Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 11, 2024

SHARE

Navigating the Visual Landscape of Depth of Market (DOM)

In modern trading, the importance of making rapid decisions cannot be

undermined. Surviving in a complex ecosystem where big bulls dominate the

market is challenging. However, having the right tools at your disposal can

make this process easier.

Central to this idea of simplification is the Depth of Market, often

abbreviated as DOM. The DOM provides a real-time representation of the

supply and demand for a financial instrument. By analyzing it, traders can

understand the market dynamics, which comprise various price levels and

corresponding buy and sell orders.

This is part two of our series of articles delving into the world of DOM

visualization. In this part, we will explore the evolution of visualization

techniques, their practical implementation, and the impact of advanced tools

on the future of trading.

We will also understand how these tools empower traders, enhance

decision-making, and shape the trading landscape as we know it. So, let’s

begin and explore further.

Visualization Techniques for DOM

Visualization techniques help traders make sense of complex market data. One

such technique is the use of heatmaps and color gradients to represent

trading activity in the Depth of Market (DOM). Let’s understand it better.

Heatmaps and Color Gradients

Traditionally, traders used to rely on static tables and text-based data to

understand market dynamics. However, as technology advanced, the need for

more intuitive and interactive visualization tools became apparent.

Heatmaps, recognized for their efficiency in swiftly conveying information,

have become a staple in trading platforms.

Most advanced market analysis tools, like Bookmap, now incorporate dynamic

and real-time heatmaps. This allows traders to:

-

Visualize market depth and order book data

-

Understand the current state of the market

Does Color Signify Trading Intensity?

Heatmaps use a color gradient to signify trading intensity within the DOM.

This intensity is proportional to the trading volume at different price

levels. Below, you can find some common colors and their associated

indications:

|

Colors |

Indication |

|

Warm colors, like red and orange |

Indicate high trading activity |

|

Cool colors, like blue and green |

Indicate low trading activity |

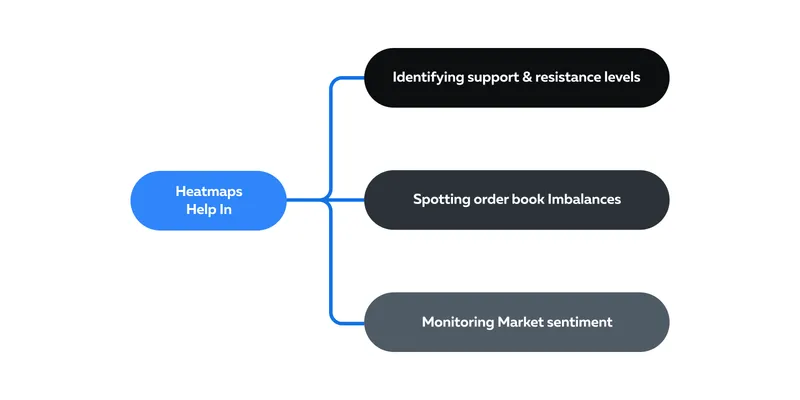

How Do Heatmaps Provide Insights?

Heatmaps allow traders to understand the current state of the market. Let’s

understand how they provide insights in multiple scenarios:

-

Identifying Support and Resistance Levels:

-

Traders use heatmaps to identify key support and resistance

levels by observing areas with intense trading activity. -

High-activity price levels often act as strong support or

resistance points.

-

-

Spotting Order Book Imbalances:

-

Heatmaps help traders spot order book imbalances quickly.

-

An imbalance between buy and sell orders can indicate potential

price movements.

-

-

Monitoring Market Sentiment:

-

By observing changes in color intensity over time, traders can

gauge market sentiment

. -

Rapid shifts from cool to warm colors usually indicate a shift

in market sentiment.

-

Volume Bars in DOM

Volume bars are a valuable tool in the Depth of Market (DOM). By observing

volume bars, traders can gain insight into historical trading activity.

Let’s understand how volume bars offer this historical context and discuss

the implications of volume spikes or troughs.

What Do Volume Bars Show?

-

Volume bars in the DOM display the trading volume executed at

various price levels over a specific time. -

Each vertical bar represents a particular price level.

-

The height of the bar indicates the total volume traded at that

price during the chosen time frame.

See this table below:

|

Height of the Volume Bar |

Indication |

|

A tall volume bar at a particular price level |

Indicates high trading volume |

|

Short volume bar at a particular price level |

Indicates low trading volume |

Implications of Volume Spikes and Troughs

The formation of volume spikes and troughs indicates future price movements:

-

Volume Spikes:

-

A spike in buying volume indicates strong buying interest

(bullish sentiment) and drives the price upward. -

A spike in selling volume indicates strong selling interest

(bearish sentiment) and drives the price downward.

-

-

Volume Troughs:

-

A notable drop in trading volume is seen as a trough in a volume

bar. Such a trough indicates a lack of interest or consolidation

in the market.

-

How Do Traders Use Volume Bars in Their Strategies?

Let’s understand the practical usage through hypothetical situations:

-

Situation 1: News-Driven Trading

-

Let us assume a trader is monitoring volume bars during an

earnings announcement for a popular stock. -

Just before the earnings release, they noticed a substantial

volume spike at a specific price level. -

This suggests heightened interest and anticipation among market

participants. -

The trader interprets this as a sign that the earnings report

will likely influence the stock’s price significantly. -

They prepare to execute a trade based on the outcome.

-

Learn more

abouttrading

the news here.

-

-

Situation 2: Support and Resistance Levels

-

A trader is observing volume bars.

-

They notice a series of tall volume bars at a particular price

level. -

They interpret this consistent historical activity as an

indication of strong support or resistance. -

They decided that if the price approached this particular level,

they would use it as a potential entry or exit point.

-

-

Situation 3: Intraday Scalping

-

An

intraday scalper

, while observing volume saw a volume spike followed by a sharp

price movement. -

They entered a quick scalp trade in the direction of the spike,

anticipating short-term price continuation.

-

Dynamic Price Ladders

Dynamic price ladders have revolutionized the trading floor and how traders

interact with financial markets. Let’s understand this revolution.

How Trading Floors Evolved

The History

-

Historically, trading floors were physical locations where traders

would gather to execute trades. -

These trading pits were crowded, noisy, and highly dependent on

human interaction. -

Traders would shout, use hand signals, and rely on floor brokers to

place orders. -

The trading floor environment was hectic and could sometimes lead to

communication errors.

The Transition

-

The transition to electronic trading and the introduction of dynamic

price ladders marked a significant shift. -

Electronic trading platforms replaced many traditional trading

floors. -

This replacement allowed traders to execute orders remotely.

-

Real-time price ladders, also known as “Level 2” or “Order Book,”

emerged as a central feature of electronic trading.

What are the Advantages of Real-Time Price Ladders?

Real-time price ladders offer several advantages:

-

Price ladders provide a live view of both buy and sell orders at

different price levels. -

Traders can see the depth of the market and the supply and demand

dynamics in real-time. -

Electronic trading platforms linked to price ladders enable traders

to execute orders instantly with a few clicks. -

Traders analyze order book data to identify:

-

Potential support and resistance levels,

-

Order imbalances, and

-

Trend reversals.

-

-

Real-time price ladders help traders in setting stop-losses and

executing take-profit orders, which are essential for risk

management.

How Live Order Flow Shapes Strategies and Predictions

Let’s understand through some practical examples:

|

How Does Live Order Flow Help? |

How do Traders Interpret it? |

|

Identifying Support and Resistance |

|

|

Gauging Order Imbalances |

|

|

News Events |

|

Practical Implementation of DOM Visualization

Traders must choose the right DOM visualization tools. This selection

involves:

-

Balancing intuitiveness with data depth

-

Considering one’s trading style, and

-

Self-realizing one’s skill level

Bookmap offers a wide suite of features, including its state-of-the-art

heatmap, volume dots, and historical depth data. These features are

beneficial for understanding:

-

Market dynamics

-

Identifying trading opportunities, and

-

Improving overall trading strategies.

Whether you are a beginner or a seasoned trader, the insights provided by

Bookmap can enhance your trading experience.

Navigating the Array of Visualization Tools

When choosing DOM (Depth of Market) visualization tools, traders must

consider the balance between interface intuitiveness and the depth of data

representation. Let’s explore this balance further.

Interface Intuitiveness vs. Data Depth

What works for you, depends on your experience. See the table below:

|

Parameters |

Beginners |

Seasoned Traders |

|

What Would Suit You? |

As a novice trader, an intuitive and user-friendly |

As an experienced trader, you will require more in-depth |

|

What Should Be Your Preferred Visual Representation |

Simple visual representations, like:

|

Detailed visual representations, like:

|

|

How These Tools Will Help: |

These tools will help you grasp the fundamentals of |

These tools will help you effectively interpret complex |

How to Align Your Choice of Tool with Trading Styles

Your trading style also plays a pivotal role in determining the kind of tool

you must use:

-

For Scalpers:

-

They require real-time and granular data.

-

They prefer tools that offer precise order book data, as

scalping involves quick decision-making based on small price

movements. -

Scalpers may prefer visual DOMs with detailed order book

information.

-

-

Day Trading:

-

Day traders prefer tools that offer a mix of:

-

Intuitive visuals for quick decisions and

-

More detailed data for in-depth analysis

-

-

-

Swing Trading:

-

Swing traders typically have more time to analyze the market.

-

They prefer tools that provide:

-

Deeper data representation

-

Historical depth data, and

-

Advanced heatmap analysis.

-

-

Harnessing Bookmap’s DOM Visualization

Bookmap is a popular tool for DOM visualization. It offers a range of

features tailored for visual DOM analysis. Let’s see some of the popular

ones below:

a) State-of-the-Art Heatmap Representation:

-

Bookmap’s heatmap representation provides a real-time and intuitive

visualization of the order book. -

It uses color intensity to display trading activity.

Primary Advantage Over Traditional Formats: The heatmap’s advantage lies in

its ability to instantly convey market-depth information. This instant

interpretation makes it easy to spot:

-

Support and resistance levels

-

Order imbalances, and

-

Liquidity changes.

b) Volume Dots:

-

Bookmap includes volume dots, which represent individual trade

executions. -

These dots provide additional granularity by showing the exact price

and volume at which trades occurred. -

This feature is valuable for understanding market dynamics at a

micro-level.

c) Historical Depth Data:

-

Bookmap archives historical depth data and allows traders to review

past market conditions. -

This feature helps in post-trade analysis.

d) Real-World Trading Benefits:

Bookmap’s features directly impact trading decisions. They offer multiple

advantages to the traders:

|

Bookmap’s Features |

Practical Usage |

|

Advanced Heatmap |

Used to identify potential entry and exit points. |

|

Volume Dots |

Used to gauge market sentiments. |

|

Historical Data |

Used for backtesting and improving trading strategies. |

Conclusion

With every passing day, financial markets are becoming increasingly complex

and global. This creates the need for effective visualization of market

data. Whether you are a beginner or a seasoned trader, market visualization

tools offer a pathway to more informed and data-driven decision-making.

Advanced visualization tools, such as dynamic price ladders, heatmaps, and

DOM analysis platforms like Bookmap, have reshaped the trading landscape.

They help traders to easily interpret vast amounts of data quickly and

enhance their ability to spot trends, and other critical market dynamics.

These tools serve as invaluable resources for traders at all levels and

boost their overall trading experiences. Are you ready to experience the

transformative power of visual DOM for your trading strategies?

Dive into Bookmap’s advanced features and unlock unparalleled market

insights.

Start Your Journey with Bookmap Today!

FAQ

What is Depth of Market (DOM) and why is it important for traders?

Depth of Market (DOM) shows the supply and demand at different price levels for a financial instrument. It provides real-time insight into buy and sell orders, helping traders make faster, more informed decisions about market sentiment, liquidity, and potential price movements.

How do heatmaps and color gradients help in DOM visualization?

Heatmaps use color intensity to represent the level of trading activity at different price levels — warm colors like red and orange indicate high trading activity, while cool colors like blue and green indicate lower activity. This visual approach allows traders to quickly identify support and resistance zones and spot shifts in market sentiment.

What are volume bars in DOM, and how do traders use them?

Volume bars show how much trading volume occurred at each price level over a specific time frame. Traders use volume spikes to identify strong buying or selling interest, while volume troughs suggest periods of market consolidation or low interest.

What is a dynamic price ladder and how does it impact trading?

A dynamic price ladder displays live buy and sell orders at different price levels. It helps traders see real-time market depth, spot order imbalances, manage risk, and react quickly to changing market conditions — especially during news events or periods of high volatility.

How does Bookmap enhance DOM visualization for traders?

Bookmap provides advanced visualization features like real-time heatmaps, volume dots, and historical depth data. These tools help traders identify liquidity zones, monitor order flow, and improve entry and exit timing by offering a clear, detailed view of market activity.