Trade Setups

Learn multiple order flow trade setup examples for Futures, Stocks, and Cryptocurrencies on various time frames. Each setup shows how to read the order flow, where consider possible entries, where to consider placing your stop loss order, and areas to consider taking your profit. The context between the price structure, volume, and liquidity high probability insights to where price might go next. use these setups as a template, and continue with your own studies and Bookmap’s Replay Mode to quanitfy your trading edge.

Futures Setups

Pullback Pattern (Futures, Crude Oil, Reversal Pattern, Medium Timeframe)

A clear Low Volume Pullback setup in the #ES_F on the higher time. Look for this setup on ALL timeframes and understand the important role liquidity plays.

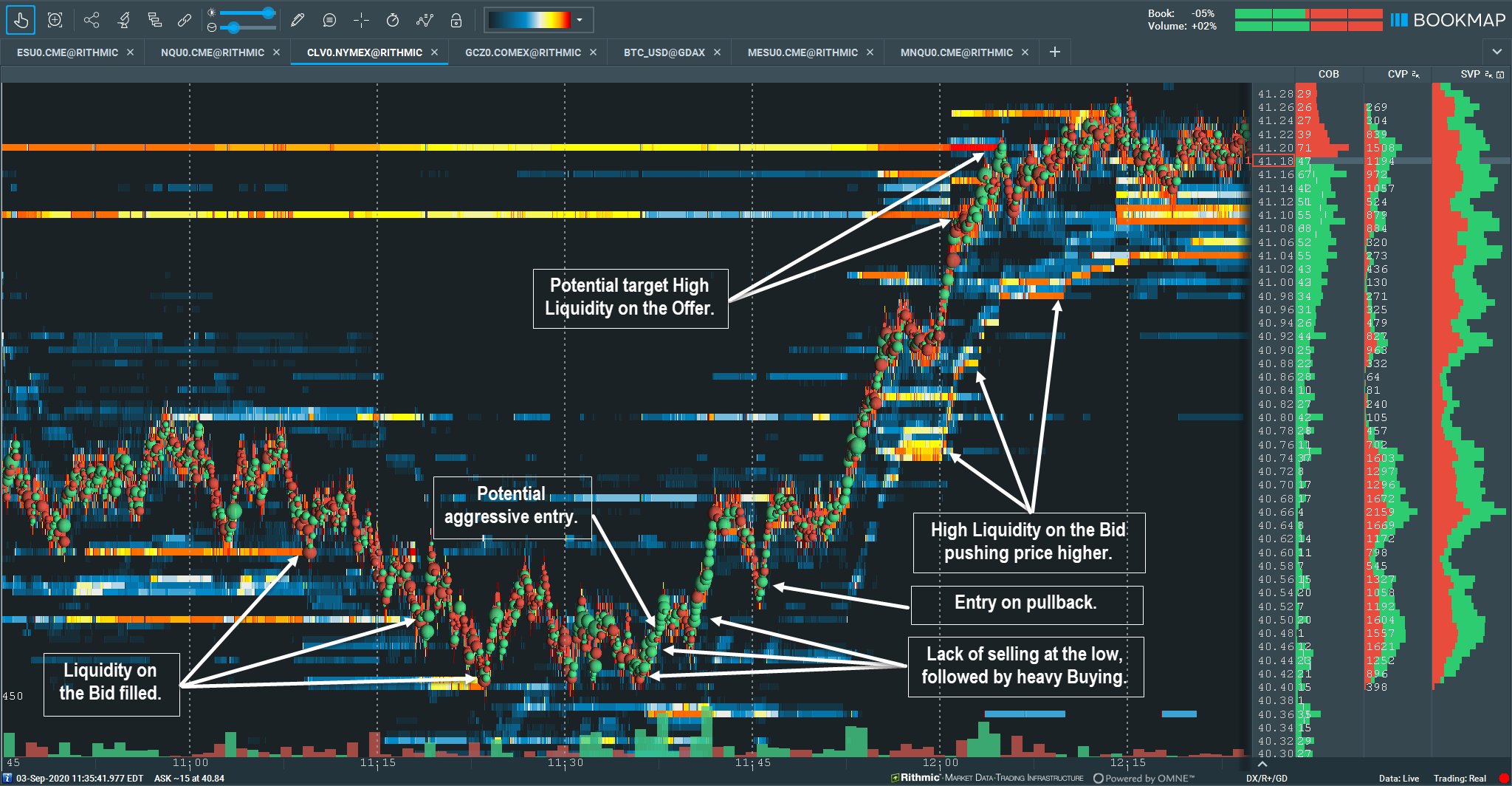

Reversal Pattern (Futures, Crude Oil, Reversal Pattern, Medium Timeframe)

In this crude oil bottoming pattern, note how high liquidity gets filled on the bid as price drops. This slows down the drop of price and begins to absorb the selling pressure. Price consolidates into sideways action, but note the the aggressive market buy orders beginning to enter the market, This is when it’s best to pay close attention and look for areas to buy. Place your stop below the latest swing low and look for swing highs and high liquidity for potential targets to take profits.

Reversal Pattern (Futures, ES, MBO, Reversal Pattern, High Timeframe)

A steep sell-off unfolds in the ES. As price drops through massive large limit buy orders on the bid. Note 100’s of stops and Native Iceberg Orders transact on the drop as well. Price finally stops at the high liquidity at the 3350 figure and bounces. Due to such a dramatic move lower into high liquidity, we are looking for buyers to start entering. Once price cannot make a equal low at 3350, and buyers enter and break the swing at 3380, then look for a long entry either on a breakout or pullback. Place the stop-loss at 3362 or below the 3350 low. Target higher areas of liquidity on the offer at 3425 and 3450.

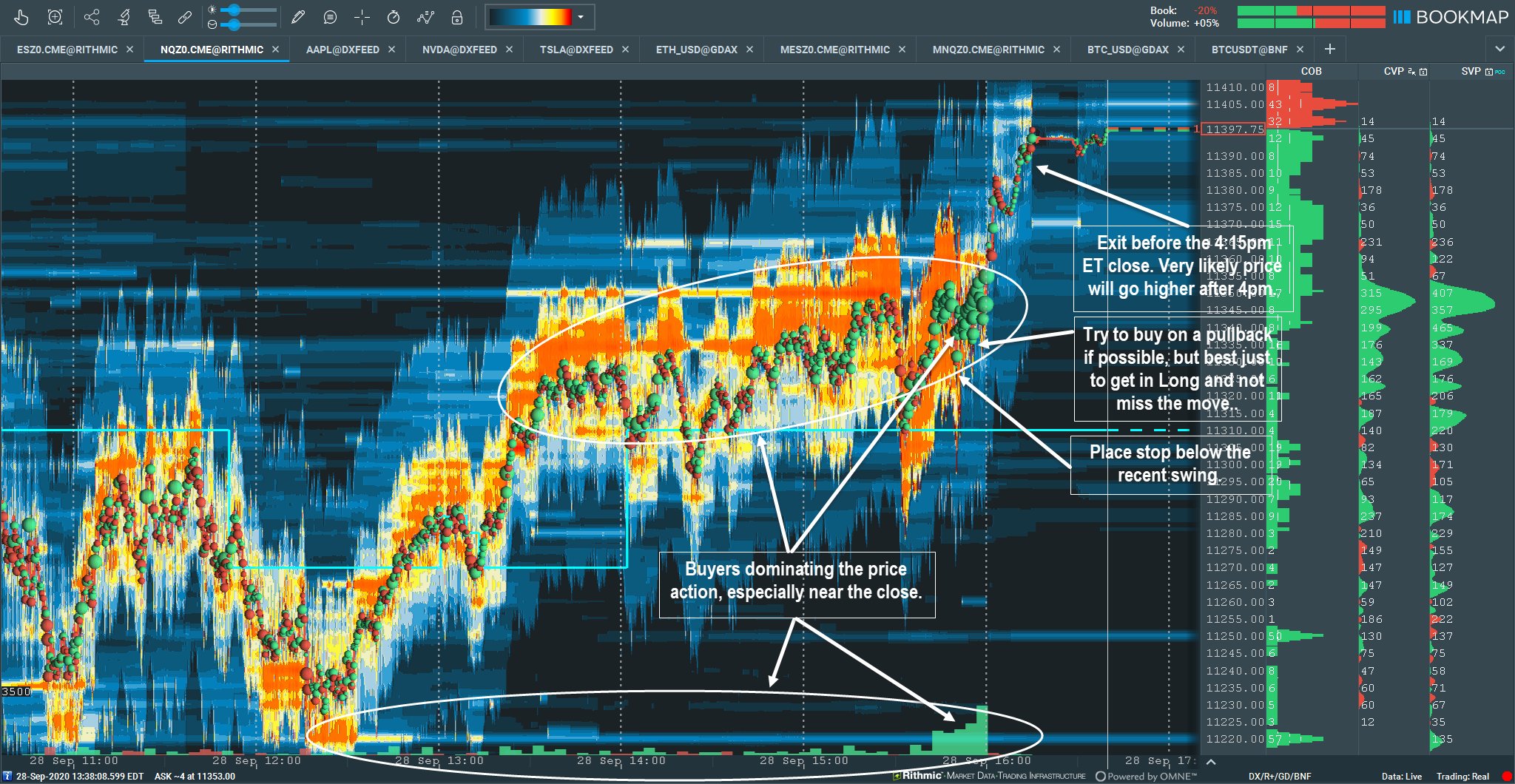

Breakout Pattern (Futures, NQ, MBO, Reversal Pattern, High Timeframe)

Buyers dominate the price action , especially after break above 11300 as price slowly trends upwards. Note around 15:45 near the cash close, the aggressive buying (green dots) is tremendous. Try to find a pullback for entry if possible, however, consider jumping in since it’s best not to miss this opportunity. Place your stop-loss below the recent swing and look to hold this through the cash close but exit before the NQ closes at 16:15 pm ET.

Stocks Setups

Reversal Pattern (Stocks, AAPL, Reversal Pattern, Medium Timeframe)

A steep selloff trades right into larger player’s high liquidity layered at several price levels on the bid. Look for structural swings to be broken as buyers begin to enter. Look for the buyers to pull away from the area quickly and consider entering on the breakout or wait for a pullback to the area it broke from. Confirm the trade strategy as higher highs and higher lows are generated. Look to take profit at High Liquidity on the Offer at 120.

Reversal Pattern (Stocks, NVDA, Reversal Pattern, Medium Timeframe)

This NVDA setup is almost identical to the AAPL example above. It occurred on the same day and gives insight to the variations of different stocks and variations of the same pattern. A steep selloff trades right into larger player’s high liquidity layered at several price levels on the bid. Look for structural swings to be broken as buyers begin to enter. Look for the buyers to pull away from the area quickly and consider entering on the breakout or wait for a pullback to the area it broke from. Confirm the trade strategy as higher highs and higher lows are generated. Look to take profit at High Liquidity on the Offer.

Cryptocurrency Setups

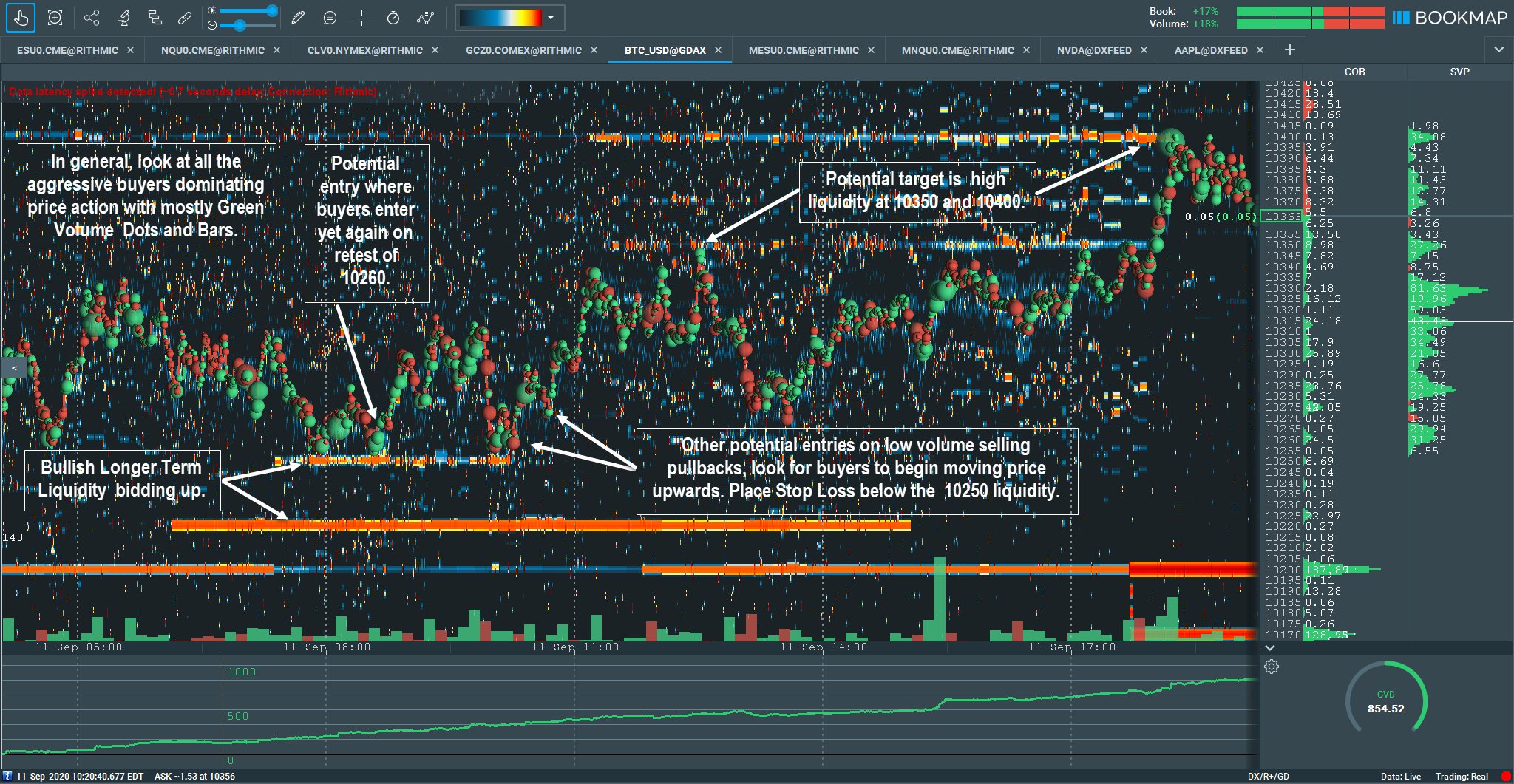

Trending Pattern (Crypto, Bitcoin, Trending Pattern, High Timeframe)

Price is range bound in a sideway market. However, notice aggressive buying dominates the chart. Note the Liquidity bidding up at higher prices and on a swing low, many buyers enter at 10260. Look to enter and consider a partial Take-Profit (TP) at the top of the range. Other potential entries present. In general, due to the aggressive buying we are looking for a up-trending market to unfold. Consider TP at areas of high liquidity at 10350 and 10400.

Reversal Pattern (Crypto, Bitcoin, Reversal Pattern, High Timeframe)

Note the major sell transaction into high liquidity at 10850. Then note how buyers begin entering. There is one more push lower, but buyers continue to enter. CVD divergence adds confluence to the buy side. Once the small swing is broken at 10840, it’s possible to buy the breakout or look for a pullback to 10840. Anticipate the move back to the previous swing at 10900. Buying really kicks in around 17:00 and it looks inevitable higher liquidity on the offer like 11000 is a likely area for taking profits.

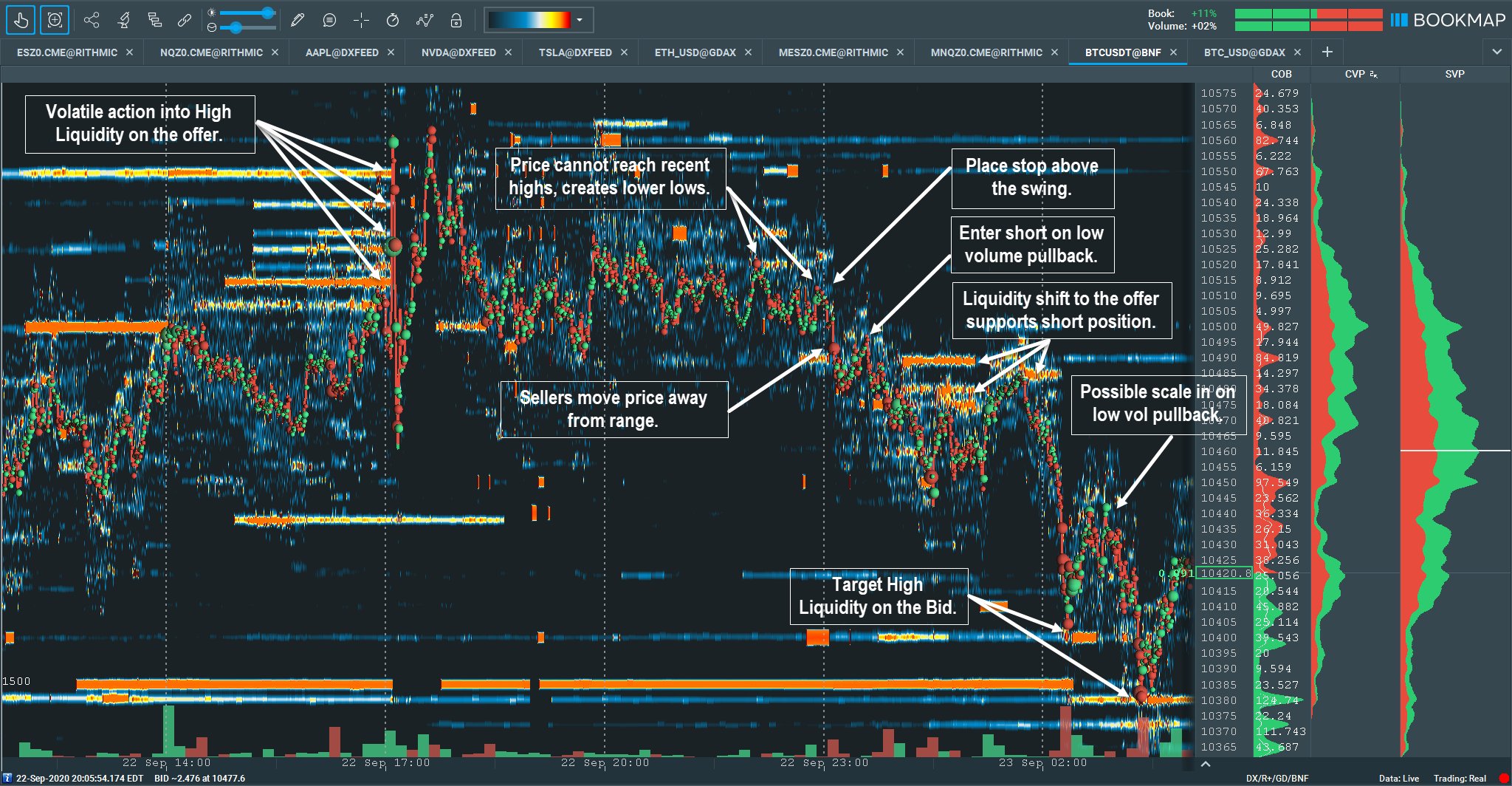

Pullback Pattern & Scaling In (Crypto, Bitcoin, Pullback Pattern, Scaling in, High Timeframe)

Some volatile price action at 17:00 fills larger player’s liquidity layered in at several rice levels on the offer. Price consolidates in a range and never obtains the recent highs. Sellers shift the market away from 10500 after 23:00. Look for teh low volume pullback and enter with a limit sell order. Place the stop-loss above the swing. Once price drops, note the high liquidity on the offer supporting the short direction. It’s possible to scale into the trade at this point. Another scling opportunity presents after the next leg lower as well. Look to take profit at the resting liquidity on the bid at 10400 and 10380.

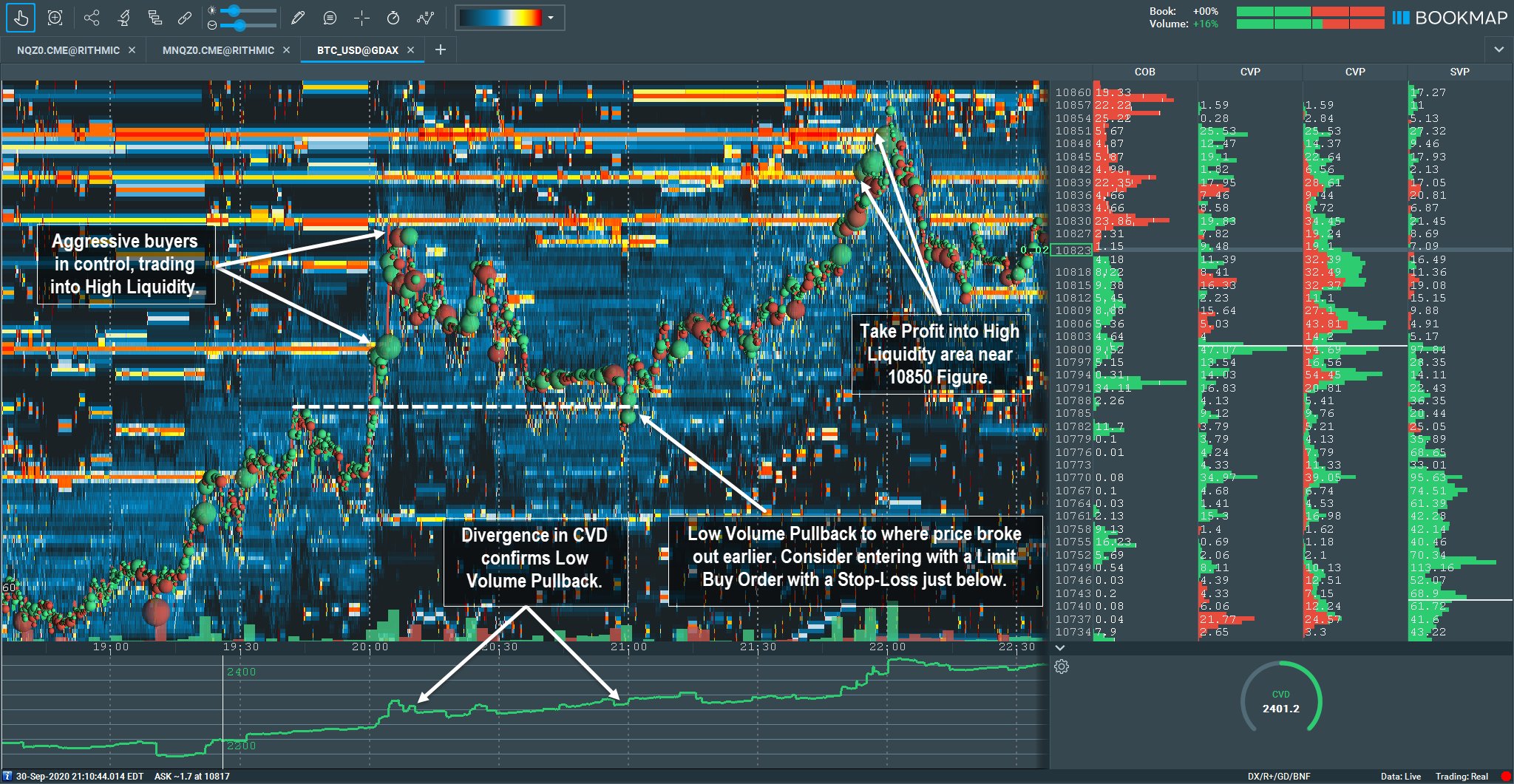

Pullback (Crypto, Bitcoin, Pullback Pattern, Scaling in, High Timeframe)

A simple pullback pattern in Bitcoin. Look for this pattern in trending environments, as it repeats again and again. Price breaks out to the upside, into high liquidity on the offer. Look for a low volume pullback to where it broke from at 10788. Place a limit sell order there for entry. Place your stop-loss below the swing and target high liquidity on the offer somewhere between 10830-10850. Repeat the process. Consider scaling in and out to maximize gains; this is a more advanced trade management strategy but can lead to sizable gains.

Breakout (Crypto, Bitcoin, Breakout, Pattern, High Timeframe)

Significant aggressive buying presents a easy breakout trade. However, other possibilities alos present for entering earlier and holding for a larger trade and breakout to unfold.