Ready to see the market clearly?

Sign up now and make smarter trades today

Education

September 21, 2024

SHARE

Advanced Order Flow Trading: Spotting Hidden Liquidity & Iceberg Orders

Market manipulations have become all too frequent. The pursuit of profit optimization often drives institutional traders towards strategies that could be detrimental to the interests of retail traders and investors alike.

However, diving deeper into trading mechanics can give you an edge in the market. This is particularly true when it comes to advanced order flow trading and spotting hidden liquidity patterns.

In this article, we’ll explore these concepts and show you how to leverage tools like Bookmap to uncover trading opportunities that others might miss.

Understanding Advanced Order Flow Trading

While many market participants profit by employing trading strategies based on charts and patterns, order flow trading offers a distinct approach.

Instead of relying on technical indicators or chart patterns, it zeroes in on actual transactions in the market, analyzing trading volumes and the sequence of orders.

Consider the following scenario:

Imagine you are an experienced trader who has interpreted the technical indicators for shares of Company XYZ and formed a bullish sentiment. However, to make a more informed decision, you resorted to the technique of order flow trading in the following manner:

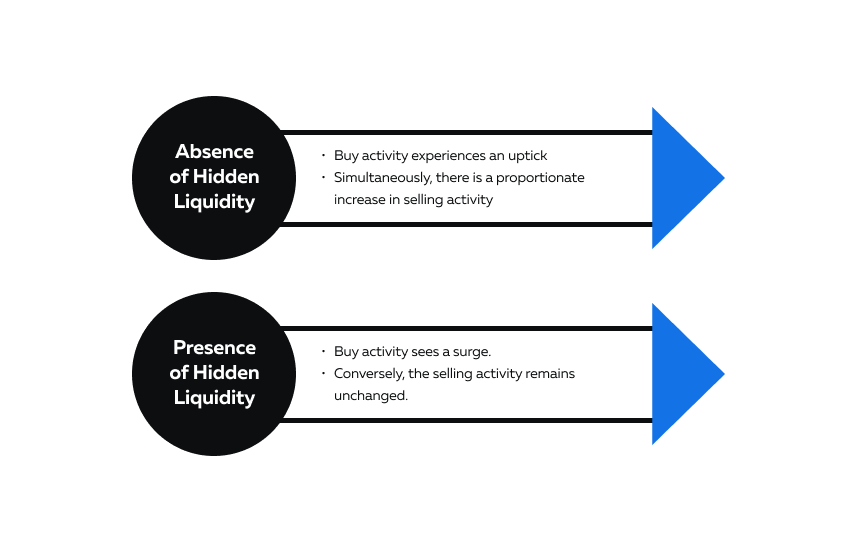

Scenario I: Absence of Hidden Liquidity

Observing Company XYZ’s order book, you note:

-

The Buy Side: Contains all buy orders, indicating demand.

-

The Sell Side: Houses all sell orders, signaling supply.

At a given point during the trading hours, the following becomes evident:

-

An abrupt surge in shares purchased at the current market price

-

Swift execution of sell orders

Interpretation: This kind of order flow suggests that there’s a strong buying interest in the stock and that it is expected to rise. You consider this a positive sign and decide to enter a buy position.

Scenario II: Presence of Hidden Liquidity

While monitoring the order book, you notice that:

-

There is a lot of buying activity at the current market price.

-

However, a noticeable disparity arises: the volume of shares being sold exhibits minimal execution.

This indicates the presence of an advanced element: hidden liquidity. It strongly suggests that a large institutional trader is likely looking to accumulate a substantial position in Company XYZ.

Thus, instead of placing a large buy order that would signal their intentions to the market, they choose to use iceberg orders. These are smaller-sized orders displayed on the order book, designed to absorb the buying activity without revealing the full extent of the trader’s interest. This allows the institutional traders to place larger orders that remain hidden from public view.

The Effect: Buy side of the order book appears active and promising, while the hidden liquidity is slowly being executed. Once these hidden orders are executed, the market experiences a significant price movement in the direction the institutional trader intended.

How Does Order Flow Trading Help?

This strategy helps you understand the behavior of market participants and recognize hidden liquidity patterns.By analyzing hidden liquidity, you can:

-

Understand the intentions of institutional traders and predict potential price movements.

-

Avoid falling into traps set by market manipulation.

-

Make better trading choices by taking advantage of price movements resulting from hidden orders.

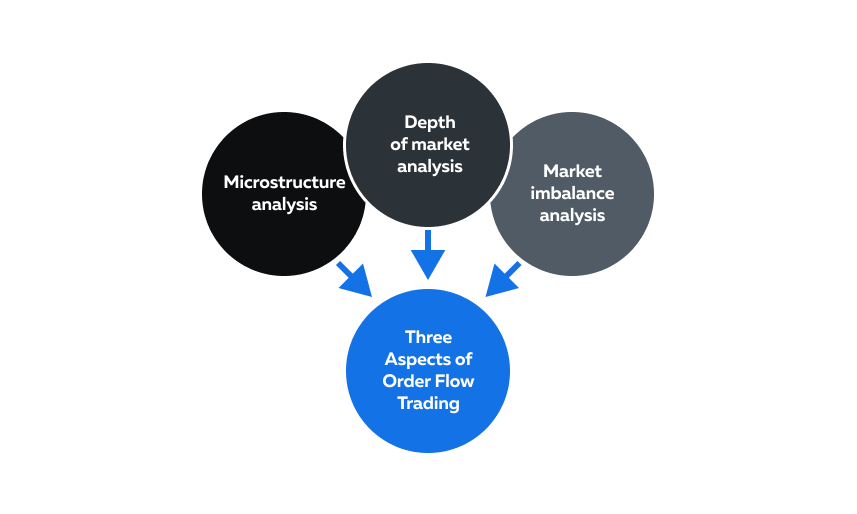

The Three Advanced Aspects of Order Flow Trading:

-

Microstructure Analysis:

-

In this analysis, traders study how orders are placed, canceled, and executed in milliseconds.

-

Making studies at such a rapid pace enables traders to spot patterns and anomalies that might not be visible through regular or conventional analysis.

-

-

Depth of Market Analysis:

-

The traders deep dive into the depth of the order book and observe the quantity of buy and sell orders at different price levels.

-

This information helps traders understand the strength of support and resistance levels. Resulting in the possibility to identify potential turning points.

-

-

Market Imbalance Analysis:

-

The traders compare the quantity and aggressiveness of buy orders versus sell orders, to decipher the market’s overall sentiment.

-

An imbalance is created when one side significantly outweighs the other in terms of volume and urgency.

-

This serves as an indicator of potential price movement in either direction.

-

The Benefits of Spotting Hidden Liquidity Patterns

Most institutional investors hide their true trading intentions by placing iceberg orders. A large order is broken down into smaller portions to avoid showing the full size on the order book. This manipulation usually misleads other traders and prevents them from interpreting the true supply and demand dynamics. Spotting hidden liquidity helps you in:

-

Anticipating Price Movements:

-

If an institutional trader is accumulating a large position, they might place iceberg orders to keep prices stable until they’ve reached their target.

-

Once the hidden liquidity is executed, it can lead to significant price moves.

-

-

Detecting Market Manipulation:

-

Concealed orders usually mislead and present a wrong view of the supply and demand dynamics prevailing in the market.

-

Traders adept at recognizing hidden liquidity can make better trading decisions.

-

-

Placing Front-Running Orders:

-

When advanced traders spot iceberg orders, they usually place front-run orders.

-

Front-running refers to the practice of trading ahead of an anticipated large order with the sole intention of taking advantage of the subsequent price movements.

-

Decoding Iceberg Orders: Hidden Liquidity in Advanced Order Flow Trading

Hidden liquidity encompasses substantial orders intentionally kept hidden from other traders; these orders are not displayed with their full size and details. The primary goal is to manipulate and prevent other traders from gauging the true intentions of a market participant.

On the other hand, iceberg orders are a specific type of hidden liquidity. An iceberg order is a large order that’s divided into smaller orders that are visible on the order book to the general public.

The impact of hidden liquidity, especially iceberg orders, on price movement can be significant:

-

When a substantial hidden buy order is executed, it can lead to increased demand that surpasses the supply, causing the share prices to move upwards.

-

In contrast, if a hidden sell order is executed, it can trigger a surplus of supply relative to demand, potentially leading to downward price pressure.

Distinction Between Dark Pools and Hidden Liquidity

One can argue that dark pools and hidden liquidity are related concepts. In both types of manipulation, big market players (such as institutional investors and hedge funds), execute orders that are hidden from the public.

But, there are several stark differences, explained in the table below:

|

Parameters |

Dark Pools |

Hidden Liquidity |

|

Meaning |

These are private trading venues operated by brokerage firms or exchanges. |

Represents orders that are concealed within the public exchange order book. |

|

Purpose |

To provide institutional traders with a private venue for executing large orders without revealing their trading intentions to the general public. |

To enable traders to execute large orders, which are hidden from the public order book. |

|

Order Execution |

Transactions are executed outside public markets. |

Transactions transpire within the boundaries of public markets. |

|

Market Impact |

This leads to price discovery and market fragmentation. |

This leads to price volatility in the financial markets. |

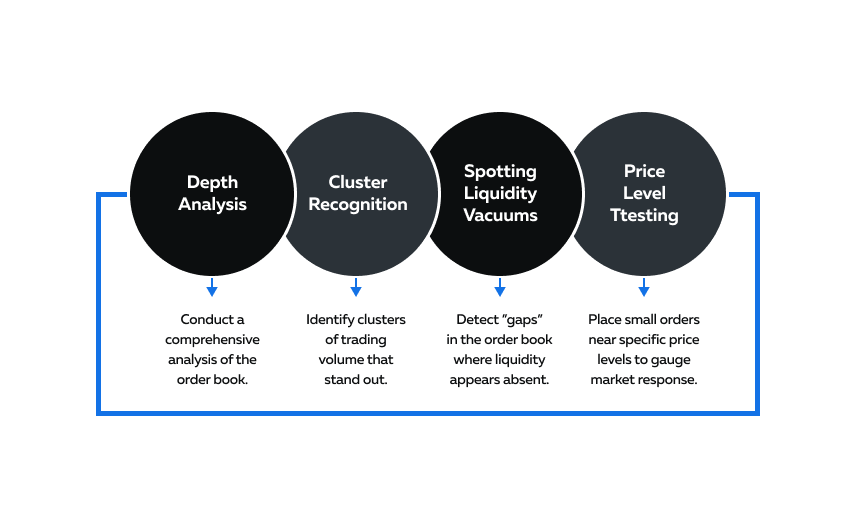

Techniques to Spot Hidden Liquidity Patterns

The strategic placement of large hidden orders not only disrupts fair trading but also leads to market manipulation. Regulatory measures, such as Rule 575, are designed to mitigate disruptive practices and discourage traders from placing iceberg orders.

Nevertheless, this practice persists, thereby creating the need for spotting hidden liquidity. As a trader, you can employ the following strategies:

|

Technique |

Description |

Signal |

|

Depth Analysis |

The depth of the order book is analyzed by observing the quantities of buy and sell orders at different price levels. |

A surge in buying activity without a proportional increase in visible sale orders. |

|

Cluster Recognition |

Volume clusters (areas of high trading activity) are identified and analyzed. |

Occurrence of significant volume at specific price levels without corresponding price movement. |

|

Spotting Liquidity Vacuums |

“Gaps” in the order book are identified as being caused by a lack of orders or the execution of hidden orders. |

The price rapidly moves in one direction without major resistance or support from visible orders in the order book. |

|

Price Level Testing |

Price levels are tested by placing small orders near the levels to be tested. |

The market reacts with unexpected intensity at the tested price level. |

How Can Traders Leverage CME’s “Market By Order” (MBO) Data?

As a trader, you can tap into the Market By Order (MBO) data offered by exchanges like CME to identify hidden liquidity patterns. MBO data provides visibility into individual order sizes and executions. This allows traders to recognize iceberg orders.

How Can Bookmap’s Capabilities and MBO Bundle Help?

Platforms like Bookmap excel at detecting and visualizing hidden liquidity patterns, particularly iceberg orders. Bookmap’s MBO bundle offers traders a detailed view of individual orders and executions, empowering them to see beyond traditional Level 2 data.

By rendering MBO data on intuitive heatmaps, Bookmap simplifies the task for traders, enabling them to swiftly identify iceberg orders and gauge their prospective influence on price movements.

The Role of Large Orders in Advanced Order Flow Trading

In advanced order flow trading, the significance of large orders cannot be undermined. A careful analysis of sizable transactions helps to identify potential hidden liquidity, which is critical for traders to gain a competitive edge in the market.

How To Detect Large Orders?

Large orders are often executed by institutional investors or major market players. They stand out due to their substantial size relative to typical retail orders. The primary effect of large orders is that they create a sudden surge of activity on the order book – involving a significant quantity of shares or contracts.

Traders can recongize these large orders by:

-

Observing sudden spikes in trading volume: These spikes signify the execution of sizable orders and can be observed on volume charts or visualized through tools like Bookmap and candlestick charts.

-

Analyzing changes in the bid-ask spread, whether it widens or narrows: Noticeable fluctuations of the bid-ask spread, particularly in periods of heightened activity, can serve as an indicator of a substantial order impacting the order book.

-

Monitoring changes in the number of bids or ask at a specific level: By checking order books for abrupt shifts in the count of bids or offers at specific price levels, you can discern hints of a sudden influx of buy or sell orders, indicating the execution of a significant order.

-

Detecting rapid price movements: Such movements, particularly those that deviate from recent trends, can be indicative of a substantial order being executed.

When it comes to identifying large orders, we can leverage Bookmap. Through Bookmap, you can:

-

Quickly identify large orders

-

Access real-time order book data

-

Spot large orders as abrupt clusters of volume

-

Analyze past market behavior to anticipate movements of significant orders

Bookmap is a trading visualization platform offering heatmap visualization, which displays order book data in real time. This makes it easier for the traders to spot large orders as sudden clusters of volume.

Additionally, Bookmap’s historical replay feature allows traders to analyze past market behavior and understand the impact of large orders on price movements with greater precision.

Bookmap’s features are tailored to empower traders, ensuring they navigate the complexities of large order detection and interpretation efficiently.

Conclusion

Advanced order flow trading is about understanding and leveraging the subtle cues in the market. Recognizing large orders and the strategies behind hidden liquidity is crucial for traders aiming to predict market shifts. By spotting volume spikes, monitoring bid-ask spread fluctuations, and analyzing the order book depth, traders can get a clearer picture of price movements and iceberg orders.

The role of tools like Bookmap in this process cannot be understated. It provides traders with real-time and historical market data, enabling a comprehensive view of the market dynamics.

Ready to explore the depth of the market with advanced order flow trading? Bookmap equips you with real-time market insights, helping you spot hidden liquidity patterns and seize potential trading opportunities. Start making more informed decisions today. Sign up for Bookmap here.