Order Types: Icebergs and How To Spot Them

There are a few techniques that buyers and sellers use to lessen the impact of large orders. Iceberg orders are one of them. While small traders may never use them, knowing about and spotting icebergs is important.

In this the third of a series about order types, we look at iceberg orders. These are buy or sell orders that have been split into multiple, smaller limit orders to hide the total order quantity. The term comes from the fact that the visible lots are just the “tip of the iceberg”.

Why are they used?

Placing a large order could unsettle other market participants and lead to sharp price fluctuations. Iceberg orders can be used to reduce the impact that introducing large orders can have on the price.

For example, suppose a large investor wants to sell and places an order to sell 100,000 shares of a large company. Assuming the order size is large relative to current market liquidity, immediately, the price would fall because of the mismatch between supply and demand. In addition, it would be very likely that with such a large sell order, rumors would arise about the financial situation of the company and the motives behind the massive sale, which could also adversely affect the price and lead to slippage.

Therefore, this large investor needs a solution that will enable them to execute a significantly large amount (compared to the available liquidity) and to make at least the first transaction without significantly affecting the price.

How do they work?

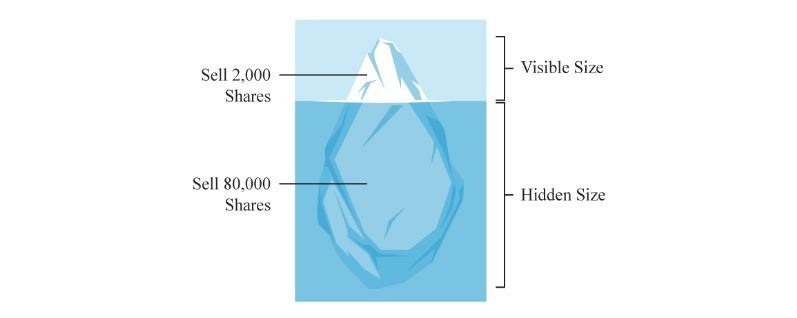

Iceberg orders are a sub-type of limit orders with an extra parameter – maximum displayed size (the tip of the iceberg). This parameter instructs the exchange to display in its market data only this amount. The difference between what is displayed and the actual order amount is called the hidden size.

Only the order for the displayed size can advance in the order queue until it is filled and then the next lot of the order advances, and so on. It is not necessary for an iceberg order to be completely filled in one day: the displayed amounts can be spread over many days.

In this way, those players with large orders can place and execute them with minimal disruption to the price they are seeking. For a more detailed look at the mechanism of these orders see the Bookmap Knowledge Base article “Iceberg Orders Tracker”.

Detecting Icebergs

Firstly, the whole point of using these orders is to hide their true size. Some iceberg orders will even use random displayed size so as not to be detected by other players.

However, they can be discovered and when they are, they can be a good guide to levels of support or resistance.

They can be detected and tracked precisely even when they are happening with Bookmap’s iceberg indicator. This shows you when and at what price icebergs are detected, traded, fully executed or canceled on the main Bookmap chart. To learn more about icebergs and Bookmap solutions, see the Iceberg Orders Tracker page or watch this short video.

Twitter

Twitter

Facebook

Facebook