Ready to see the market clearly?

Sign up now and make smarter trades today

Education

October 3, 2024

SHARE

Order Types: The Basics

Buying or selling, the type of order that you submit should be thought about carefully. This is a brief overview of three basic order types. If you want to get some grounding in them in action, a good way to start is Bookmap’s simulation mode.

The Top 3

At its most basic, an order is just two or more parameters that give instructions on how you want to buy or sell a particular instrument on an exchange. These parameters allow traders to place orders based on the criteria they set for the trade.

So what are these parameters? Let’s begin by looking at the three most basic market orders.

A market order is the most basic type of order. Not counting the name of the instrument, it has just two parameters: buy or sell and size. It is in effect saying, for example, “buy this many at whatever the price is now.”

A limit order is the most frequently used type of order. It adds another parameter: price. You are instructing an exchange that you want to, for example, to sell this quantity but the order must not be executed at a worse price than you specify.

A stop order includes a conditional parameter. With this order you are including in your instructions a specific trigger. For example, you are saying “sell this quantity only if a trade occurs at equal or worse than my specified price.” Once the trigger is activated it becomes a market order.

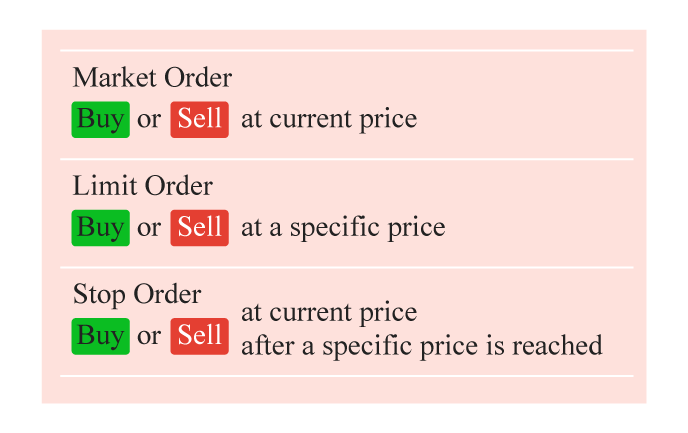

To summarize so far:

- Market order: at the current, best available price

- Limit order: at a specific price or better.

- Stop order: triggered once the price reaches a specified point

Market Orders

A market order is placed to buy or sell stocks at the best price and, generally, they are executed immediately. However, the price of a market order is not guaranteed at the moment of execution.

A market order doesn’t necessarily represent the price at which it is executed. Fast-moving markets often result in market orders being executed at prices that differ from last-traded or “real-time” quotes. (see the Bookmap blog article on slippage.)

Market Order Example: A trader places a market order for 1000 ABC shares at the best offer price of $4.00. This order may execute at different prices if other orders are executed first and as a result the price changes.

Likewise, parts of the order may not be able to be filled immediately and may execute at a different price. In a fast-moving market, the order could be executed at less than $5.00 per share for 500 shares, while in other conditions of market volatility, 500 shares might be executed at more than $5.00 per share.

Limit Orders

Limit orders are orders placed at a specific price or better. Here, “better” depends on whether you are buying or selling. There are therefore two types, buy limit orders and sell limit orders.

It is important to understand that, for limit orders, the price is guaranteed but the actual trade is not. The price may never reach the limit you specify. Or, in other cases, the price may only briefly go through the barrier, other orders may be executed before yours and the price returns to its previous level.

Limit Order Example: A trader places a limit order to purchase shares of XYZ stock for no more than $20. The trade can only be filled if the stock price falls to or falls below $20. If the price does not fall to $20, the order will not be executed.

Stop Orders

Stops can be complex and there are different types of stop orders, including stop-limits and trailing stops. The basic stop order, also known as a stop-loss order, is executed when a stock price reaches a specified price.

Stops are most commonly used as exits, to get out of a position moving against the trader, usually triggering as market orders. However, stops can also be used to enter positions. Buy-stop orders are placed at prices above the current market price. Sell-stop orders are used to limit a loss or protect a profit on a stock. To limit a loss, a sell-stop order would typically be placed below the current market price.

Practice First

There are other, advanced types of orders that are like a series of orders chained together. These are discussed in the article Chains And Triggers: The Beginners Guide to Advanced Orders.

Orders are the first fundamental step of a live transaction and they should be done carefully and precisely. Understanding which order types to use when entering and exiting a market is essential.

If you are just starting out, a great place to learn about orders is in a simulated trading environment. Bookmap provides a simulation mode that allows new traders to train by pausing, rewinding, fast forwarding, and taking positions. It also includes a queue simulator to accurately recreate the execution of your orders.

Click here to get started with the free version of Bookmap.