Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

February 26, 2025

SHARE

Pi Network Listing Sparks Chaos: What Crypto Traders Need to Know

Pi Network, a crypto project that gained massive popularity over the past several years, has officially been listed on major exchanges, causing a chaotic market response as millions of users rush to cash out their tokens.

Launched in 2019, Pi Network introduced a unique mining concept, letting users mine tokens directly on their smartphones without needing specialized hardware. This novel approach quickly attracted a massive user base, resulting in approximately 19 million KYC-verified users by early 2024.

The Controversy and Scam Allegations Surrounding Pi Network

Despite its remarkable growth, Pi Network has been embroiled in controversy from its early days. Many within the crypto community criticized its opaque roadmap, unclear token valuation, and repeated delays in launching tradable tokens. These red flags led many observers and crypto enthusiasts to label it as potentially another elaborate crypto scam or pyramid scheme.

Critics argued that the Pi Network app was merely a sophisticated data-gathering exercise, monetizing user data while offering vague promises of future value. The persistent delays further fueled skepticism, casting doubt on the legitimacy and eventual real-world utility of the Pi token. Worth mentioning that despite this, they still got 19M KYC’d users, demonstrating the strong appeal and curiosity around the project.

Mass Sell-Off and Market Volatility

Immediately following Pi Network’s recent exchange listing, the crypto market saw extraordinary volatility. Millions of users who had accumulated tokens over the years began aggressively selling their Pi tokens, eager to cash out their holdings after years of waiting. The resulting price swings have been drastic, highlighting the speculative nature of this token launch.

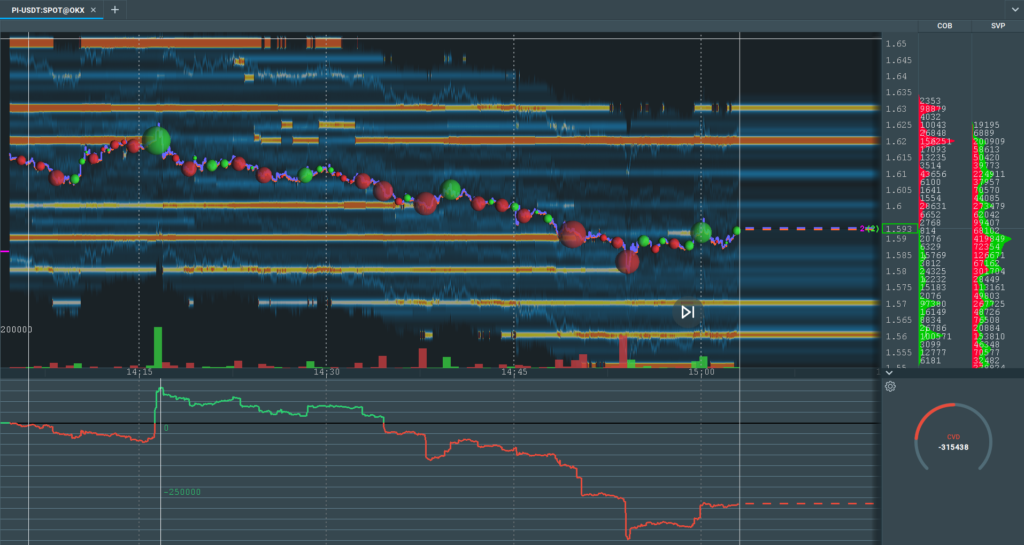

Using Bookmap’s visualization tools, traders could clearly observe real-time liquidity shifts and panic-driven order flow. Bookmap’s heatmaps provided vivid visuals of substantial sell walls as early adopters dumped large volumes onto the market, easily overwhelming initial buy-side demand. This real-time order flow visualization helps traders better understand market sentiment and identify critical liquidity levels during chaotic listing events.

Practical Insights for Crypto Traders

As crypto traders grapple with Pi Network’s turbulent market dynamics, it’s crucial to approach with caution and a clear strategy. Here are some key considerations:

- Analyze Order Flow in Real-Time: Tools like Bookmap offer traders a significant advantage by displaying hidden market liquidity, large orders, and significant buy and sell walls.

- Implement Strong Risk Management: Given the extreme volatility and speculative nature, traders must establish clear entry and exit points, using stop-loss orders to manage potential downside.

- Assess Project Fundamentals: Beyond the short-term volatility, traders should evaluate Pi Network’s longer-term viability, scrutinizing factors like its technology roadmap, community engagement, and utility value. It’s also worth considering the perspective of longer-term traders, who may be evaluating Pi Network’s potential adoption and ecosystem development rather than just short-term volatility.

Next Steps for Crypto Traders

For traders looking to capitalize responsibly on volatile market opportunities like Pi Network’s listing, Bookmap offers essential resources:

- Understanding Order Flow and Liquidity

- Volatility Trading Strategies

- Overcoming the Challenges of the Crypto Market

Stay informed, remain cautious, and always thoroughly vet crypto projects beyond immediate market hype.