Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 26, 2024

SHARE

Trade Journaling: Why, How, and What to Include

Are you interested in improving your trading strategy? Every trader makes

occasional mistakes, but the path to refinement lies in learning from them.

In this article, we will explore the value of a trading journal, a tool

frequently utilized by successful traders. You will come to understand the

significance of meticulously recording your trades, tracking your progress,

and recognizing patterns.

Regardless of whether you’re a novice or an experienced trader, you will

discover how this tool can enhance your approach and contribute to your

success. Let’s begin.

Why Journal Your Trades?

By having a record of trades, you can reflect on:

-

Patterns

-

Mistakes

-

Successful strategies

It allows for a comprehensive review of your trading behavior and provides

valuable insights into your trading habits. Let’s understand some of its

major benefits.

Accountability

Journaling your trades creates a sense of responsibility. When traders

maintain a journal, they establish a documented history of their trades.

This record serves as a concrete reminder of their decisions and their

outcomes.

It’s easy to forget or selectively remember trades when there isn’t a

record. However, a journal forces a trader to confront both good and bad

trades. This accountability is crucial as it:

-

Prevents forgetting mistakes and

-

Helps to recognize successful strategies.

Also, the act of documenting trades has a psychological impact on traders.

Knowing that every trade will be written down fosters a more thoughtful

approach to decision-making. When a record exists, there’s a natural

inclination to avoid rash decisions.

Tracking Progress

A beginner trader starts with uncertainty and a lack of experience. They may

make impulsive decisions or lack a solid strategy. As they progress, they

gain knowledge, experience, and a better understanding of the market.

However, this progress might go unnoticed without proper tracking. With a

journal, they can document their journey from initial trades to more

informed decisions.

Traders who review their monthly or yearly performance can:

-

Observe trends in their success rates

-

Identify areas for improvement

-

Track their learning curve

Celebrating successful strategies or trades is equally crucial as it boosts

confidence and reinforces the application of effective tactics.

Recognizing Patterns

Humans are inherently inclined to seek and recognize patterns, and this

tendency extends to the realm of trading. A well-kept trading journal plays

a pivotal role in pattern recognition, whether they are positive or

negative. It achieves this by recording:

-

Trade outcomes

-

Market conditions

-

Emotional states

-

Various other factors that could impact trading decisions.

Let’s illustrate the concept with a hypothetical scenario:

-

A trader consistently experiences poor performance on Mondays.

-

Through diligent journaling, this trader recognizes that their

Monday losses form a recurring pattern. -

This realization prompts them to delve deeper and investigate the

reasons behind this pattern.

Possible reasons:

-

The trader may still be in a weekend mindset and not fully focused

on Monday. -

Mondays might witness the emergence of a market trend that

consistently works against their strategies.

Without a journal, such patterns may go unnoticed or be considered random

occurrences. However, once patterns are identified, traders can take

appropriate actions. For instance, in the example of recurring Monday

losses, traders can:

-

Develop a specific Monday trading strategy.

-

Focus on mental preparedness to transition out of a weekend mindset.

Essential Elements of a Trading Journal

A trading journal is an indispensable tool for traders to track and analyze

their trading performance. Here are some crucial components:

Date and Time

Market behavior can vary significantly at different times of the day, week,

or month. News releases or economic events can also impact the market. Thus,

noting the precise date and time of each trade is crucial for aligning with

market conditions and specific events.

Documenting the trade’s date and time allows traders to correlate their

performance with these market factors. For instance, a trade executed during

a volatile news event might yield different outcomes compared to a trade

conducted during a quiet market period.

Instrument / Asset Traded

Clearly specifying the instrument or asset traded (e.g., stocks, forex

pairs, cryptocurrencies) helps in understanding which markets the trader is

most successful in. This information assists in:

-

Analyzing performance across different asset classes

Recognizing whether specific assets align better with the trader’s strategy

or demonstrate more consistent profitability.

Entry and Exit Points

Documenting the exact prices or market levels helps in evaluating the

effectiveness of a trader’s strategy and decision-making. Understanding

these points allows traders to:

-

Analyze the accuracy of their predictions

-

Assess risk management strategies

-

Identify areas for improvement

For example,

-

A trader might notice that they consistently exit their trades too

early. -

By reviewing their journal and seeing the price movements after

their exits, they may realize they are missing out on potential

profits by not allowing their positions to run longer.

Trade Rationale

Recording the reasoning behind a trade is crucial. This rationale often

originates from:

-

Technical analysis

-

Fundamental analysis

-

News-driven events

-

Intuition

By documenting the thought process leading to a trade, traders can

retrospectively evaluate the efficacy of their trading strategy. See the

table below:

|

What was the basis of trade? |

What can the traders assess? |

|

The trade was based on technical analysis |

The trader can assess how accurate the technical |

|

The trade was based on fundamental analysis or news |

The trader can analyze how well they interpreted and |

Consistently logging these rationales offers insight into what works and

what doesn’t. Over time, traders can:

-

Identify patterns in successful decision-making processes and

-

Refine their strategies.

Trade Outcome

It’s crucial to document both the financial outcome and the emotional

response to each trade. Beyond profit or loss, comprehending emotional

reactions offers valuable insights into a trader’s psychology and the

influence of emotions on decision-making.

Noting feelings such as regret, satisfaction, stress, or anxiety helps us

understand emotional triggers that impact trading decisions. Explore this in

the table below:

|

What are your emotional triggers? |

What action can you take? |

|

The trader consistently experiences regret after a |

The trader should re-evaluate their risk management or |

|

The trader notices a pattern of stress or anxiety during |

The trader may need to address personal stress and find |

By documenting emotional responses, traders can identify whether losses or

suboptimal decisions are due to external factors or emotional biases. This

awareness allows them to:

-

Work on controlling emotions

-

Maintain a rational mindset

-

Make less emotionally driven trading decisions in the future.

How To Consistently Maintain Your Journal

Maintaining a trading journal consistently is vital for reaping its

benefits. Here’s how you can inculcate this habit:

Make it a Routine:

Just like any other habit, setting aside a specific time post-trading to

update the journal is crucial. Treat journaling as a non-negotiable task,

similar to brushing your teeth before bed. Find a time that suits your

schedule, whether it’s:

-

Immediately after trading hours or

-

At the end of the day

Digital vs. Physical Journal:

Consider the advantages and disadvantages of both digital and physical

journals.

|

Digital Journals |

Physical Journals |

|

Digital platforms offer ease of data analysis, |

A physical journal might offer a more personal and |

|

They allow for quick sorting, charting, and analysis of |

Writing by hand can sometimes enhance memory and |

However, some traders prefer a combination, using digital tools for

analytics and a physical journal for deeper reflections.

Review Periodically:

A regular reflection is performed periodically to refine strategies and

decision-making processes. Follow this step-by-step guide:

-

Schedule routine reviews of the journal.

-

Set aside time, perhaps every weekend, to reflect on the week’s

trades. -

Use this time not just to spot mistakes but also to understand

what’s working well. -

Identify successful patterns.

-

Analyze why certain trades were profitable.

-

Learn from both positive and negative experiences.

-

Note down all your findings under separate headings.

Community Journaling with Bookmap’s Blue Jacket

The

Blue Jacket content competition by Bookmap

is an innovative experience that encourages traders to share and learn from

each other. It is specifically designed for traders to foster a community of

shared insights and experiences.

On the Bookmap Insights page,

traders can engage in this competition by sharing various forms of content

such as:

-

Screenshots

-

Videos, and

-

Other insights related to trading

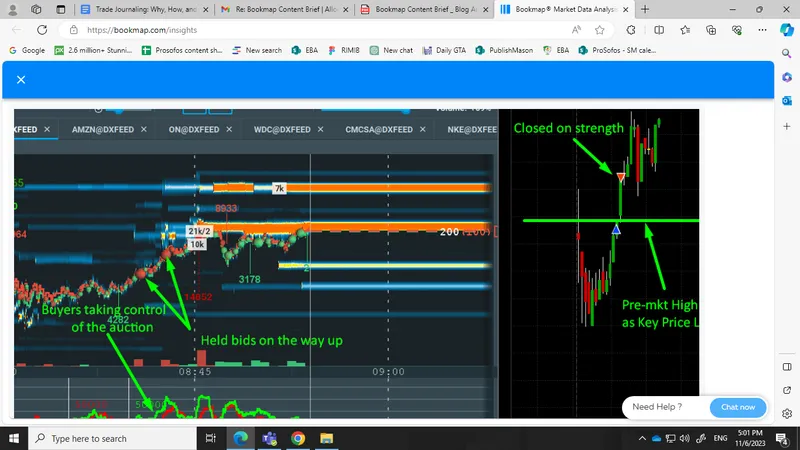

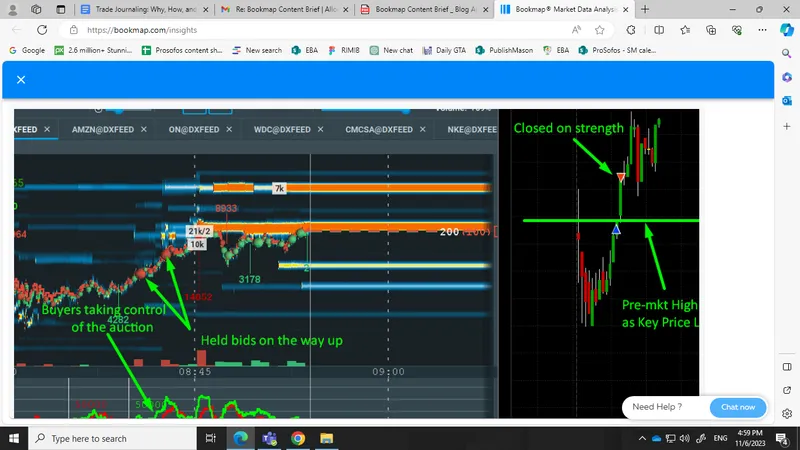

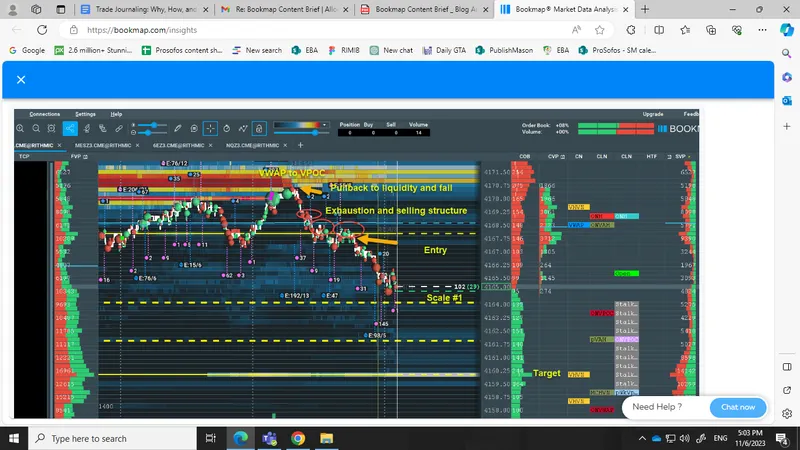

Have a look at some screenshots below:

-

Occurred on: 03.11.2023

Type: Surfer Iceberg

-

Occurred on: 31.10.2023

Type: Long CCJ Earnings Play

-

Occurred on: 30.10.2023

Type: VWAP to VPOC Tlab Structured Trade

This diversity allows participants to showcase their unique perspectives,

strategies, and trading techniques. By sharing their trading experiences,

beginners and seasoned professionals alike have the opportunity to learn

from a wide array of trading practices.

One of the key attractions of this competition is the opportunity to win a

valuable prize – Three months of Bookmap’s Global with stocks and futures

data.

The winner gains access to premium features and extensive data that can

significantly enhance a trader’s capabilities. This competition is designed

for both novice and experienced traders:

-

Beginners can learn from seasoned professionals.

-

Experienced traders can showcase their expertise and potentially

uncover new insights from fellow participants.

Participating in community learning initiatives, such as the Blue Jacket

competition accelerates individual growth as traders through the following

key factors:

-

Gain diverse perspectives

-

Learn new strategies

-

Refine trading skills

All traders should consider joining the competition not only for the chance

to win a prize but also for the opportunity to engage with a community of

traders. Learning from shared knowledge and gaining valuable insights can

significantly contribute to one’s growth and success in the trading world.

Conclusion

Maintaining a trade journal significantly impacts trading success.

Consistent journaling cultivates discipline and fosters a deeper

understanding of one’s trading decisions. By reflecting on trade entries,

exits, rationales, and emotional responses, traders can enhance their

strategies and decision-making processes.

Remember, the value of a trade journal lies not just in its records but in

the insights it provides. It is a personal roadmap to better decision-making

and continuous improvement.

It’s never too late to start a trade journal. Even a modest beginning can

yield significant benefits. Whether jotting down trades in a notebook, using

a digital platform, or participating in a community-driven initiative like

the Blue Jacket content competition, initiating the process is crucial.

Eager to showcase your trading insights and stand a chance to win? Dive into

Bookmap’s Blue Jacket competition now and elevate your trading journey!

Join Here.