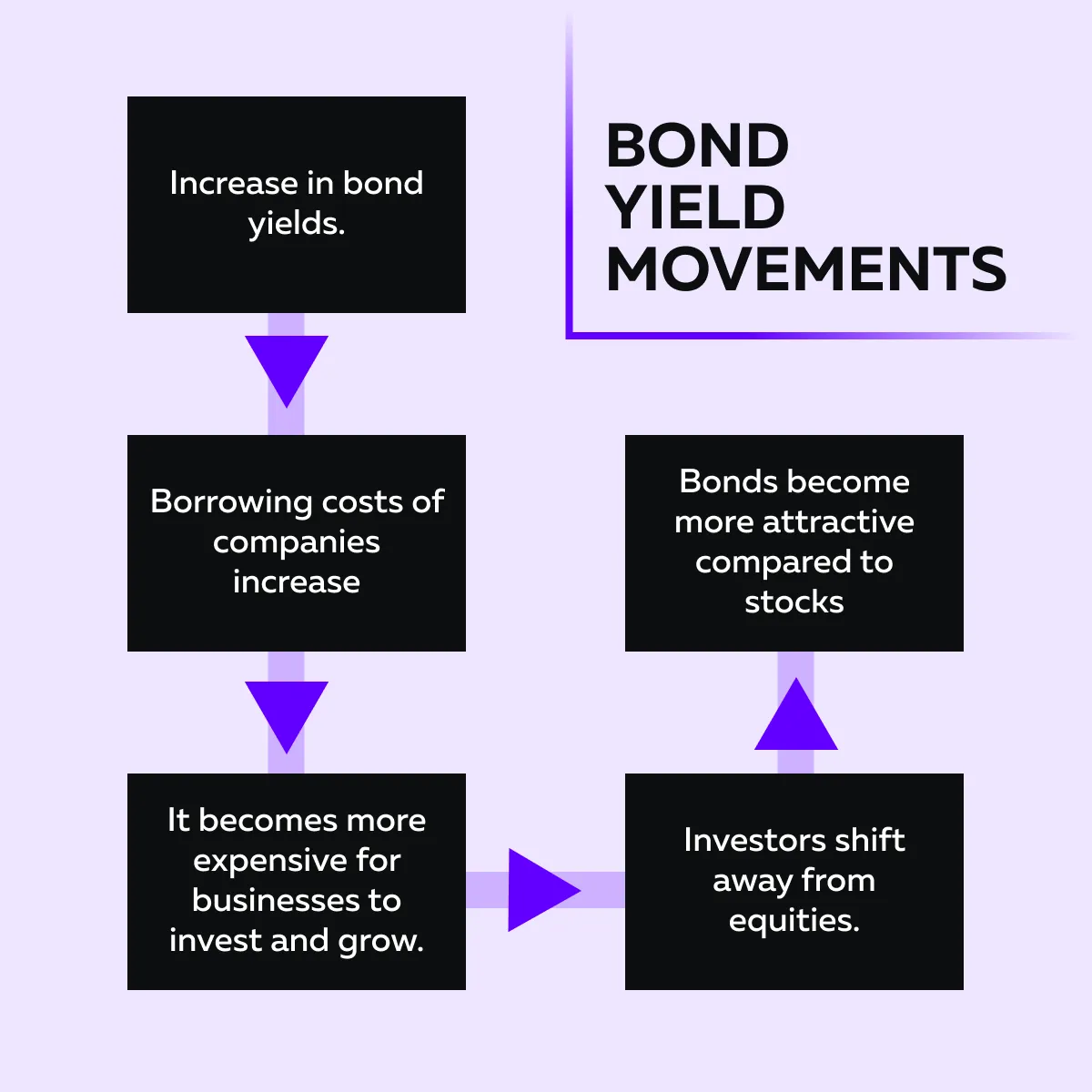

A) Bond Yield Movements

Eurozone bond yields have been rising for four consecutive days. This increase in yields could create challenges for stocks. Learn why this is happening through the graphic below:

Such a situation significantly impacts STOXX 600 performance, particularly in sectors that rely on cheap financing (such as real estate and technology).

B) Inflation Trends

The UK’s inflation rate has hit 3.0%, a ten-month high. As you’re already aware, rising inflation affects both consumers and businesses. When prices go up, people spend less on non-essential goods. This constraint on spending impacts companies in the retail and consumer sectors.

At the same time, higher inflation puts pressure on central banks to adjust interest rates. If the Bank of England or the European Central Bank signals a tighter monetary policy, it could:

- Impact market sentiment,

and

- Lead to shifts in investment strategies.

C) Corporate Moves

Large companies continue to make strategic decisions that influence sector rotation in European stocks. For example,

- BP is selling its Castrol unit. It is a move that could reshape competition in the energy and industrial sectors.

- Meanwhile, Antofagasta (a major mining company) has received a rating boost. This boost signals confidence in its future performance.

You must understand that these corporate actions play a significant role in shifting market momentum. Thus, in response, you should adjust your positions based on these industry changes.

Defense Stocks on the Rise Amid Geopolitical Uncertainty

Defense stocks in Europe are gaining traction. Geopolitical tensions and increased military spending are pushing investors toward this sector. Governments across Europe are prioritizing national security, which leads to:

- Higher defense budgets,

and

- Long-term contracts for key industry players.

Why Are Defense Stocks Rising?

Some major factors driving the rise in defense stocks are:

| Increased Military Spending | Geopolitical Risks | Supply Chain Resilience |

|

|

|

Keep up with evolving market trends by tracking real-time liquidity shifts.

Key Players Benefiting from Market Shifts

Major European defense stocks that have seen sharp price increases are:

- BAE Systems,

- Rheinmetall, and

- Thales.

These companies are surging in value as investors recognize the sector’s growth potential. These companies are also securing large contracts from European governments. This further solidifies their market position.

Impact on STOXX 600 Performance

Defense companies are gaining momentum, contributing positively to STOXX 600 performance. In the future, defense spending is expected to continue growing.

In such an environment, ETFs focused on European defense stocks and companies like Leonardo and Saab are expected to remain strong investment options.

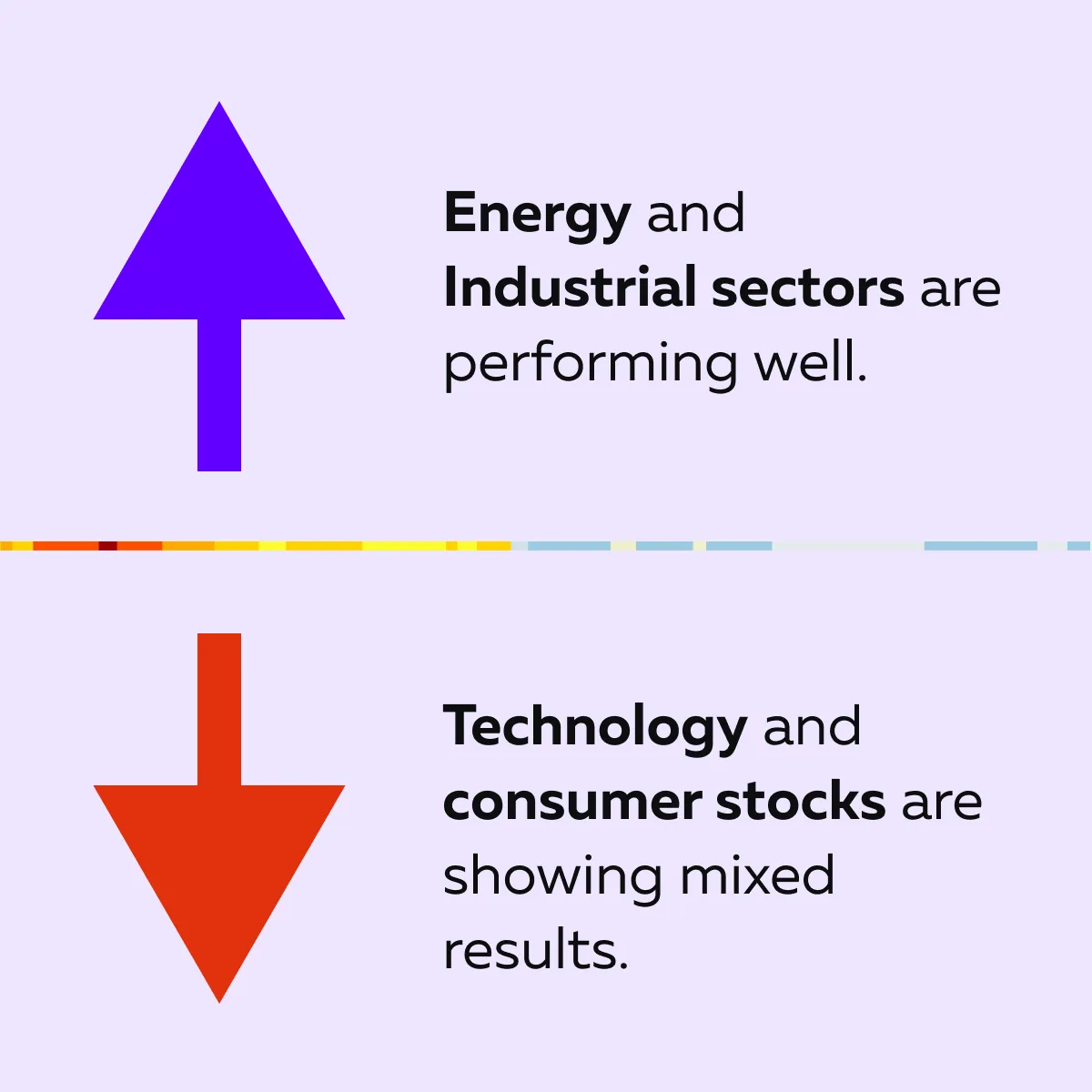

Sector Winners and Losers in Europe’s Market Landscape

As per the latest European market trends in 2024, some industries are seeing substantial gains, while others face challenges. Learn more through the graphic below:

Let’s understand in detail:

A) Energy Sector Gains from Oil Price Strength

Rising oil prices have helped boost the energy sector. Companies like BP are seeing stock gains due to increased investor confidence. Recently, BP’s stock climbed due to:

- Positive sentiment around its asset sales,

and

- The overall strength of oil prices.

Additionally, geopolitical concerns and supply constraints are also pushing energy stocks higher. The oil supply is expected to remain uncertain due to global conflicts and production limits. As an investor, consider betting on energy companies.

B) Industrial Stocks Show Resilience

Industrial stocks remain strong due to renewed optimism in the mining sector. A key example here is Antofagasta. It recently received an upgrade from J.P. Morgan, reflecting confidence in its future growth.

Additionally, Germany’s stock market also reflects this trend. Its main index rose 0.3%, showing that industrial sentiment remains positive. Moreover, this strength in industrial stocks contributes to sector rotation in European stocks as more investors seek reliable growth opportunities.

C) Technology and Consumer Stocks: A Mixed Picture

Not all sectors are performing equally well. The technology sector was recently boosted when STMicroelectronics’ stock jumped 6% after an upgrade from Jefferies. This event shows strong investor confidence in the semiconductor industry.

However, consumer and healthcare stocks are struggling. For example, Philips’ stock dropped 7.4% after disappointing earnings. This decline shows ongoing challenges in these sectors.

These mixed performances show that some industries are thriving while others face headwinds. Thus, most investors are adjusting their strategies based on these trends.

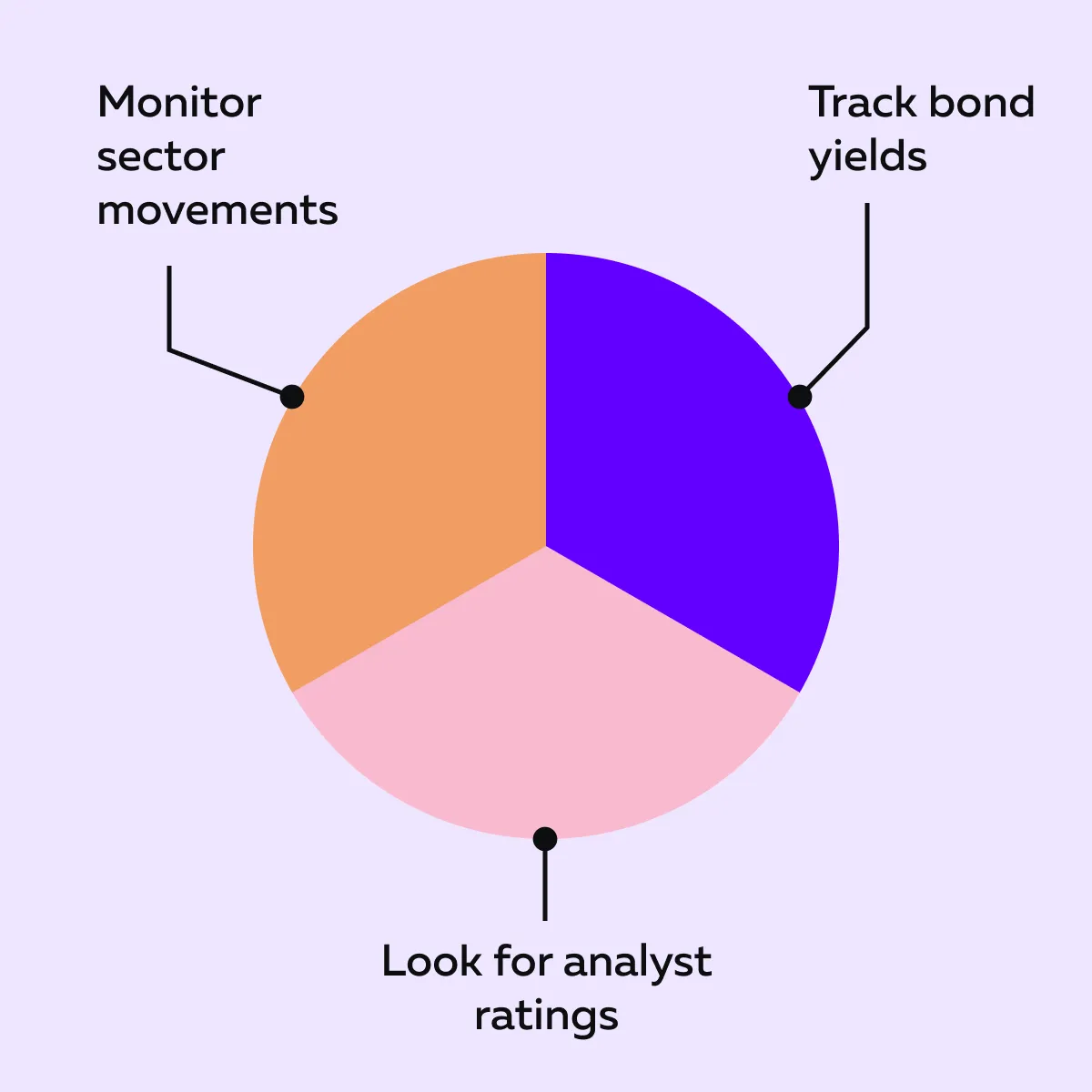

How Traders Can Navigate These Divergent Market Trends

As a trader, you need to stay flexible and adapt your strategies. Check the graphic below to learn how you can do so:

Let’s understand these techniques in detail:

A) Monitor Sector Rotation

Markets are constantly shifting. Some sectors are gaining momentum while others are weakening. Due to this sector rotation in European stocks, you, as a trader, must identify well-performing industries, such as energy and industrials.

At the same time, you must be cautious about struggling sectors like healthcare and consumer staples. Following these shifts can position yourself in sectors with strong growth potential.

B) Keep an Eye on Bond Yields

Rising bond yields can impact STOXX 600 performance. They can make certain stocks less attractive. Please note that when yields go up, borrowing becomes more expensive. The rise in borrowing costs puts pressure on companies, particularly in capital-intensive industries like real estate and technology.

However, at the same time, higher yields create buying opportunities in undervalued sectors that can weather rising rates better. Thus, understanding how yields affect different industries is key to European stock market analysis.

C) Watch Institutional Upgrades and Downgrades

Stock prices can move significantly based on:

- Analyst ratings,

and

- Institutional upgrades.

For example, the share of STMicroelectronics jumped 6% after Jefferies upgraded it. This price increase clearly shows how these ratings influence market sentiment.

Thus, you should pay attention to upgrades and downgrades from major financial institutions. That’s because they signal opportunities or risks in specific stocks.

Conclusion

As per the latest European market trends in 2024, the STOXX 600 remains stable despite fluctuations in different sectors. Currently, rising bond yields are influencing market sentiment. They are pushing investors to rethink their strategies.

At the same time, sector rotation in European stocks is quite evident. Due to this, energy and industrial stocks are gaining strength, while consumer and healthcare sectors are facing challenges.

To manage these shifts, you should monitor sector momentum, track bond yield movements, and pay close attention to institutional upgrades and downgrades. Also, stay flexible and adapt to macroeconomic indicators.

These efforts will allow you to position yourself in sectors with strong growth potential. Understand how sector rotation affects European equities and adapt your portfolio accordingly.