20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Education

April 21, 2024

SHARE

What is a Short Squeeze in Trading?

Life and business is all about survival. So it’s only natural for stories of financial hardships to make the rounds in the financial world. Such situations are often described as a “squeeze”, a very expressive verb that describes where companies find it tough to keep ticking over and finance their existing operations. In other words, it represents a period of make-or-break financial distress.

Fig 1: A hypothetical short squeeze (image source)

In securities trading, the term “short-squeeze” is interpreted in a slightly different context. It refers to a scenario in which:

- There is an increase in the price of an asset, and

- Short sellers are covering their positions, either out of fear of a further surge in prices, or due getting margin calls

A short squeeze is an important concept to understand for all traders. Let’s explore it further.

What is Short Selling in Trading?

Fig 2: All about short selling (image source)

To understand short squeezes, it is first necessary to understand the concept of short welling.

What Is Short Selling?

Most investors prefer to buy and hold the assets they buy in the markets.

However, traders usually prefer to speculate across shorter durations, and short selling is a nice addition to a day trader’s or swing trader’s arsenal.

Since it is not possible to sell what you don’t own, so short selling requires borrowing the asset to sell immediately, before eventually buying back (and returning to the borrower). Luckily, the lending and borrowing process is completely automated and requires no action from the reader, other than opening and closing their position.

This is short selling, usually based on the assumption that prices will go down.

How Does Short Selling Work?

Usually, short selling starts with the assumption that the price of the security are set to fall. However, this is not always so, as in the case of hedgers. Sometimes, just the risk that prices could fall is enough for a short seller.

To execute a short selling operation, a trader will:

- Sell the particular security the current prices in the event of a market order, or at lower prices with a stop order / higher prices with a limit order. Sometimes various order types are used as confirmation or risk management strategies, which you can read more about here.

- If prices decrease, the short seller will be sitting on a paper profit.

- If prices reach their target price or some other parameter for exiting, the short seller will cover their position by buying back the security sold.

To recap, short sellers make a profit when the price at which they buy back is lower than the price at which they sold.

Why Short Sell?

Instead of investing and holding a stock for long periods based on the company’s fundamentals, short selling is usually done the intent to either speculate and hedge.

Speculators usually short sell in an attempt to profit from a potential downward movement in the stock, whereas hedgers do so to mitigate price risk.

Short Sell Example

- The stock price of ABC Manufacturing Corporation Inc. is trading in the market at a middle price of $10 per share.

- Whether based on some form of fundamental, technical, or order flow analysis, some traders see the risk that prices of the stock could go south.

- In a bid to cash in the expected price movement, such a trader decides to short sell 250 shares @ $10 per share.

- Over the course of the trading day, the price does indeed fall, and the short seller covers their position at $6 per share by buying back 250 shares from the open market.

In this hypothetical scenario, the short seller bags a net profit of $1,000 (250 shares x $10-$6).

What is a Squeeze in Trading?

So far in this article, we’ve been exploring scenarios where short selling results in a profit. However, predicting price movements is a game of probabilities, and sometimes short sellers can find themselves facing constantly rising prices. When this happens to a large collective of market participants (or a few participants with larger positions), this can lead to a short squeeze.

A short squeeze occurs when:

- Prices begin to increase, often rapidly.

- The short sellers, in a rush to cover their positions before prices rise further, begin buying back their positions

- This surge in demand, alongside the already large buying activity, leads to a mass of aggressive buying with an imbalance that the sell-side liquidity can’t match, ultimately resulting in a sharp and rapid price increase.

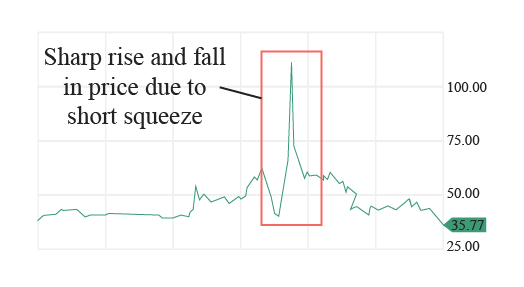

Sometimes, after the short squeeze event takes places, market prices normalise, and can be followed by a sharp fall in price, usually back to the price range from where the move started.

Fig 3: The kind of brief rise and fall short squeezes sometimes look like (image source).

Types of Squeezes

As previously mentioned, squeezes are usually referenced in terms of general economic conditions, such a profit squeeze, wherein a business’ profit margins are decreased.

But in financial markets, they refer to asset price changes. The two most common short squeezes are:

- Short Squeeze: The price of the stock increases along with the trading volume. This prompts the short sellers to cover their position, either in an attempt to minimize their losses or because they are becoming forced buyers due to trigger buy stops or receiving margin calls.

- Bear Squeeze: Whereas a typical short squeeze is based on shorter-term trader positioning and may lead to an event that only lasts a few hours or even minutes, a bear squeeze refers to a scenario where prices begin consistently trending up, impacting the longer-term bearish sentiment.

- Long Squeeze: This article has been about short squeezes because they tend to be the most dramatic in terms of price fluctuations, but the same can happen to longs too. If the market is biased long and the market price begins to drop, this can lead to a long squeeze—the opposite of a short squeeze.

Short Squeeze Example

- The share prices of XYZ Trading Corporation are trading in the spot market at $25 apiece. There is a widespread notion within the trading community that the company’s prices are about to crash.

- This prompts several short sellers to short the stock at the current market price of $25. Suddenly, the central bank makes a surprise announcement that could positively impact the company’s revenue and profit margins.

- There is a surge in the volume and the market price soars.

- The short sellers are forced to buy back their shares at higher prices.

- This in turn creates even stronger demand for the stock in question, and the stock price sees a rapid and sharp upward spike.

Conclusion

What separates a successful and unsuccessful trader in the financial markets? Amongst many things, the ability of the trader to anticipate potential price movements is undoubtedly of them.

A short squeeze is a unique situation where the short sellers, anticipating a fall in prices, have the market blow up in their faces and our forced to buy back their positions at higher prices.

Even if you are not a short seller, it is worth understanding. Perhaps you can even profit from it.

Bookmap comes with multiple tools that can show a short squeeze is either about to happen, or is currently happens, with indicators such as the Cumulative Volume Delta (where you can keep an eye out for divergences), or the Stops & Icebergs On-Chart (where you can see stop runs happening in real time). Try it out for free today.