Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

May 19, 2025

SHARE

The History of Tariffs: How Trade Policies Shape Markets and Trading Opportunities

Tariffs have been around for centuries- sometimes protecting local jobs, other times sparking international trade wars.

For the unaware, tariffs are taxes on imported goods. However, their influence goes way beyond price tags! Usually, they influence supply chains, impact currencies, and create intense market volatility. Usually, sectors like agriculture, tech, and autos feel the heat first.

From the Great Depression to the U.S.-China trade war, the history of tariffs shows us how powerful and unpredictable they can be. Afraid? Don’t be! As a trader, you can make large profits within a few minutes when trading in a tariff-driven market. Want to learn how? In this article, we’ll understand the impact of tariffs on markets through some real-world examples. Also, we will learn how you, as a smart trader, can spot the adverse effects of tariffs and manage positions accordingly.

What Are Tariffs and Why Do They Matter to Traders?

Tariffs are taxes. They are imposed by a government on goods coming into a country from abroad. The goal is to protect local businesses by making imported products more expensive. That way, people might be more likely to buy things made locally! Sometimes, tariffs are also used to pressure other countries during trade negotiations.

For traders and investors, tariffs are of significant relevance. When tariffs are introduced or changed, the cost of goods can increase. This effect leads to changes in:

- Consumer demand,

and

- Currency values.

A good real-world example is the U.S.-China trade war between 2018 and 2019.

- The United States placed tariffs on hundreds of billions of dollars worth of Chinese goods.

- In response, China levied its own tariffs.

- This back-and-forth causes major swings in stock markets.

- It affected commodity prices and created a lot of uncertainty around the world.

Historical Overview: Significant Tariff Events and Market Impact

Tariffs are not new! Since times immemorial, countries have been placing tariffs on their trading partners. One of the most famous examples is the Smoot-Hawley Tariff Act of 1930. Let’s understand what happened in detail:

The Smoot-Hawley Tariff Act (1930): Triggering a Global Economic Crisis

In 1930, during the early stages of the Great Depression, the U.S. government passed the Smoot-Hawley Tariff Act. The goal was to protect American farmers and industries by placing high tariffs on thousands of imported goods.

Lawmakers hoped:

- The imposition of tariffs would make imported products more expensive,

and

- People would buy American-made goods instead.

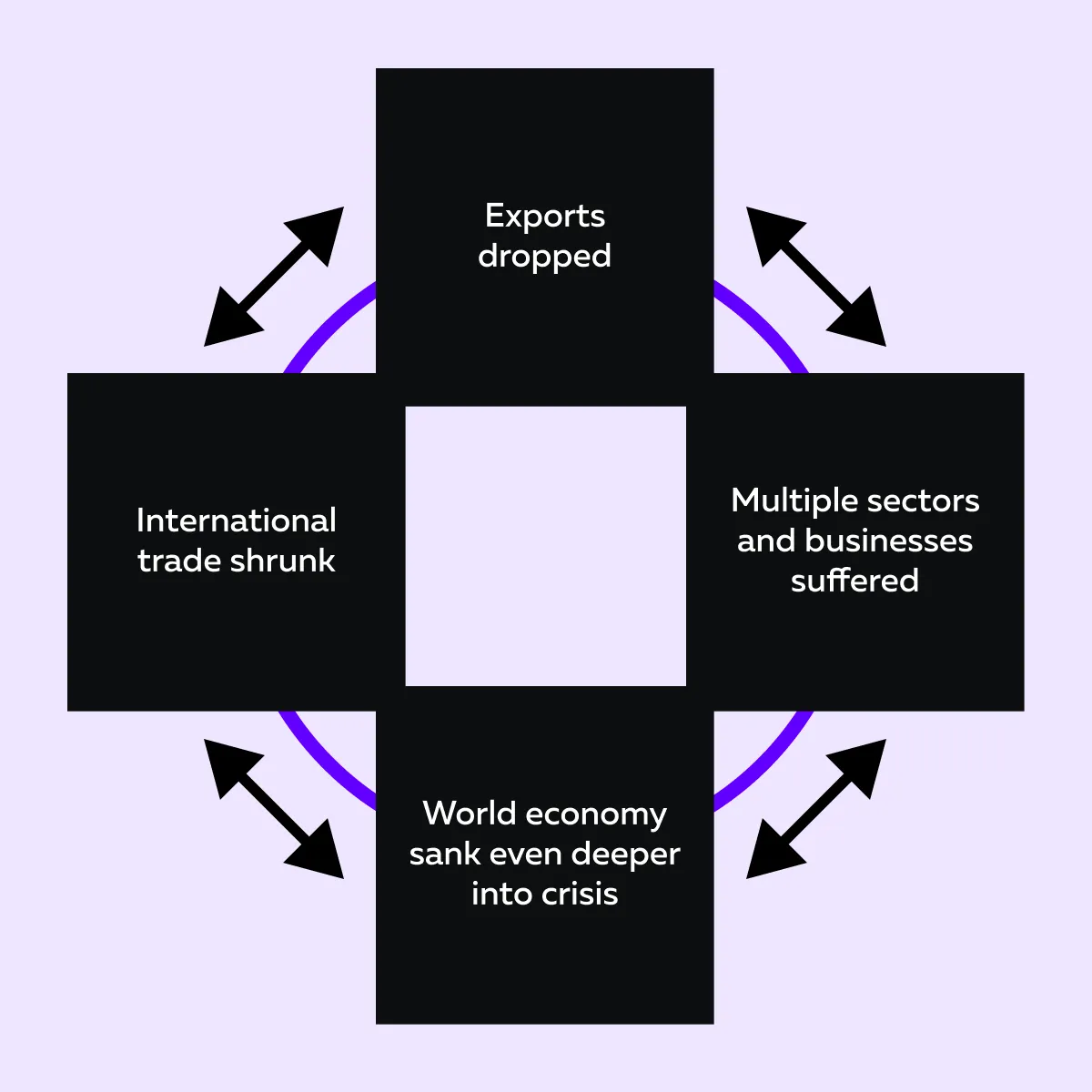

However, the plan backfired. Other countries didn’t sit back! They responded by putting their own tariffs on U.S. goods. Check out the graphic below to learn what this kind of global retaliation led to:

Additionally, the financial markets became highly bearish. The Dow Jones Industrial Average lost more than 40% of its value in just a few months after the tariffs were passed. That sharp decline wasn’t just about fear! Instead, it reflected real damage to:

- Trade,

- Profits,

- Investor confidence.

Post-WWII Tariff Reductions: Growth in Global Trade (GATT and WTO)

After World War II, world leaders wanted to avoid the kind of economic chaos that followed the Great Depression and earlier trade wars. So, they came together to create agreements that would:

- Reduce tariffs,

and

- Promote global cooperation.

This event led to the creation of the General Agreement on Tariffs and Trade (GATT) in 1947.

The Role of GATT

GATT allowed countries to gradually lower trade barriers, which made it easier and cheaper for goods to move across borders. Over time, GATT evolved into the World Trade Organization (WTO) in 1995. This entity continues to oversee global trade rules today.

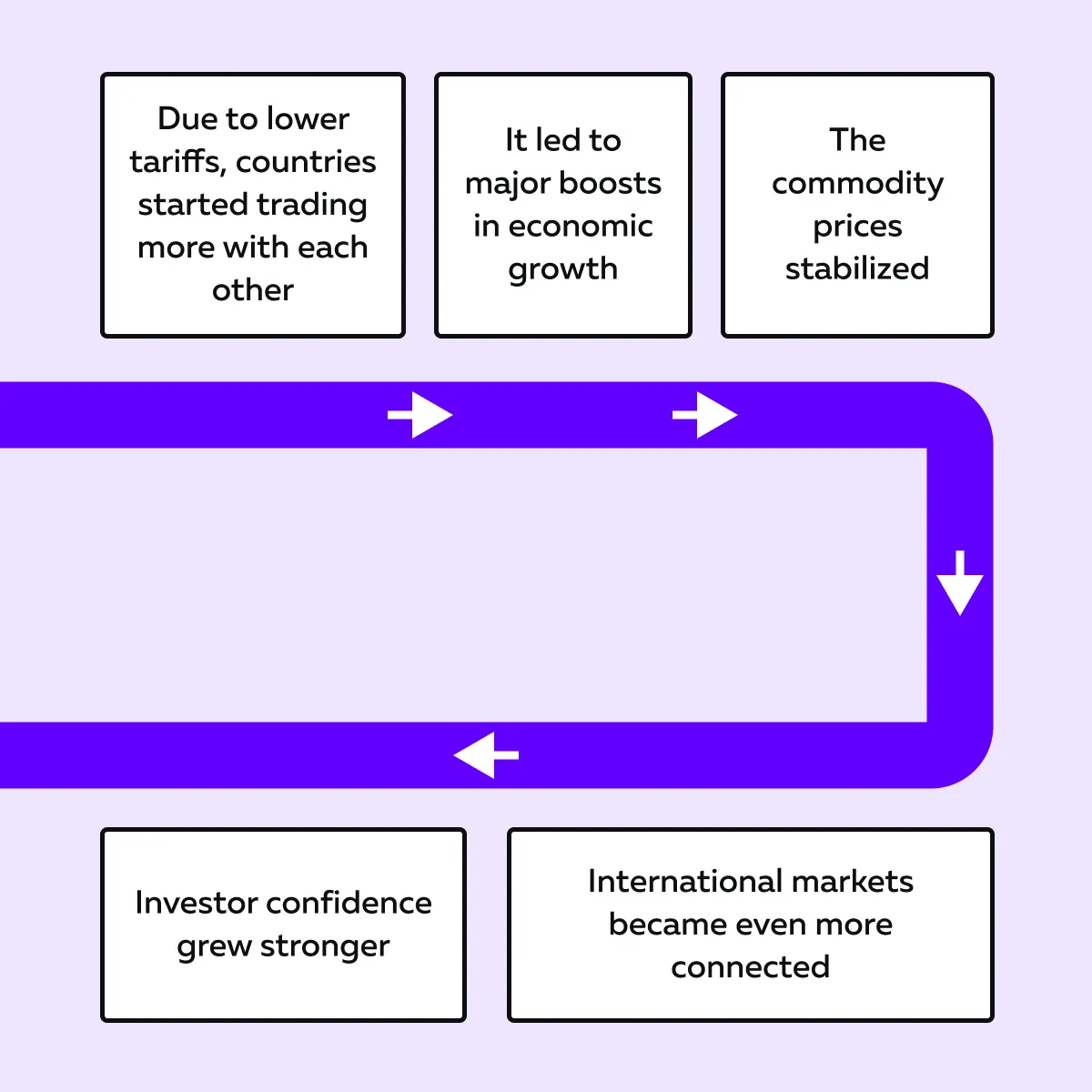

As tariffs dropped, global trade took off. Let’s see how through the graphic below:

These lower tariffs also led to the economic boom of the 1990s. During this period-

- Many countries significantly reduced tariffs (particularly on manufactured goods).

- As a result, trade flows increased dramatically.

- Increased trade led to growth in stock markets.

- Also, the global supply chains expanded and created more jobs.

2018–2019 US-China Trade War: Volatility Returns

Now, let’s fast forward to recent years! In 2018 and 2019, the U.S. and China (the world’s two largest economies) started raising tariffs on each other’s goods. Let’s see how:

This event marked a major reversal of the free-trade trend that had defined the decades since World War II.

The Market Impact

Please note that this trade war had serious and immediate effects on the markets. Markets became extremely volatile (particularly in sectors that depended heavily on international trade).

For example,

- Agriculture was affected badly.

- China imposed tariffs on U.S. soybeans.

- As a result, soybean futures dropped nearly 20%.

- This drop significantly hurt American farmers.

Other markets, like steel and aluminum, also saw sharp price swings due to the tariffs. Equities in industries tied to global supply chains were also affected.

How Tariffs Can Influence Global Markets?

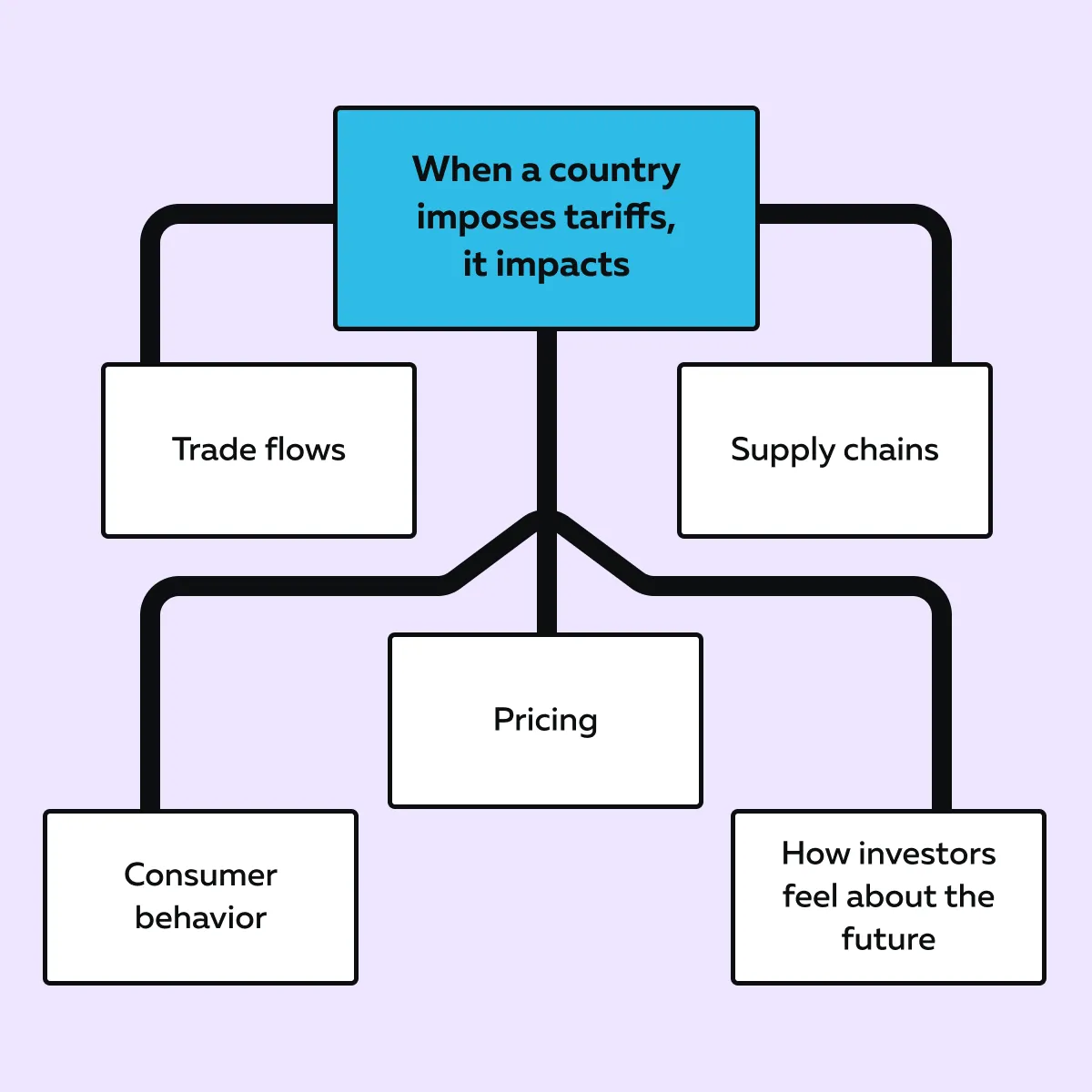

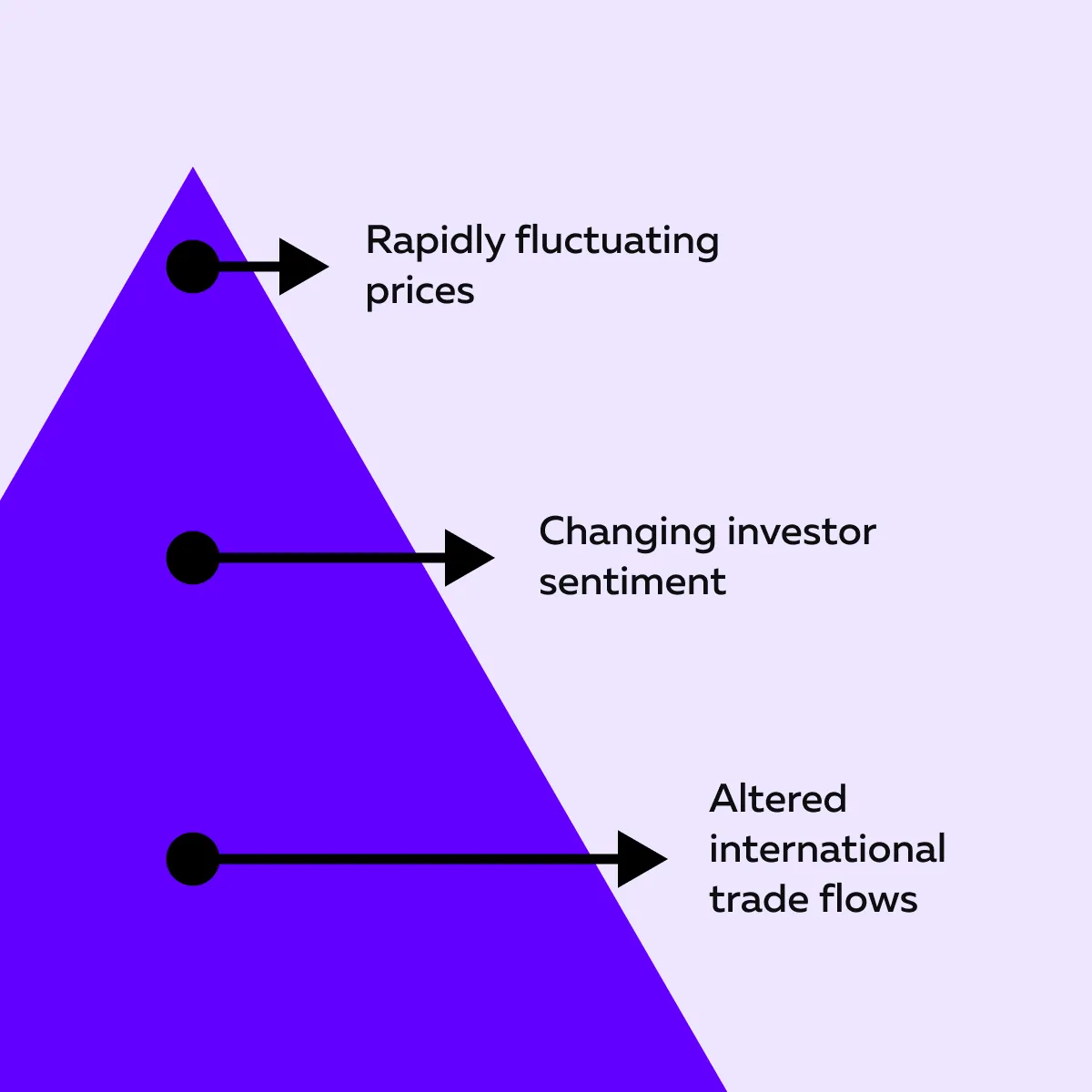

Tariffs don’t just affect the price of goods. They affect the entire economy! Check out the graphic below to learn about the blanket impact of tariffs on the economy as a whole:

Please realize that tariffs raise the cost of imported goods. When prices increase, people end up buying less. That drop in demand hurts both:

- Foreign sellers,

and

- Local buyers.

At the same time, businesses that rely on international suppliers have to adjust their supply chains. Usually, they try to:

- Find new supply sources,

- Shift production,

- Pass higher costs onto consumers.

Secondly, markets don’t wait long to react! You often see immediate volatility when new tariff policies are announced. This volatility is usually more prominent in sensitive industries like:

- Agriculture,

- Technology,

- Automobiles.

In these sectors, stock prices swing, and commodity futures move sharply because traders try to price in the likely effects. Here’s something worth considering: Are tariffs truly effective, or do they do more harm than good?

History shows a mixed picture!

- On the one hand, tariffs protect strategic industries (like semiconductors)

- But on the other hand, many tariff-driven trade wars have led to:

- Economic isolation,

and

- Short-term market downturns.

So, you can observe that tariffs might achieve short-term policy goals. However, it is unclear whether they can lead to long-term market expansion.

If we talk about their role in trading, we can say that tariffs may create risks. However, they can create opportunities if:

- You know how to time the market,

and

- You understand which sectors are most affected.

Let’s gain more clarity and see how tariffs impact the markets in particular:

Immediate Market Volatility Upon Tariff Announcements

Whenever a new tariff is announced, it creates uncertainty about how trade and profits might change. That uncertainty makes traders and investors nervous, prompting them to adjust their positions and leading to volatility.

A good example happened when the U.S. announced tariffs on imported steel and aluminum:

- Right away, industrial sector stocks took a hit.

- This happened because most investors got worried about:

- Higher input costs,

and

- Strained global trade relations.

- As a result, many stocks dropped sharply on the same trading day.

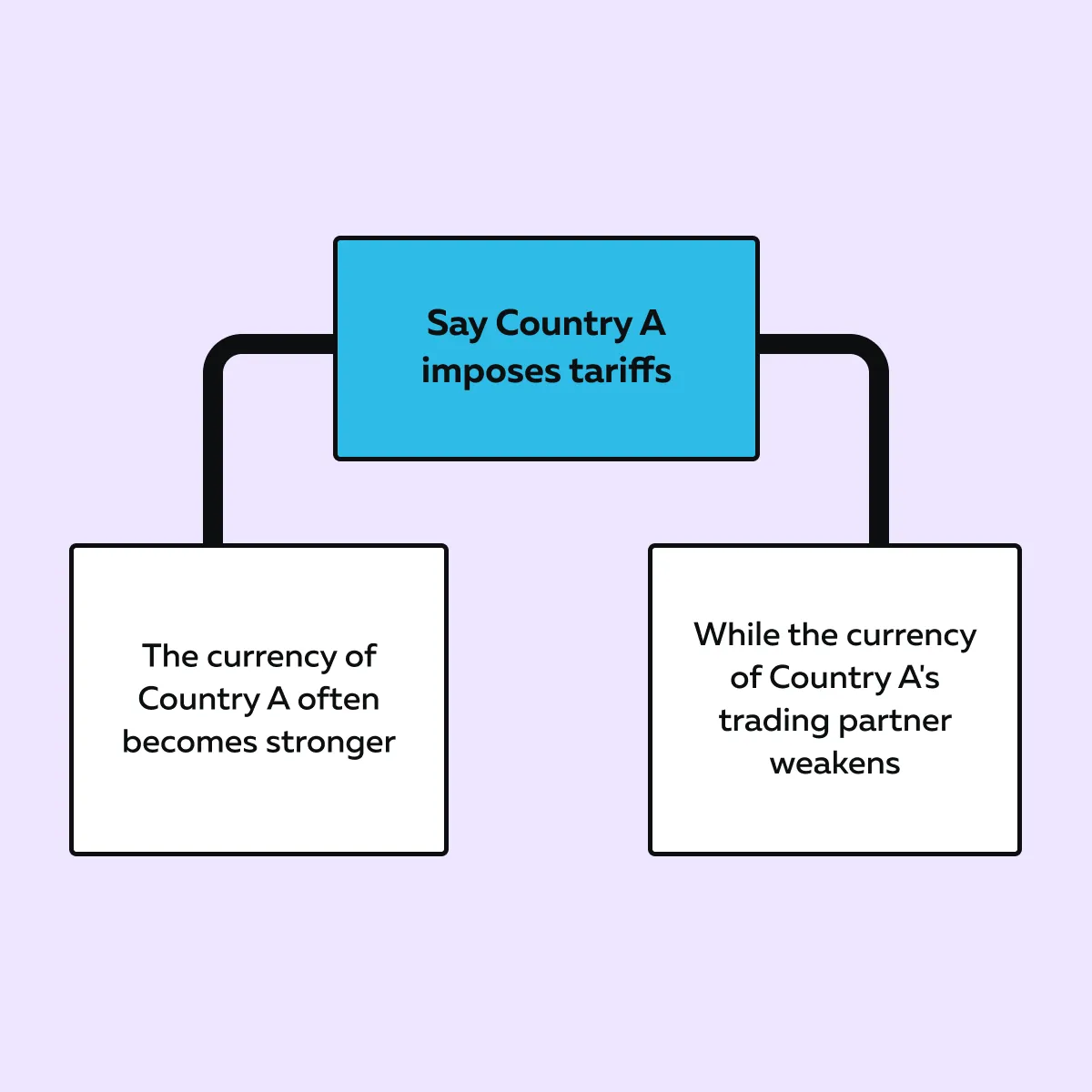

Currency Movements Driven by Tariffs

Tariffs don’t just shake up stock markets! They also have a significant effect on currencies. Let’s see how:

But why? That’s partly because of tariffs:

- Shift the flow of money between countries,

and

- Change the demand for different currencies.

You can practically observe this concept in the US-China trade war when the U.S. dollar strengthened sharply against the Chinese yuan. As a result, the USD/CNY exchange rate climbed. Navigate complex global markets clearly—see real-time liquidity shifts with Bookmap.

Long-Term Structural Market Shifts

Beyond short-term shocks, tariffs also lead to long-term changes in:

- How do companies do business?

and

- Where does money flow globally?

Usually, when tariffs stay in place for a while, companies often move their supply chains to countries with better trade conditions. These business moves reshape entire markets, from where goods are made to countries that attract investment.

For example,

- During extended U.S.-China tensions, many companies shifted manufacturing to countries like Vietnam, India, or Mexico.

- They did so to avoid high tariffs.

- As a result, you could see changes in stock market performance in those regions.

- Also, you can observe visible shifts in global trade routes.

Opportunities and Risks for Traders Around Tariff Events

Tariff news often creates volatility in the markets. For traders, these moments create both exciting opportunities and serious risks. Check out the graphic below to learn what you have to deal with during these times:

Want to still trade profitably? Below are some risks and rewards you can expect while trading during tariff events:

Short-Term Trading Opportunities

Tariff announcements often cause immediate market reactions. Prices of affected stocks, commodities, or currencies change within minutes (sometimes even seconds). Many active traders look to take advantage of this short-term volatility.

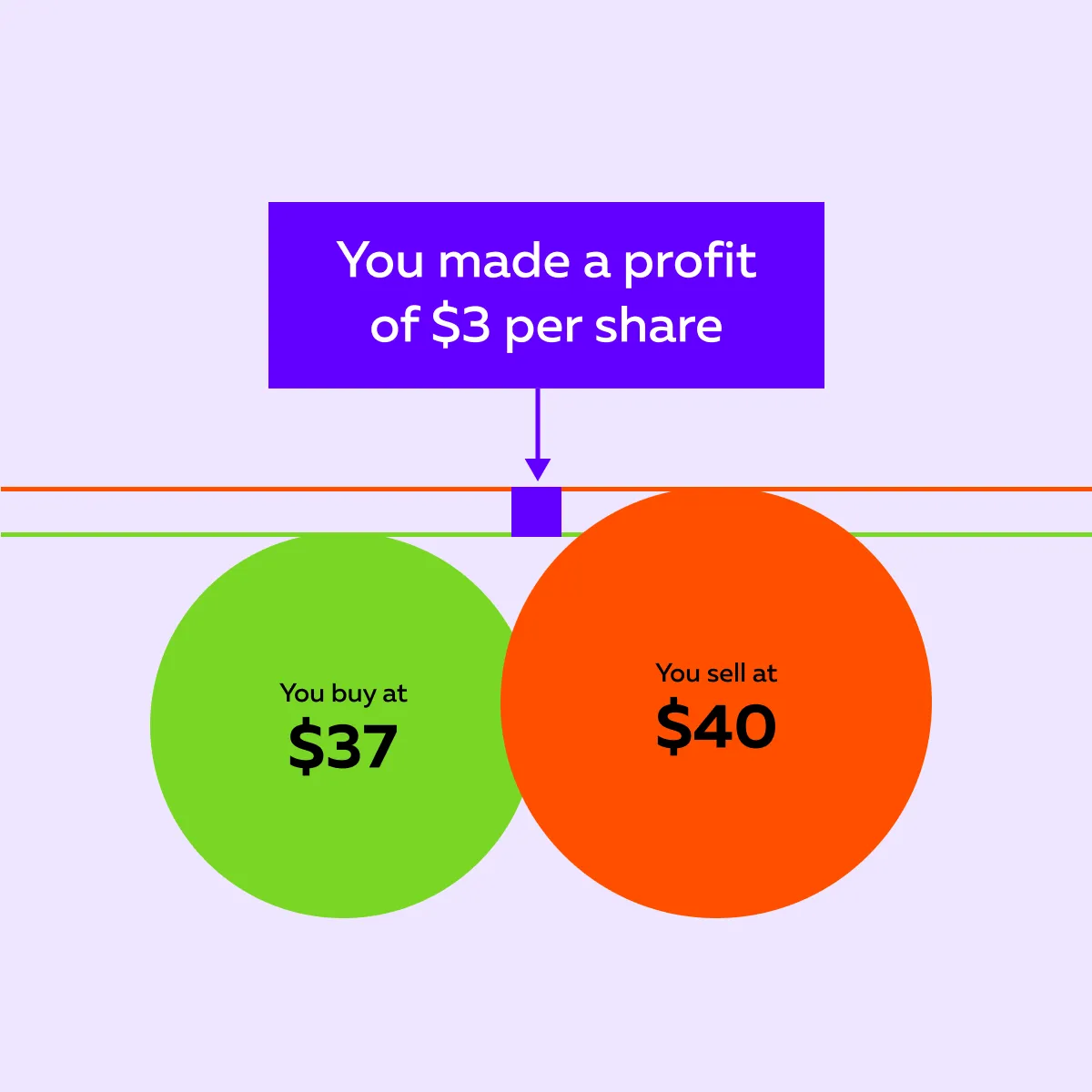

Let’s learn how through the example below:

The Backdrop

- It’s a regular trading day.

- Suddenly, the U.S. government announces a 20% import tariff on foreign-made cars.

- This tariff is placed to support domestic automakers.

What Happens Immediately?

- This announcement surprises the market.

- Big auto companies are expected to face higher costs or lower sales.

- Companies like Toyota (TM), BMW, and even U.S. companies with international supply chains [like Ford (F) or General Motors (GM)] are under scrutiny.

Let’s focus on General Motors (GM) for this example.

- Before the news, GM stock was trading at $40.00 per share.

- Right after the announcement, traders anticipate that profits may fall because of:

- Supply chain disruptions,

or

- Declining sales in foreign markets.

- Within an hour, the stock drops to $37.00 due to panic selling and uncertainty.

- That’s a $3.00 drop per share in a very short time.

What Active Traders Do?

- Suppose you saw the news immediately and acted fast.

- You “short sell” GM at $40.00 (you borrow shares and sell them)

- You are betting the price will drop.

- After the price drops to $37.00, you buy back the shares.

- Now, say you traded 1,000 shares.

- So, that’s $3,000 profit in under an hour (just from reacting quickly to the tariff announcement).

What Made This Possible?

- Please realize that these quick profits are possible because of liquidity and volume spikes after tariff news.

- The spikes make it easier to enter and exit trades quickly.

Be aware that this kind of trading isn’t just limited to equities. It also happens in commodities like:

- Steel,

- Soybeans,

- Oil.

It all depends on which sectors are affected by new tariffs.

Risks of Tariff-Driven Trading

Trading during tariff events is highly profitable. You can make quick profits within a few minutes. However, such a trade also comes with serious risks. One of the biggest dangers is unpredictability.

You must understand that:

- Tariffs are political tools,

and

- Government decisions can change suddenly.

As a result, negotiations can often stall, escalate, or completely reverse (sometimes overnight).

For traders, this creates a minefield. Let’s learn how:

- Suppose a trader bets that new tariffs will hurt tech stocks.

- Thus, they take a short position.

- But then, a last-minute deal is struck!

- The tariffs are canceled or delayed.

- In response, the market reverses direction quickly.

- The trader faces large and unexpected losses.

This is why volatility spikes during trade negotiations. The sensitivity is so high that even rumors or social media posts from political leaders can send markets swinging.

Thus, please think of it as a reminder that while tariff-driven volatility can create opportunity, it can also amplify risks for those caught on the wrong side of a sudden shift.

Conclusion

You pick history! Tariffs have always influenced the international markets. They have shown a clear pattern from historical events like the Smoot-Hawley Act to recent trade wars. What’s that? Tariffs create volatility.

Now, for traders, that means both risk and opportunity. In such an environment, prices change rapidly (particularly in sectors directly impacted by tariff news). Here, you can make significant profits within a few minutes.

However, the flip side is equally vital! Sudden political changes or negotiations can reverse the market in seconds. That’s why you must stay alert and try to gain a competitive advantage using our real-time market analysis tool, Bookmap.

Using our Bookmap, you can visualize order flow and liquidity in real-time. This data allows you to understand where the market is moving and why. Always remember that clear visibility is a real edge. Trade tariff-driven volatility with greater clarity using Bookmap’s advanced market visualization tools.