Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 16, 2024

SHARE

Unmasking Spoofing: Detecting and Navigating Deceptive Trading Practices

Knowledge is power, and in the world of financial markets, this adage rings

especially true. Having a deep understanding of market dynamics is crucial

for making wise investment choices. However, amid all this, there exists a

shadowy art known as

“spoofing.”

As its name suggests, spoofing is a deceptive tactic that can leave honest

investors reeling and create turmoil in markets. In this insightful article,

we will explore the intricate web of spoofing.

Join us as we uncover its telltale signs and explore strategies to safeguard

your investments.

What is Spoofing in Trading?

Spoofing in trading refers to the deceptive practice of submitting or

canceling multiple bids or offers in financial markets. It is a form of

market manipulation in which traders engage in fraudulent activities to gain

an advantage or influence market perceptions.

This is often done to:

-

Create a misleading appearance of market depth or

-

Manipulate prices artificially.

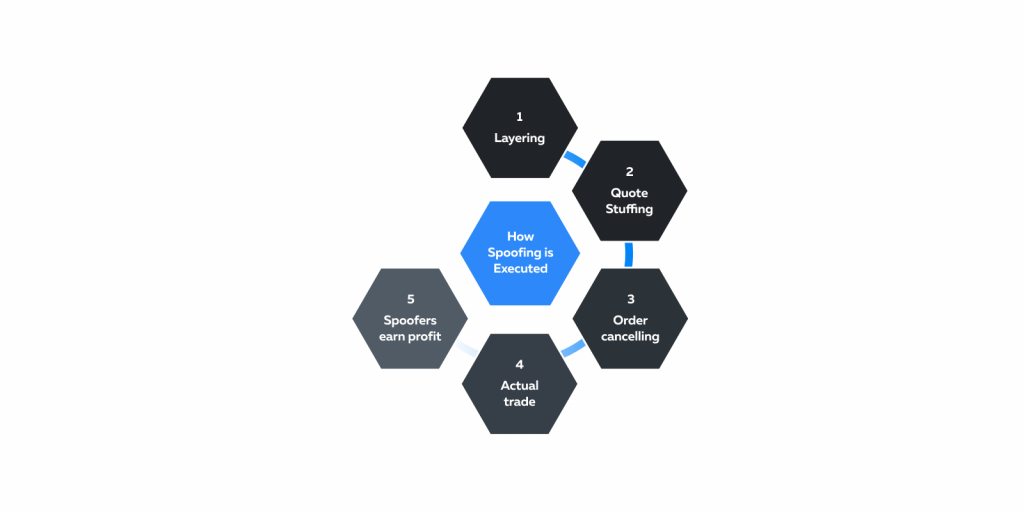

The Mechanics: How is Spoofing Executed?

Spoofing involves a trader placing orders with no intention of executing

them. Let’s understand the mechanics step-by-step:

|

Steps |

Explanation |

|

Layering |

|

|

Quote Stuffing |

|

|

Order Canceling |

|

|

Actual Trade |

|

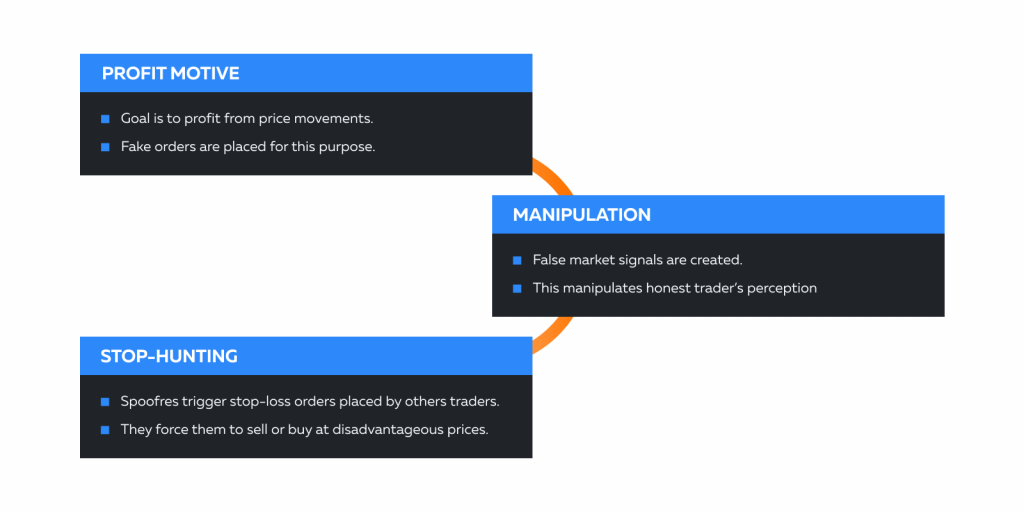

Why Spoofing?

Various motivations drive traders to engage in spoofing.

How Is Spoofing Practiced?

Spoofers employ several strategies to execute their deceptive tactics:

|

What is the spoofing tactic? |

How is it done? |

How does it affect the market? |

|

Layering |

|

|

|

Quote Stuffing |

|

|

|

Ping Pong |

|

|

|

Momentum Spoofing |

|

|

Understanding Through a Hypothetical Example

Let’s assume there is a trader, John. He aims to manipulate the price of a

popular tech stock, XYZ Inc., using spoofing. He seeks to create the

illusion of strong buying interest in the market, ultimately profiting from

the subsequent price increase. Here’s how it unfolds:

-

Creating the illusion:

-

John starts by looking at the order book for XYZ, Inc.

-

He sees that the current best ask price is $100 per share.

-

Deceptive Move: To fabricate the appearance of substantial

buying interest, he places a large order to buy 10,000 shares of

XYZ, Inc. at $101 per share. -

Price Differential: Importantly, this order is $1 above the

current best ask price.

-

-

Immediate Impact:

-

Order Visibility: John’s large buy order immediately appears on

the order book. -

Market Perception: Other traders notice the substantial demand

for XYZ, Inc. at $101 per share. -

Response: Some traders interpret this as a bullish signal and

start buying shares of XYZ, Inc. -

Price Uptick: The stock’s price begins to rise.

-

-

Cancellation and Profit:

-

Strategic Withdrawal: Just as the price of XYZ, Inc. reaches

$103 per share, John cancels his buy order for 10,000 shares at

$101. -

Eroding Buying Pressure: The moment John cancels his order, the

apparent buying pressure in the market, which was artificially

inflated, substantially diminishes.

-

-

Price Reversal:

-

Initiating Price Decline: As John’s order disappears, the

stock’s price starts to drop. -

Reality Sets In: This price reversal transpires because there

was never any authentic buying interest at the elevated prices

created by John’s deceptive order. -

Unfavorable Position: Traders who hastily bought shares in

response to John’s fake order now find themselves holding stocks

acquired at inflated prices, resulting in potential losses.

-

How Does Spoofing Create a Psychological Impact?

Spoofing can have a significant psychological impact on other traders. When

traders see large orders in the order book, they may interpret it as a sign

of strong market sentiment. This leads to panic buying or selling, which

spoofers exploit to their advantage. The fear and uncertainty generated can

further advantage the spoofer by causing other traders to second-guess their

strategies.

The Repercussions on the Market

Spoofing harms individual traders and:

-

Erodes trust

-

Causes artificial volatility

-

Leads to a decline in market participation.

Spoofing is illegal. Regulators and exchanges actively work to detect

spoofing activities. The aim is to protect the interests of genuine market

participants and preserve market integrity.

Let’s understand in detail the repercussions of spoofing:

-

Creates False Perceptions:

-

Spoofing

creates a false sense of market depth or direction. -

Honest traders see large orders in the order book and believe

that a significant market sentiment exists. -

They initiate new positions or exit existing ones.

-

When the market doesn’t move as anticipated due to spoofers

canceling their orders, these traders can incur losses or

suboptimal outcomes.

-

-

Triggers Market Instability:

-

Spoofing causes abrupt price swings or spikes due to the

artificial demand or supply created by the spoofer’s deceptive

orders. -

This volatility destabilizes the market and misleads other

traders into thinking that genuine market events are occurring.

-

-

Erodes Trust:

-

Persistent spoofing erodes trust in market mechanisms.

-

Traders feel that the market is manipulated or unfair.

-

They become less willing to participate, which reduces market

liquidity. -

Also, investors may seek alternative investment opportunities,

which can result in reduced capital flows and investments.

-

Regulatory Actions and Penalties

Regulations against spoofing are enforced in various regions. Explore some

notable examples below:

|

Regions |

Regulatory Body |

Enforcing Body |

|

United States |

|

|

|

Europe |

|

|

|

Japan |

|

|

|

Hong Kong |

|

|

How Regulators Detect and Deter Spoofing

Regulators and exchanges use techniques to detect and deter spoofing. These

are:

-

Monitoring of trading activity for unusual patterns, such as rapid

order cancellations aftermarket impact. -

Analysis of trading data to identify suspicious patterns, including

excessive order-to-trade ratios. -

Encouraging individuals with knowledge of spoofing to report it.

-

Regulators collaborate with other agencies and exchanges to share

information and coordinate enforcement efforts. -

Imposing significant fines and penalties on individuals and firms

found guilty of spoofing serves as a deterrent.

How to Spot Spoofing

Indeed, spotting spoofing can be challenging. But it is essential to gain

protection from manipulation. Here are some top tell-tale signs for spotting

spoofing:

-

Monitor frequent placing and cancellation of orders, especially when

they are not executed. -

Orders significantly larger than the typical order sizes in a given

market indicate spoofing. -

Look for repetitive patterns of order placement and cancellation

that don’t align with normal trading behavior. -

Watch for instances where the market suddenly reverses direction

after a spoofer cancels their orders.

Traders Must Access Transparent Data and Perform Real-time Monitoring:

To effectively spot spoofing, it is essential to have access to transparent

market data, including order book depth and trade. Traders should be

well-equipped with information about the number of orders at various price

levels. Furthermore, traders should use real-time market data and analysis

tools to identify abnormal patterns and behaviors promptly.

How Tools Like Bookmap Can Help

Market analysis tools like Bookmap provide valuable insights into order

flows and aid in the detection of abnormal trading behavior, such as order

placement and cancellation patterns.

-

Real-time Order Flow Visualization: Bookmap offers a detailed

visualization of order flows in real time. -

Heatmap Presentation: It displays the order book and historical

order book data in a heatmap format, making it easier to spot

abnormal order placement and cancellation patterns.

Most traders rely on Bookmap to see the density of orders at different price

levels and identify sudden changes or manipulative activities in the market.

Conclusion

Spoofing, as a deceptive trading tactic, significantly undermines the

integrity of financial markets. Its mechanics involve submitting and

canceling multiple bids or offers to distort the market’s true state. The

primary intent behind spoofing is to gain an edge, manipulate prices,

trigger stop-loss orders, and provide false liquidity in the market.

Thus, it is of paramount importance for traders to spot spoofing by

recognizing tell-tale signs. Rapid order placement and cancellation,

disproportional order size, avoidance of execution, and price reversal after

order cancellation are some common indicators.

Want to further enhance your ability to detect spoofing and algorithmic

trading? Watch our educational video in Bookmap’s Learning Center and

empower yourself with valuable insights to confidently navigate the trading

landscape.

Check out the video here.