Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 12, 2025

SHARE

The Rise of Zero-Day Options: Opportunities and Risks for Traders

Want to earn quick profits? Want to execute high-reward trades? Have you ever heard of zero-day options trading? Also known as 0DTE options trading, it presents exciting opportunities for traders to earn fast profits with minimal capital outlay. However, they also come with heightened risk due to their short lifespan and rapid time decay. Want to balance risk and reward?

This article will explore the core concepts of zero-day options, from their definition and popularity to the risks and strategies that can help you manage them. Also, you’ll learn about strict risk management, pre-planned entries, exits, and how advanced tools like our Bookmap can help you deal with volatility. Read till the end to sharpen your trading skills and gain confidence!

What Are Zero-Day Options and Why Are They Popular?

Zero-day options are also known as 0DTE options. They are options contracts that expire on the same day they are purchased. They are only available for major stock market ETFs [such as the S&P 500 (SPX)] but not for individual stocks.

Unlike weekly options that can expire after a few days, zero-day options offer a much shorter timeframe, making them ideal for traders looking to capitalize on intraday price movements.

Why Are Zero-Day Options So Popular?

The popularity of zero-day options has surged in recent years due to several reasons:

| High Potential for Quick Profits | Low Capital Requirement | Speculative Appeal |

|

|

or

|

Example of 0DTE Options

- Let’s assume that during a recent FOMC announcement, market volatility spiked.

- This spike happened because investors reacted to changes in interest rate policies.

- In such a scenario, many traders used zero-day options trading strategies.

- They tried to profit from the rapid price fluctuations that followed.

- For example:

- They buy call options if they expect the market to rise.

- They buy put options if they anticipate a decline.

Key Opportunities With Zero-Day Options

Zero-day options, or 0DTE options, offer you several unique advantages, such as:

- Minimal capital outlay,

- Ability to earn quick profits,

and

- Short-term hedging.

Let’s understand these benefits in detail:

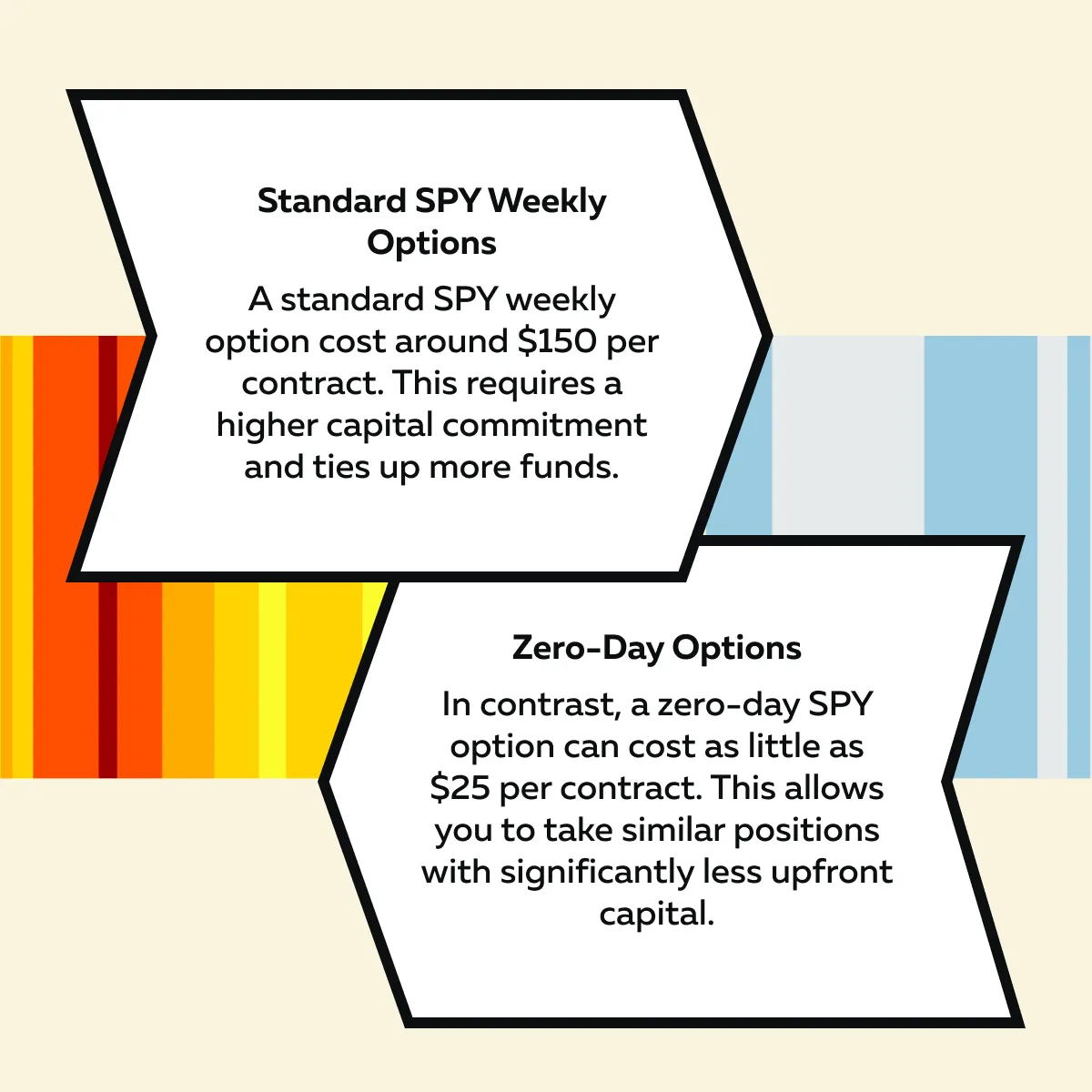

Capital Efficiency and Leverage

You can control larger positions with minimal investment using zero-day options because the premiums for 0DTE options are much lower than those of standard options. Thus, you can leverage smaller accounts to generate higher returns.

The graphic below makes the concept clearer:

Such cost-efficiency makes 0DTE trading strategies a preferred choice for active and speculative traders.

Quick Profit Potential

Through zero-day options trading, you can make quick profits by taking advantage of intraday volatility. Since 0DTE options expire on the same day, you can capitalize on fast market movements after key events or announcements.

Let’s understand better through an example:

-

- Let’s assume inflation data is released, and the numbers are higher than expected.

- This unexpected news leads to a sharp drop in the stock market.

- Most investors start worrying about likely interest rate hikes.

- Here, a trader anticipates this market reaction.

- They buy zero-day put options just before the data is released.

- The trader purchased the options at a low premium.

- Now, due to the report, the market falls.

- The value of these put options skyrockets within minutes.

- The trader sells options contracts at a much higher price.

Any cautions? Yes! While the potential for profit is high, these options contracts carry a very short timeframe. Thus, if the market moves against you, it will lead to possible losses. See actionable market sentiment unfold live. Try Bookmap for futures, stocks, and crypto.

Flexible Short-Term Hedging

Zero-day options (0DTE options) are not just for speculation! They can also be used for short-term hedging. Institutional investors and experienced traders often use these options to protect their portfolios from sudden market volatility, particularly when key economic events or earnings reports are due.

How 0DTE Options Help with Hedging?

Using zero-day options, you can hedge against intraday market swings. Let’s learn how through an example:

- A hedge fund holds large long positions in tech stocks.

- Assume that it is a volatile earnings week.

- To protect against sudden price drops, the fund buys zero-day put options when the market opens.

- Later, the earnings reports were disappointing, and the market declined.

- The value of these put options increases.

- This hedging strategy offsets the losses from the long positions.

Thus, you can manage risk using 0DTE trading strategies and protect your portfolio from short-term price fluctuations without tying up significant capital.

Major Risks Associated With 0DTE Trading

Zero-day options have an extremely short lifespan, which requires traders to be always prepared for:

- Rapid price changes,

and

- Expected losses.

Let’s understand the various associated risks you must be aware of:

Extreme Volatility and Time Decay (Theta Risk)

A major risk in 0DTE trading strategies is time decay (also known as theta risk). As the expiration time approaches, the value of zero-day options drops quickly, even if the underlying asset’s price doesn’t move significantly.

Why does Time Decay happen?

One must understand that zero-day options have very little time left before expiration. Thus, their value is mainly driven by how close the underlying stock or index is to the strike price.

As time passes, the option’s value declines rapidly (if the price doesn’t move favorably) within just a few hours. Let’s gain more clarity through the graphic below:

For example,

- Suppose a trader buys zero-day call options on a stock trading at $100 at market open.

- They are expecting the price to rise.

- By midday, the stock remains at $100.

- However, the call options lose 70% of their value because of time decay.

- The premium collapses since the option is nearing expiration, and the price hasn’t moved.

- This collapse leaves the trader with an unrealized loss.

Stay one step ahead in volatile markets using Bookmap’s real-time order flow insights.

Emotional Decision-Making and Overtrading

Zero-day options trading (0DTE trading) happens quickly! This fast pace often leads to emotional decision-making. Most traders usually experience greed, fear, and impulsivity, which can cloud judgment and increase risk. Check out the graphic below to learn how emotions affect 0DTE trading:

For example,

- A trader starts the day with a few profitable 0DTE trades.

- They decide to quadruple their position size for the next trade.

- They do so, hoping for even bigger profits.

- Unfortunately, the market suddenly reverses.

- The large position results in devastating losses.

- In this way, emotional decision-making leads to increased risk.

- It even wiped out earlier gains.

Thus, you need to stay disciplined to succeed in zero-day options trading. Also, avoid letting emotions drive your decisions.

Liquidity and Execution Challenges

Be aware that liquidity can become a major issue in 0DTE trading strategies (particularly near the end of the trading session). Let’s see how:

Why Liquidity Becomes a Problem?

The two primary reasons are:

| Wider Bid-Ask Spreads | Execution Difficulty |

|

or

|

Let’s study an example:

- A trader tries to close a profitable zero-day options position in the final hour of trading.

- Due to low liquidity, their order fills at a less favorable price.

- These occurrences reduce profits or turn a winning trade into a loss.

As a Practical Solution, Start Using Our Bookmap for Liquidity Management

To manage these risks, traders can use our avant-garde market analysis tool, Bookmap. It offers a real-time liquidity heatmap. Using it, you can easily visualize liquidity pockets on the order book, which allows you to:

- Identify areas of strong liquidity for better order execution,

and

- Avoid getting stuck in positions during periods of thin liquidity.

Best Practices for Trading Zero-Day Options

Be aware that zero-day options are highly volatile and time-sensitive. Thus, to succeed in zero-day options trading (0DTE trading), you must follow disciplined strategies that balance risk with reward. Let’s check them out:

Strict Risk Management

Risk management is essential in 0DTE trading strategies. It prevents heavy losses from rapid market moves. As a trader, you should:

| Aspects | Set Stop-Loss Orders | Keep Position Sizes Small | Set Maximum Loss Limits |

| How to? | Define clear exit points where you will square off. | Limit each trade to a small portion of your portfolio. | Predetermine how much loss you are willing to accept per trade. |

| How does it help? | You can cut losses if the trade goes against you. | This measure allows you to reduce overall exposure. | This approach lets you avoid emotional decisions. |

A Smart Approach

- Allocate no more than 1-2% of your trading capital to each 0DTE trade.

- This strategy ensures that in the event of a losing trade, your overall portfolio won’t be affected significantly.

Pre-Planning Entries and Exits

To execute profitable zero-day options trades, you must carefully plan entry and exit points (before placing a trade). That’s because without a plan, it’s easy to:

- Get caught up in intraday emotions,

and

- Make impulsive decisions.

Why Pre-Planning Matters?

| Avoid Emotional Trading | Improve Trade Consistency |

| Pre-determined entry and exit points reduce the likelihood of reacting emotionally to sudden price changes. | By following a well-defined plan, you can maintain discipline and improve long-term success. |

For example,

- A disciplined trader identifies key technical levels before entering a trade.

- They do so by analyzing support and resistance zones.

- Then, they use our real-time market analysis tool, Bookmap.

- They analyze real-time order flow on Bookmap.

- Our tool, Bookmap, helps them visualize where liquidity is concentrated.

- This data allows them to set precise entry and exit points.

Such preparation helps to avoid impulsive adjustments during volatile market conditions.

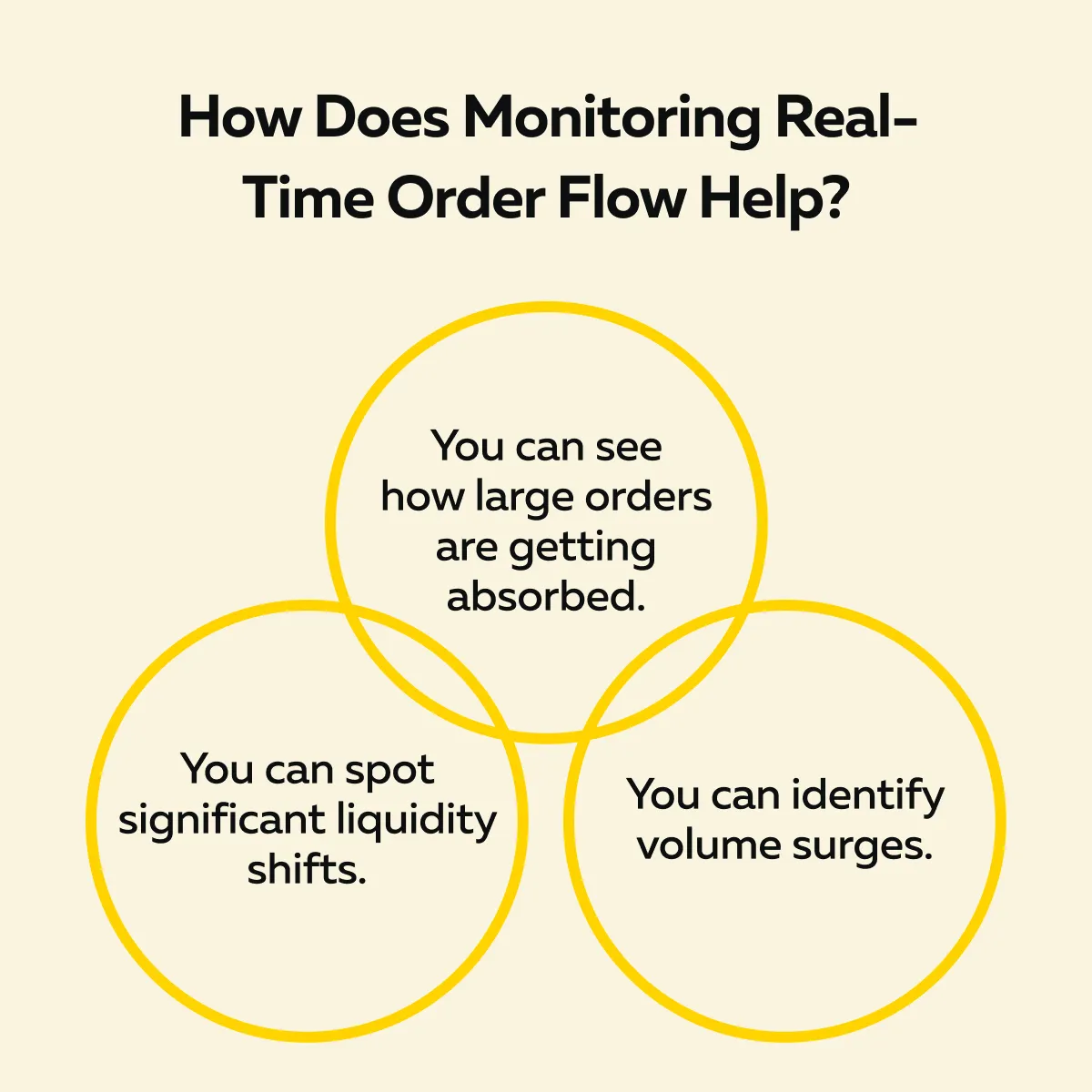

Monitoring Real-Time Order Flow

By monitoring real-time order flow, you can gain valuable market insights. Check out the graphic below:

Be aware that these signals can indicate imminent price movements. Using them, you can smartly adjust your positions accordingly.

Why Order Flow Is Important?

- Identify Key Liquidity Zones: You can see where large buyers or sellers are positioned.

- React to Market Changes: You can detect sudden shifts in order flow to exit or adjust positions quickly.

For example,

- Let’s assume a trader is using our platform, Bookmap’s heatmap.

- They notice heavy selling liquidity forming at a resistance level.

- This large order absorption prevents the price from rising further.

- Recognizing this, the trader exits their long position.

- By doing so, they preserve their profits before a likely market reversal.

Using Bookmap to Navigate Zero-Day Options Volatility

Be aware that in zero-day options trading (0DTE trading), market conditions can change within seconds. By using our tool, Bookmap, you gain a unique advantage! You get several real-time visual insights into market dynamics. These cues allow you to make better decisions during periods of high volatility. Let’s see how:

How Bookmap Helps in 0DTE Trading?

Bookmap’s advanced visualization tools allow traders to:

| Track Liquidity Shifts | Monitor Buyer and Seller Activity | Identify Significant Volume Changes |

|

|

|

Now, let’s gain more clarity by checking out two practical cases:

| Case I: Identifying Short-Term Reversal Zones | Case II: Confirming Breakout Scenarios |

|

|

Why Bookmap is a MUST for 0DTE Trading?

By using our Bookmap, you can better understand market intent. Using Bookmap’s heatmap, you can:

- Prevent impulsive decisions,

and

- Optimize trade timing.

Also, you can strategically enter and exit trades by identifying liquidity zones, which reduces the risk of poor entries/exits.

Conclusion

Zero-day options trading (0DTE) offers an opportunity to earn smart profits in the market. Through it, you can capitalize on rapid price movements. Also, the capital requirements are low. However, the rapid time decay and volatility can quickly erode gains!

Therefore, you must set clear stop-loss orders, avoid emotional decision-making, and manage position sizes to succeed. Additionally, you can start using our real-time market analysis tool, Bookmap. It offers real-time insights into market liquidity and order flow. You can also identify key price levels, spot potential reversals, and refine entry and exit points on our platform.

Navigate rapid market movements with clarity—visualize liquidity instantly with Bookmap.