Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 11, 2025

SHARE

Top 10 Biggest Trades in History

They say history is written by the victors. But in the world of trading, it’s often the savvy investors who hold the pen. When you learn from past successful traders, you not only understand their mindset but also their trading approach. To make you a smart investor, we have carefully picked the 10 most famous trades of all time.

In this article, we will learn from the trade stories of legendary figures like George Soros, John Paulson, and Warren Buffett. You will clearly understand their strategies and decision-making processes.

Also, we will explain the techniques they employed, the risks they managed, and the lessons they imparted. From Soros’ bold shorting of the British pound to Buffett’s strategic investment in Bank of America, each example provides a unique perspective on dealing with volatile markets. Let’s begin.

1. George Soros and the Black Wednesday Bet (1992)

In 1992, George Soros made one of the biggest trades in financial history. He shorted the British pound. Known as “Black Wednesday,” this event occurred when Britain was part of the European Exchange Rate Mechanism (ERM). The goal of the ERM was to stabilize exchange rates, but Britain’s economic fundamentals were weak, and Soros saw this as an opportunity to profit.

Key Takeaway

Soros clearly shows how macroeconomic analysis can help in executing successful trades. By understanding Britain’s overvaluation of the pound and the strain it was causing on the economy, he predicted that the Bank of England would be unable to maintain the currency’s fixed exchange rate.

What Exactly Happened?

- Soros analyzed Britain’s economic fundamentals.

- He found that high inflation and sluggish growth were not compatible with the ERM’s requirements.

- The pound was overvalued.

- The Bank of England struggled to maintain its value by:

- Spending reserves

and

- Raising interest rates.

- Soros, seeing the unsustainable position, made a calculated move to short the pound.

- When the Bank of England eventually gave up defending the currency, the pound was devalued.

- This resulted in Soros earning a $1 billion profit.

2. John Paulson’s Bet Against the Housing Market (2008)

In 2008, hedge fund manager John Paulson shorted subprime mortgage-backed securities. This famous market trade made him earn approximately $20 billion. As the U.S. housing market was soaring, Paulson noticed troubling signs beneath the surface. Many homebuyers were securing subprime loans they couldn’t afford. This led to an unstable housing bubble.

Key Takeaway

Paulson’s strategy shows the importance of recognizing economic bubbles and taking positions that can capitalize on their eventual collapse. He had the ability to “see through” the excitement of the housing market. Also, he had a strong understanding of the financial instruments tied to subprime mortgages. This knowledge allowed him to execute one of the most profitable trades in history.

What Exactly Happened?

- Paulson analyzed the housing market.

- He realized that rising home prices were “unsustainable”.

- He became more confident in his analysis when he observed widespread issuance of risky subprime mortgages.

- He believed these loans were bound to default.

- Consequently, the market will collapse.

- Now, to profit from this, Paulson took “short positions” on:

- Mortgage-backed securities (MBS)

and

- Collateralized debt obligations (CDOs) linked to subprime mortgages.

- Eventually, the housing bubble burst, and defaults skyrocketed.

- The value of these securities plummeted.

- Paulson’s bet against the housing market led to a massive profit.

3. Jesse Livermore’s Stock Market Short (1929)

In 1929, legendary trader Jesse Livermore made $100 million by shorting the stock market just before the infamous Wall Street crash that led to the Great Depression. Livermore’s success was based on his deep understanding of market trends and sentiment. He even used technical analysis to identify early warning signs of the impending collapse.

Key Takeaway:

Livermore’s story tells us the importance of technical analysis and market sentiment in predicting downturns. By carefully monitoring price patterns, volume, and market behavior, he was able to anticipate the crash before most investors.

What Exactly Happened?

Livermore studied market data to learn about the “instability in stock prices”. See the graphic below to understand what he focused on:

Upon noticing this market data, he noticed speculative buying and inflated stock values. Also, he found the growth to be unsustainable. In his opinion, the market was heading toward a correction.

As a result, Livermore adopted a shorting strategy and bet against overpriced stocks when market excitement peaked. As the market crashed in October 1929, Livermore’s positions grew in value. He earned massive profits. His success in predicting the crash was due to his keen ability to:

- Read the market

and

- Act decisively based on data and sentiment.

Ready to track liquidity like the pros? Try the heatmap tool on our platform, Bookmap, to spot major market moves before they happen.

4. Andrew Hall’s Oil Trade (2003)

In 2003, Andrew Hall, a trader at Phibro (Citigroup’s commodities trading unit), predicted a dramatic surge in oil prices. His prediction turned out to be correct, and he ended up earning billions for his hedge fund. Hall’s analysis was based on understanding the supply-demand imbalances in the oil market. He also focused on geopolitical risks that would impact global oil production and consumption.

Key Takeaway:

Hall’s oil trade shows that traders must track shifts in commodity markets. He correctly predicted market trends and then aligned his strategy with major changes in global economic conditions.

What Exactly Happened?

- In 2003, Hall analyzed several key factors, such as:

- “Growing global demand” for oil (especially from developing economies like China),

- “Limited oil supply” from major producers, and

- “Political instability” in the Middle East, particularly due to the Iraq War.

- Upon observing all these factors, Hall believed that oil prices would rise significantly.

- Based on his prediction, he took long positions in oil futures.

- He was anticipating a price increase.

- Later, oil prices surged.

- Hall’s trade paid off massively.

5. Stanley Druckenmiller’s German Bond Trade (1992)

In 1992, Stanley Druckenmiller was managing money for George Soros’ Quantum Fund. He made a bet on German bonds following the unification of East and West Germany. Before making this move, Stanley analyzed:

- What economic shifts will likely happen due to the unification?

and

- How would these shifts impact bond prices?

Eventually, Druckenmiller capitalized on these changes to generate substantial profits.

Key Takeaway:

Druckenmiller’s famous market trade shows how major political and economic transformations (such as Germany’s reunification) can create profitable opportunities in financial markets. By understanding “interest rate movements” and economic policy changes, investors can position themselves to benefit from these transitions.

What Exactly Happened?

- Druckenmiller analyzed the economic consequences of Germany’s unification.

- He predicted that there would be massive costs of integrating East Germany into the Western economy.

- This would force the German government to raise interest rates to control inflation.

- Consequently, this higher interest rate environment would boost the value of German bonds.

- Now, based on this belief, Druckenmiller purchased long-term German bonds.

- He predicted that bond yields would rise after the reunification.

- As predicted, the German government raised rates.

- This caused the bond prices to surge.

6. Bill Ackman’s Covid-19 Market Hedge (2020)

At the onset of the COVID-19 pandemic in early 2020, Bill Ackman, CEO of Pershing Square Capital, placed a hedge against a looming market collapse. Ackman anticipated that the global economic shutdowns would lead to a sharp downturn in financial markets. He strategically used credit default swaps (CDS) and earned $2.6 billion in profit.

Key Takeaway

Ackman’s trade shows that hedging during times of global uncertainty is highly important. He positioned his portfolio in such a way that he could profit from market declines. Also, Ackman smartly managed risk and used hedging strategies to grow his investments during crises.

What Exactly Happened?

- Ackman utilized credit default swaps (CDS) to hedge his portfolio against a market collapse.

- For the unaware, CDS are financial derivatives.

- They act like insurance on debt.

- These instruments gain value if the underlying bonds or markets experience distress.

- As COVID-19 spread, Ackman foresaw the economic fallout.

- He purchased CDS on companies and markets likely to be hit hard by the pandemic.

- When markets plunged due to widespread panic and economic shutdowns, the value of Ackman’s CDS soared.

- This resulted in a $2.6 billion profit.

These monumental trades were shaped by deep analysis and strategy. Use our market analysis tools at Bookmap to develop your own winning strategies today.

7. David Tepper’s Bet on Bank Stocks (2009)

In 2009, hedge fund manager David Tepper made a bold bet on U.S. bank stocks. Following the 2008 financial crisis, while most investors were avoiding the banking sector, Tepper took a contrarian stance. He believed that government interventions would eventually stabilize the financial system. This intervention would allow banks to recover. And that’s what happened! His famous market trade earned billions as bank stocks surged.

Key Takeaway:

Tepper’s trade shows the “value of contrarian investing”. He found profits by going against prevailing market sentiment. His confidence in the banking sector’s eventual recovery (despite widespread pessimism) showed how understanding market cycles and external support (like government aid) can lead to significant gains.

What Exactly Happened?

-

- In 2009, most investors were deeply bearish on banks.

- They had suffered massive losses during the crisis.

- However, Tepper analyzed the U.S. government’s financial rescue efforts.

- Particularly, he focused on the Troubled Asset Relief Program (TARP) and stimulus measures.

- He became assured that the government would ultimately prevent banks from failing.

-

- He invested heavily in distressed bank stocks, such as Bank of America and Citigroup.

- Eventually, the government’s actions restored confidence and liquidity in the financial system.

- Bank stocks rebounded sharply.

- This led to Tepper earning massive profits.

Want to understand the depth behind the largest trades in history? Use our advanced tools at Bookmap to analyze real-time market data and gain deeper insights into market movements.

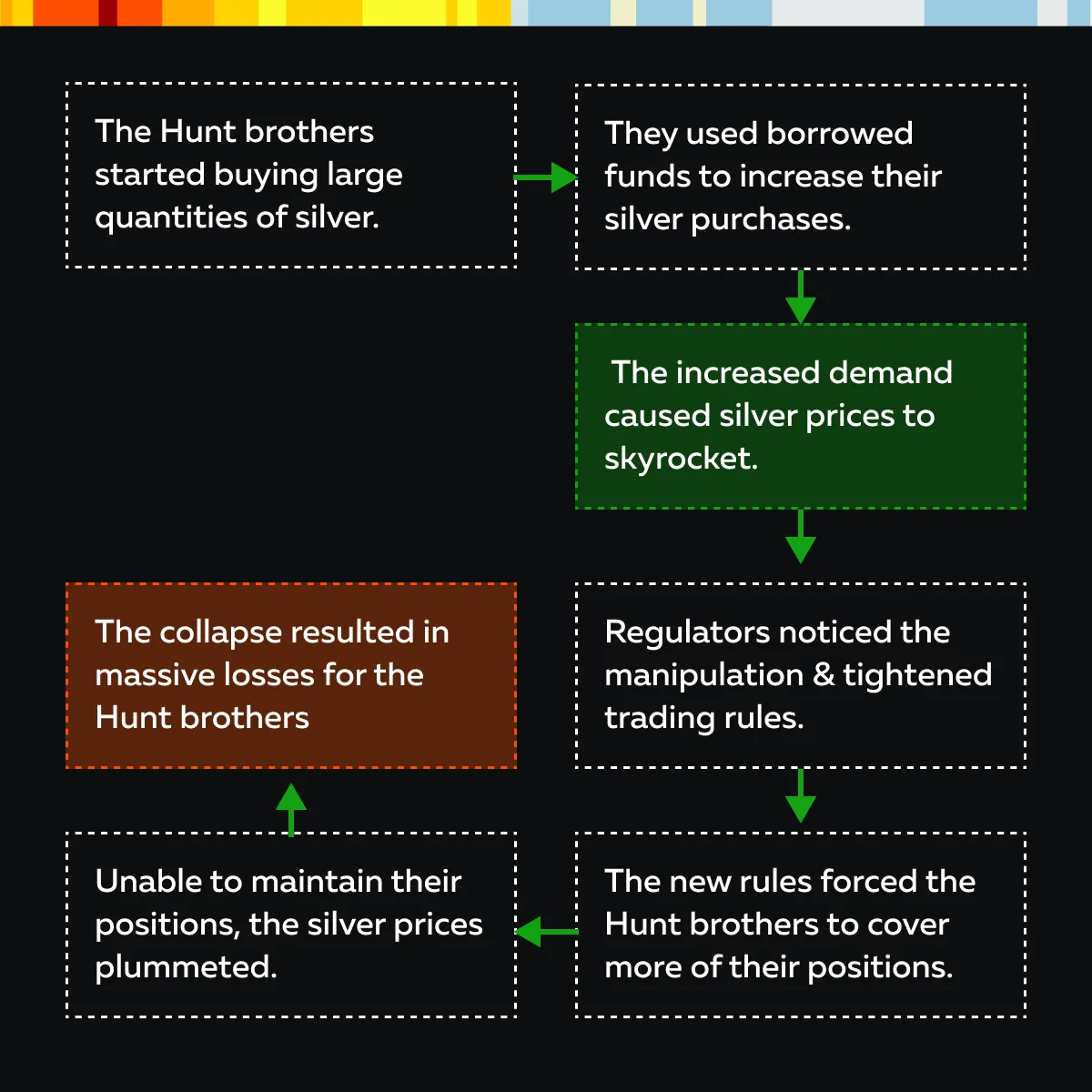

8. The Hunt Brother’s Silver Corner (1979-1980)

In the late 1970s, the brothers, Nelson and William Hunt attempted to corner the silver market. They amassed large amounts of the metal. Their buying spree caused silver prices to soar from $6 per ounce to nearly $50 by early 1980. However, their strategy ultimately backfired when silver prices collapsed. Hunt brothers faced millions in losses.

Key Takeaway:

The failure of the Hunt brothers to manipulate the silver market shows the dangers of:

- Over-leveraging

and

- Market manipulation.

See the graphic below to understand how trying to control a market through excessive speculation leads to the creation of a bubble:

What Exactly Happened?

- The Hunt brothers heavily borrowed money to purchase vast quantities of silver.

- They intended to dominate the market.

- However, their strategy unraveled soon.

- Regulators became concerned about their manipulation.

- They changed trading rules by increasing margin requirements.

- This forced the brothers to liquidate their holdings as silver prices plummeted.

- By March 1980, silver dropped to $10 per ounce.

- This resulted in massive losses for the Hunts.

9. Paul Tudor Jones and the 1987 Stock Market Crash

In 1987, Paul Tudor Jones famously predicted the stock market crash known as Black Monday. He made $100 million by shorting the market. While making assessments, he used a combination of:

- Technical analysis

and

- Historical comparisons.

Jones was able to foresee the dramatic sell-off before most investors. Based on his analysis, he positioned his portfolio to profit from the decline.

Key Takeaway:

Jones’ trade shows the significance of technical analysis in predicting market crashes. He specifically studied market patterns, trends, and signals. Based on his analysis, he identified potential risks and took advantage of downturns before they occurred. This method even allowed Jones to foresee the 1987 crash.

What Exactly Happened?

- Jones relied heavily on technical analysis to anticipate the crash.

- He observed patterns in the stock market.

- He found that these patterns were like those leading up to the 1929 market collapse.

- Additionally, he tracked indicators like:

- Excessive market volatility

and

- High levels of margin debt.

- Both these indicators signaled a likely crash.

- As these technical indicators aligned, Jones increased his short positions.

- He bet against the stock market.

- Eventually, Black Monday arrived on October 19, 1987.

- The market plunged by over 20% in a single day.

- Jones capitalized on this massive downturn and secured a $100 million profit.

10. Warren Buffett’s Investment in Bank of America (2011)

In 2011, during the European debt crisis, Warren Buffett made a bold $5 billion investment in Bank of America. This move earned him billions in profit as the stock recovered. While many investors were wary of the banking sector at the time, Buffett saw a valuable opportunity amidst the market’s pessimism.

Key Takeaway:

This investment shows Buffett’s “value investing” philosophy. For the unaware, this philosophy focuses on buying fundamentally strong but undervalued stocks during times of market distress. Buffett successfully identified businesses with solid long-term prospects, even in periods of uncertainty. After this, he positioned himself for substantial gains once the market stabilized.

What Exactly Happened?

- Bank of America was under pressure.

- Buffett analyzed the stock.

- He found that it had strong fundamentals and was “undervalued”.

- Next, he purchased preferred shares with a 6% annual dividend.

- Also, he bought warrants to buy additional common stock at a low price.

- This strategy allowed Buffett to limit downside risk while gaining exposure to potential upside.

- Eventually, the market recovered, and even Bank of America’s financial position strengthened.

- Its stock price surged.

- Buffett’s investment resulted in substantial long-term gains.

Lessons from History’s Biggest Trades

Strategy over luck. Yes, upon closely analyzing history’s most significant trades, you can observe that successful traders prioritize strategy over luck. Each trader, whether George Soros or Warren Buffett, relied on “comprehensive market analysis”. Also, they had a keen understanding of economic cycles. For example,

- Soros analyzed macroeconomic indicators before shorting the British pound.

- David Tepper assessed the fundamentals of U.S. banks after the financial crisis.

- Warren Buffett fundamentally analyzed Bank of America amid widespread market pessimism.

These strategic approaches clearly show that thorough research and informed decision-making are highly important for capitalizing on market opportunities rather than relying on chance.

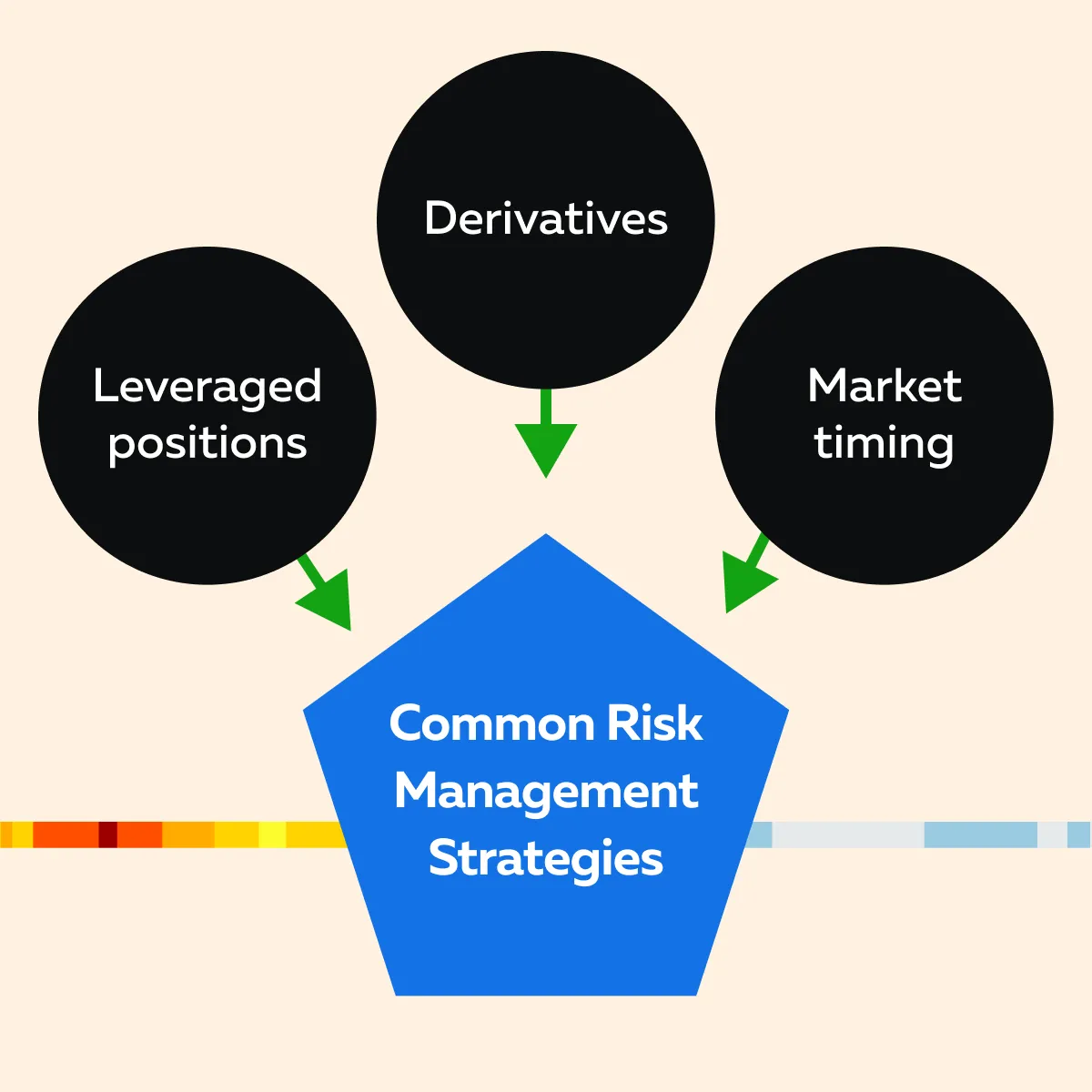

Moreover, we can also observe “strong risk management” in the stories of all these renowned traders. Almost all of them dealt with the volatile markets without exposing themselves to downturns. For example,

- Bill Ackman utilized credit default swaps to hedge against expected losses during the COVID-19 pandemic.

- Paul Tudor Jones employed short positions and gained protection against the stock market crash in 1987.

In this way, most traders handled potential losses and optimized their profit potential. See the graphic below to check what risk management strategies were commonly used by them:

The focus of these successful traders on risk management clearly shows that successful trading is not just about making bold bets but also about safeguarding investments against unpredictable market movements.

Conclusion

The historic trades of influential investors like George Soros, John Paulson, and Warren Buffett reveal valuable lessons for modern traders. Some important things you can learn from them are the importance of thorough market analysis and the ability to identify undervalued assets during turbulent times. Please note that each of these traders employed strategies based on their understanding of economic conditions. This clearly shows that successful trading is not about luck but informed decision-making.

Moreover, effective risk management is important. Traders like Bill Ackman and Paul Tudor Jones used hedging strategies to protect themselves from the likely downturns. Thus, traders must be prepared for market fluctuations as they will not always succeed.

Moreover, developing a “strategic mindset” is highly crucial. Our advanced market analysis tool, Bookmap, can help you visualize market liquidity and observe the real-time flow of orders. This presentation of market data allows you to spot emerging opportunities easily. Do you wish to improve your chances of success?

Join Bookmap today and smartly position yourself to earn profits!