Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 18, 2024

SHARE

Trading Myths Debunked: Separating Fact from Fiction in the World of Trading

Many traders view the market as a shortcut to quick riches, only to find that it’s a shortcut to bankruptcy instead. Trading in the financial markets is rife with myths. From the allure of instant profits to the reliance on hot tips or recommendations, these misconceptions usually result in significant financial losses.

Through this article, we’ll debunk these common myths and reveal the realities of trading. Also, we will highlight the critical role of risk management, the need for adaptability, and the value of emotional discipline in trading. Lastly, we will learn how cutting-edge market analysis tools like Bookmap offer transparent, real-time data, aiding traders in making well-informed decisions. Let’s get started.

5 Common Trading Myths

“Leave your jobs and businesses. Start trading and get rich!” The stock market is riddled with myths and misconceptions about the financial markets and trading practices. They often lead traders into:

- Making poor decisions

or

- Adopting ineffective strategies.

These myths popularly include notions, such as trading being a quick path to wealth or the belief that certain indicators or tips can guarantee profits. However, in reality, successful trading requires discipline. It is only through appropriate risk management and a deep understanding of financial markets that traders can optimize their trading outcomes and maximize their earning potential.

Let’s debunk the top 5 trading myths every trader must avoid.

Myth 1: The ‘Get Rich Quick’ Scheme

It can come to you as a harsh reality, but trading is not a guaranteed or quick path to wealth. Several studies have highlighted the staggering failure rate among day traders, with over 90% losing their initial investment within a short period. This statistic dispels the myth of easy riches and cautions against the dangerous illusion of overnight success.

So, should you abandon trading? Absolutely not! Instead, approach it with the right mindset and strategies. Traders must note that the essential qualities and efforts required for successful trading, include:

- Education,

- Strategic planning, and

- Risk management.

Trading demands patience and discipline. Traders who try to time the market perfectly or chase quick profits often sustain losses and lose their money. Thus, efforts must be made towards:

- Developing a robust trading plan

and

- Gradual transitioning from simulation to real accounts.

Myth 2: The More Complex, the Better

It is a widely prevalent belief that complex trading strategies yield superior results. For the unaware, these strategies involve:

- Sophisticated algorithms,

- Advanced technical indicators, and

- Intricate risk management techniques.

One popular example is high-frequency trading (HFT). In this strategy,

- Computer algorithms execute a large number of orders,

- The order execution occurs at lightning speed, and

- The aim is to exploit small price discrepancies in milliseconds.

To take another example, we can consider arbitrage. This strategy involves the simultaneous buying and selling of securities in different markets to profit from price differentials.

Indeed, these strategies can yield profits and are widely adopted. But market participants, especially individual traders must consider that these strategies require:

- Significant computational power,

- Deep expertise, and

- Modern infrastructure.

These requirements make complex strategies inaccessible or impractical for many traders. Moreover, their complexity can increase the risk of errors and losses if not implemented carefully.

Simplicity reigns supreme in trading strategies

Numerous studies have shown that simple and non-complex trading strategies have consistently outperformed their more evolved counterparts. Let’s have a look at some popular simple trading strategies:

Upon observation, it can be noticed that these simple strategies require minimal technical analysis. They can be easily understood and implemented by traders of all experience levels. While they may not offer the complexity of advanced strategies, their simplicity often leads to:

- Greater clarity

and

- Ease of execution.

Some More Evidence

Renowned investor Warren Buffett is famous for his value investing approach. His success highlights the effectiveness of a simple yet well-executed strategy over the long term. Similarly, we can take inspiration from the famous “Turtle Traders” experiment, in which a group of novice traders was taught a simple trend-following system. The end results demonstrated remarkable success and promoted the need for simplicity in trading.

Myth 3: Following Hot Tips from Forums or Social Media Guarantees Profits

In this modern age of social media and online forums, trading advice and tips are readily available. Traders often follow these recommendations or tips and look to effortlessly generate profits. However, this belief is a fallacy and can lead to significant financial losses.

But why? Let’s have a look at some proven facts

- Speculative Recommendation

-

-

- The tips shared on forums or social media platforms are often based on:

- Speculations,

- Rumors, and

- Personal opinions.

- Usually, individuals sharing these tips do not have any expertise or credibility in trading.

- Often, their recommendations lack sound reasoning or proper risk assessment.

- The tips shared on forums or social media platforms are often based on:

-

- Manipulated Information

-

-

- Tips shared on these platforms can be biased or manipulated for personal gain.

- In some cases, individuals even have ulterior motives.

- One common example of such a motive is “pump and dump” in which:

- The price of a particular stock is pumped up by giving false recommendations.

- The stock is sold at a higher price later.

- The stock price gets crashed again after profit booking.

-

- Irrational Decision-making

-

- Social media and online forums amplify herd behavior.

- They create a sense of FOMO (fear of missing out) among traders.

- This fear leads to irrational decision-making.

- Following it, traders jump into trades, based solely on the fear of missing out on potential profits.

- While doing so, they do not consider:

- Underlying fundamentals

or

- Technical analysis.

The High Chances of Missing Trading Opportunities

In addition to the above pointers, we can safely assume that markets are efficient to some extent. This means that any publicly available information, including tips shared on social media, is quickly priced into asset prices. However, by the time a tip reaches a wider audience, there could be two possibilities:

- The opportunity to profit from it has already passed.

or

- The market has already adjusted to reflect the new information.

In such cases, traders relying solely on hot tips from forums or social media are bound to sustain losses.

Myth 4: Technical Analysis Alone Can Predict Market Movements Accurately

Technical analysis is a valuable tool for analyzing price charts and patterns. Several successful traders prefer using it to predict future market movements. However, relying solely on it for predicting market movements is fraught with limitations and risks. Let’s see why:

Sole Focus on Historical Price Data

- Technical analysis primarily focuses on historical price data and market activity, such as:

- Trends,

- Patterns, and

- Indicators.

- While past price movements can provide valuable insights, they do not guarantee future outcomes.

- That’s because market conditions are constantly evolving.

- They are influenced by a lot of fundamental factors like:

- Geopolitical events,

- Investor sentiment,

- Earnings reports, and

- Central bank decisions.

- These factors are not fully reflected in historical price data alone, which can lead to erroneous predictions.

Technical Analysis Interpretation Is Subjective

- Different analysts interpret the same chart or pattern differently.

- This variation leads to conflicting signals and trading decisions.

- Additionally, it has been observed that technical indicators also produce false signals during periods of high volatility or low liquidity.

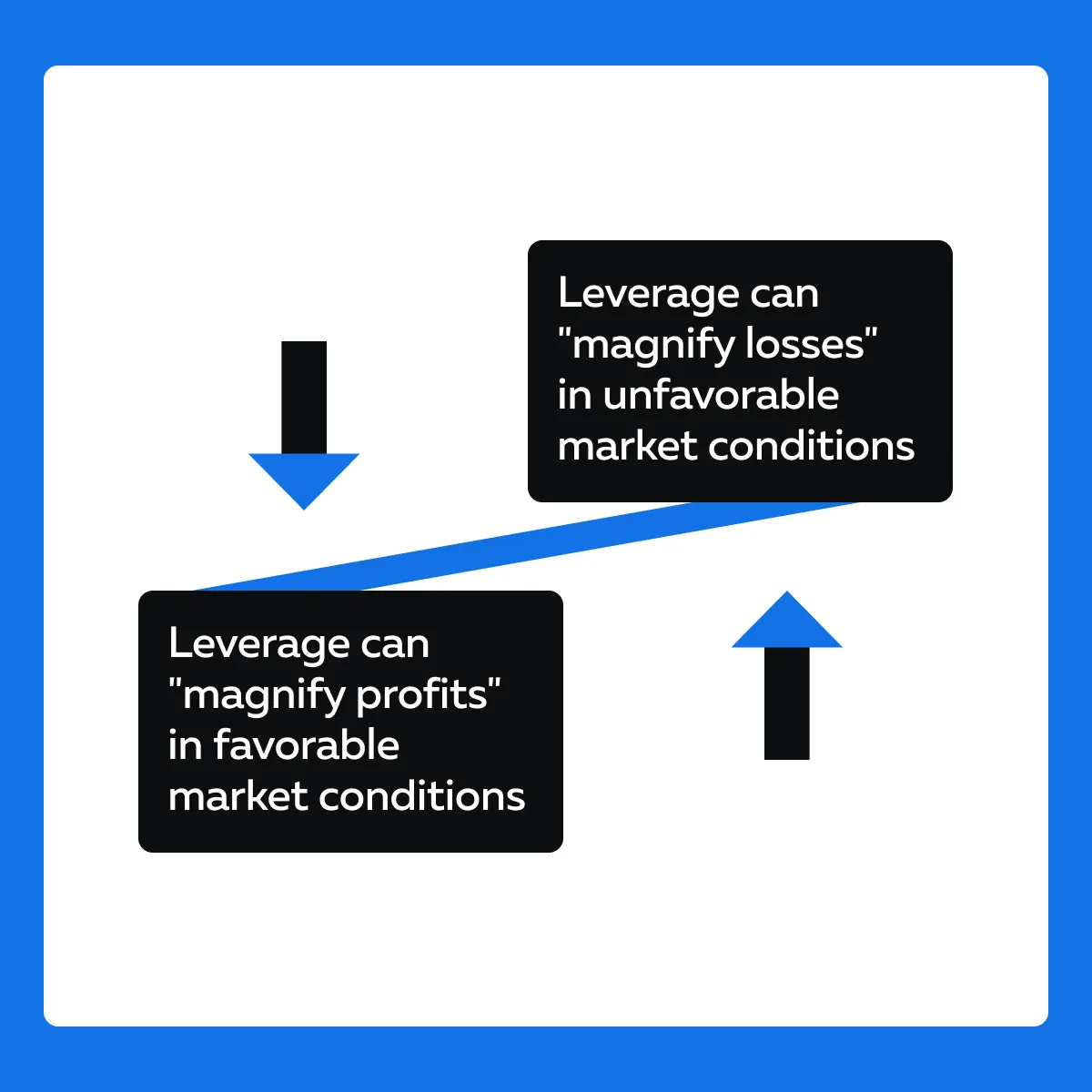

Myth 5: Leverage Always Maximizes Profits and Minimizes Risk

Leverage enables traders to control larger positions in the market with a smaller amount of capital. However, this control has the potential to amplify both potential gains and losses.

This happens because, for every unit of leverage, traders are exposed to a higher degree of market risk. In volatile market conditions, sharp price movements can quickly erode leveraged positions. This erosion leads to substantial losses or even margin calls. In such cases, traders are required to deposit additional funds to cover their positions.

Let’s have a look at some other major drawbacks of leverage:

- Unpredictability of Financial Markets

-

-

- Successful leverage requires that trades consistently move in the desired direction.

- However, markets are inherently unpredictable.

- Even the most well-reasoned trades may incur losses.

- In such cases, using excessive leverage can quickly deplete trading capital and wipe out accounts.

-

- Amplified Emotional Responses

-

- Usually, traders who overleverage their positions panic and exit trades prematurely.

- Such reactions typically result in financial losses, as they prevent positions from having the opportunity to recover.

- Moreover, adverse market fluctuations can further lead to:

- Impulsive decision-making

and

- Irrational trading behavior.

What’s the Best Way to Use Leverage?

Leverage can be a powerful tool when used judiciously but it is not a one-size-fits-all solution. Successful traders enhance trading profitability under the right conditions by employing risk management techniques, such as:

- Setting stop-loss orders

and

- Limiting the size of leveraged positions relative to their account size.

The Realities of Trading

Successful trading is not about making quick profits or chasing hot tips. Instead, it is all about:

- Sticking to a well-defined trading plan

and

- Waiting for the right opportunities to present themselves.

To stay ahead, traders must commit to continuous learning and skill development. They must use the right tools, like Bookmap, and the latest technology to enhance trading performance. Let’s have a look at the top five facts highlighting the realities of trading.

Fact 1: Education and Experience Matter

It is a proven fact that success in trading is not solely determined by:

- Following trends

or

- Relying on hot tips.

Instead, it stems from a combination of education, experience, and continuous learning. Numerous stories of successful traders show the importance of acquiring a deep understanding of the markets and honing analytical skills. Let’s study some popular stories:

The Warren Buffett Story

- Legendary investor Warren Buffett is renowned for his disciplined approach to investing.

- His conviction in fundamental analysis and a thorough understanding of a company’s fundamentals have been the cornerstone of his strategy.

- Also, Buffett has consistently emphasized the importance of:

- Patience,

- Adherence to value investing principles, and

- Maintaining a long-term perspective over short-term market fluctuations.

The George Soros Ideology

- George Soros is considered one of the most successful investors of all time.

- He has performed rigorous analysis and research to anticipate market trends.

- Soros has emphasized the importance of reflexivity in markets.

- It refers to a situation where perceptions and expectations influence the market dynamics.

Fact 2: Risk Management is Key

By managing risk, successful traders can protect capital and preserve long-term profitability. Jim Rogers, a renowned commodity trader and investor, has always emphasized the significance of risk management in his approach. He advocates for the use of stop-loss orders to limit potential losses on trades. This ensures that no single trade can significantly impact overall portfolio performance.

Similarly, professional traders and institutional investors often employ sophisticated risk management strategies to protect against adverse market movements. Some commonly used techniques are as follows:

- Diversification,

- Position sizing, and

- Hedging.

For example, hedge fund manager Ray Dalio, founder of Bridgewater Associates, is known for his adherence to a risk management framework known as the “All Weather” strategy. This strategy aims to:

- Achieve consistent returns across various market environments and

- Minimize downside risk through a balanced portfolio allocation.

Fact 3: Adaptability is Essential

Successful trading requires adaptability to changing market conditions and evolving trends. Historical analyses and studies corroborate that those traders are left behind who:

- Rigidly adhere to a single strategy

or

- Fail to adjust their approach in response to new information.

However, adaptability helps traders with discerning shifts in the market sentiment. This recognition facilitates:

- Strategic adjustments of trading strategies to align with current market dynamics, and

- Capitalizing on emerging opportunities.

See the graphic below to understand how adaptive traders change their market approach:

Fact 4: Psychology Plays a Crucial Role

Traders often overlook the psychological aspect of trading. However, it is crucial for long-term success and maintaining peak performance under pressure. Emotions such as fear, greed, and overconfidence cloud judgment and lead to irrational decision-making. Successful traders cultivate emotional discipline and mental resilience, enabling them to remain calm and focused during periods of market turbulence. Some traders manage their emotions by using the following techniques:

- Mindfulness,

- Meditation,

- Journaling, and

- Visualization.

Fact 5: Consistency Trumps Perfection

In the realm of trading, consistency is valued more than achieving perfect trades. While traders may strive for flawless execution, the reality is that losses and mistakes are inevitable. What sets successful traders apart is their ability to:

- Maintain consistency in their approach over time, and

- Stick to their trading plan and risk management rules.

Traders who execute trades consistently can manage risk effectively. They can achieve long-term profitability and success in the markets.

How Tools Like Bookmap Can Help?

Advanced market analysis tools like Bookmap provide traders with transparent and real-time data to make informed, evidence-based trading decisions. It offers several features that allow traders to visualize critical aspects, such as:

- Order flow

and

- Market liquidity.

Let’s understand these benefits in detail:

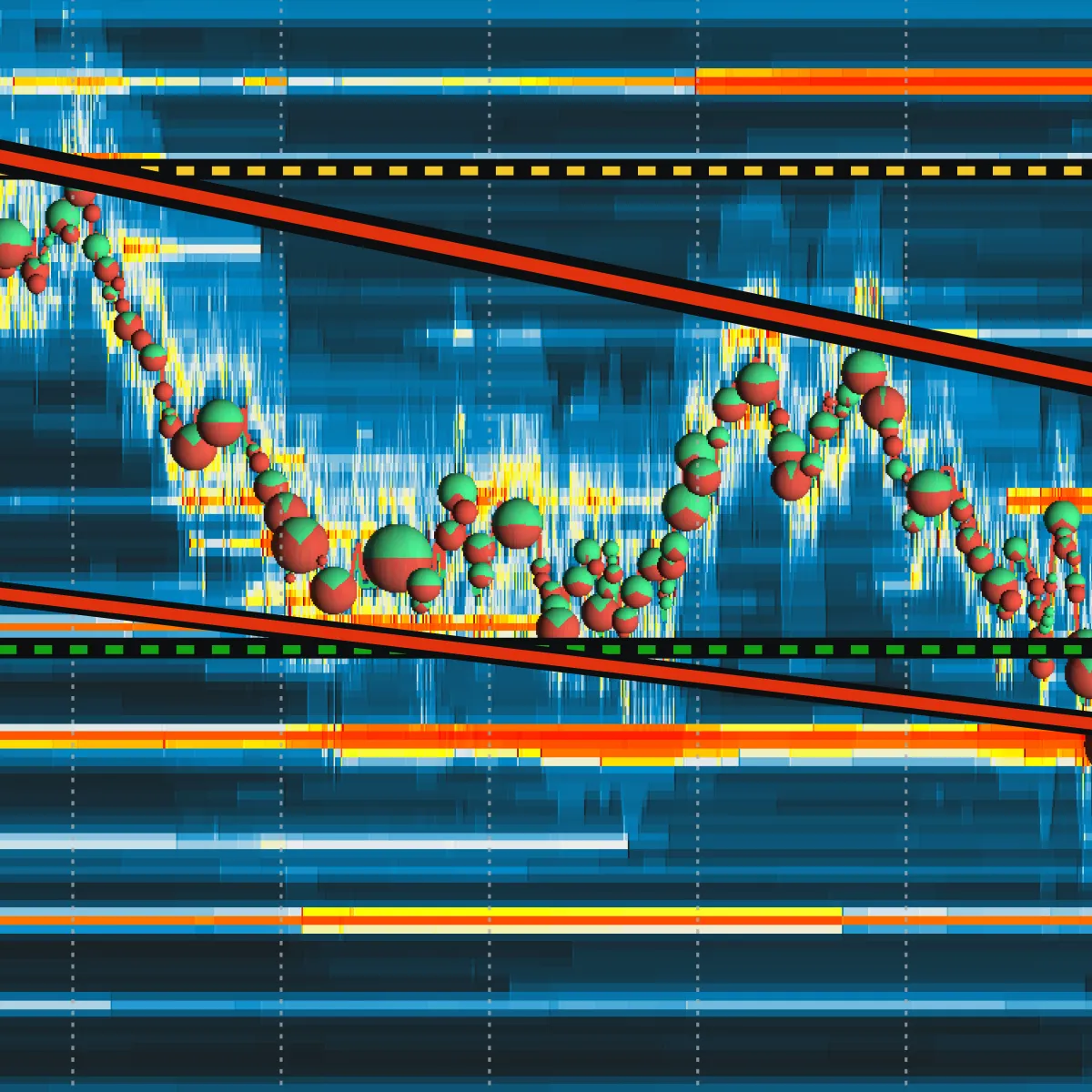

Visual Representation of Order Flow

Using Bookmap, traders get a clear view of the market activity. They can visualize the placement and execution of orders on the price ladder. This sort of visualization is instrumental in:

- Gauging the market sentiment

and

- Spotting potential areas of support and resistance.

Furthermore, Bookmap promotes transparency as traders can see firsthand the real-time interactions between buyers and sellers shaping market movements.

Colour-coded Representation of Market Liquidity

Bookmap’s heatmap feature provides a colour-coded representation of market liquidity. By analyzing this heatmap, traders can identify areas of high or low liquidity levels. Using this information, traders can decide about their entry and exit points. Also, Bookmap offers real-time liquidity data. Using it, traders can better anticipate price movements and manage risk effectively.

The Historical Data Playback Feature

Bookmap’s historical data playback feature allows traders to:

- Review past market activity

and

- Analyze trading patterns and trends over time.

This functionality further supports evidence-based decision-making as it enables traders to understand the market dynamics and behavior. By studying historical data, traders can:

- Debunk myths about the predictability of market movements

and

- Develop more robust trading strategies.

Conclusion

Financial markets are marred by a plethora of myths. For some, it’s a gateway to quick riches; for others, using complex trading strategies is the only way to make money. However, the truth is that success stems from a comprehensive understanding of the realities of trading and trading principles.

Traders must understand that education and experience, rather than hot tips, form the foundation of profitable trading. Also, risk management helps protect capital, and emotional discipline is crucial for maintaining composure during turbulent times. By being consistent, traders can strive for perfection and enjoy long-term profitability.

Furthermore, advanced market analysis tools like Bookmap provide traders with transparent and real-time data to support evidence-based decision-making. By visualizing order flow and market liquidity, traders can debunk market myths and gain a competitive advantage.

Success in trading requires patience and discipline. To further expand your trading acumen, consider reading about the 5 most common trading biases.