Ready to see the market clearly?

Sign up now and make smarter trades today

Education

February 12, 2024

SHARE

First Principles and Market Mechanics: A Comprehensive Guide for Traders

Understanding the ‘why’ behind market trends can transform your trading strategies. Most successful traders frame and execute profitable trading strategies through “first principles thinking“.

This article enables you to grasp the practical application of these principles and their impact on market mechanics. Also, we will explore how using an advanced market analysis tool like Bookmap can help you gain a competitive advantage.

Whether you’re a seasoned trader or just starting, read this article to discover the keys to adaptability, innovation, and the power of first principles in trading. Let’s begin.

Understanding First Principles in Trading

First principles in trading involves breaking down complex concepts into their fundamental, indisputable components. Using this strategy, traders analyze the underlying principles that govern the market. They do not rely on analogies or existing models, which allows for a deeper understanding of the market dynamics.

For instance, instead of relying on historical patterns or market trends, a trader using first principles thinking analyzes the following:

- Fundamental economic factors

- Supply and demand dynamics, and

- Macroeconomic indicators that drive asset prices.

First Principles Thinking is a Universal Approach

First principles thinking is a universal approach that extends beyond just trading. Innovators like Elon Musk are known for applying first principles thinking in various fields. Musk often breaks down problems to their fundamental principles to find unconventional solutions.

For example, when developing SpaceX’s reusable rockets, he questioned traditional assumptions in the aerospace industry and reimagined rocket design from scratch.

The Falcon 9, SpaceX’s two-stage rocket, is the world’s first orbital-class reusable rocket. It is designed to transport both people and payloads into Earth’s orbit. Reusability allows SpaceX to refly the most expensive parts of the rocket. This technique substantially drives down the cost of space access.

The Falcon 9’s reusability has been a game-changer, with some customers now preferring reused boosters over new ones. In doing so, Musk challenged traditional norms. The Falcon 9’s reusability has been a key factor in SpaceX’s efforts to revolutionize space travel and make it more cost-efficient.

For a more in-depth understanding of first principles thinking, check out Elon Musk’s interview on First Principles Thinking: https://www.wsj.com/articles/elon-musk-first-principles-e50c2a07.

What are the Benefits of First Principles Thinking in Trading?

The first principles approach in trading facilitates a clearer understanding of market trends. Let’s explore some of its major benefits:

- Deeper Understanding of Market Trends:

-

-

- First principles thinking prompts traders to question and understand the fundamental reasons driving market trends.

- Such traders go beyond merely observing patterns and historical data.

-

- Tailored Strategy Development:

-

-

- Instead of employing generic strategies, traders tailor their approaches to specific market conditions.

- This customization allows for making strategies that align more closely with the unique factors influencing asset prices.

-

- Innovative Strategy Development:

-

- First principles thinking encourages traders to challenge:

- Conventional trading wisdom and

- Explore innovative strategies

- By discarding assumptions and examining the market from its foundational principles, traders can identify new opportunities that may be overlooked by those relying solely on analogies and historical data.

- First principles thinking encourages traders to challenge:

In this article, Bookmap’s focus is on core market mechanics and how understanding them through first principles thinking can revolutionize trading strategies. By delving into the ‘why’ behind market trends, traders gain insights that transcend surface-level observations.

How First Principles Thinking Steers Away from Analogies

Instead of just relying on analogies, traders use reasoning gained from first principles thinking. This helps them analyze market mechanics, make more informed decisions, and set up trades.

How Impactful Can First Principles Thinking Be in Trading?

Let’s understand this concept by considering a situation where traders notice heightened volatility within a particular industry.

| Trader’s Reaction | Traditional Approach | First Principles Approach |

| The thought process | Traders look at historical data of the sector during volatile periods. |

|

| The action taken | Traders apply strategies used in similar situations in the past. |

|

Exploring Market Mechanics Through First Principles

Market mechanics refer to the underlying processes and structures that govern the functioning of financial markets. By applying the first principles approach, traders break down these market mechanics into their fundamental components.

To understand this breakdown process better, let us explore some key elements of market mechanics:

-

- Best Bid and Ask:

- Instead of merely observing the bid and ask prices, traders using first principles thinking understand the fundamental concept of supply and demand.

- The best bid represents the highest price a buyer is willing to pay, while the best ask is the lowest price a seller is willing to accept.

- Analyzing these levels from first principles involves considering the following:

- Dynamics of order placement and

- Psychology of market participants.

- Best Bid and Ask:

-

- Order flow represents the real-time buying and selling activity in the market.

- Traders employing first principles thinking:

- Go beyond superficial analysis and

- Analyze the reasons behind order flow changes.

- This mainly includes finding answers to these questions:

- How do large trades impact order books?

- How do market participants react to the news?

- How can order flow signal shifts in market sentiment?

- Microstructure:

- Market microstructure involves the detailed analysis of how orders are executed.

- It also defines the role of market makers along with the impact of transaction costs.

- A first principles examination of microstructure includes understanding the rules and mechanisms that govern the market’s inner workings, such as:

- Different order types

- Market regulations, and

- The role of technology in trade execution.

For a more in-depth exploration of market mechanics, particularly order flow, check out the educational course provided by Bookmap – Bookmap Order Flow Course. This is a must-study course as it offers valuable insights into understanding order flow from first principles.

What is the Significance of Visualizing Market Mechanics?

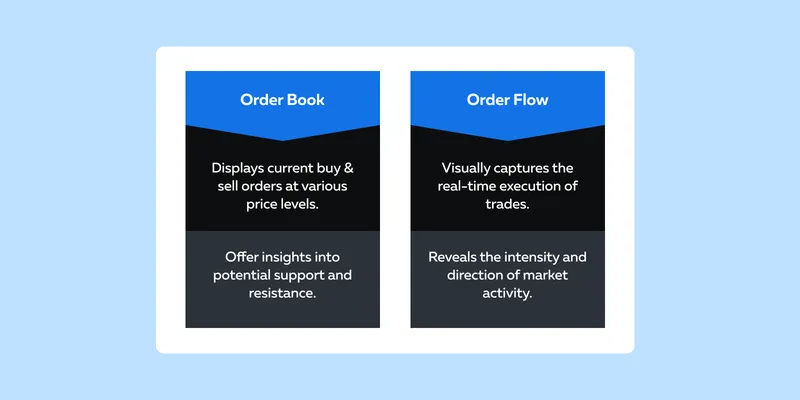

The Order Book and Order Flow are the two most important components of market mechanics that provide a visual representation of market dynamics. Both serve different purposes that are graphically highlighted below:

Using First Principles to Comprehend Market Mechanics

Mastering market mechanics through a first principles approach is essential for making well-informed trading decisions. Think of it as learning the rules of a game before playing; understanding how the pieces move and why certain moves are strategic gives a clear advantage.

Similarly, in trading, comprehending market mechanics provides the foundational knowledge essential for profitable trading. Most traders apply the first principles thinking approach through visualization, which enables them to see beyond price charts. This offers clarity and helps in making enables more decisive actions as traders can:

- Interpret the intentions of market participants and

- React strategically.

Aids in Developing Tailored Strategies

Understanding market mechanics helps traders develop strategies tailored to specific market conditions. By visually analyzing the order book and order flow, traders can adapt their approaches based on the prevailing supply and demand dynamics. This dynamic strategy development allows for agility in response to changing market environments and helps traders with:

- Identifying areas of high liquidity

- Anticipating potential support or resistance levels

- Detecting market sentiment shifts

- Observing whether buyers or sellers are in control

- Setting up effective risk management strategies

Applying First Principles to Trading Strategies

In essence, applying first principles to trading strategies involves:

- Going beyond conventional methods and

- Understanding the foundational elements that drive market movements.

Traders willing to apply first principles to their trading strategies can read the table below for a step-by-step guide:

| Steps | Explanation | Practical Application |

| Identify Core Market Drivers |

|

|

| Analyze Order Flow and Liquidity |

|

|

| Tailor Strategies to Market Microstructure |

|

|

| Adapt to Changing Volatility | Instead of using fixed risk parameters, analyze the fundamental reasons behind changing market volatility. | Develop a volatility-adjusted position sizing strategy that adapts to changing market conditions. |

| Integrate Fundamental and Technical Analysis |

|

|

How to Gain an Advantage By Using Bookmap

Bookmap is an advanced market analysis tool. It enables traders to apply first principles thinking in breaking down market mechanics and providing data critical for strategy adjustments, based on core market signals.

Let’s understand this usage even further:

- Traders can use Bookmap to visualize the ebb and flow of order book liquidity. This visualization enables them to identify support and resistance levels based on real-time data.

- By using Bookmap’s real-time data, traders can adjust their strategies based on core market signals. For example,

- If Bookmap signals a sudden surge in buying interest at a specific price level, a trader can adjust their strategy to capitalize on potential upward momentum.

- If Bookmap reveals a shift in order flow dynamics, such as increased selling pressure, a trader can adjust their risk management or exit strategies accordingly.

How Bookmap Enhances First Principles Reasoning

Bookmap’s visualizations provide a holistic view of market mechanics, which aligns with the first principles approach. This view allows traders to understand the depth and dynamics of the order book in real time. This helps traders using Bookmap to make more informed decisions by incorporating real-time data into their first principles analysis.

Furthermore, the platform’s visualizations offer practical insights that go beyond theoretical market models. These insights provide traders with concrete and observable signals.

Conclusion

The key to market success is an emphasis on the ‘why’ behind market trends. Traders adopting the first principles approach go beyond surface-level observations and gain a deeper understanding of the fundamental drivers of market trends. By doing this, they stay ahead of the curve in dynamic and evolving market environments.

Furthermore, to strengthen outcomes, Bookmap offers dynamic visualizations of order flow and provides real-time data to traders. This helps traders gain a holistic understanding of the market.

Interested in further exploring the concepts of first principles and market mechanics in trading? Watch our detailed video on YouTube for an in-depth discussion and practical insights. Elevate your trading knowledge with this valuable resource. Click now to learn directly from the experts!