20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Trading Basics

October 23, 2024

SHARE

A Gap in the Market: Understanding Price Gaps in Trading

New traders may be surprised by gaps when they first come across them but they are widespread. You should therefore know about gaps and, where necessary, how to take advantage of them.

This is an introduction to gaps and we look at what they are and the types of gaps. The astute trader can interpret and benefit from gaps and that subject is dealt with in a separate article. The study of gaps and how traders can use them to find entry and exit points, as well as better manage their risk, is part of technical analysis.

A gap is a space on a chart where an instrument’s price goes up or down with no trading activity happening during the time in between. Therefore, the chart indicates a deviation from the expected price trend or a continuation of a strong existing trend.

This is most often seen when there is a difference in a closing price and the next day’s opening price, but they can also occur during a trading session. The difference may be higher—a gap up—than the previous price or lower, a gap down.

The How and Why of Gaps

In the typical situation—the gap that appears in the new day’s opening—they are often the result of any new information coming to light between the close and the open, that is to say, outside of market hours.

For a gap to appear, such new information must first be seen by traders as positive or negative and could be political or economic events, natural disasters or more commonly company news, for example unexpectedly lower or higher quarterly sales. In this sense, a gap is merely a reaction to news, and could in some circumstances be seen as an overreaction, due to the herd mentality of traders.

Negative new information produces what is known as a gap down while positive information results in a gap up.

Gaps can also appear in situations of low liquidity and high volatility. They reveal a discontinuity in the evolution of price and a sudden imbalance between supply (sell orders) and demand (buy orders) for a particular instrument.

What Are Gap Fills?

After a gap opens, whenever the price of an instrument returns to its pre-gap level, this is known as a gap fill or a gap ‘getting filled’ or ‘closing the gap’.

A gap up fill is marked when the higher price returns back down to its previous level, while a gap down fill means the lower price returns to the previous higher level.

It is important to understand that although gaps frequently close, it is never guaranteed that a gap will be filled or when it will be filled. Gaps might close within minutes, or they can take many days, or even months, in some cases years. In addition, they may only be partially filled, meaning that the price only returns some of the way to its previous pre-gap level.

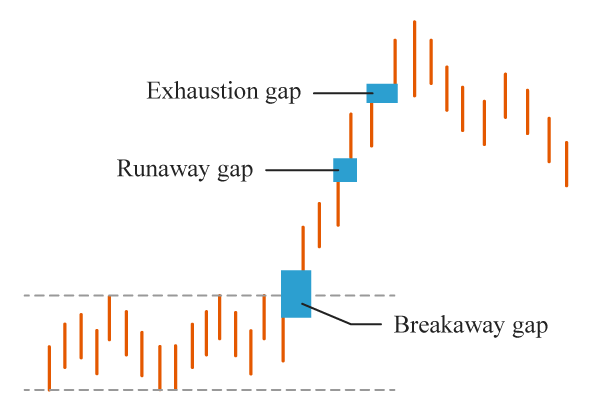

Types of Gaps

Gaps can occur in all markets and for all instruments, including, stocks, crypto and futures. There are four main kinds of gaps that might occur.

Common gaps

These are also called trading gaps and are usually not relevant. They are gaps within an existing trading range and not a signal of a new trend. They may be related to low volumes and are almost always filled.

Breakaway gaps

These occur when a price moves above or below a resistance or support level and could mark the start of a new trend. They are often preceded or accompanied by high volumes. For a gap up, the gap point turns into a new support level and for a gap down, this point will act as resistance. It is possible that this gap will not be filled.

Continuation or Runaway gaps

These occur within the context of a clear trend. They can confirm the strength of the current trend, and are marked by strong volumes. In an uptrend, the gap will logically be a gap up and vice versa in a downtrend. This gap may be partially filled.

Exhaustion gaps

These indicate a trend reversal. An exhaustion gap often occurs at high volumes. Stopping the trend does not always immediately mean a reversal, but a consolidation can certainly happen.

Playing the gaps

Gaps are easy to spot but understanding them is more difficult. For traders, the interest of these gaps, apart from the fact they may be filled, are the indications they give.

They can offer information about support or resistance levels, trend reversals, and about the continuation, acceleration or completion of a trend. A breakaway or continuation gap can be a buy signal or a sell signal depending on the trend and momentum. The exhaustion gap announces the end of a trend or even a market cycle.

To sum up, it does not matter if you are dealing with a gap up or gap down. It is above all the nature of this gap that should give you information for trading.

There are various tactics that traders may use while trading gaps and gap fills and the best approach will be determined by identifying the type of gap.

Finally, for day traders, one of the biggest advantages is that it allows them to avoid the risk of loss from gaps at market opening and closing, since all positions are closed before the end of the trading day.

Ready to easily identify price gaps in the market? Get started with Bookmap today for FREE.