Ready to see the market clearly?

Sign up now and make smarter trades today

Education

August 9, 2024

SHARE

Seasonality in Agricultural Futures: Trends and Trading Tips

Have you ever wondered why agricultural commodity prices change predictably at certain times of the year? The secret lies in “seasonality,” which widely prevails in agricultural markets. In this article, we will learn about key factors that drive seasonal trends, such as planting and harvesting cycles, weather patterns, and government policies.

Further, we’ll explore how historical price data can help traders predict future price movements and optimize their trading strategies. Using real-life examples, we’ll show how seasonality affects commodities like corn, soybeans, and wheat and offer practical tips for timing trades and managing risks. Additionally, we’ll cover advanced strategies like spread trading, options trading, and algorithmic trading to help you capitalize on seasonal trends. Let’s get started.

What is Seasonality in Agricultural Markets?

Seasonality in agricultural markets refers to the predictable changes in market prices that occur at specific times of the year due to recurring events or patterns. Often, they are driven by the natural and economic cycles of agricultural production and consumption. Let’s have a look at some key factors driving seasonality in agricultural markets:

Factor I: Planting and Harvesting Cycles

| Planting Season | Harvest Season |

|

|

Factor II: Weather Patterns

- Weather significantly impacts crop yields.

- Favorable weather leads to abundant harvests and lower prices.

- In contrast, adverse weather conditions reduce yields and drive prices up.

- Seasonal weather patterns, such as monsoons or dry seasons, influence planting and harvesting times, thus affecting market prices.

Factor III: Government Policies

- Policies such as subsidies, tariffs, and import/export restrictions affect supply and demand.

- For example,

- Say a government might implement subsidies during planting season to encourage production

- Similarly, policies may be placed to restrict exports during harvest in order to ensure domestic supply.

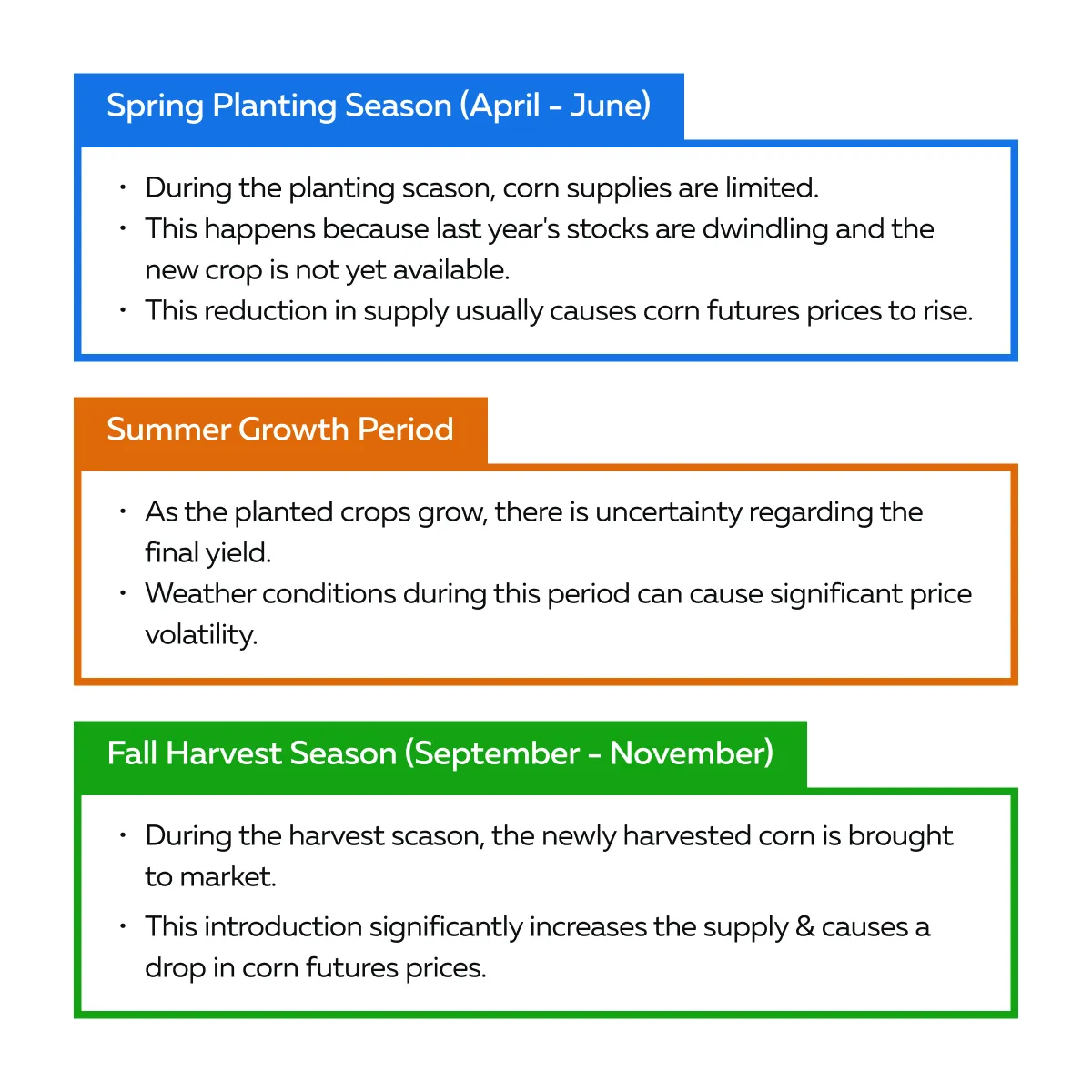

It is worth mentioning that prices usually rise during the planting season and fall during the harvest. To understand better, let’s study an example showing Seasonal Trends in Corn Futures:

Illustrative Example:

- In April, farmers begin planting corn.

- The anticipation of a new crop causes prices to stabilize or rise slightly due to uncertainty about the upcoming harvest.

- By July, if weather conditions are favorable, the market may expect a good harvest.

- This causes prices to start declining as confidence in a strong yield grows.

- Come September, the harvest begins, and the market is flooded with new corn.

- This leads to a substantial drop in prices as supply exceeds immediate demand.

Note: These patterns repeat annually. That’s because they are driven by the cyclical nature of agricultural production and external influencing factors. Hence, market participants must understand these trends to make more informed decisions about:

- Buying,

- Selling, or

- Holding agricultural commodities.

Analyzing Seasonal Trends

It must be noted that analyzing historical price data is crucial for identifying seasonal trends in agricultural futures. By examining past price movements, traders can:

- Predict future price changes

- Identify patterns

- Determine recurring cycles

- Optimize their trading strategies, and

- Mitigate risks associated with market volatility

For more clarity, let’s study a case study showing how a trader identifies consistent seasonal patterns in soybean futures using historical price data:

- Collecting Historical Data

- Gather data on soybean futures prices over a long period.

- Ideally, 10-20 years, to ensure a comprehensive analysis.

- Analyzing Monthly Trends

- Break down the data into monthly segments.

- This breakdown helps in observing average price movements throughout the year.

- Identifying Patterns

- Look for recurring trends, such as

- Price increases during planting seasons

- Look for recurring trends, such as

and

- Price decreases during harvest periods.

- Testing Consistency

- Ensure the observed patterns are consistent across multiple years.

- This consistency confirms that they are truly seasonal rather than anomalies.

Using Tools and Charts for Better Analysis

Furthermore, to precisely analyze seasonal trends, market participants can use several tools and charts. By using them, traders can:

- Effectively analyze seasonal trends.

- Enhance their trading strategies, and

- Improve their ability to forecast market movements.

Let’s have a look at some popular tools and charts:

| Seasonal Charts | Spread Charts | Moving Averages | Statistical Analysis Tools |

|

|

|

|

Now, let’s learn in simple steps how seasonal charts help in visualizing average monthly price changes in wheat futures:

- Step I: Collect Data: Obtain historical price data for wheat futures over the past decade.

- Step II: Create the Chart: Plot the average monthly prices for each year, and then calculate the average of these monthly prices across all years.

- Step III: Analyze Trends: Identify patterns such as consistent price increases or decreases during specific months.

- Step IV: Interpret Results: Use the chart to understand the typical price behavior of wheat futures, aiding in decision-making.

For Example:

Say a trader is examining a seasonal chart for wheat futures. They observe the following:

- January – March: Prices tend to be stable or slightly increase as winter crops are dormant.

- April – June: Prices often rise as spring wheat is planted, and market anticipation grows.

- July – September: Prices may peak due to summer weather conditions and potential crop stress.

- October – December: Prices usually decline as the harvest concludes and supply increases.

3 Key Seasonal Trends in Agricultural Futures

Be aware that seasonal trends in agricultural futures are “patterns.” These patterns occur at specific times of the year due to predictable changes in:

- Agricultural production cycles

- Weather conditions, and

- Market behaviors.

These trends significantly impact the prices of various commodities. Analyzing these seasonal trends can help market participants optimize their trading strategies and manage risks more effectively. To enhance comprehension, let’s study the key seasonal trends in three major agricultural commodities:

- Corn

- Soybeans, and

- Wheat.

- I) Seasonal Trends in Corn

| Planting Season (April – June) | Growth Period (July – August) | Harvest Season (September – November) |

|

|

Increased Supply: The abundance of new corn reduces scarcity, leading to lower prices. |

- II) Seasonal Trends in Soybeans

| Planting Season (April – June) | Growth Period (July – August) | Harvest Season (September – November) |

|

|

|

III) Seasonal Trends in Wheat

| Planting Season (October – November for Winter Wheat, March – April for Spring Wheat) | Growth Period (Spring – Early Summer) | Harvest Season (June – August for Winter Wheat, August – September for Spring Wheat) |

|

|

|

Trading Tips for Seasonal Trends

Managing seasonal trends in agricultural futures requires strategic planning and a deep understanding of market patterns. Several studies have shown that traders can optimize their entry and exit points and enhance profitability by using:

- Historical data

- Technical indicators, and

- Robust hedging strategies.

To gain more knowledge in this context, let’s first check how different climatic events impact seasonal trends:

- Weather Patterns:

- Droughts: Can severely impact crop yields, leading to higher prices due to reduced supply.

- Excessive Rain: Can delay planting or damage crops, causing price volatility.

- Temperature Extremes: Unseasonal hot or cold spells can affect crop growth and yield.

- Unusual Activities:

- Early Planting or Harvest: Changes in usual planting or harvesting schedules can shift traditional seasonal patterns.

- Quality Issues: Poor crop quality due to pests or diseases can affect supply and prices.

- Geographical Factors: Shifts in the regions where crops are grown due to climate change or soil degradation can impact overall supply and market dynamics.

- Market Shifts:

- Policy Changes: Government interventions such as subsidies, tariffs, or trade agreements can alter market conditions.

- Economic Factors: Global economic conditions, such as currency fluctuations and demand changes, can influence commodity prices.

Furthermore, it must be noted that unusual activities can significantly impact crop prices earlier in the year, such as:

- Weather anomalies

- Pest infestations, or

- Unexpected shifts in planting decisions

These factors affect crop quality, scarcity, and the regions where crops are grown. Their impact often leads to variability in supply and prices at harvest. For example,

- A drought in a key growing region can reduce yields and create scarcity, which drives prices up.

- Whereas an early planting season due to favorable weather can lead to an abundant supply and lower prices.

While following cyclical trends is essential, it’s important to recognize that “seasonality” can shift due to these unexpected events. Hence, traders must stay vigilant and adapt their strategies to account for these variations. Now, let’s study some practical tips for effectively timing trades and protecting against adverse price movements.

Tips for Timing Trades Based on Seasonal Trends

Entering and exiting positions at the right times can significantly enhance a trader’s success. Below are some tips and a step-by-step guide for timing trades:

- Study Historical Data: Analyze historical price patterns to identify consistent seasonal trends.

- Monitor Weather Reports: Keep an eye on weather forecasts and climatic conditions, as they significantly influence agricultural cycles.

- Use Technical Indicators: Combine seasonality analysis with technical indicators to confirm entry and exit points.

- Stay Informed: Follow market news, government policies, and global economic factors that may impact commodity prices.

- Set Targets and Stops: Define clear price targets and stop-loss levels to manage risk and protect profits.

To understand better, let’s see a step-by-step guide for trading corn futures:

- Research Historical Trends:

- Review historical data

- This will help you identify that:

- Corn prices typically rise during the planting season (April – June)

and

- Fall during the harvest season (September – November).

- Monitor Market Conditions:

- Keep track of weather reports, soil conditions, and early planting progress in key corn-growing regions.

- Use Technical Indicators for Confirmation:

- Moving Averages: Check if the 50-day moving average is crossing above the 200-day moving average (indicates uptrend).

- RSI: Ensure the Relative Strength Index (RSI) is above 50 (indicates bullish momentum).

- MACD: Confirm that the MACD line is crossing above the signal line. (indicates increasing positive momentum)

- Entry Point (April – June):

- Identify the Entry: When market conditions and technical indicators align with the expected seasonal rise, they enter a long position in corn futures.

- Place the Order: Buy corn futures contracts at the beginning of the planting season.

- Monitor the Position:

- Continuously track

- Weather updates

- Crop progress reports

- Any significant market news.

- Adjust your position if unexpected events occur, such as adverse weather or significant policy changes.

- Continuously track

- Prepare for Exit (August – September):

- Set Exit Criteria: Determine price targets based on historical peak prices during the planting season.

- Technical Exit Indicators: Watch for signs of a trend reversal, such as

- The RSI dropping below 50

or

- The MACD line crosses below the signal line.

- Exit Point (Before Harvest):

- Close the Position: Exit the long position in late summer or early fall before the harvest season starts.

- Execute the Trade: Sell the corn futures contracts to lock in profits.

Combining Seasonality Analysis with Other Forms of Analysis

In order to enhance their ability to predict market movements, several traders integrate seasonality analysis with technical, fundamental, and sentiment analysis. This comprehensive approach enables better timing of entry and exit positions Let’s see how you can do so:

- Technical Analysis:

- Chart Patterns: Use historical price charts to identify patterns and trends that coincide with seasonal movements.

- Indicators: Employ technical indicators such as

- Moving averages

- RSI, and

- MACD to confirm entry and exit points.

- Fundamental Analysis:

- Supply and Demand

- Analyze reports on crop conditions, yield estimates, and global demand.

- This analysis will help you assess the fundamental drivers of price movements.

- Economic Indicators:

- Consider macroeconomic factors, such as:

- Interest rates,

- Currency exchange rates, and

- Global trade policies.

- Consider macroeconomic factors, such as:

- Supply and Demand

- Sentiment Analysis:

- Market Sentiment:

- Monitor news, reports, and market sentiment indicators.

- This will help you gauge investor mood and potential market reactions.

- Speculative Activity

- Be aware of speculative trading activities that can influence price volatility.

- Market Sentiment:

Now, let’s see an example involving corn futures to understand how you can implement this comprehensive approach practically:

- Seasonality Analysis: Identify the typical price rise during the planting season and decline during the harvest.

- Technical Analysis: Use moving averages to confirm an upward trend in prices during the planting season.

- Fundamental Analysis: Review USDA reports on expected corn yields and global demand forecasts.

- Sentiment Analysis: Monitor news on weather conditions and market sentiment to anticipate potential price movements.

How to Use Technical Indicators to Confirm a Seasonal Uptrend?

To identify seasonal uptrends, you can perform historical data analysis. In this, you review historical price data to identify consistent seasonal uptrends. Usually, prices peak in the summer due to weather concerns impacting crop yields. Next, use technical indicators for confirmation in the following manner:

- Simple Moving Average (SMA):

- Use a 50-day and 200-day SMA.

- A crossover where the 50-day SMA rises above the 200-day SMA (Golden Cross) signals an uptrend.

- Relative Strength Index (RSI):

- An RSI above 50 shows buying strength.

- When RSI crosses above 50 during the expected seasonal uptrend period, it can confirm bullish momentum.

- If RSI is nearing overbought levels (above 70), it may suggest the uptrend is strong but also approaching a potential reversal.

- MACD (Moving Average Convergence Divergence):

- When the MACD line crosses above the signal line, it shows a bullish trend.

- Increasing positive values in the histogram suggest strengthening momentum.

Let’s understand better through an example showing the usage of technical indicators for Soybean Futures:

- Late Spring: As planting progresses, the trader observes that the 50-day SMA is crossing above the 200-day SMA.

- RSI Monitoring: The RSI has moved above 50, indicating bullish momentum but is not yet overbought.

- MACD Confirmation: The MACD line has crossed above the signal line, with the histogram showing increasing positive values.

- Entry Decision: With these technical indicators confirming the seasonal uptrend, the trader decides to enter a long position in soybean futures.

Using Seasonality to Inform Hedging Strategies

Hedging helps protect against adverse price movements. This strategy ensures more predictable revenue or cost management. Let’s learn through an example how a farmer uses futures contracts to hedge against price declines during harvest.

Scenario:

- A soybean farmer plants crops in April and anticipates the harvest in September.

- The farmer is concerned about potential price declines during the harvest due to increased supply.

Hedging Strategy:

- Futures Contracts:

- In April, the farmer sells soybean futures contracts for September delivery.

- This locks in a price at which the farmer can sell the crop.

- This way, they gain protection against potential price declines.

- Position Management:

- Throughout the growing season, the farmer monitors

- Weather reports

- Crop progress, and

- Market trends.

- If market conditions change significantly, the farmer adjusts the futures position, either by

- Buying back the futures contracts

- Throughout the growing season, the farmer monitors

or

- Rolling them over to a later month.

Outcome:

- By September, if soybean prices have declined as anticipated, the farmer will buy the physical crop at the lower market price.

- However, they offset the loss with the profit from the futures contract sold at a higher price in April.

- This strategy ensures that the farmer receives a more stable and predictable income, regardless of the market price fluctuations during the harvest season.

Combining Seasonality and Technical Analysis for Hedging

By combining seasonality analysis with technical and fundamental analysis, traders and farmers can develop robust strategies. They can gain better protection against adverse price movements and capitalize on predictable seasonal trends. Being an integrated approach, it significantly enhances decision-making by optimizing hedging strategies and reducing market risk. Now, let’s see how you can implement this strategy:

- Seasonal Analysis: Identify the typical price decline during the harvest season.

- Technical Analysis:

- Use technical indicators to monitor for bearish signals as the harvest approaches.

- If the RSI drops below 50 and the MACD line crosses below the signal line, it confirms bearish momentum.

- Hedging Decision:

- Based on both the seasonal expectation of price decline and confirmation from technical indicators, you can sell futures contracts to hedge against the anticipated price drop.

Strategies for Seasonal Trading

To effectively capitalize on seasonal trends in agricultural futures, traders can employ several seasonal trading strategies, such as:

- Spread trading

- Options strategies, or

- Algorithmic trading.

By understanding these strategies and leveraging seasonality, traders can significantly improve their trading outcomes. For more clarity, let’s understand these strategies in detail:

Strategy I: Spread Trading

Spread trading involves taking simultaneous long and short positions in related futures contracts to profit from the price difference between them. This approach reduces exposure to market-wide risk by focusing on the relative performance of the contracts.

A popular type of spread trading strategy is the “calendar spread.” It is also known as an intra-market spread and involves buying and selling futures contracts of the same commodity but with different delivery months.

Let’s study the implementation of this strategy through an example showing how a trader exploited the price difference between December and March corn futures contracts:

- Trader Identified Seasonal Trends:

- Historical data shows that corn prices often

- Rise during the Planting season (spring)

- Historical data shows that corn prices often

and

- Decline post-harvest (fall).

- Trader Sets Up the Spread:

- Buy the December Contract: Expecting lower prices post-harvest in December.

- Sell the March Contract: Expect prices to rise as planting season approaches in the new year.

- Trader Executes the Trade:

- If the price difference between December and March contracts widens (December falls more or March rises more), the trader profits from the spread.

- Trader Closes the Spread:

- As the seasonal trends unfold and the spread widens, the trader closes both positions to realize the profit.

Strategy II: Options Strategies

It is essential to note that options offer a flexible way to manage risk and leverage positions in anticipation of seasonal price movements. Let’s see through an example how you can use a call option to capitalize on an expected seasonal rise in wheat prices:

-

- Identify Seasonal Trend:

- Wheat prices tend to rise in the spring as planting progresses and concerns about crop establishment grow.

- Select the Option:

- Choose a call option with an expiration date that captures the anticipated price rise, such as a June call option.

- Determine Strike Price:

- Select a strike price that is near the current market price or slightly above.

- Execute the Trade:

- Pay the premium to buy the call option.

- Monitor the Market:

- As wheat prices rise, the value of the call option increases.

- Now, you can either sell the option at a profit or exercise it to take a long futures position at the favorable strike price.

- Identify Seasonal Trend:

- Close the Position:

-

- If the price rise occurs as expected, you sell the option or exercise it before expiration.

- This way, you capture the profit from the seasonal price movement.

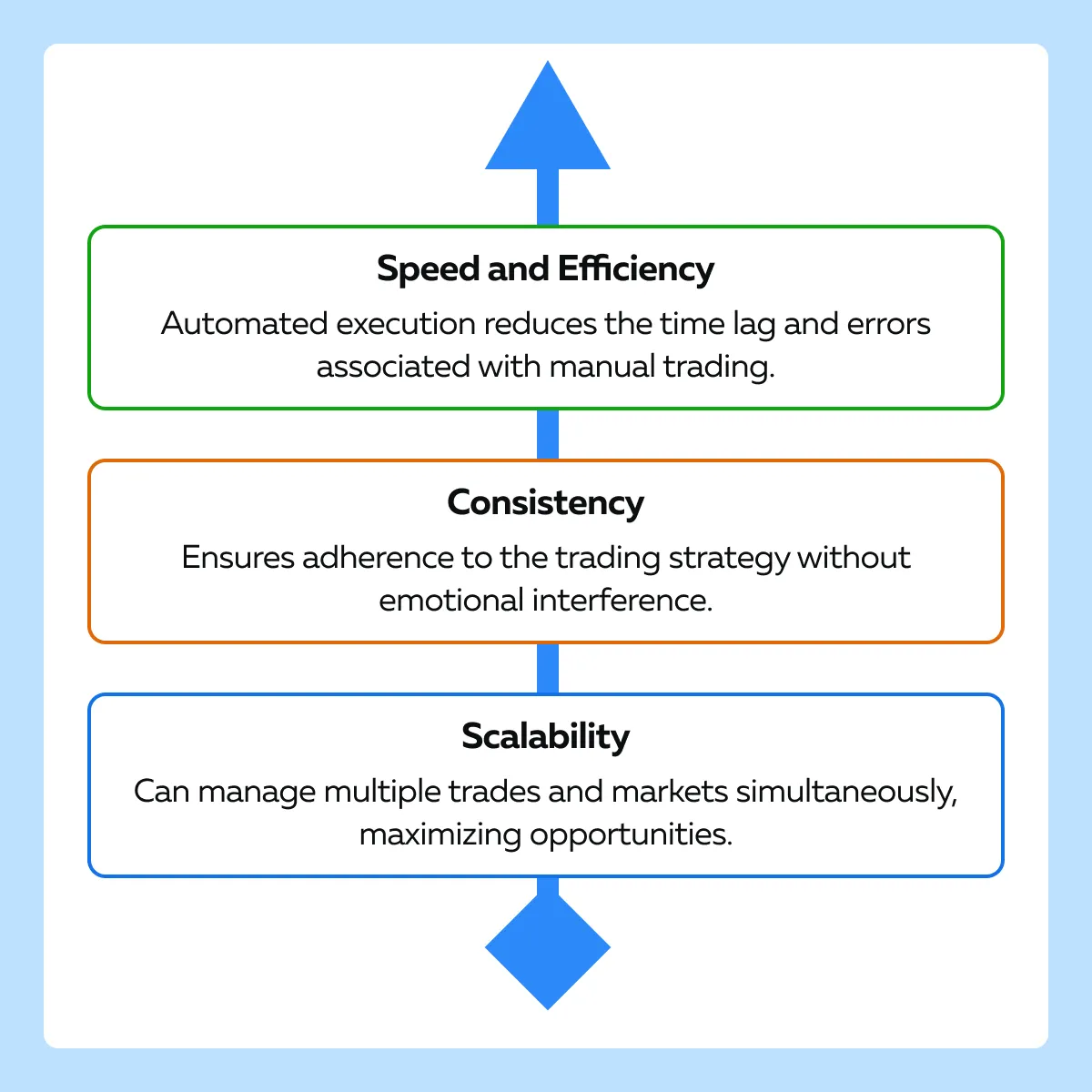

Strategy III: Algorithmic Trading

Algorithmic trading involves using computer programs to automate trading strategies based on predefined rules and patterns. Let’s see how you can use Algorithmic Trading System for Soybean Futures:

- Historical Data Analysis:

- Program the algorithm to analyze historical price data.

- Identify seasonal patterns in soybean futures.

- Define Trading Rules:

- Set rules for entering and exiting positions based on seasonal trends, such as:

- Entry Rule: Buy soybean futures at the beginning of July when prices typically rise.

- Exit Rule: Sell soybean futures at the end of August before prices decline post-harvest.

- Set rules for entering and exiting positions based on seasonal trends, such as:

- Incorporate Technical Indicators:

- Enhance the algorithm with technical indicators (e.g., moving averages, RSI) to confirm seasonal trends and reduce false signals.

- Automate Execution:

- The algorithm automatically executes trades when the predefined conditions are met.

- This automatic execution ensures timely and accurate order placement.

- Continuous Monitoring and Adjustment:

- Continuously monitor the algorithm’s performance

- Keep adjusting parameters to accommodate changes in market behavior or seasonal patterns.

Some Common Benefits of Using Algorithmic Trading

Conclusion

Seasonality in agricultural futures trading allows market participants to maximize their profitability and minimize risks. By studying historical patterns and seasonal trends, traders can anticipate price movements based on predictable cycles of planting, growth, and harvest. This knowledge allows them to enter positions at opportune times when prices are likely to rise and exit before anticipated declines.

Monitoring weather conditions and market factors further enhances decision-making. They enable adjustments to strategies in response to unforeseen events that may impact crop yields and prices. Several successful traders combine this seasonal analysis with practical indicators and risk management techniques to make informed trading decisions.

Furthermore, traders can improve their performance in the agricultural markets by staying informed and adaptable. They can take advantage of seasonal opportunities and optimize their overall trading performance. For further insights on how geopolitical factors shape commodity trading strategies, click here.