Ready to see the market clearly?

Sign up now and make smarter trades today

Education

April 8, 2024

SHARE

P2P Lending Power: Strategies for Financial Market Success

Ever heard of a place where both those with money to invest and those in need of funds can mutually benefit? A place where the former gets better returns and the latter gets cheaper credit! P2P lending is a modern marketplace offering a win-win situation for both investors and borrowers.

This article will explore P2P lending in detail, explaining its mechanics from the loan application process to loan funding and repayment. As we progress, we will examine the factors driving the expansion of P2P lending as an alternative investment avenue, including technological advancements and changing consumer preferences.

Also, we will delineate some best practices for optimizing returns and mitigating risks in P2P lending. From diversification strategies to due diligence techniques, we’ll learn how to construct a robust investment portfolio and make informed decisions to maximize our returns while minimizing potential risks. Let’s begin.

What is Peer-to-Peer (P2P) Lending?

Peer-to-peer (P2P) lending is a method of debt financing. It enables individuals to borrow and lend money without the use of traditional financial institutions acting as intermediaries, such as banks or credit unions.

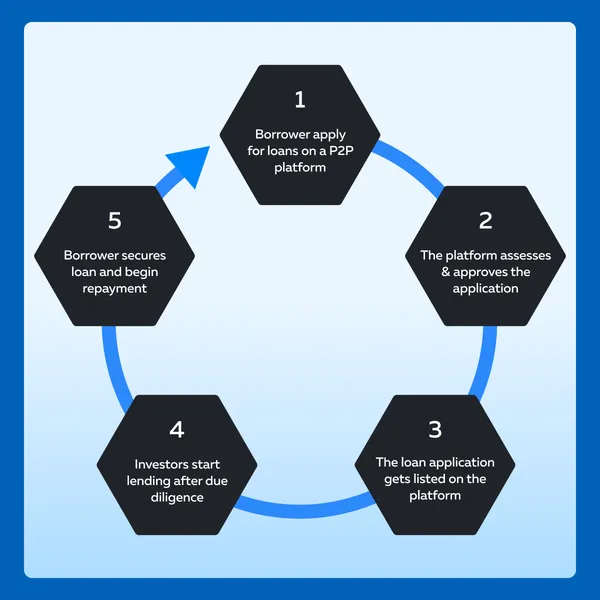

In P2P lending, individuals can directly lend money to other individuals or small businesses. Most financing happens through online platforms. Let’s understand the working of P2P through a 5-step process:

Step I: Borrowers apply for loans

- Individuals or small businesses in need of funds apply for loans through P2P lending platforms.

- They typically provide information about:

- The amount they wish to borrow,

- The purpose of the loan,

- Their credit history, and

- Other relevant financial details.

Step II: Assessment and approval process

-

- P2P lending platforms typically assess the creditworthiness of borrowers using various criteria, including:

- Credit scores,

- Income verification, and

- Risk assessment algorithms.

- P2P lending platforms typically assess the creditworthiness of borrowers using various criteria, including:

- This assessment helps determine the interest rate and terms of the loan.

Step III: Listing and funding

- Once a borrower’s loan application is approved, it is listed on the P2P lending platform’s marketplace.

- Individual lenders, often referred to as investors, can:

- Browse through these listings and

- Choose the loans they want to fund.

- They can typically see information about the:

- Borrower,

- Purpose of the loan.

- Interest rate, and

- Term.

Step IV: Lending

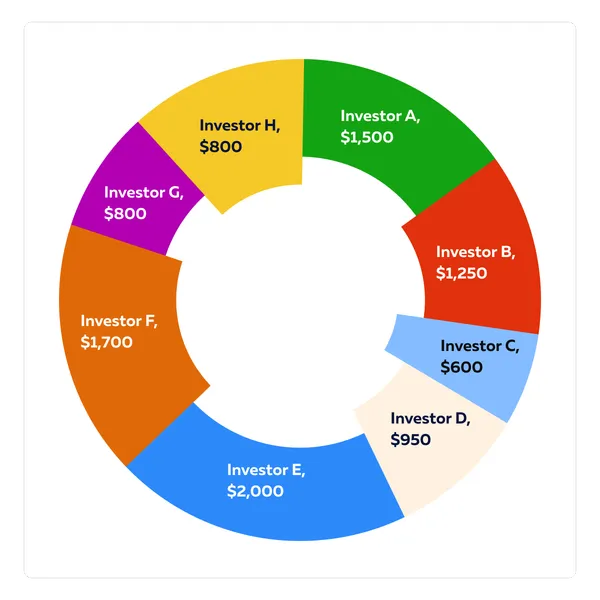

- Investors can then choose to fund all or a portion of the loan amount.

- Since loans are typically funded by multiple investors, each investor contributes a fraction of the total loan amount.

- This diversification spreads the risk across multiple lenders.

For example,

A borrower got approval for $10,000 worth of funds on a popular P2P platform. Owing to an attractive rate of return, multiple investors decided to invest their money. The pie chart of such a funding would be visible as follows:

Step V: Loan servicing and repayments

- After the loan is fully funded, the borrower:

- Receives the funds and

- Begins making regular repayments, usually every month.

- P2P lending platforms handle the collection of repayments from borrowers and distribute them to the investors.

- This includes managing late payments and defaults, if they occur.

What is the Role of P2P Lending Platforms?

P2P lending platforms provide an online marketplace where borrowers and investors can connect. They handle the administrative tasks, such as:

- Loan origination,

- Underwriting, and

- Servicing.

Also, they provide the technology infrastructure. Through these platforms, borrowers have access to an alternative source of financing, while investors have the opportunity to earn potentially higher returns compared to traditional savings or investment products.

Let’s understand better using a hypothetical example,

- a) The Scenario

- Sarah is an entrepreneur with a small business idea.

- She is struggling to secure funding through traditional banks due to a lack of collateral or credit history.

- She turns to a P2P lending platform like LendingClub.

- b) A Shift to Alternative Financing

Sarah applies for a loan on the LendingClub platform. She provides details about her:

- Business plan,

- Financial projections, and

- The amount she needs.

P2P Assessment

LendingClub assesses Sarah’s application using their proprietary algorithms and criteria. They evaluate her creditworthiness, business plan viability, and other relevant factors to determine the risk associated with her loan.

Approval and Listing

Post satisfaction, LendingClub approves Sarah’s loan and lists it on their marketplace. Over here, investors like John can browse through various loan opportunities and invest in them.

Investor Participation

- John is an investor in LendingClub.

- He is looking for investment opportunities with potentially high returns.

- He comes across Sarah’s loan listing.

- It catches his interest due to:

- Its attractive interest rate and

- Promising nature of Sarah’s business.

Fund Disbursal

After conducting some due diligence, John decides to invest a portion of his funds into Sarah’s loan. He selects her loan listing and commits to funding a fraction of the total loan amount. Similarly, more investors like John participate and Sarah’s loan gets fully funded. She receives the funds she needs to start or grow her business.

Loan Repayment

Over time, Sarah makes regular monthly payments towards her loan, including both principal and interest. LendingClub handles the collection of these payments from Sarah and distributes them proportionally to the investors who funded her loan.

Returns for Investors

John earns returns on his investment as Sarah continues to make repayments. These returns are in the form of interest payments, providing John with a steady income stream.

Some Popular P2P Lending Platforms

LendingClub, Prosper, and Funding Circle are some popular online P2P marketplaces that have revolutionized the way individuals and small businesses access financing. They directly connect borrowers and investors. These platforms have gained popularity due to their:

- Accessibility,

- Flexibility, and

- Potential for higher returns (for investors).

Let’s learn more about them:

- LendingClub

-

-

- One of the largest P2P lending platforms, LendingClub offers:

- Personal loans,

- Business loans, and

- Auto refinancing.

- Borrowers can apply for loans ranging from $1,000 to $40,000, with fixed monthly payments and competitive interest rates.

- One of the largest P2P lending platforms, LendingClub offers:

-

- Prosper

-

-

- Prosper is another leading P2P lending platform that focuses primarily on personal loans.

- Borrowers can apply for loans of up to $40,000, with terms ranging from 3 to 5 years.

- Prosper uses a risk-assessment model called Prosper Rating to determine the interest rates for borrowers.

-

- Funding Circle

-

- Funding Circle specializes in small business loans.

- It provides financing options for businesses in various industries.

- Borrowers can apply for loans of up to $500,000, with terms ranging from 6 months to 5 years.

- Funding Circle offers:

- Transparent pricing and

- Fast funding decisions for eligible businesses.

P2P Lending Strategy

Developing a solid strategy is essential for success in P2P lending, as it helps balance potential returns with associated risks. Here are some key components of a robust P2P lending strategy:

1. Risk Assessment and Loan Selection

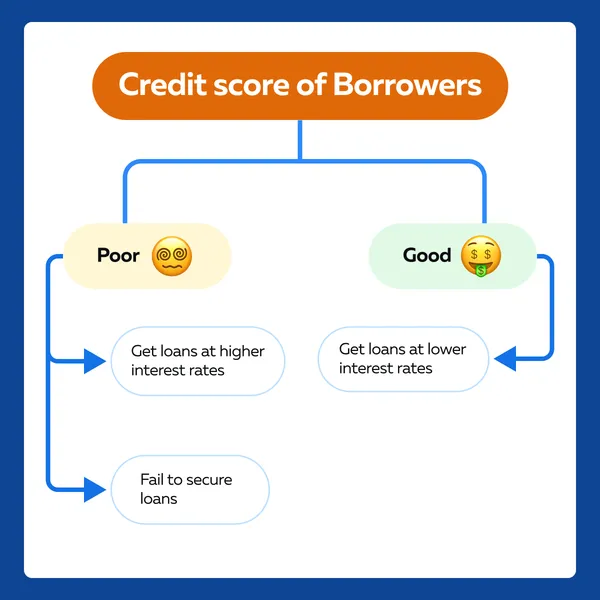

- Evaluate borrowers’ creditworthiness by examining their credit history, income stability, and debt-to-income ratio.

- Focus on loans with reasonable interest rates and repayment terms that align with your risk tolerance.

2. Diversification

- Spread your investments across multiple loans, borrowers, and platforms to reduce exposure to default risk.

- Consider diversifying across different loan grades, industries, or geographic regions for broader risk mitigation.

3. Leverage Platform Tools

- Utilize filtering and analytics tools provided by P2P platforms to identify loans that meet your criteria.

- Take advantage of auto-invest features to automate investments based on pre-set parameters like loan grades, terms, and interest rates.

4. Monitor Economic Trends

- Stay informed about economic conditions that could affect borrowers’ repayment capabilities.

- Adjust your strategy during economic downturns by favoring lower-risk loans or withdrawing funds to maintain liquidity.

5. Reinvestment

- Reinvest earned interest and principal repayments into new loans to compound your returns over time.

- Ensure reinvestments align with your overall portfolio goals and risk management strategy.

By employing these strategies, investors can enhance their potential returns while minimizing the risks associated with P2P lending.

The Growth of P2P Lending

The P2P lending market is growing at a steady rate. In North America, its popularity is attributed to:

- Increased access to credit,

- Alternative investment opportunities,

- Lower interest rates, and

- Convenience of use.

This market dominance is reflected in the revenue share exceeding 30% in 2023. Let’s delve deeper and understand the reasons for its growth:

| Reasons for Growth | Explanation |

| Technological Advancements |

|

| Changing Consumer Preferences |

|

| Market Demand for Credit |

|

| Low-Interest Rates Environment |

|

| Diversification |

|

The Benefits of P2P Lending

P2P lending offers benefits to both borrowers and investors. Let’s see how:

| Benefits for Borrowers | Benefits for Investors |

|

|

|

a) Interest payments and b) Loan repayments. |

|

|

|

|

Investment Strategies for P2P Lending

Effective investment strategies in P2P lending involve a combination of:

- Diversification,

- Due diligence, and

- Risk management techniques.

These strategies help investors to maximize returns while minimizing risks. Let’s understand them in detail:

| P2P Lending Investment Strategies | Meaning | Trader’s Action |

| Diversification | Diversification involves spreading risk across multiple loans and enhancing overall portfolio performance. |

|

| Due Diligence | Before committing funds, investors must conduct thorough due diligence on

|

a) Credit history, b) Income stability, and c) Debt-to-income ratio.

a) Interest rates, b) Loan amounts, c) Repayment schedules, and d) Loan purpose.

a) Loan origination process, b) Underwriting standards, and c) Default rates.

|

| Risk Management | Set lending criteria and investment parameters based on your

|

|

Optimizing Returns Through P2P Lending

To optimize returns in P2P lending and maximize wealth accumulation, consider the following actionable tips and best practices:

- Reinvestment Strategies

-

-

- To continuously generate income, accelerate wealth accumulation by reinvesting your earned interest and principal repayments into new loans.

- Set up automated reinvestment strategies through the P2P lending platform’s auto-invest feature.

- This feature ensures that your returns are reinvested promptly and efficiently, without the need for manual intervention.

-

- Loan Selection Criteria

-

-

- When selecting loans for investment, focus on the following key factors:

- When selecting loans for investment, focus on the following key factors:

-

- Creditworthiness

-

-

-

-

- Gauge the ability of borrowers to repay the loan by assessing borrowers’:

- Credit history,

- Credit scores, and

- Debt-to-income ratios.

- Gauge the ability of borrowers to repay the loan by assessing borrowers’:

-

-

-

- Loan Purpose

-

-

-

-

- Evaluate the purpose of the loan and the potential impact on repayment risk.

- Loans for essential purposes, such as debt consolidation or home improvement, may be less risky than loans for discretionary spending.

-

-

-

- Borrower Demographics

-

-

-

-

- Consider demographic factors, such as:

- Age,

- Employment status, and

- Geographic location.

- This way, you can better understand borrowers’ financial stability and repayment capacity.

- Consider demographic factors, such as:

-

- Utilize loan filters and screening tools provided by P2P lending platforms to narrow down investment opportunities based on your preferred loan criteria.

-

-

- Automating Investments

-

- Take advantage of P2P lending platforms’ auto-invest features to:

- Automate your investment strategy and

- Capitalize on available opportunities efficiently.

- Set up predefined investment criteria, such as:

- Loan grades,

- Interest rates, and

- Loan terms.

- This setup eliminates the need for manual selection and allows you to invest in loans quickly as they become available.

- Monitor your investment portfolio regularly to identify any underperforming loans.

- Take advantage of P2P lending platforms’ auto-invest features to:

Risk Mitigation Strategies

P2P lending can be risky, especially due to the compromised credit profiles of borrowers. Thus, investors must exercise caution and adopt advanced risk mitigation strategies to optimize portfolio performance. Let’s see some popular strategies:

- Regularly monitor loan performance and borrower behavior to identify early signs of financial distress or default risk.

- Evaluate the default recovery processes of P2P lending platforms to recover funds in the event of borrower default.

- Analyze economic cycles and their impact on borrower repayment behavior.

- During economic downturns, borrowers face financial challenges that increase default risk.

- Conversely, during economic expansion periods, borrowers have stronger repayment capacity.

- Stress test investment portfolios to assess resilience to adverse market conditions. To do so, you can simulate hypothetical scenarios, such as:

- Economic recessions or

- Sharp increases in default rates.

- Consistently identify potential vulnerabilities and areas for improvement in investment strategies.

How Can Bookmap Help P2P Lending Investors?

Bookmap is an advanced market analysis tool. It helps P2P lending investors by providing:

- Real-time market data visualization,

- Order flow analysis, and

- Risk management tools.

Read the table below to understand better:

| What are Some Popular Bookmap Features? | What do they do? | How do they help P2P lending investors? |

| Real-time Market Data Visualization | Bookmap offers a visually intuitive interface that displays real-time market data, including:

|

P2P lending investors can use Bookmap’s market data visualization to track changes in:

|

| Order Flow Analysis | Bookmap provides advanced order flow analysis tools that enable investors to analyze the flow of buy and sell orders in real-time. |

a) Market sentiment and b) Investor behavior.

a) Liquidity risks, b) Market inefficiencies, or c) Emerging trends |

| Risk Management Tools | Bookmap offers risk management tools that enable investors to:

|

|

P2P Lending Tips

Maximizing returns and mitigating risks in P2P lending requires attention to detail and disciplined practices. Here are actionable tips to improve your P2P lending experience:

1. Start Small

- Begin with a small investment to familiarize yourself with the platform and lending process.

- Gradually increase your investments as you gain confidence and experience.

2. Review Borrower Profiles Carefully

- Take time to review each borrower’s purpose for the loan, credit history, and financial stability.

- Prioritize borrowers with consistent income and a clear repayment plan.

3. Focus on Loan Grades

- Consider lending to borrowers with higher credit grades for more stability, even if returns are slightly lower.

- Balance high-grade loans with moderate-risk loans to achieve a diversified portfolio.

4. Avoid Emotional Decisions

- Stick to your pre-defined lending criteria and avoid making impulsive investment decisions based on market hype or borrower narratives.

5. Utilize Secondary Markets

- Leverage secondary markets to buy or sell loans and adjust your portfolio as needed.

- This feature can improve liquidity and help manage exposure to underperforming loans.

6. Set Realistic Expectations

- Understand that while P2P lending offers attractive returns, it also involves risks like defaults and economic fluctuations.

- Align your investment strategy with your financial goals and risk tolerance.

7. Stay Updated

- Regularly monitor loan performance and platform updates to ensure your strategy remains effective.

- Engage with community forums or educational resources to stay informed about trends and best practices in P2P lending.

By following these tips, investors can navigate the complexities of P2P lending with greater confidence and achieve more consistent results.

Conclusion

Peer-to-peer (P2P) lending facilitates the lending and borrowing process by allowing individuals to lend and borrow money directly through online platforms, such as LendingClub, Prosper, and Funding Circle. Through this process, P2P lending effectively bypasses the traditional financial institutions that acted as intermediaries.

This type of lending benefits both borrowers and investors, with the former getting lower interest rates and the latter, attractive returns. However, for investors to optimize returns, it is necessary to adopt effective risk management strategies, such as diversification, due diligence, and automated investing.

Additionally, investors must be cognizant of default risk, economic cycles, and market volatility for reduced occurrences of borrower’s default. Utilizing advanced market analysis tools like Bookmap can afford investors a competitive advantage with its modern features like order flow analysis and market data visualization.

Are you ready to delve deeper into the world of innovative financial instruments? Explore the

concept of stablecoins and their role in modern finance by reading our insightful guide here.