20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Crypto

December 25, 2024

SHARE

Crypto Pricing: Exchange Fluctuations, Arbitrage, and Finding the Right Price

In the world of cryptocurrencies, figuring out the exact value of a digital

coin isn’t a cakewalk. The prices of these digital assets constantly change

and are influenced by numerous factors. Do you want to uncover the secrets

behind how the prices of cryptocurrencies are determined?

This article will bring to light some of the fascinating complexities and

hidden dynamics that shape the value of these virtual coins. Also, explore

innovative tools to gain a competitive edge. Let’s get started.

An Overview of Crypto Pricing

In the world of cryptocurrencies, volatility is the price we pay for the

promise of higher returns and the potential for wealth creation. This is how

many crypto traders perceive the infamous price swings in the cryptocurrency

market. Multiple factors come into play when it comes to influencing crypto

pricing. Let’s gain a comprehensive understanding of them.

Factors Influencing Cryptocurrency Prices

-

Supply and Demand Dynamics

-

One of the fundamental factors affecting crypto prices is the

concept of limited supply. -

For instance, Bitcoin has a capped supply of 21 million coins,

resulting in scarcity and potentially increasing value due to a

fixed supply against rising demand.

-

-

Increasing Interest:

-

Over time, an increasing number of people are showing interest

in and adopting cryptocurrencies. -

This surge in demand has the potential to drive prices upward.

-

Apart from demand-based factors, there are some major external factors as

well:

-

Media Influence:

-

Media coverage, whether positive or negative, can significantly

impact crypto prices. -

Positive news, like endorsements by influential figures or

adoption by major companies, often leads to price increases. -

While negative news, such as regulatory crackdowns or security

breaches, can lead to rapid declines.

-

-

Governmental Regulations:

-

Announcements of new regulations or bans can trigger market

uncertainty and impact prices. -

For example, the news of

China’s crackdown on crypto mining

in mid-2021 caused a significant drop in Bitcoin prices.

-

-

Technological Updates:

-

Changes in the underlying technology of a cryptocurrency, such

as software updates or forks (like Bitcoin’s numerous forks such

as Bitcoin Cash or Bitcoin SV), can also impact prices. -

Forks can create new cryptocurrencies and even influence the

value of the original currency.

-

-

Large Whale Movements:

-

Crypto markets can be influenced by large investors or “whales”

who hold substantial amounts of a particular cryptocurrency. -

Their buying or selling activities in the market can cause

sudden price shifts due to the sheer volume of their

transactions.

-

Why Do Prices Vary Across Exchanges?

Unlike prices of securities in traditional financial markets, cryptocurrency

prices exhibit significant variations across different exchanges. This

disparity majorly happens due to the following factors:

24/7 Trading and Fragmented Nature

|

Continuous Trading |

Fragmented Trading Platforms |

|

|

Geographical Location Impact

Exchanges situated in different geographical locations experience unique

local demand and supply dynamics. Various factors influence these dynamics,

which are:

-

Regulatory environments

-

Cultural acceptance

-

Market sentiments

Additionally, varying prices across exchanges due to local market conditions

can create opportunities for geographical arbitrage. In this technique,

traders buy on one exchange where the price is lower and sell on another

where it is higher, seeking to profit from these variances.

A prime example of this type of price disparity was visible in the event of

“Kimchi Premium.”

-

The “Kimchi Premium” is a compelling illustration of significant

price disparities, particularly evident on South Korean exchanges

like Bithumb or Upbit, where prices frequently surged above the

global average. -

Sudden surges in demand within the Korean market primarily caused

this phenomenon. -

This event led to prices significantly higher than those seen on

exchanges in other parts of the world.

Arbitrage in the World of Crypto

Effective execution of

arbitrage strategies

in the crypto world requires swiftness. This is primarily due to steep price

disparities in the highly volatile cryptocurrency market. To identify

profitable arbitrage opportunities, traders and automated systems monitor

multiple exchanges and aim to benefit from market inefficiencies before they

normalize. Let’s understand this concept in detail.

Understanding Crypto Arbitrage

The Definition

Arbitrage in the context of cryptocurrencies refers to:

-

Exploiting price differences between different exchanges or

-

Timing disparities on the same exchange to make a profit.

The Process

-

Buying a cryptocurrency on one exchange where the price is lower.

-

Promptly selling it on another exchange where the price is higher.

The Allure of Arbitrage

-

The allure of crypto arbitrage lies in the potential for risk-free

profits, at least in theory. -

Unlike other trading strategies, arbitrage, when executed

successfully, can yield profits without exposure to market

volatility.

The Two Main Types of Arbitrage

|

Spatial Arbitrage |

Temporal Arbitrage |

|

|

Illustrating Crypto Arbitrage with a Hypothetical Example

-

Ethereum is priced at $2000 on Binance and $2050 on Kraken.

-

A vigilant trader identifies this price disparity and acts promptly

by executing the following steps: -

They purchase Ethereum for $2000 on Binance.

-

Simultaneously, they sell the acquired Ethereum on Kraken, where

it’s priced at $2050. -

This swift and well-coordinated transaction results in a $50 profit

per Ethereum.

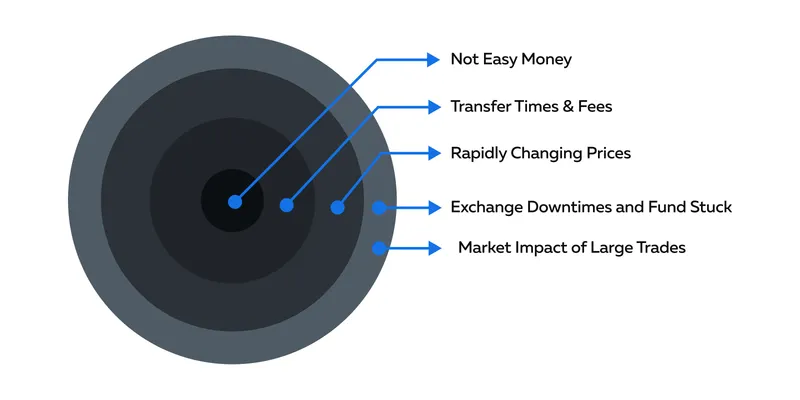

Challenges & Risks with Arbitrage

Despite the profit potential, crypto arbitrage isn’t without its hurdles and

risks. Here’s an overview of the challenges involved:

-

Not “Easy Money”:

-

Arbitrage is not a guaranteed, easy money-making strategy.

-

It demands quick and precise execution.

-

-

Transfer Times and Fees:

-

Blockchain confirmation times delay transfers between exchanges.

-

This delay impacts the speed of arbitrage.

-

Additionally, fees associated with transactions, withdrawals,

and deposits can significantly eat into potential profits.

-

-

Rapidly Changing Prices:

-

Cryptocurrency markets are highly volatile, with constantly

fluctuating prices. -

An arbitrage opportunity that seems lucrative can disappear

within moments, making swift execution a necessity.

-

-

Exchange Downtimes and Fund Stuck:

-

Exchanges occasionally experience downtime, hindering the

execution of trades. -

Moreover, funds might get stuck during transfers due to issues

like network congestion or technical problems on the exchanges.

-

-

Market Impact of Large Trades:

-

Large trades involved in arbitrage can affect market prices.

-

This phenomenon, known as slippage, occurs when executing

significant transactions, causing the price to move against the

trader’s favor. -

For instance, selling a large amount of Bitcoin to exploit an

arbitrage opportunity might drive the price down, reducing or

nullifying the expected profit.

-

Finding the ‘Right’ Price for a Cryptocurrency

Gauging the value of a cryptocurrency goes beyond simply observing its price

on a single exchange. To achieve a more comprehensive and balanced

perspective of a crypto’s worth, we rely on the concept of a weighted

average price.

Weighted Average Price

|

Characteristics |

Explanation |

|

Holistic View |

|

|

Considers Exchange Volumes |

|

|

Balanced Price Evaluation |

|

Illustrating the notion of a weighted average price with a hypothetical

example

-

Bitcoin is being traded at two different prices:

-

$45,000 on a high-volume exchange like Binance.

-

$46,000 on a smaller exchange with less trading activity.

-

The weighted average price takes both of these prices into account.

-

However, it leans closer to the $45,000 mark, as Binance, with its

higher trading volume, holds more weight in the overall calculation.

Using Bookmap for Price Visualization

Do you know the biggest challenge for traders in the crypto space? It lies

in aggregating and interpreting information from many sources to gauge a

cryptocurrency’s potential price trajectory. The usage of advanced market

analysis tools like Bookmap addresses this challenge by offering a unique

feature,

“Multibook”.

The Multibook Advantage

-

Bookmap’s Multibook isn’t merely another data feed.

-

It amalgamates instruments from various cryptocurrency exchanges

into a suite of synthetic instruments. -

Such an amalgamation offers a comprehensive perspective to crypto

traders after considering the extensive number of exchanges

available.

Let’s understand some major benefits:

|

Benefits |

Explanation |

|

Visualizing Aggregated Trading Activity |

|

|

Consolidation of Order Books |

|

|

Holistic Market Understanding |

|

|

Prompt Detection of Market Aggressors |

|

|

Effortless Access to Vast Data |

|

|

Reinforcing Trust in Levels |

|

For more detailed information on Multibook and its functionalities, click

here

.

Conclusion

Determining the “right” price for cryptocurrencies is a challenging task due

to the dynamic and decentralized nature of the market. Despite efforts to

gauge a cryptocurrency’s value, the complexity and variability persist.

Thus, traders and investors must stay informed about the latest news,

regulatory changes, and market trends. Also, the utilization of modern tools

like Bookmap, having features such as Multibook, offers invaluable tools for

aggregating and visualizing data across multiple exchanges. Such tools

provide a broader understanding of market dynamics.

For those keen on capitalizing on these insights in real-time and elevating

their crypto trading strategies, Bookmap offers an advanced visualization

platform.

Sign up and begin your enhanced trading journey today

!