Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

September 21, 2024

SHARE

The Best Day Trading Charts: A Brief Guide

Interested in day trading? It’s a dynamic venture that demands quick thinking and precise decision-making. In the trading world, where experienced players make strategic moves, having the right tools is essential.

Charts are one of these vital tools, forming the backbone of your day trading strategy. They help you understand price patterns, spot trends, and identify support and resistance levels—essential for wise decision-making in this complex field. And that’s where Bookmap comes in, providing real-time visuals of order book data, so you can see where buyers and sellers are concentrated and how they interact.

Let’s delve deeper into the best day trading charts and explore how you can attain a competitive edge.

Essential Day Trading Charts

Day trading is a high-stakes game that requires sharp thinking and precise decision-making. In a world where big players manipulate and maneuver, the right tools can make or break your success. Footprint and Volume Profile charts are two such tools. They provide insights into trading activity and price distribution helping traders gain a significant edge in the market.

Footprint and Volume Profile Charts

Let’s dive in and understand how these charts can improve your trading.

a) Footprint Charts:

Footprint charts (also known as Market Profile charts) are a visual representation of trading activity within specific price levels over a given period.

How Footprint Charts Help Day Traders

-

Price Discovery:

-

Footprint charts reveal where buying and selling activity is concentrated at different price levels.

-

This helps traders identify areas of price discovery.

-

-

-

Volume Analysis:

-

These charts provide information about the volume traded at each price level.

-

This allows traders to test the strength of support and resistance levels.

-

-

Market Imbalance:

-

Footprint charts highlight at what price level aggressive buyers or sellers are entering the market.

-

This helps traders spot potential trend reversals or breakout opportunities.

-

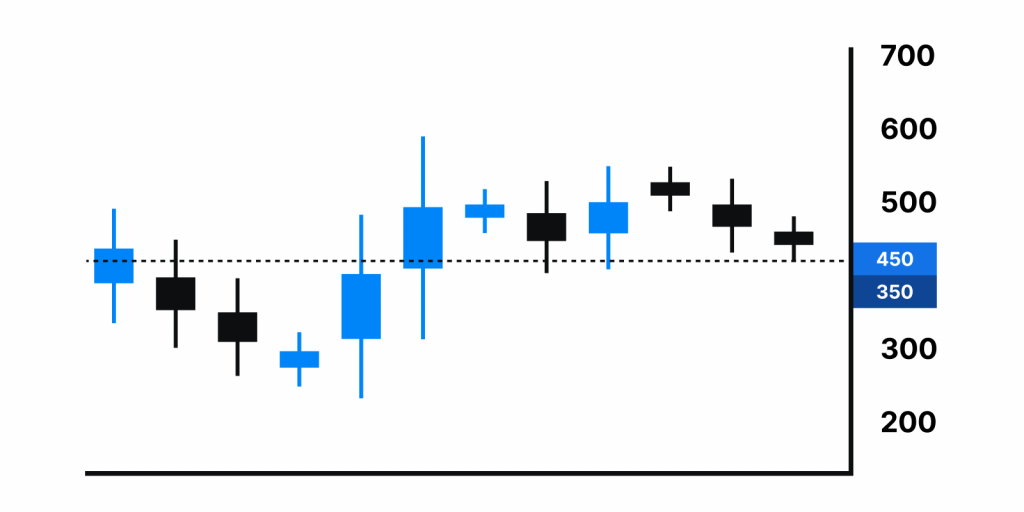

b) Volume Profile Charts:

Volume Profile charts focus primarily on volume traded at specific price levels over a given time frame. They create a histogram that represents the volume distribution across different price levels.

How Volume Profile Charts Help Day Traders

-

Price Acceptance:

-

Volume profile charts help traders identify price levels where the market has accepted a particular price as fair.

-

-

Point of Control (POC):

-

These charts help traders gauge the POC, which is the price level with the highest traded volume.

-

Most day traders consider it a critical reference point for potential support or resistance.

-

-

Value Area:

-

This is a range of prices where a significant portion of trading has occurred.

-

Day traders use it to identify price ranges with high trading activity.

-

How Are They Related to Day Trading?

Both Footprint and Volume Profile charts provide insights into market dynamics that are crucial for day traders. They help in:

-

Making informed decisions as they show where trading activity is concentrated.

-

Managing risk as traders use them to understand the distribution of trading activity and volume.

-

Spotting trends as footprint and volume profile charts reveal potential trend reversals or trend continuation patterns.

Bar Data Charts (Bar Charts, Candlestick Charts, Heikin-Ashi Charts)

Bar Data charts are commonly used in trading and technical analysis. They aggregate data over specific periods, which may not necessarily be based on time. In this category, we include candlestick and Heikin-Ashi charts due to their shared characteristics related to bar data representation.

The Concept of Bar Data Charts Explained

Bar Data charts represent price and trading data by forming bars or candles, each of which summarizes the price action during a predefined time or volume interval. Unlike time-based charts, where each bar represents a fixed amount of time (e.g., one minute or one hour), bar data charts can have:

-

Bars of varying time lengths or,

-

Be based on a certain volume of trades.

Volume-Based Bars

-

Some bar data charts are based on volume periods rather than time.

-

In other words, a new bar is formed after a specific volume of trades has occurred, regardless of the time it takes to reach that volume.

-

This approach is particularly useful for traders who want to gauge market activity based on the number of trades executed.

The Benefits for Traders (Especially Volume-Centric Traders)

Bar Data charts offer several advantages for traders. Read the table below for a comprehensive understanding:

|

Benefits |

Meaning |

Practical Usage |

|

Establish Price & Volume Relationship |

These charts provide a clear view of how price movements correlate with trading volume. |

|

|

Identify Price Support and Resistance Levels |

Traders can identify support and resistance levels easily on these charts, as price levels with significant trading volume tend to act as barriers.

|

|

|

Trend Analysis |

Bar data charts are useful for trend analysis, helping traders spot potential reversals or confirmations of existing trends based on volume-based patterns. |

|

Candlestick and Heikin-Ashi Charts

Candlestick and Heikin-Ashi charts provide unique visualizations, aiding traders in the analysis of price dynamics and the identification of:

-

Key price levels

-

Trends

-

Potential reversals

By understanding these chart types, traders can enhance their ability to make informed trading decisions in various market conditions.

Let us understand them individually.

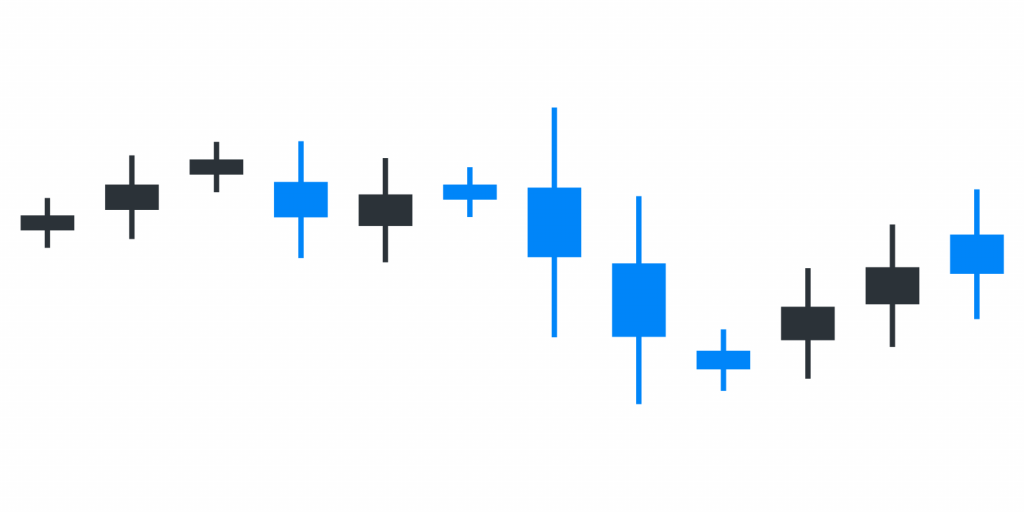

-

-

Candlestick Charts:

-

-

provide richer insights compared to traditional bar charts

-

highlight the opening and closing prices for each period, which are represented by the “body” of the candle

-

display high and low prices through the “wick” or “shadow”

-

-

Heikin-Ashi Charts:

-

-

employ a modified formula to smooth out price movements, making trends and reversals more apparent

-

are the preferred choice for traders seeking a clearer representation of market trends

Last Trade / Best Bid and Offer

Last Trade and Best Bid and offer data are crucial tools for day traders. They provide real-time information about the most recent transaction prices and the current state of supply and demand for an asset. This data enables traders to:

-

assess market sentiment

-

execute trades at optimal entry and exit points

Understanding the significance of these tools:

|

Last Trade |

Best Bid & Offer (BBO):

|

|

|

Meaning |

|

|

|

Benefits |

|

|

|

|

|

|

|

Pros and Cons of Different Chart Types

The choice of chart type depends on several factors:

-

Your skill level

-

Your trading style

-

Your analysis needs

Beginners should start with simpler charts to build a solid understanding of price movements, while advanced traders can explore more complex chart types for deeper market insights.

Depth of Information vs. Clarity

When selecting chart types, there’s often a trade-off between the depth of information they provide and the clarity of that information. Let’s explore this concept:

Depth of Information

The more detailed the information is, the better your decision-making will be. It is a plain and simple belief, widely followed in the stock market. A chart or tool with a greater depth of information provides more detailed insights into:

-

Price movements

-

Market dynamics

-

Trading patterns

Most day traders prefer the following tools for gaining in-depth information:

|

Chart |

Benefits |

Negatives |

|

Candlestick Charts |

|

|

|

Heikin-Ashi Charts |

|

|

|

Footprint & Volume Profile Charts |

|

|

Clarity

Clear data visualizations are user-friendly, facilitating:

-

Insights extraction

-

Pattern identification

-

Information comprehension

Most day traders prefer the following tools for gaining clarity in their trading decisions:

|

Chart |

Benefits |

Negatives |

|

Line Charts |

|

|

|

Bar Charts |

|

|

|

Renko Charts |

|

|

Suitability for Trading Styles

Different trading styles, such as scalping, swing trading, and position trading, require specific chart types that align with their objectives and timeframes. Let’s explore which charts are better suited for each trading style.

a) Scalpers

-

Scalpers are traders who aim to profit from very short-term price movements, often holding positions for minutes or even seconds.

-

For scalping, chart types that provide quick and precise information are preferred.

Preferred Charts:

|

Chart |

Explanation |

|

Tick Charts |

|

|

1-Minute Candlestick Charts |

|

Note: Bookmap’s heatmap provides a visual representation of market depth, showing where buyers and sellers are concentrated in real-time. Scalpers can quickly assess liquidity levels to make rapid trading decisions.

b) Swing Traders

-

Swing traders aim to capture medium-term price movements over several days or weeks.

Preferred Charts:

|

Chart |

Explanation |

|

Candlestick Charts |

|

|

Footprint Charts |

|

Note: Bookmap also offers swing traders Historical Depth Data & Iceberg Detection. Swing traders can analyze how the order book evolves over time to identify recurring patterns and potential support/resistance levels. And the Iceberg Detector helps identify hidden large orders, which can be crucial for swing traders looking for support/resistance zones.

c) Position Traders

-

Position traders hold trades for much longer periods, from weeks to months or even years.

-

They require chart types that provide a long-term perspective with less noise.

Preferred Charts:

|

Chart |

Explanation |

|

Weekly or Monthly Line Charts |

|

|

Renko Charts |

|

How Bookmap Revolutionizes Day Trading Visualization

Bookmap’s real-time market dynamics visualization capabilities help day traders gain a competitive advantage. It transforms the way traders perceive and respond to market data, offering a dynamic, visual representation of live order book data, trade executions, and liquidity levels. Here’s how Bookmap’s real-time market visualization capabilities are reshaping day trading:

Real-time Market Dynamics

Bookmap revolutionizes the way day traders perceive and respond to market data, allowing them to make more informed trading decisions. With greater emphasis on real-time market visualization, Bookmap stands out by providing traders with a unique, real-time view of market dynamics.

Unlike traditional charts that display historical price data, Bookmap offers a dynamic, visual representation of live order book data and trade executions.

Let’s understand how Bookmap’s real-time visualization is a game-changer:

-

Live Trade Executions:

-

Bookmap displays trades as they occur.

-

These are represented as dots or bubbles on the chart, with colors indicating buy or sell activity.

-

Traders can witness the precise moment when trades are executed.

-

-

-

Order Book Heatmap:

-

Bookmap’s heatmap visualizes the depth of the market, showing:

-

Areas of high liquidity (congestion) and

-

Low liquidity (gaps).

-

-

This information helps traders identify critical support and resistance levels in real-time.

-

-

Depth of Market (DOM) Visualization:

-

The DOM ladder within Bookmap offers a clear view of limit order levels, allowing traders to see where buying and selling interest is concentrated.

-

This transparency is invaluable for understanding market sentiment.

-

The Heatmap and Volume Dots

Bookmap offers two distinctive features that significantly enhance a trader’s understanding of market dynamics: the Heatmap and Volume Dots.

These tools provide real-time insights into order flow and volume distribution, offering traders a unique advantage in their decision-making process. See how:

|

Aspects |

Heatmap |

Volume Dots |

|

What does it mean? |

|

|

|

How is it used? |

|

|

|

How does it help day traders? |

|

|

|

|

|

A sudden surge in dark blue (high liquidity) on the heatmap may indicate a breakout level.

|

Seeing a cluster of red dots followed by a cluster of green dots might signal a short-term reversal.

|

Order Flow: Understanding Market Pulse

Understanding order flow is essential for grasping the dynamics of buying and selling activity within the market. Bookmap’s Market Pulse feature takes this understanding to the next level by providing real-time visualization of order flow. It offers:

-

Visualizing Order Flow:

-

Bookmap displays the order flow on its intuitive chart, offering traders a dynamic view of market activity.

-

It shows individual trades, their sizes, and their prices as they occur.

-

-

Market Depth Analysis:

-

The Depth of Market (DOM) ladder within Bookmap displays limit order levels, revealing where buyers and sellers are concentrated.

-

This allows traders to anticipate potential support and resistance levels based on order book dynamics.

-

-

Market Sentiment Insights:

-

By observing the order flow, traders can gauge market sentiment.

-

For instance, a surge in buy orders may indicate bullish sentiment, while an increase in sell orders could suggest bearish sentiment.

-

Market Pulse Feature:

Bookmap’s Market Pulse feature provides traders with an additional layer of information. It quantifies market activity in real-time, offering insights into market conditions.

|

Benefits |

Explanation |

Practical Usage |

|

Gauging Strength |

|

|

|

Consolidation vs. Momentum |

|

|

Conclusion

Selecting the appropriate chart type based on one’s trading style and objectives is paramount for success in the dynamic world of trading.

For beginners, simpler charts like Line Charts and basic Bar Charts provide a clear and manageable view of price movements, helping them build a foundational understanding. On the other hand, advanced traders may benefit from the depth of information provided by Candlestick Charts, Heikin-Ashi Charts, Footprint Charts, and Volume Profile Charts, allowing for more in-depth analysis and strategy refinement. Trading styles, such as scalping, swing trading, or position trading, further influence the choice of chart type.

Bookmap’s real-time market visualization tools (including heatmap and volume dots) provide insights into order flow, liquidity, and market sentiment. These tools empower traders to make well-informed decisions, adapt to changing market conditions, and anticipate shifts in supply and demand dynamics.

Ready to elevate your day trading with advanced visualization tools? Dive into the world of Bookmap and experience trading insights like never before. Start Your Bookmap Journey Today!