FAQ

General

Bookmap is a unique platform that provides clear visualization of the past and present state of the market depth. As such Bookmap allows traders to easily follow the evolution of market liquidity and discern the real intention of market participants. Bookmap provides far broader view of available market data than any traditional chart or dom (aka matrix) thus allowing traders to gain unparalleled market transparency and better opportunities to assess potential price action.

Use the Bookmap Wiki and Bookmap User Guide for detailed information on the platform functionality

Yes, you can use Bookmap as a standalone platform connected to dxFeed US equity data feed and place your orders directly on Bookmap. The orders will be executed through your Tradestation account. All you need is your Tradestation account credentials to connect Bookmap to your Tradestation account. Note that for trading you would need Bookmap Global+ version.

You can get education material on:

-

- Bookmap portal (requires Bookmap subscription)

- Bookmap Wiki

- Bookmap User Guide

- Bookmap Forum

- Bookmap youtube channel

Bookmap has regular webinars every day. Once logged in to the Bookmap portal you can subscribe to the webinar by clicking the Register to Webinars button on the left pane of the portal page

-

-

- click here to download Bookmap 7.1.

- Follow the instruction in this video to connect Bookmap to your Tradestation account

-

The fastest, most convenient way to open an equities/options or futures account with TradeStation is by using the online application process. You may use this process to open individual, tenants in common, joint tenants with right of survivorship, and traditional/Roth/SEP IRA accounts. You can open multiple accounts across multiple asset classes during your session.

Data & Connectivity

It is a real-time, full depth, order-by-order raw data for all US Equities. The exchanges coverage are Nasdaq Totalview and Nasdaq Last Sale (both order book and trades) and EDGX. National Best Bid and Offer (NBBO) feed can be added to the bundle feed as well.

-

-

-

As opposed to Futures that are traded on a single exchange, Equities are traded on several exchanges in parallel. Using Bookmap with dxFeed US equities bundle will give you access to the full order depth and trades for the all US equities based on data coming from 2 of the most liquid US exchanges.

-

Level 1 data includes the Best Bid and Offer (BBO) prices and the last traded prices with the respective volumes. Level 2 data in some cases refers to Level 1 from different exchanges, where the BBO may be different between the exchanges. In other cases, Level 2 may relate to depth of market with limited levels (e.g. up to 10 levels.

-

Full depth data includes all available real time bid and ask prices (on all levels) and also the last traded prices.

-

-

-

-

-

The market data feed contains the highest resolution from the covered exchanges and includes all depth of market data updates and all trades.

-

Unlike some of the Futures exchanges there is no limitation of the transmitted number of depth levels.

-

-

dxFeed US equities data support all US traded equities

National Best Bid and Offer (NBBO) shows the national BBO and traded volume covering all US stocks and all US exchanges (20+). The national BBO offered by CTA/UTP is displayed on Bookmap chart and can be either same or better as the BBO from Nasdaq & EDGX. The volume collected from all exchanges is shown on the 3D volume bubbles, on the volume bars, and in the columns.

The value of NBBO – There are 13 exchanges, more than 30 active ATSs and significant bilateral trading. It’s no surprise one of the most common complaints about U.S. market structure is “too much fragmentation.”

Despite all the different exchange venues, the SIP (Securities Information Processor) combines all quotes and provides an NBBO (National Best Bid and Offer). The NBBO allows everyone to know the best bid and offer regardless of what venue they are posted on, all less than a millisecond (one-thousandth of a second) after the quotes change.

Traders get the total volume across all exchanges and can view the smallest spread (National Best Bid and Offer). This is very important for the following reasons:

-

-

- Know what price you can buy/sell in with market orders. This is more important with symbols that are not heavily traded or that are mainly traded on NYSE

- View all market traded volume, not only the exchange/s you are subscribed to

- See the spread behavior over time

-

Bookmap requires full depth data. To use Bookmap you would need to subscribe to dxFeed US equities data. If you do not yet have a Bookmap subscription click here to subscribe to Bookmap with dxFeed US equities data bundle. If you already have a Bookmap account login here to add dxFeed US equities data bundle.

Trading

Yes, Bookmap supports trading that are routed via your Tradestation account. You will need to use dxFeed US equities data.

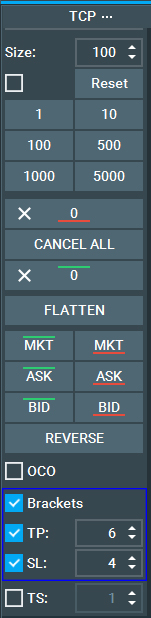

Yes, bracket orders are supported. If you want to send bracket orders just check the Bracket checkbox on the Bookmap trading control panel (TCP) and specify your bracket orders as an offset from the leading order execution price. See image below.

Yes, stop orders are supported. Stop orders can be placed either as part of a bracket order or by placing the order directly on the chart at the price level where you want the order to be placed: press shift and right click for a sell stop or shift and left click for a buy stop. Stop orders can also be placed through the Trading DOM (aka Matrix) column

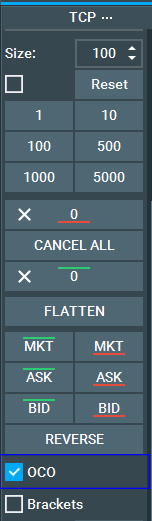

Yes, just check the OCO checkbox on trading control panel (TCP). Once you place your first order you will be asked to position the second leg. Once the second leg is positioned the OCO order will be sent to the market. See image below

OSO orders are only supported in the form of bracket orders.

Help

For Bookmap support, please send an email to support@bookmap.com