Our 4th of July Sale is Live

Offer Valid July 4 – July 11

Get 50% off Global+ AND data for 3 months—or save 30% on Global+ for the full year

Claim Your DealReady to see the market clearly?

Sign up now and make smarter trades today

Crypto

May 6, 2024

SHARE

Trading Cryptocurrency with Multibook

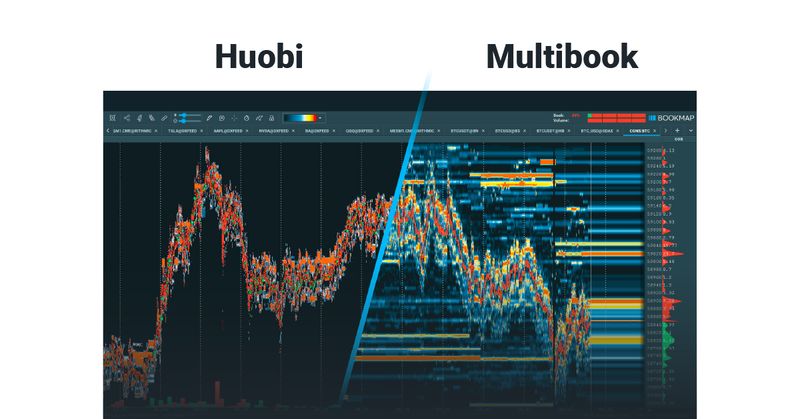

See cross-exchange cryptocurrency liquidity and volume delta in a single chart

What is Multibook?

Cryptocurrencies are digital assets that trade 24 hours a day, 7 days a week. All these different exchanges and trading instruments mean that it’s hard to know the true price of any particular cryptocurrency or pair.

With Multibook, a trader can generate a synthetic instrument based on all the liquidity and volume across multiple exchanges and plot it on a single chart. Bookmap heatmap and volume delta will visualise the order flow data of all market participants in real-time, even if they are trading Bitcoin across exchanges or trading completely different instruments.

Introduction to Multibook

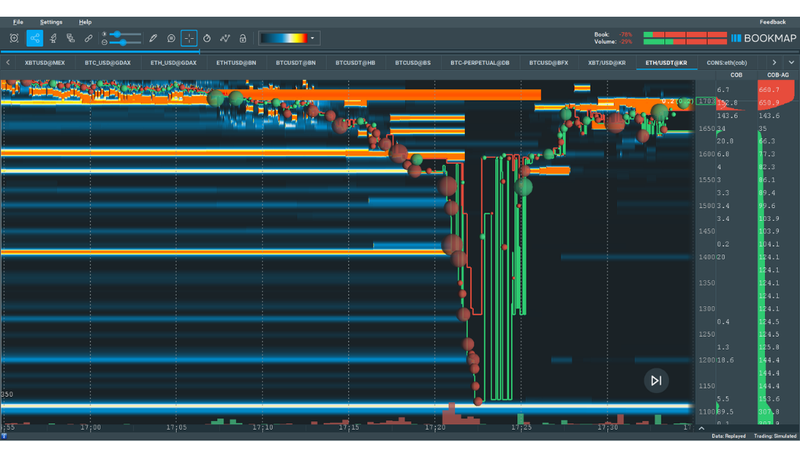

Once you’ve downloaded and installed the Bookmap addon (see the Multibook Guide for instructions), you will see a chart that looks similar to this.

This is the default chart for the BTCUSD spot, and the addon also comes with default settings for ETHUSD.. All the settings can be modified and you can create your own synthetic instruments from any cryptocurrency pairs and exchanges of your choosing.

Configuration

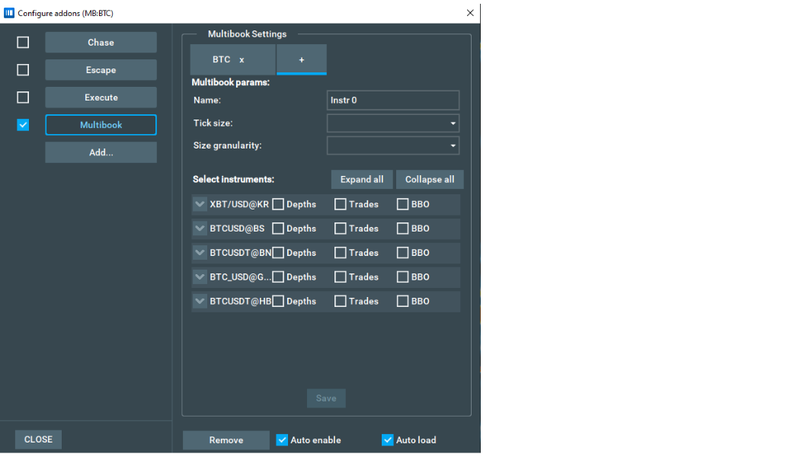

If you go to Settings > Configure add-ons, and then select Multibook, you will see the settings parameters to edit or create a Multibook instrument. You can combine from 2 to 5 instruments into one consolidated instrument. First, you define a name for this synthetic instrument, and then you can choose the details of what you want to see from each instrument. Let’s move on to the checkboxes, we will come back to tick size and size granularity after.

- Depths – Check this box to see the liquidity (limit order book) of each instrument combined in the Bookmap heatmap. You must select at least one to generate a chart.

- Trades – These are the trade bubbles and volume delta that represent aggressive market order transactions. You can choose to see only the trades of a single instrument on an exchange or multiple trades across exchanges. Please note, if you select more than one instrument, you may see trades transacted above or below the best bid vs ask. This is because prices are different across exchanges, as previously mentioned. You can also edit which trades are visible after the Multibook instrument has been created.

- Best Bid and Offer (BBO) – If you don’t select any BBO, the chart will show 2 lines by default. This is the virtual mid-price across an aggregate of the instruments you have chosen. You can also select to view the BBO of each individual instrument and modify its color. The name of the instrument and exchange is shown when you hover your mouse over the BBO lines. You can also modify which BBOs to see after the Multibook instrument has already been created.

Tick size and Size granularity

These values have already been optimised for the default Multibook instruments, but you can adjust the default when you create your own synthetic instruments.

Tick size is the vertical scaling of price levels. In other words, the minimum price change. This will be different depending on the instrument selected and how finely you want to see changes in price.

Size granularity is the minimum size of transacted trades and liquidity in the order book you would like to see, as well as the minimum size to trade.

The Advantages of Multibook

Absorption

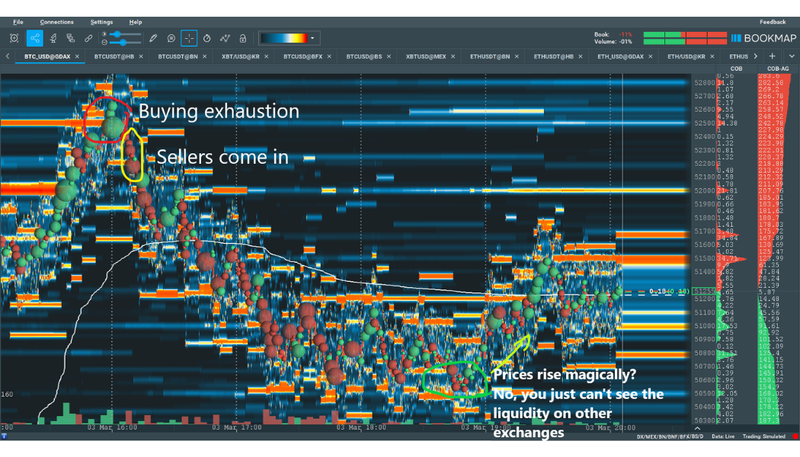

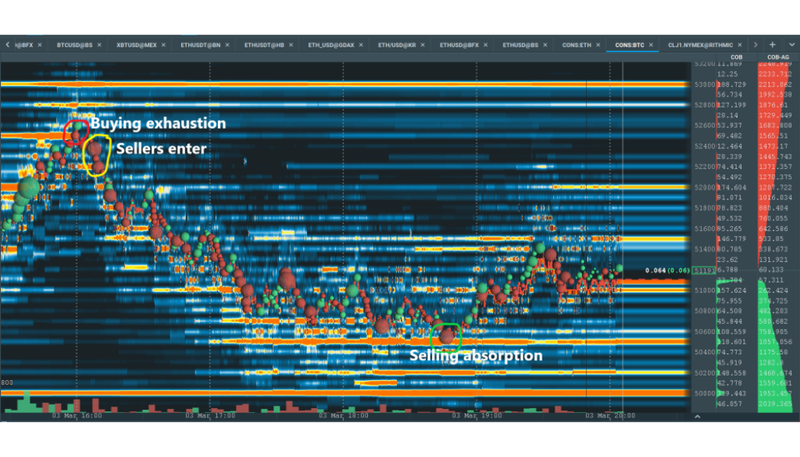

Even if you are viewing the order book of the largest cryptocurrency exchange, you see only part of the picture. The trading activity and liquidity levels on the rest of the exchanges remain hidden from you.

At the beginning of the chart, prices are rising rapidly and buyers plow through large offers at 52,000, but large offers at 52,500 absorb the buying momentum. Aggressive buyers manage to push through the level, but having spent so much capital to meet the offers, buyers taper off and sellers enter the market.

For many Bookmap traders, this would have been a high-probability signal to get short. Prices dropped consistently for the next three hours, but just looking at the Coinbase Pro order book showed no significant area of liquidity for a profitable exit of the trade. Instead, about 2 hours after the original signal, prices just suddenly decided to rebound for no apparent reason.

However, looking at the Multibook chart we see a very clear absorption of the selling at 50,500. A trader that took the original position could take full or partial profits here, or even go long. Either way, the Bookmap heatmap of a BTCUSD pair on a single exchange showed a very clear potential entry point, but only in combination with Multibook would the trader have had the opportunity to seize as much of the $2k move as possible.

Cross-exchange Arbitrage

Because different instruments trade at different prices—even those based on the exact same asset—sometimes the price of a lone instrument can be temporarily dislocated from the average. If you have trading accounts across multiple exchanges, the ability to always choose the best price could significantly increase your P/L over time. It can also be a great trading signal.

Consider the last ETHUSD flash crash on Kraken. On February 22, 2021, the rate fell from 1600 to a low of 1120 in a matter of minutes.

Sellers ate through bids at 1600 which then immediately flipped to the offer. The level absorbed a brief moment of market buying, before very rapidly tanking, falling through large bids at 1400 to trade smaller bids just above 1100. Spreads widened and very few trades were transacted during this time. The first reasonably sized volume delta dots appeared as spreads narrowed towards where the movement started at 1600.

While it seems that a market participant did manage to successfully trade this move (the red dot being a market sell that traded into somebody’s best bid at 1120), it’s hard to know if the transaction was a participant closing a short, a market maker balancing their books, or a trader betting that the down move was over. Either way, the reality is that trading this would be very difficult, not to mention risky.

Looking at a Multibook of ETH based on 5 exchanges including Kraken, we see a clearer picture. The other exchanges only traded as low as 1510, the volume bubbles for the Kraken pair being literally off the charts.

Zooming into the Multibook heatmap further, we can see that some exchanges saw selling absorption of the large offers just above 1500. The selling momentum is stalling, and this could have been taken as confirmation that the rapid down move was overdone. This turned out to be the low of the day, the pair making a short term higher high minutes later and trading back up into the 1600-1700 zone almost as quickly as it fell.

Whether a trader utilized this signal to initiate a trade or just to manage risk all comes down to individual trading preferences and style. Either way, the bottom line is simple: Multibook can provide an edge even in high-volatility environments.

Conclusion

Cryptocurrencies are a truly international asset class, and this brings with it both positives and negatives. For traders, the increased interconnectivity provides the potential for more alpha generation. But all these exchanges with their different prices can be dangerous, even for the best traders. Multibook simplifies by consolidating it all into a single, easily accessible and customizable chart. If used correctly, Multibook provides that ever so vital edge in this often extremely volatile space.