Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 5, 2024

SHARE

Using Economic Calendars for Trading: A Comprehensive Guide

Have you ever wondered how some traders precisely predict market moves?

Well, the secret lies in something you might not have fully explored yet –

economic calendars. Don’t let the jargon scare you away; think of them as

your roadmap to potential profits in the dynamic financial landscape.

In this article, we’re diving deep into the world of economic calendars,

breaking down the complex stuff into bite-sized pieces. Also, we will

unravel the mysteries of economic events and discover how they can help you

execute profitable trades. Let’s get started.

Understanding Economic Calendars

Economic calendars serve as indispensable tools for investors, traders, and

analysts. They provide a comprehensive overview of scheduled economic events

and releases.

Unlike geopolitical events such as the G7 or OPEC meetings, economic

calendars predominantly focus on pre-planned meetings and financial

indicators. A thorough analysis of these indicators enables traders to gain

insights into the state of the global economy. Let’s explore this in more

detail.

What is an Economic Calendar?

An economic calendar is a chronological compilation of upcoming:

-

Events

-

Announcements, and

-

Data releases

These calendars encompass a wide array of information, including but not

limited to economic indicators, central bank meetings, government reports,

and corporate earnings releases.

Key Inclusions

Economic calendars include certain crucial aspects, which are:

-

Time zones:

-

Economic calendars include time zones.

-

This inclusion enables the investors to anticipate and react to

economic developments promptly, irrespective of their

geographical location.

-

-

Significant indicators:

-

Economic calendars feature several significant indicators.

-

These indicators range from employment reports and inflation

data to manufacturing indices and GDP releases. -

Investors use these indicators to:

-

Gauge the health of economies and

-

Make informed decisions regarding their portfolios.

-

-

Economic Events vs. Geopolitical Events

It’s important to distinguish economic events from geopolitical events.

While geopolitical events like G7 or OPEC meetings can have profound effects

on markets, economic calendars primarily focus on events that are scheduled

in advance. This emphasis on pre-planned events allows investors to:

-

Anticipate market movements based on data and forecasts

-

Prepare their trading strategies accordingly

Key Features of Economic Calendars

Economic calendars boast several key features that empower traders and

investors to achieve trading success. Let’s understand them in-depth to

harness the full potential of economic calendars.

A) Time Zones

-

With economic events unfolding across different regions and time

zones, economic calendars play a pivotal role in ensuring timely

responses. -

A well-designed economic calendar will display events in their

respective local times, helping users grasp the chronological

sequence of events worldwide. -

This feature is particularly valuable for global traders who need to

align their strategies with market-moving announcements.

B) Event Descriptions:

-

Each event listed in the economic calendar comes with a detailed

description outlining its:-

Nature and

-

Potential impact

-

-

Traders must comprehend these descriptions to assess the

significance of an event. -

Whether it’s a central bank meeting, employment report, or GDP

release, understanding the context and implications of each event is

essential for informed decision-making.

C) Country-Specific Information:

-

Economic calendars provide a breakdown of events by country that

lets users filter events by specific regions of interest. -

This feature is especially beneficial for traders who specialize in

particular markets. -

For instance, a forex trader may customize their calendar to

highlight events in the currencies they are actively trading.

D) Cyclical vs. Non-Cyclical Events:

-

Some economic indicators follow predictable cycles, such as regular

interest rate decisions or quarterly earnings reports. -

On the other hand, indicators like the Consumer Price Index (CPI)

might not adhere to a fixed schedule. -

Understanding the cyclical nature of events aids traders in:

-

Anticipating market movements and

-

Adapting trading strategies accordingly.

-

How to Customize and Interpret Economic Calendars?

To gain maximum advantage, traders can customize the economic calendars as

per their specific needs. Read the table below for some effective

customization options:

|

Customization Techniques |

Explanation |

Benefits |

|

Filtering by Country and Impact Level |

Traders can customize economic calendars by filtering |

This targeted approach allows users to focus on the |

|

Setting Personalized Alerts |

Utilize alert features offered by economic calendars to |

This ensures that traders do not miss critical |

|

Historical Data Analysis |

Explore historical data available on economic calendars |

This analysis provides valuable insights into potential |

Major Economic Indicators and Their Impact

Understanding major economic indicators is crucial as they serve as

barometers of economic health and can significantly influence market

movements. Read the table below to understand the breakdown of key economic

indicators and their typical impact on different market sectors:

|

Economic Indicators |

Explanation |

Market Impact |

|

Interest Rate Decisions |

Central banks, such as the U.S. Federal Reserve or the |

|

|

Unemployment Figures |

Unemployment rates reflect the health of the job market |

|

|

Consumer Price Index (CPI) |

CPI measures the average change in prices paid by |

|

|

Gross Domestic Product (GDP) |

GDP represents the total value of goods and services |

|

Analyzing Economic Events for Trading Opportunities

Economic events play a pivotal role in:

-

Shaping market dynamics

-

Understanding market trends, and

-

Spotting profitable market opportunities

Now, let’s learn how to interpret economic events.

Interpreting Economic Events

Analyzing economic events involves more than just understanding the numbers.

It requires insight into how these events can influence

market sentiment

. Let’s learn through an example.

The Event

-

The Federal Reserve’s most

recent hike

in interest rates was in July 2023. -

Fed raised its benchmark rate by 25 basis points, putting the

federal funds’ target rate range between 5.25% and 5.50%

The Interpretation

Traders who anticipated this move took the following steps:

-

Pre-Event Analysis:

-

Before the announcement, traders assessed the economic landscape

by considering factors like:-

Inflation

-

Employment data, and

-

GDP growth.

-

-

A comprehensive understanding of these factors provided them

clues about the likelihood of a rate hike.

-

-

Volatility Expectations:

-

Knowing that interest rate decisions often lead to market

volatility, traders accommodated for potential price swings by:-

Adjusting their positions or

-

Employing risk management strategies

-

-

-

Post-Event Analysis:

-

Following the announcement, traders performed a quick analysis

of market reactions. -

The traders found that:

-

The stock market experienced initial volatility, with

certain sectors being more sensitive to interest rate

changes. -

Forex markets witnessed significant currency movements, such

as a strengthening of the USD.

-

-

The Benefits

Traders who were prepared for these scenarios:

-

Capitalized on the volatility or

-

Protected their positions.

Economic News and Market Trends

Understanding how

economic news correlates with market trends is a key element of

successful trading. Historical data often highlights patterns where certain

economic indicators consistently impact specific markets. Traders can use

economic calendars to anticipate the following:

|

Identify Trends |

Anticipate Market Movements |

|

By analyzing historical data traders can identify trends

|

By utilizing economic calendars, traders can anticipate

|

|

For instance, strong employment figures may historically |

For instance, if a trader observes a pattern where |

Note: Anticipating market movements based on economic news doesn’t guarantee

success. Therefore, incorporating

effective risk management strategies

is essential. This includes:

-

Setting stop-loss orders and

-

Diversifying portfolios to mitigate potential losses.

Additionally, traders can use advanced market analysis tools like Bookmap

that provide a visually rich environment for traders to analyze market data

and make informed decisions. It offers features such as heatmap

visualization, which allows traders to see market dynamics and depth in a

way that was not possible before.

Practical Application in Trading

Developing a trading strategy around economic calendar analysis involves a

systematic approach that integrates careful planning, risk management, and a

keen understanding of market reactions to specific events. Let’s delve

deeper.

How to Develop a Trading Strategy?

Read the table below for a step-by-step guide:

|

Steps |

Explanation |

|

Identify High-Impact Events |

|

|

Set Up Alerts |

|

|

Analyze Historical Market Reactions |

|

|

Evaluate Market Expectations |

|

|

Plan Trades Based on Expected Outcomes |

Develop a trading plan that aligns with your

|

|

Implement Risk Management |

|

How to Achieve a Balance Between Risk and Potential Reward?

Trading based on economic news involves a delicate balance between risk and

potential reward. You can create a perfect one by considering the following:

-

Evaluate the potential impact of the economic event on the market.

-

Assess the historical volatility associated with similar events to

gauge potential risks. -

Determine the appropriate size of your positions based on the level

of risk you are comfortable with. -

Avoid over-leveraging, as unexpected market movements can lead to

significant losses. -

Spread your investments across different assets or markets to

diversify risk. -

Be prepared to adapt your strategy based on real-time market

developments.

Integrating Economic Calendars into Your Trading Strategy

Economic calendars help traders capitalize on market movements influenced by

economic events. You can integrate these calendars into your trading

strategy by creating a personalized plan and implementing effective risk

management strategies.

Creating a Personalized Trading Plan

Developing a personalized trading plan is essential for aligning your strategy with your trading style and risk

profile. Consider the following strategies based on different risk

preferences:

|

For Risk-Averse Traders |

For High-Risk Traders |

|

Focus on Low-Volatility Events Target events with historically lower volatility to |

Seek High-Impact Events Look for events with the potential for substantial |

|

Conservative Position Sizing Use smaller position sizes to reduce exposure and |

Aggressive Trading Tactics Employ more aggressive trading tactics, including higher |

|

Long-Term Perspective

|

Stay Informed and Adaptive

|

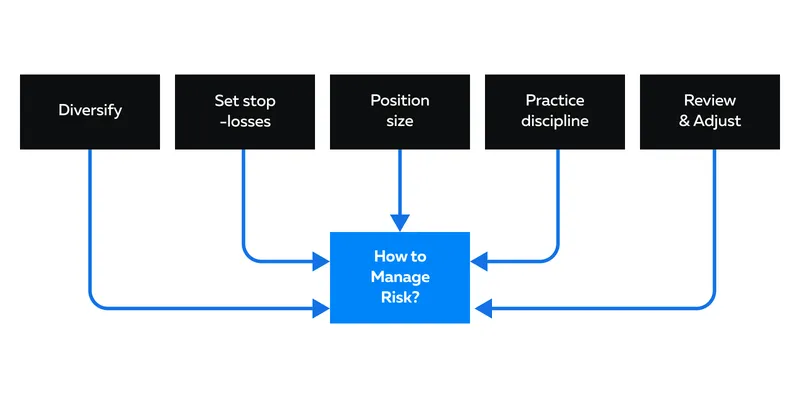

Risk Management Strategies

Effective risk management is paramount in mitigating potential losses and

preserving capital. Consider implementing the following risk management

strategies:

-

Diversification:

-

Spread your investments across different assets or markets to

reduce the concentration risk. -

Diversification helps cushion the impact of adverse events on

your overall portfolio.

-

-

Setting Appropriate Stop-Losses:

-

Establish clear stop-loss levels based on:

-

Your risk tolerance and

-

The volatility associated with the event.

-

-

This ensures that losses are controlled, and emotions don’t

override rational decision-making.

-

-

Position Sizing:

-

Determine the size of your positions based on:

-

Your risk tolerance and

-

The potential impact of the economic event

-

-

Avoid over-leveraging to prevent significant financial setbacks.

-

-

Psychological Discipline:

-

Acknowledge the psychological aspects of trading, especially

during high-impact events. -

Ensure you are adhering to your trading plan and not succumbing

to impulsive decisions driven by fear or greed.

-

-

Regularly Review and Adjust:

-

Periodically review and adjust your risk management strategies.

-

Try to stay adaptive. This ensures that your risk management

aligns with the evolving landscape.

-

How to Maintain Trading Discipline

Trading on economic news can evoke emotional responses, especially during

periods of heightened volatility. To maintain discipline:

-

Adhere to your trading plan, even if market movements trigger

emotional reactions -

Wait for optimal setups and don’t succumb to FOMO (Fear of Missing

Out) -

Stay informed and continuously educate yourself on market dynamics

Conclusion

For many traders, integrating economic calendars into their strategy is a

game-changer. They gain insights from analyzing and interpreting these

events which provide them a competitive edge.

Economic calendars offer a roadmap of scheduled events and potential market

movements. By creating a personalized trading plan that aligns with your

risk tolerance and trading style, you can significantly improve your chances

of trading success.

To achieve sustainable profits, traders must manage risks by diversifying,

position sizing, and setting clear stop-loss levels.

Are you ready to dive deeper into how economic events can impact your

trading strategies? Explore our comprehensive guide, ‘Economic Events and

Order Flow: A Trader’s Guide to Navigating Market Fluctuations’ for more

advanced insights and strategies.

Read it Here.