Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

August 9, 2024

SHARE

The Impact of Hash Rate Changes on Crypto Prices

In the world of cryptocurrency, one factor often influences another. Numerous studies have shown that changes in “hash rate” can affect mining profitability, which in turn impacts market sentiment and price movements. This makes understanding the hash rate and its impact on cryptocurrency necessary for anyone involved in blockchain technology and trading.

In this article, we’ll start by defining hash rate and its crucial role in mining and transaction processing on a blockchain network. We will explore how hash rate ensures network security and efficiency, using Bitcoin as a primary example. Next, we’ll explain the three key factors that influence hash rate: mining difficulty, energy costs, and technological advancements. You’ll study how these factors interact with real-world scenarios, such as changes in Bitcoin’s mining difficulty or the impact of new mining hardware on the Ethereum network.

Following this, we’ll discuss the relationship between hash rate changes and cryptocurrency prices. You’ll learn how higher hash rates can boost investor confidence and lead to price increases. Conversely, lower hash rates can signal decreased mining profitability and trigger price drops. We’ll also provide a detailed case study of the 2020 Bitcoin halving event, illustrating how significant hash rate changes coincided with price movements.

Finally, we’ll guide you on how to trade based on hash rate changes. This section will cover tools for monitoring hash rate trends, analyzing hash rate indicators, and incorporating these insights into trading strategies. Let’s begin.

Understanding Hash Rate

The hash rate is a measure of the “computational power” used in mining and processing transactions on a blockchain network. It represents the number of hash calculations a device or network can perform per second. These hash calculations are part of the proof-of-work (PoW) consensus mechanism. In this mechanism, miners solve complex mathematical puzzles to:

- Authenticate transactions

and

- Allow the addition of new blocks to the blockchain.

It is worth mentioning that hash rate plays a critical role in maintaining the network security and processing efficiency of a blockchain network. Let’s see how:

| Network Security | Processing Efficiency |

|

and

|

How the Hash Rate Works in a Bitcoin Network

In the Bitcoin network, the hash rate maintains the integrity and efficiency of the blockchain. Let’s understand how the hash rate works:

For more clarity, let’s see an example:

- Say the Bitcoin network’s target hash rate for adding a new block is “one valid hash every 10 minutes”.

- If the current combined hash rate of all miners is 100 exahashes per second (EH/s), this means the network can perform 100 quintillion hash calculations per second.

- The difficulty is set such that, on average, one of these calculations will produce a hash below the target every 10 minutes, thereby adding a new block to the blockchain.

- By maintaining a high hash rate, the Bitcoin network ensures it remains secure and transactions are processed efficiently.

3 Key Factors Influencing Hash Rate

The three key factors influencing the hash rate of a blockchain network are:

- Mining difficulty

- Energy costs, and

- Technological advancements.

All these factors contribute to the dynamic nature of the network’s hash rate. See the graphic below:

Now, let’s understand these factors in detail:

Factor I: Mining Difficulty

Mining difficulty is a measure of how hard it is to find a valid hash for a new block. The Bitcoin network adjusts this difficulty approximately every two weeks to ensure that blocks are added roughly every 10 minutes. Higher difficulty levels mean that miners need to perform more hash calculations to find a valid hash, requiring more computational power.

For example,

- Suppose there is a sudden increase in Bitcoin’s price.

- This surge makes mining more profitable and attracts more miners to the network.

- This increased participation increases the total hash rate.

- To maintain the 10-minute block interval, the network increases the mining difficulty.

- In response, miners invest in more advanced hardware

- They deploy additional resources to keep up with the higher difficulty.

- This deployment leads to an overall increase in the network’s hash rate.

Factor II: Energy Costs

Numerous studies have shown that energy costs are a significant factor in mining profitability. That’s because mining operations consume substantial amounts of electricity. Higher energy costs usually reduce the profit margins for miners and make it less economically viable to continue mining, especially for those using less efficient hardware.

For example,

- Let’s assume a country where a significant portion of the Bitcoin hash rate is located experiences a spike in electricity prices due to a natural disaster or policy change.

- This will cause the energy costs to rise.

- Miners in that region may find it unprofitable to continue operations and shut down their mining rigs.

- This event results in a drop in the overall hash rate of the Bitcoin network until:

- Miners relocate to regions with lower energy costs

or

- Energy prices stabilize.

Factor III: Technological Advancements

Technological advancements in mining hardware, such as the development of more efficient and powerful application-specific integrated circuits (ASICs), can significantly increase the hash rate.

These advancements:

- Improve the efficiency and computational power of mining operations

and

- Allow miners to perform more hash calculations per second.

Let’s understand better through an example showing the impact of technological advancement on the Ethereum Network:

- Consider the introduction of a new generation of ASIC miners designed for Ethereum mining.

- These new miners are significantly more efficient than the previous generation of GPUs.

- As miners adopt these new ASICs, the hash rate of the Ethereum network increases due to the:

- Higher efficiency

and

- The computational power of the new hardware.

- This boost in hash rate improves the network’s security and processing efficiency.

- This improvement happens as more powerful hardware validates transactions and adds blocks to the blockchain more quickly.

The Impact of Hash Rate Changes on Crypto Prices

Hash rate changes significantly impact cryptocurrency prices by influencing:

- Network security

- Mining profitability, and

- Market sentiment.

Often, traders and investors interpret these changes as market signals. This interpretation affects their trading decisions and contributes to price volatility. Let’s understand in detail and see how hash rate changes influence different factors:

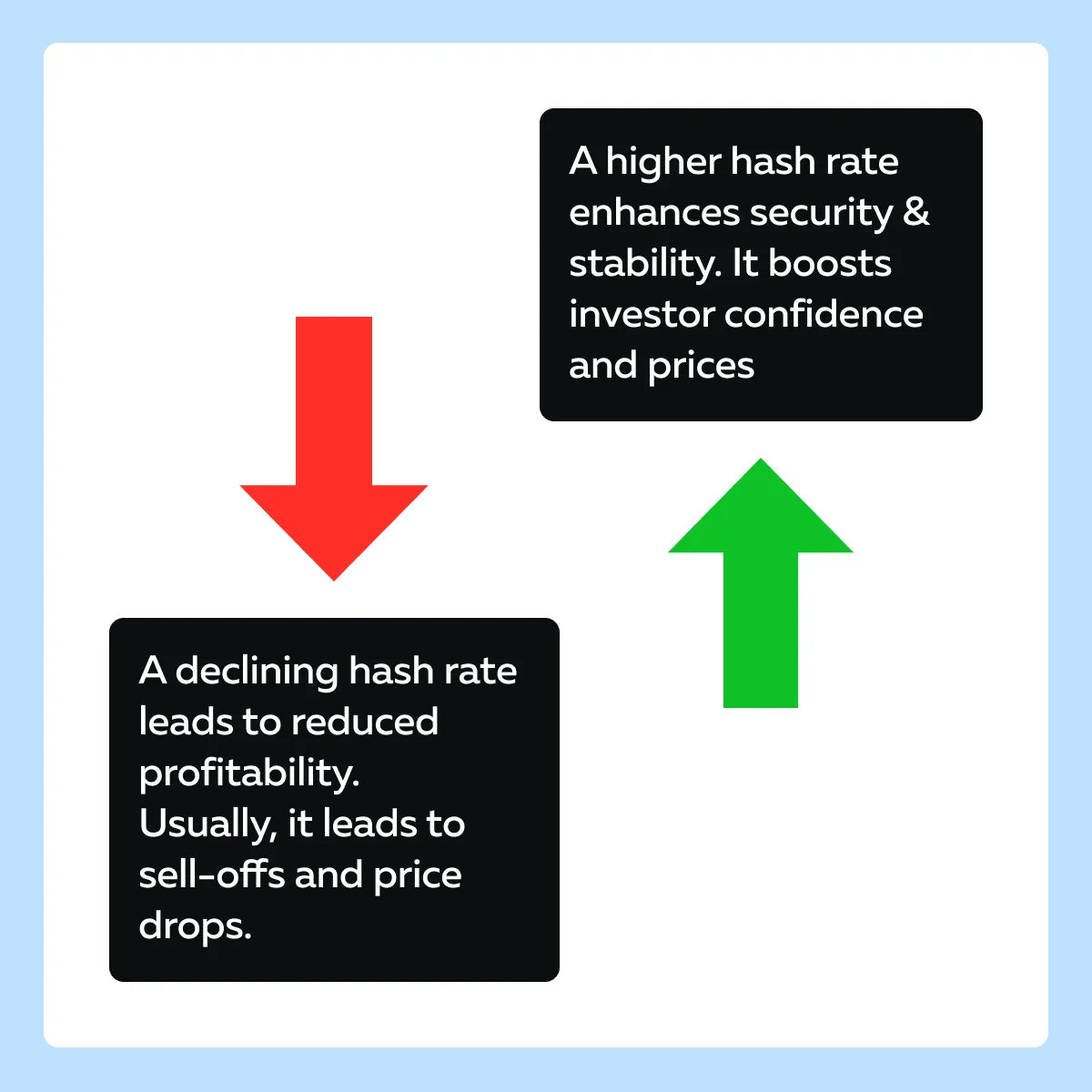

- I) How do Hash Rates Impact Network Security and Investor Confidence?

A higher hash rate enhances network security and stability by making it more difficult for malicious agents to alter the blockchain. This increased security creates trust among users and investors. It leads to greater confidence in the cryptocurrency. Moreover, enhanced confidence attracts more investors. Increased participation drives up the demand and, consequently, the price of the cryptocurrency.

Let’s understand better through a case study:

- In early 2021, Bitcoin experienced a significant increase in its hash rate

- This happened because more miners joined the network and invested in powerful mining equipment.

- This surge in hash rate coincided with Bitcoin’s price rally.

- The price reached an all-time high of over $60,000 in April 2021.

- The increased hash rate was perceived as a sign of improved network security and robustness.

- It significantly increased investor confidence and contributed to the price surge.

- II) How Do Hash Rates Influence Mining Profitability and Crypto Prices?

Readers must note that there is a strong relationship between:

- Hash rate

- Mining profitability, and

- Crypto prices.

See the graphic below:

For example,

- Suppose a prolonged bear market leads to a decline in the price of Bitcoin.

- This decline reduces mining profitability.

- Some miners find it unprofitable to continue operations and shut down their mining rigs.

- Such shutdowns cause the overall hash rate to drop.

- Also, this decline in hash rate triggers a sell-off as miners liquidate their assets.

- This event further depresses the price of Bitcoin and leads to a negative feedback loop of declining prices and hash rates.

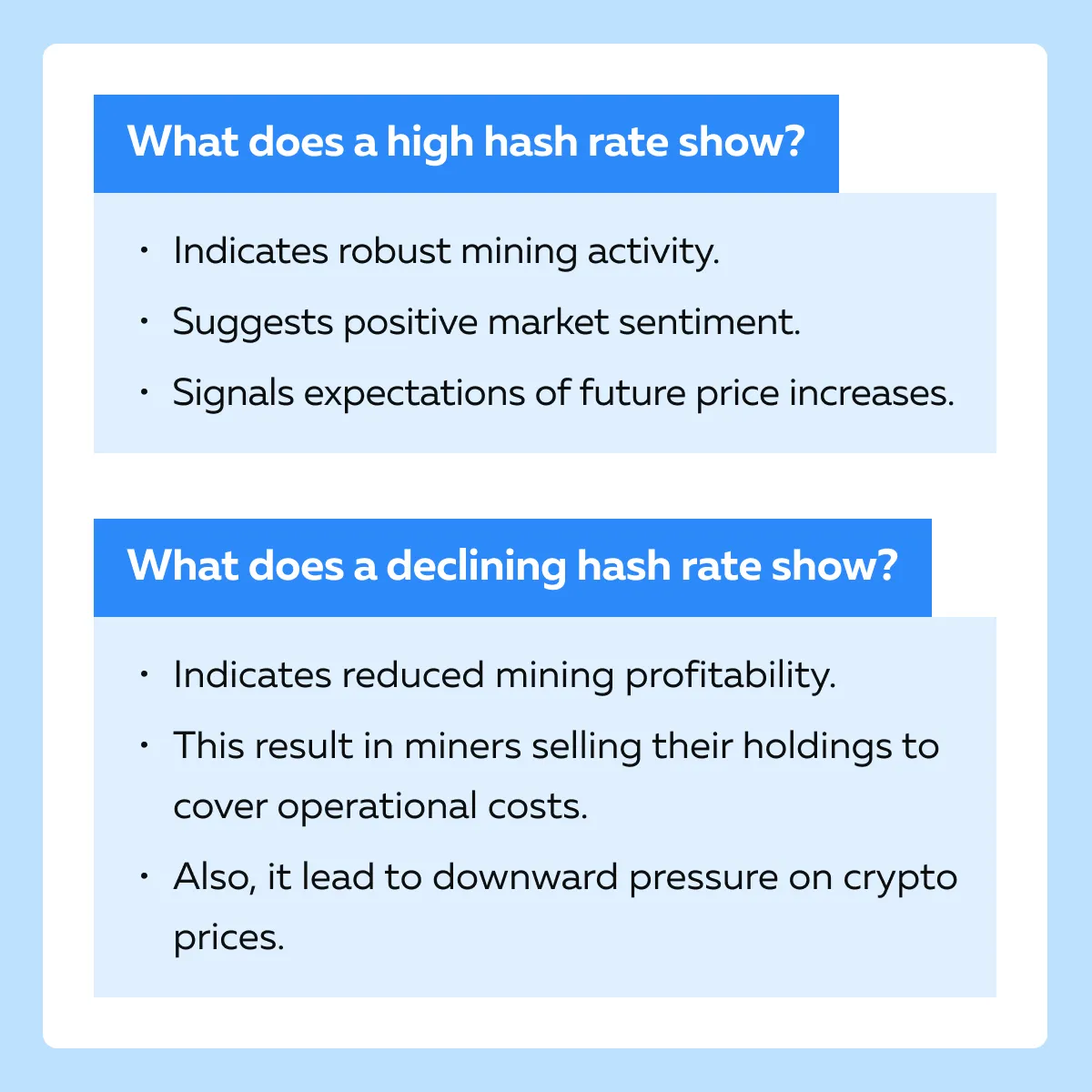

III) How Do Hash Rates Change Market Trends and Sentiment?

Traders and investors closely monitor hash rate changes as indicators of market trends and sentiment. See the graphic below:

For example,

- Say a significant number of Bitcoin miners face regulatory crackdowns or unfavorable policies in a major mining hub.

- This crackdown causes a sudden drop in the hash rate.

- This sharp decline triggers panic among investors and leads to a wave of selling as they anticipate further negative developments.

- The increased selling pressure resulted in:

- Short-term price volatility

and

- A temporary dip in Bitcoin’s price.

Case Study: Hash Rate Changes and Price Movements

Bitcoin halving events significantly impact:

- Hash rate

and

- Price movements.

These events alter mining profitability and influence market sentiment. The 2020 halving demonstrated these effects. It caused an initial dip in the hash rate followed by recovery and growth and a substantial price rally driven by increased scarcity and investor confidence.

Let’s understand Bitcoin halving events in detail:

What are Bitcoin Halving Events?

Bitcoin halving events come about every four years on average. These events led to a reduction in the block reward awarded to miners by half. This reduction aims to control the supply of new bitcoins and is an integral part of Bitcoin’s monetary policy. Halving events impact the hash rate. Also, it impacts the price movements by affecting mining profitability and market sentiment. Let’s see how:

Impact on Hash Rate and Mining Activity:

- Mining Profitability

- Halving reduces the block reward, which directly impacts miners’ revenue.

- Miners with less efficient hardware find it unprofitable to continue.

- This leads to a temporary drop in the hash rate.

- Network Security

- Initially, the hash rate might decrease as some miners shut down their operations.

- However, as less efficient miners leave, the overall efficiency of the network can improve.

- Difficulty Adjustment

- Bitcoin’s network adjusts the mining difficulty after every 2016 block (about every two weeks) to account for changes in the hash rate.

- This adjustment is done to maintain a consistent block creation time.

Impact on Market Sentiment:

- Investor Confidence

- Halving events are often seen as bullish signals by investors.

- That’s because they reduce the rate at which new bitcoins are created

- This reduction leads to increased scarcity.

- Price Movements

- Historical data shows that halving events are often followed by significant price rallies, driven by increased demand and reduced supply.

Detailed Analysis of the 2020 Bitcoin Halving

Leading up to the halving on May 11, 2020, Bitcoin’s price experienced volatility as miners and investors anticipated the event. The hash rate also saw fluctuations as miners prepared for the reduced rewards.

Immediate impact after the halving

- The hash rate saw a slight dip.

- This happened because some miners with higher operating costs shut down their rigs due to reduced profitability.

- Despite the initial drop, the hash rate began to recover as remaining miners benefited from a:

- Slightly reduced difficulty

and

- The overall increase in Bitcoin’s price.

- More efficient miners continued to invest in better hardware.

- This investment contributed to a gradual increase in the hash rate.

Price Movements

- In the weeks surrounding the halving, Bitcoin’s price was volatile.

- This volatility reflects the uncertainty and speculative trading typical of such events.

- After the initial post-halving period, Bitcoin’s price began a steady ascent.

- By December 2020, Bitcoin reached a new all-time high, surpassing $20,000.

- The price rally continued into 2021, eventually reaching over $60,000 in April 2021.

Market Sentiment

- The halving event reinforced the narrative of Bitcoin’s scarcity.

- It drove demand among institutional and retail investors.

- This increased demand, coupled with the reduced supply of new bitcoins, fueled the price rally.

- Investors viewed the increasing hash rate post-halving as a sign of network strength and security.

- This further increased confidence and market sentiment.

How to Trade Based on Hash Rate Changes?

Trading based on hash rate changes involves:

- Monitoring real-time data

- Analyzing key indicators, and

- Incorporating these insights into broader trading strategies.

Some popular tools like “Blockchain.com” and “CryptoCompare” also provide valuable data for tracking hash rate trends. To anticipate market movements, traders can use indicators like:

- Hash rate growth rate

and

- Volatility.

Also, they can integrate hash rate analysis with technical analysis to make informed trading decisions by optimizing their entry and exit points. Let’s see some popular tools and platforms that enable effective hash rate-based trading:

| Aspects | Blockchain.com | CryptoCompare |

| Meaning |

|

|

| Usage |

and

|

|

How to Analyze Hash Rate Indicators

By analyzing hash rate indicators, you can understand the health and security of a blockchain network. Some key metrics like hash rate, growth rate, and volatility provide insights into the following:

- Mining activity

- Network stability, and

- Potential market trends.

Let’s study these indicators in detail:

| Hash Rate Growth Rate | Hash Rate Volatility |

and

|

or

|

Now, let’s see an example involving the Ethereum Hash Rate Growth Rate:

- A trader monitoring Ethereum’s hash rate notices a consistent growth rate over several weeks.

- This suggests increasing miner participation and confidence in the network.

- After seeing the positive market sentiment and studying the technical indicators, the trader:

- Anticipates a bullish trend in Ethereum’s price

and

- Decides to take a long position.

How to Incorporate Hash Rate Analysis into Trading Strategies?

Let’s understand better through the table below:

| Entry Points Based on Hash Rate Trends | Exit Points Based on Hash Rate Declines |

|

|

For more clarity, let’s read an example where a trader combined technical and hash rate analysis:

- A trader uses moving averages and RSI (Relative Strength Index) to identify potential entry points for Bitcoin.

- They observe that the 50-day moving average is crossing above the 200-day moving average, signaling a bullish trend.

- To confirm, they checked the hash rate on Blockchain.com and found a steady increase over the past few weeks.

- Confident in the bullish trend, the trader enters a long position.

- Conversely, if the hash rate had shown a decline or high volatility, they may reconsider the entry.

Conclusion

Hash rate changes have a significant impact on cryptocurrency prices. A higher hash rate generally indicates increased network security and miner confidence, which can boost investor sentiment and lead to higher prices. Conversely, a declining hash rate signals reduced mining profitability and network instability. Usually, it causes prices to drop as miners sell off their holdings.

By closely monitoring hash rate trends, traders can gain valuable insights into market sentiment and make more informed decisions. They can also use tracking metrics like “hash rate growth” and “volatility” to anticipate bullish or bearish trends. For more detailed insights into crypto pricing and market fluctuations, check out this article on crypto pricing.