Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 19, 2024

SHARE

Sector Rotation Strategies for Long-Term Investors: Maximizing Returns by Capitalizing on Market Trends

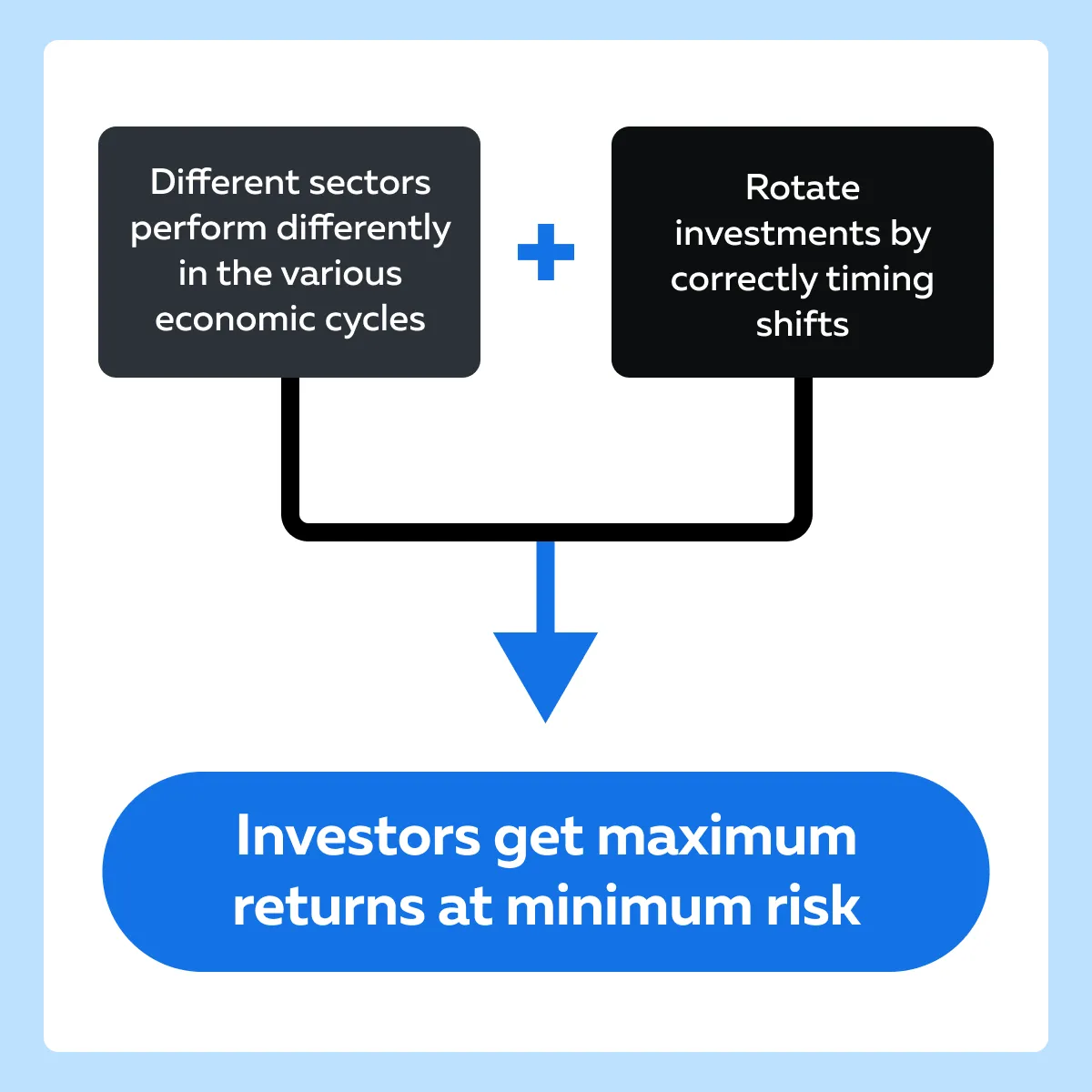

The world changes, and so do the financial markets. In every economic cycle, some stocks are the best performers, while a few unfortunate ones are under fire. But, as an investor, how does one account for these changes? The answer lies in allocating and re-allocating or implementing “sector rotation strategies.”

Following these strategies, you move investments between different industry sectors based on the economic cycle stages. This movement significantly enhances your long-term investment plan.

Through this article, we will learn the concept of sector rotation, the various stages of economic cycles, and some key economic indicators that signal these stages, such as GDP growth rates, interest rates, and unemployment rates.

We will also discuss the differences between defensive sectors (like utilities and healthcare) and cyclical sectors (like technology and consumer discretionary) and how they perform during different economic phases.

Lastly, we will understand specific strategies for various phases of the economic cycle. For early cycle investments, we’ll look at how to capitalize on cyclical sectors at the beginning of economic expansions. For late-cycle investments, we’ll explain the benefits of rotating into defensive sectors as the economy peaks and begins to contract. Moreover, we will also cover a contrarian approach, where investors seek opportunities in underperforming sectors poised for recovery. Let’s get started.

What is Sector Rotation?

Sector rotation is an investment strategy. It involves shifting investments from one industry sector to another in response to the stages of the economic cycle. This approach is based on the observation that different sectors tend to perform better or worse at various points in the economic cycle. By timing these shifts correctly, investors aim to maximize returns and minimize risks.

What are the Different Phases of the Economic Cycle?

The economic cycle is divided into four main phases:

- Expansion

- Peak

- Contraction

- Trough

Each phase has distinct characteristics that influence the performance of different industry sectors. Let’s understand them in detail:

| Phase | Characteristic | Best-performing sector | Rationale |

| Expansion |

|

|

|

| Peak |

|

|

|

| Contraction |

|

|

|

| Trough |

|

|

|

Identifying Sector Rotation

Now, let’s study some key economic indicators and what they signal in the four phases of the economic cycle (as discussed above):

- GDP Growth Rates

- Expansion: Steady or accelerating GDP growth

- Peak: High or slowing GDP growth

- Contraction: Declining GDP

- Trough: Low or negative GDP growth, potentially stabilizing

- Interest Rates

- Expansion: Gradually increasing interest rates as the central bank aims to manage inflation

- Peak: High interest rates as a measure to curb inflation

- Contraction: Falling interest rates as the central bank seeks to stimulate the economy

- Trough: Low interest rates to encourage borrowing and investment

- Unemployment Rates

- Expansion: Decreasing unemployment as businesses hire more workers

- Peak: Low unemployment, potentially beginning to rise

- Contraction: Rising unemployment as businesses cut back

- Trough: High unemployment, potentially starting to stabilize

How to Analyze Historical Sector Performance?

Most investors analyze historical sector performances to:

- Identify patterns

and

- Predict future sector rotations

Let’s learn about the various tools and resources using which you can perform this analysis:

- Sector ETFs (Exchange-Traded Funds)

- Sector ETFs provide a way to track the performance of specific sectors.

- By analyzing these ETFs over time, investors can identify trends.

- Investors also get to know how sectors responded during different economic phases.

- Performance Indexes

- Indexes such as the S&P 500 Sector Indexes track the performance of sectors within the broader market.

- Reviewing these indexes reveals which sectors outperformed or underperformed during the previous cycles.

- Financial News and Reports

- To stay informed, regularly review:

- Economic reports,

- Market analyses, and

- Financial news.

- To stay informed, regularly review:

- Technical Analysis Tools

- Use charting tools and software.

- These help in:

- Visualizing sector performance trends

and

- Identifying key turning points.

Example of Sector Rotation

Let’s understand the concept better through a hypothetical example related to rising interest rates and financial stocks.

As per a thumb rule, when interest rates rise, financial stocks often become attractive. This happens because of the following reasons:

- Bank Profit Margins

- Higher interest rates generally lead to increased margins on loans for banks.

- That’s because the difference between the rates at which they borrow and lend widens.

- Investment Income

- Financial institutions, including insurance companies, benefit from higher yields on their investment portfolios.

- This portfolio commonly includes bonds and other interest-sensitive assets.

- Demand for Financial Services

- During the initial phases of rising interest rates, economic growth is still strong.

- This strong growth maintains the demand for:

- Loans,

- Mortgages, and

- Other financial services.

Sector Rotation Strategies for Long-Term Investors

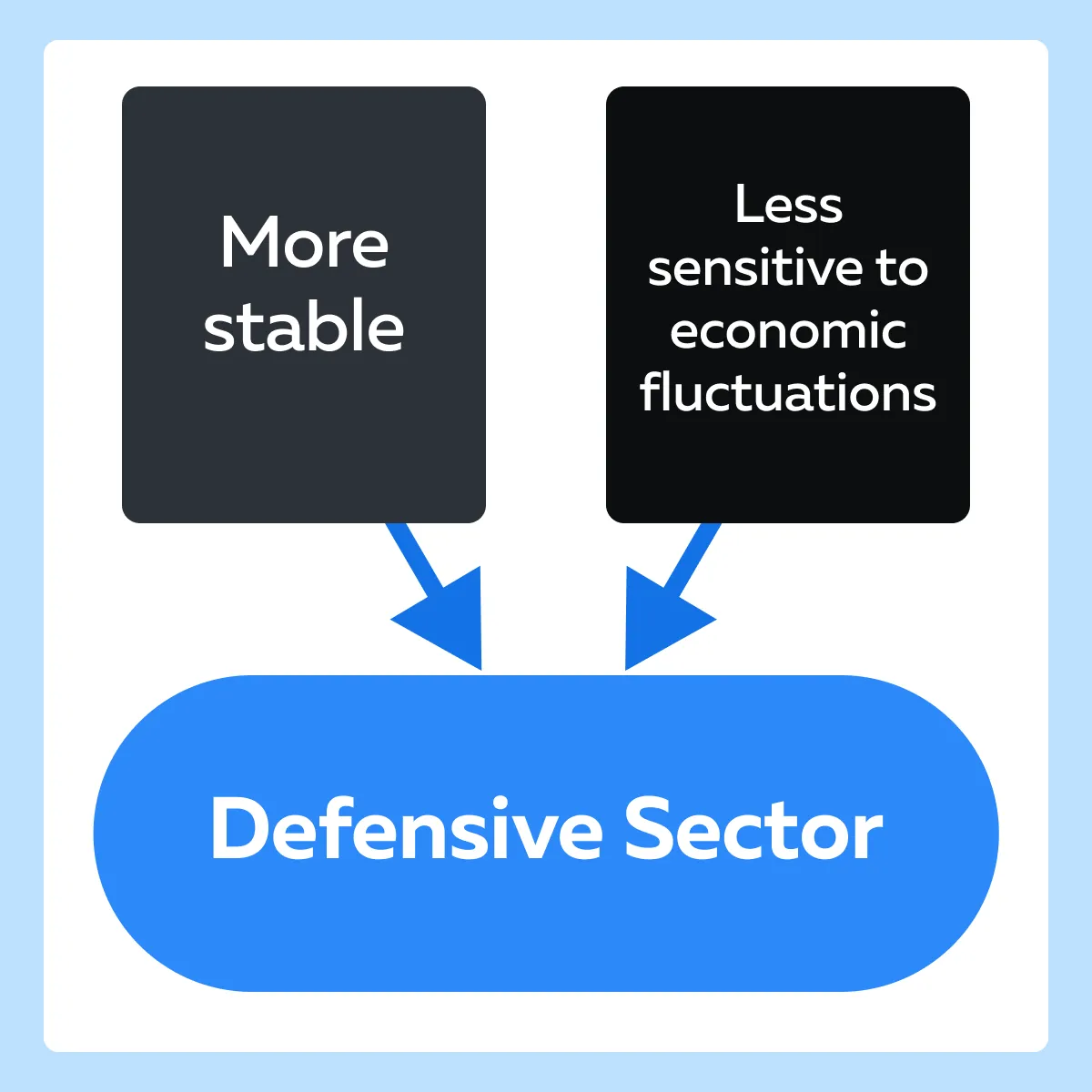

To form robust sector rotation strategies, investors must understand the difference between defensive and cyclical sectors. These two categories of sectors respond differently to economic changes and offer varied opportunities based on the stage of the economic cycle. Let’s study them in detail:

What are defensive sectors?

Defensive sectors include industries that provide essential goods and services, that consumers and businesses need, regardless of economic conditions.

Now, let’s see some common items covered under this segment:

| Items | Companies covered | Economic Response | Investment Strategy |

| Utilities | Includes companies that provide essential services like

|

|

|

| Healthcare | Includes:

|

|

|

| Consumer Staples | Includes companies that produce essential goods such as

|

|

|

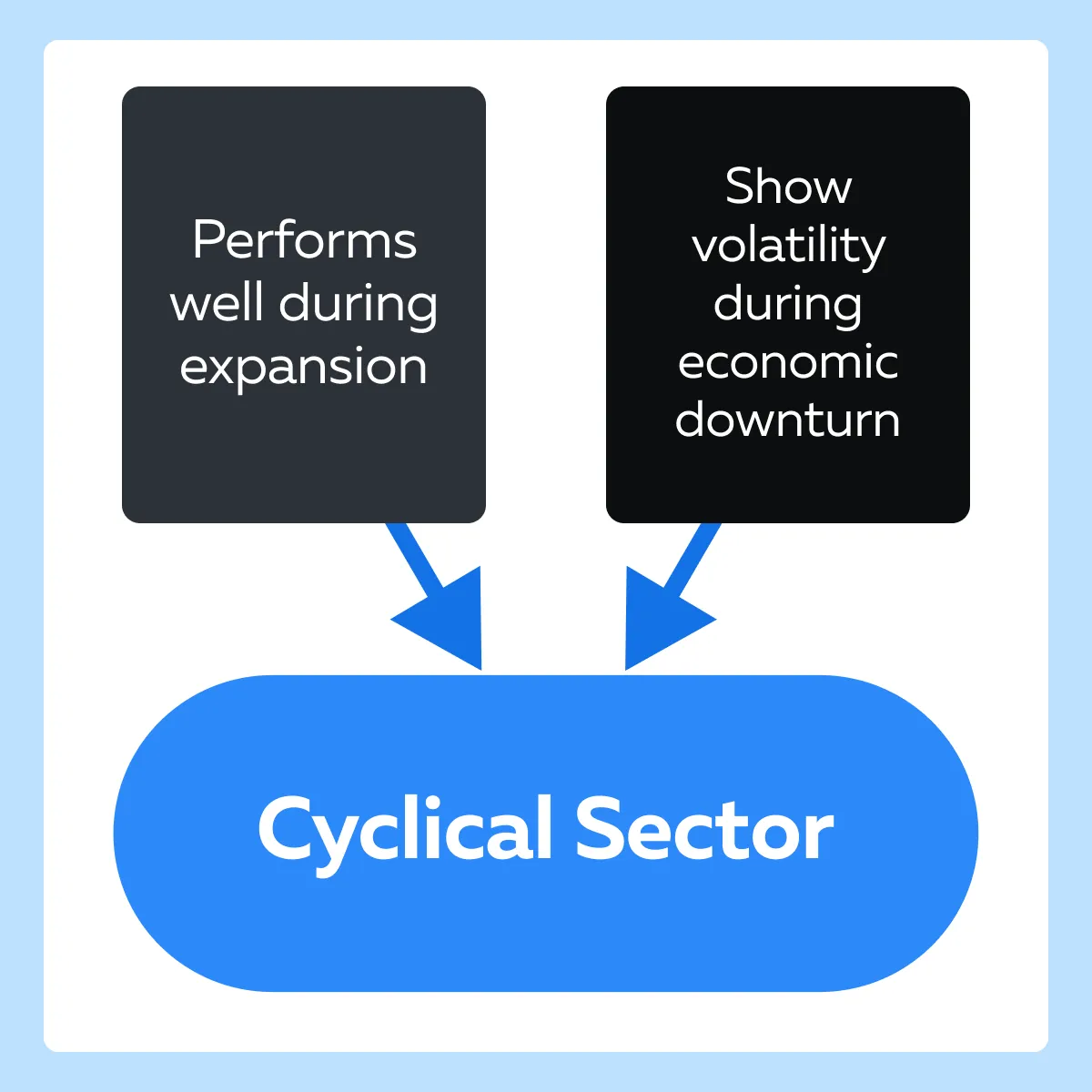

What are Cyclical Sectors?

Cyclical sectors are industries that tend to perform well during periods of economic growth and expansion but can be more volatile and sensitive to economic downturns. These sectors thrive when consumer confidence and spending are high.

Now, let’s see some common items covered under this segment:

| Items | Companies covered | Economic Response | Investment Strategy |

| Technology | Includes:

|

Technology companies benefit from increased business and consumer spending on innovation and new products during economic expansions. |

|

| Consumer Discretionary | Includes companies that offer non-essential goods and services, such as

|

These companies see higher sales when the economy is strong and consumer confidence is high. | This sector is attractive during economic recoveries and expansions when discretionary spending increases. |

| Financials | Includes:

|

Financial companies benefit from higher interest rates and increased lending activity during economic growth periods. | Financial stocks are often favored during the early to mid-stages of economic expansion when loan demand and investment activities rise. |

Now, having understood the difference between defense and cyclical sectors, it’s high time that we implement the various sector rotation strategies. Let’s study the three most preferred sector rotation strategies:

Strategy 1: Early Cycle Investments

Investing in Cyclical Sectors at the beginning of an Economic Expansion

It is essential to note that during the early stages of an economic recovery, cyclical sectors experience significant growth due to increased:

- Consumer confidence

and

- Spending

See how you can capitalize on this phase under different sectors:

Technology Sector

| Rationale | Implementation |

Technology companies often benefit from increased:

and

|

|

For Example,

- Say the economic indicators suggest the end of a recession and the start of a recovery.

- Investors then proceed to allocate a major share of their investment portfolio to technology-based ETFs.

- They anticipate increased corporate spending on IT infrastructure and consumer interest in new gadgets and services.

Consumer Discretionary Sector

| Rationale | Implementation |

|

|

For Example,

- With signs of an economic upturn, an investor buys shares in a consumer discretionary ETF.

- They expect that retailers, automakers, and entertainment companies will see revenue growth as consumers begin to spend more freely.

Strategy 2: Late Cycle Investments

Rotating into Defensive Sectors as the Economy Peaks and Begins to Contract

As the economy reaches its peak and the risk of contraction increases, defensive sectors provide stability and consistent returns. This is how you can adjust investments accordingly:

Healthcare Sector

| Rationale | Implementation |

| Demand for healthcare services and products remains steady, regardless of economic conditions. | Invest in healthcare ETFs, such as:

|

For Example,

- Say the economic indicators show signs of peaking growth and a potential downturn.

- An investor shifts funds into healthcare ETFs.

- By doing so, they take advantage of the sector’s stability and growth potential driven by ongoing demand.

Utility Sector

| Rationale | Implementation |

| Utilities provide essential services, resulting in stable revenues and dividends. | Invest in utilities ETFs, like the:

|

For Example,

- As interest rates rise and economic growth slows, an investor increases their allocation to utilities ETFs.

- They seek the safety of steady dividends and reliable performance in a weakening economy.

Strategy 3: Contrarian Approach

Investing in Underperforming Sectors Expected to Recover in the Next Cycle Phase

Contrarian investors look for opportunities in sectors that are currently out of favor but poised for recovery as economic conditions change. Let’s see how to win this phase:

Energy Sector

| Rationale | Implementation |

|

|

For Example,

- Say, during a recession or contraction phase, energy stocks are undervalued.

- A contrarian investor buys energy ETFs.

- They anticipate that as the economy improves, demand for energy will increase.

- The trader believes this increase will lead to higher prices and stock performance.

Materials Sector

| Rationale | Implementation |

|

Invest in materials ETFs, such as:

|

For Example,

- Say construction and industrial activity are at a low point.

- In this situation, materials stocks might be undervalued.

- A contrarian investor purchases materials ETFs.

- They expect a strong recovery as economic conditions improve and demand for raw materials rises.

Case Study: Sector Rotation Strategies

In this case study, we will follow an investor, Alex, who effectively rotates their portfolio from cyclical to defensive sectors as economic indicators signal an:

- Approaching peak

and

- Subsequent contraction in the economic cycle.

Indicators Observed by Alex

- GDP Growth

- After several quarters of strong GDP growth, the pace begins to decelerate.

- This situation suggests that the economy might be reaching its peak.

- Interest Rates

- The central bank raises interest rates multiple times to combat inflation, which is starting to rise more quickly.

- Unemployment Rates

- Unemployment has reached a low point.

- Job growth is slowing.

- These situations signal that the economy might soon contract.

- Consumer Confidence Index

- Consumer confidence is high.

- However, it shows signs of plateauing.

- Corporate Earnings

- Company earnings reports indicate solid performance but with increased cautionary outlooks for the future.

Execution of Rotation

- Choosing Defensive Sectors

- Healthcare

- Alex identifies healthcare as a stable sector due to its non-cyclical demand.

- He decides to invest in the Health Care Select Sector SPDR Fund (XLV).

- Utilities

- Recognizing the essential nature of utility services, Alex chooses the Utilities Select Sector SPDR Fund (XLU) for its:

- Steady dividends

- Recognizing the essential nature of utility services, Alex chooses the Utilities Select Sector SPDR Fund (XLU) for its:

- Healthcare

and

- Stable performance.

- Consumer Staples

- Alex includes the Consumer Staples Select Sector SPDR Fund (XLP) in his portfolio.

- By doing so, he aims to benefit from the constant demand for essential goods.

- Transition Management

- Reducing Exposure to Cyclical Sectors

- Alex sells off a significant portion of his holdings in technology and consumer discretionary ETFs, such as the:

- Technology Select Sector SPDR Fund (XLK)

- Consumer Discretionary Select Sector SPDR Fund (XLY)

- Alex sells off a significant portion of his holdings in technology and consumer discretionary ETFs, such as the:

- Reallocating Funds: The proceeds from these sales are reinvested into the selected defensive ETFs (XLV, XLU, XLP).

- Diversification Within Defensive Sectors

- To further mitigate risk, Alex ensures diversification within each defensive sector.

- He selects ETFs that cover a wide range of companies within:

- Healthcare,

- Utilities, and

- Consumer staples.

- Reducing Exposure to Cyclical Sectors

Rationale Behind the Strategy

- Preservation of Capital

- By shifting to defensive sectors, Alex aims to protect his investments from the volatility seen during economic contractions.

- Steady Income

- Defensive sectors often provide stable dividends, which can be particularly attractive during periods of economic uncertainty.

- Reduced Volatility

- These sectors are less sensitive to economic downturns.

- They often offer a smoother performance trajectory.

Outcomes

- Initial Transition Period

- In the months following the rotation, the broader market experienced increased volatility.

- Cyclical sectors see a decline as investors react to economic uncertainty.

- Defensive Sector Performance

- The healthcare, utilities, and consumer staples sectors show resilience.

- While they do not achieve high growth, they provide:

- Steady returns

and

- Maintain capital value better than cyclical sectors.

- Dividend Income

- Alex benefits from consistent dividend payments from his defensive sector investments.

- This provides him with a reliable income stream despite market turbulence.

Overall Impact

- Portfolio Stability

- Alex’s portfolio experiences less volatility compared to the broader market.

- This happened due to the defensive investments made by him.

- Preserved Capital

- The defensive sectors preserve capital during the contraction phase.

- They ensure that Alex’s investment value does not erode significantly.

- Preparedness for Recovery

- As economic indicators eventually begin to show signs of recovery, Alex is well-positioned to:

- Reallocate funds back into cyclical sectors

- As economic indicators eventually begin to show signs of recovery, Alex is well-positioned to:

and

- Capture early recovery gains.

Conclusion

Incorporating sector rotation strategies into a long-term investment plan offers several key benefits. It helps investors optimize returns by shifting funds to sectors poised for growth during different economic phases.

This approach substantially reduces risk by moving into defensive sectors during downturns. Also, it preserves capital and ensures steady returns. By staying informed about economic indicators and adjusting investments accordingly, investors can better manage market volatility and capitalize on emerging opportunities.

Thus, we can say that sector rotation provides a balanced approach to long-term investing and enhances both growth potential and stability. For more insights on making timely trading decisions, visit this insightful article on market cycles.