Ready to see the market clearly?

Sign up now and make smarter trades today

Education

March 16, 2024

SHARE

The 3 Steps to Trading Success

Unless you’re a large corporation looking to hedge price risks, you are probably coming to the market to make money. Everybody knows how: just buy low and sell high. But the stats showing how the majority of market participants fail to do so suggest it’s anything but easy.

Failure in the financial market is usually because of a lack of basic trading knowledge or unawareness of the various techniques to improve your chances. Making money in the financial markets is a result of patience and forward thinking coupled with a sound trading philosophy.

But before you can even think about profitability in trading, you need to make sure you have the main aspects of trading. Here are 3 steps to help you reach trading success.

Step 1: Market Analysis

Before you can come to any conclusions about buying or selling, you must first analyse the market. These can involve anything from trying to derive a stock’s intrinsic value based on company cash flows, or analysing weather predictions to gauge how crop harvests could affect futures prices.

Without a huge research team at their disposal, though, most traders go down the route of technical analysis. The belief is that all of the most important information related to the asset in question will be embedded in the price. Armed with historical patterns, this serves as the basis for making assumptions and anticipating an asset’s potential future price trajectory (based on probabilities).

The practical element of market analysis depends on your choice of trading indicators and strategies.

Trading Indicators

Indicators are the core of any trading strategy. But they can’t be used in isolation. That doesn’t mean traders should combine multiple indicators and get overwhelmed by ‘analysis paralysis’, but that they should be smartly placed within the larger framework of your trading approach. Your trading strategy should include things like risk and money management and potentially even sound trading psychology practises.

With that in mind, some of the most reliable trading indicators include:

-

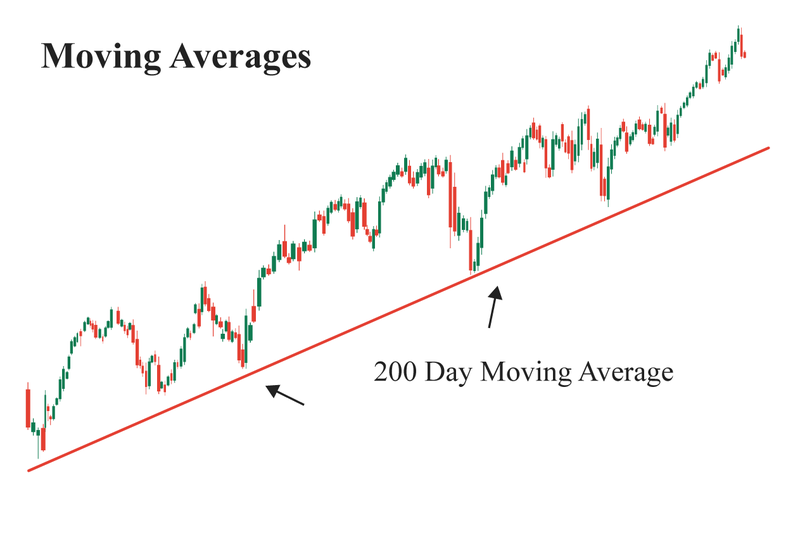

Moving Average (MA)

This indicator smoothes out the price fluctuations across the period of time chosen for that particular asset, resulting in an average price. The most common period used by traders is the 200-day moving average, which can often act as a form of price support and resistance and can also show the direction of the longer-term trend.

This indicator is often divided into two subcategories:

- Short-term averages: 10 to 30-day moving averages

- Long-term averages: 50 to 200-day moving averages

-

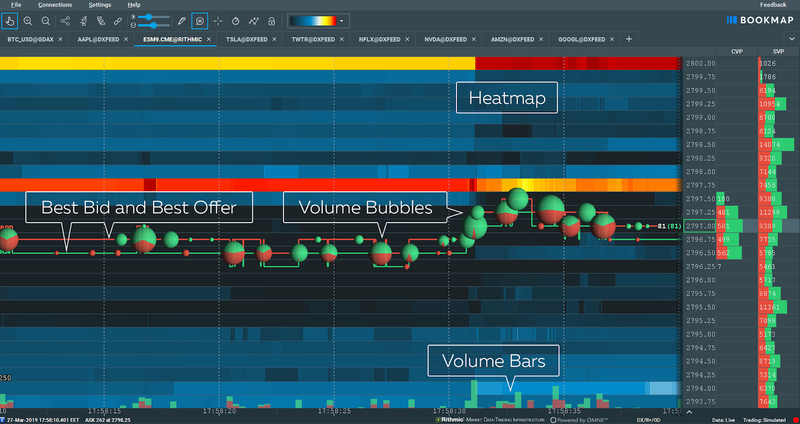

The Heatmap

A good heatmap will show you transactional volume, resting liquidity, and the best bid and offer. With Bookmap’s heatmap, you can also overlay candlesticks to look for traditional patterns within the broader context of order flow.

The heatmap shows the interactions between aggressive market participants and the resting liquidity in the order book.

Thanks to the color gradient element of the heatmap, it is possible to quickly and intuitively see if orders are pulling or adding, giving you extra insights into the intentions of market participants.

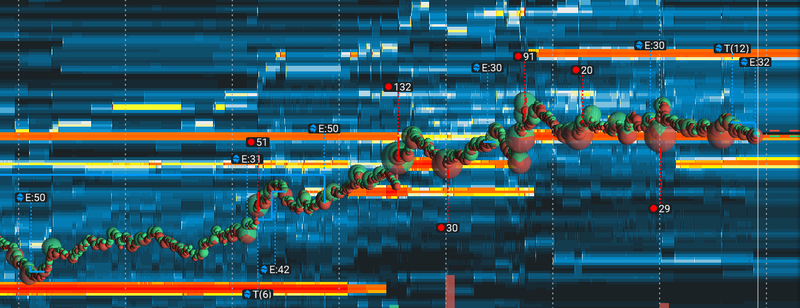

- Stops & Icebergs On-Chart

While the heatmap will show you the interaction between aggressive and passive orders, the Stops & Icebergs indicator can give you an even deeper look into these interactions.

Since stops act as aggressive market orders, and icebergs are essentially passive limit orders (with a twist), both potentially giving clues as to if the market is about to reverse, or if it’s more likely for the current trend to continue.

Trading Strategy

Nobody can expect long-term success without a strategy. Sure, trading success is possible in the short-term but, to be consistently profitable and thrive for the long-term requires a plan. This helps a trader determine the asset classes and specific securities that will be traded, their entry and exit signals, as well as the position size of the trades executed.

An appropriate trading strategy should usually be developed in the following order:

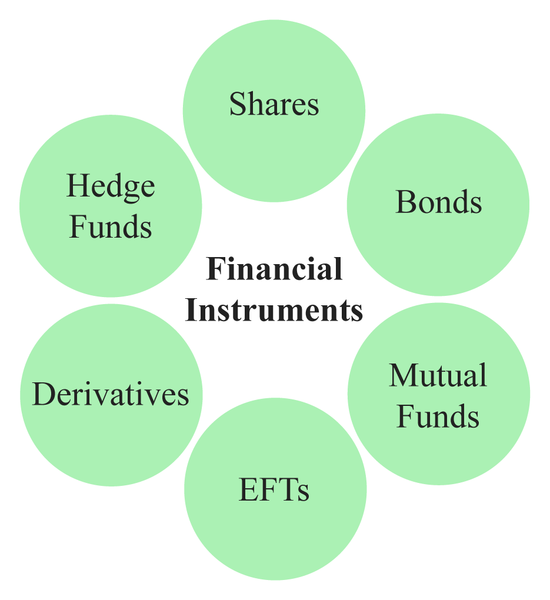

Select your Security

There are countless different markets such as options, futures, exchange-traded funds (ETFs), etc. Each asset class has it’s own unique set of characteristics. Therefore, a trader needs to choose what they will be trading based on:

- Their risk tolerance (Are you trading on the side, or full-time? Do you have the necessary capital?)

- Their knowledge of the market (Do you know how to read a balance sheet? If not, perhaps you shouldn’t be trading stocks. But this depends on your style: as long as you know your strategy and it’s relevant to the asset being traded).

Analysis: Choosing a time frame is an important aspect of every strategy. Time frames can usually be split into three separate categories:

| Time Frame | Trading Style | In Practice |

| Tick chart – 5m | Scalping | Jumping in an out of positions very quickly multiple times throughout the hour, closing losers almost instantly and having tighter profit targets. |

| 15m – 1H | Intraday | Buying and selling before the market close, sometimes a couple of times. |

| 4H – Daily | Swing trading | Working into a trade and holding for days, or evens weeks. These types of trades are the definition of “letting your profits run”. |

Entry and Exit: A trader must identify the:

- Entry triggers (the time to enter into the market) using various indicators or methods of analysis, and

- Exit triggers (the time to exit from the market) by determining an appropriate invalidation points, as well as target areas.

Step 2: Risk Management

Risk is the inescapable truth of trading in the market: there be always be a chance you are wrong. Hence, a good trader must mitigate the risk of large losses by using sound risk management principles.

This can be done by following certain risk management rules, such as:

The 1% Rule

This rule defines the maximum risk on any single trader. A trader must take a position size relative to a stop loss that equates to 1% of their trading capital.

For example, if a trader has a trading account of $25,000, then as per the 1% rule, he or she will place the stop loss so that the dollar amount at risk with a losing trade is $250. A trade is booked as a loss when the stop loss is triggered and the trade thereby invalidated. You can read more about stops in our Complete Guide to Stops.

Other Rules

Some rules may not be able to be translated into mathematical rules, but it doesn’t mean they shouldn’t also be hard and fast rules.

Here are some rules that professional trades live by:

Switching off the screen after consecutive losses: A trader must define their risk appetite relative to their strategy and stop after sustaining a series of losing trades. Depending on the strategy, multiple trades in a row may indicate that the strategy isn’t working for now and that it may be best to come back later (especially when day trading). The exact numbers should depend on the individual characteristics of your strategy, but as a general rule of thumb, a trade should stop after:

- Experiencing a 3% loss of trading capital (when using the 1% Rule), or

- 3 full losses in a row (translation: 3 invalidated trading signals in a row).

Avoid trading when you are tired: Trading losses might not always be due to your strategy, though. It could just be that you didn’t have enough sleep that night. No matter if you had too much fun partying the previous night, or you had a fierce argument with your significant other, the results remain the same: you are not at peak concentration, and mistakes are more easily made. In this case, it’s better to come back and only put capital at risk when you are ready to take it on.

Step 3: Discipline

Discipline is something that is considered to be a virtue in many practices: from meditating monks to fighting soldiers. Trading is no exception. It dictates that a trader is not influenced by their elusive emotions, nor swayed by shifting market sentiment that can cause a trader to miss the bigger picture.

Practise make perfect when it comes to discipline. But you can also incorporate these rules into your trading to aid better discipline:

Sticking to Your Trading Plan: A trading plan is a trader’s personal bible, which states exact rules for:

- Entering and exiting trades

- Game plans for different market environments

- The risk appetite of the trader, meaning:

- The maximum amount a trader can lose in a single trade and

- The maximum capital loss in one trading session

Keeping A Detailed Trading Journal: Discipline is not a one-time affair. Instead, it is a result of persistent efforts. Hence, every trader must keep a trading journal, which must comprise a description of every trade undertaken by the trader. It usually has the following details:

- The reason a trade was entered

- How the trade was executed and its results

- Any emotions felt throughout the duration of the trade

Conclusion

Success cannot be achieved overnight. Instead, it comes over time with the help of discipline—to plan trades, to manage risks, and to execute consistently.

Bookmap is a high-performance trading platform that comes with must-have tools designed with the sole intention of helping traders to reach success.

You can try it out today for free. Click here to get started.