Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

April 2, 2024

SHARE

Cascades in Crypto – Rising Tides Raise All Ships

Nowadays, cryptocurrencies are attracting investors and traders. However, they are also prone to sudden and extreme price movements. These movements can trigger cascades, which are chain reactions of buying or selling activity that amplify the initial price change.

In other words, crypto cascades have a ripple effect causing other coins to experience selling pressure. Most traders suffer losses during these market conditions. However, there are a few who deploy smart crypto trading strategies and execute profitable trades even during this period of turmoil.

This article explores key aspects of cryptocurrency trading, emphasizing the significance of Bitcoin (BTC) pairings, the impact of BTC spot value events, and strategies for traders during market cascades, such as hedging, diversification, trend following, stop-loss orders, and arbitrage.

We’ll discuss how BTC pairings serve as a reference point for valuing other cryptocurrencies and understand techniques like position sizing, volatility considerations, and liquidity assessment specific to crypto trading. Let’s get started.

BTC Pairings and Their Significance

Bitcoin (BTC) pairings play a crucial role in the cryptocurrency market as a reference point for valuing other digital assets. Let’s understand its significance.

BTC acts as a Valuation Benchmark

BTC is the first and most well-known cryptocurrency, often considered a benchmark for the entire market. Many exchanges list altcoins in trading pairs with BTC. When altcoins are listed in trading pairs with BTC, it means their value is denominated in terms of Bitcoin. This listing makes it a standard reference for assessing the value of other cryptocurrencies.

Also, BTC pairs exhibit higher liquidity and trading volume compared to other altcoin pairs. This liquidity ensures that traders can easily buy or sell altcoins without facing significant price slippage.

Why is Altcoin Valued in Terms of BTC Pairings?

| Relative Performance | Bitcoin as a Reserve Asset |

|

|

The Causal Relationship between BTCUSD Movements and Altcoin Values

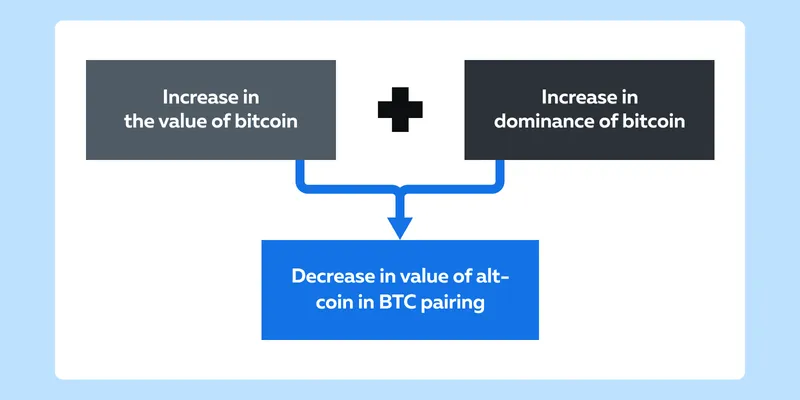

Changes in BTCUSD prices can impact the dominance of Bitcoin in the overall market. When Bitcoin’s value rises, its dominance often increases. This increased dominance potentially decreases the value of Altcoins in BTC pairings.

Also, BTCUSD movements can the influence overall market sentiment. Positive movements in Bitcoin often lead to increased confidence in the market, which benefits Altcoins as well.

What are Cascades in the Crypto Market?

“Rising tides raise all ships.” – This adage holds fittingly true in the crypto market. In the crypto market, cascades refer to a chain reaction of price movements. These reactions are often triggered by a significant event or a series of events, which often lead to a domino effect.

By domino effect, we mean that cascades influence the broader market and cause a ripple effect on various cryptocurrencies. Cascades can be both upward and downward, but they are frequently associated with rapid and substantial price changes. The table below will help you understand this better:

| Positive Cascades | Negative Cascades |

|

|

The Bitcoin’s Influence

Bitcoin’s price movements often trigger market-wide reactions. Usually, a significant rise in BTCUSD creates a positive sentiment, which benefits the entire cryptocurrency market. Also, such positive movements in Bitcoin inspire confidence among investors and lead to increased interest and investments in Altcoins.

Importance and Impact of Cascades

The importance of cascades lies in understanding sentiment shifts within the cryptocurrency market. Their impact extends to liquidity, trading volumes, systemic risk, and the potential for both risks and opportunities for market participants. Let’s understand this in-depth.

Importance

- Interconnected Market Dynamics:

-

-

- The cascades highlight the interdependence of cryptocurrencies.

- The value and behavior of one cryptocurrency significantly influence others.

- This relationship emphasizes the interconnected nature of the market.

-

- Amplification of Market Movements:

-

-

- The cascades amplify market movements and lead to accelerated price changes.

- This phenomenon underscores the potential for:

- Rapid shifts in sentiment and

- Changes in market activities.

-

- Market-Wide Sentiment Shifts:

-

- The cascades are often associated with shifts in market sentiment.

- Recognizing and understanding these sentiment shifts is crucial for traders and investors to adapt to:

- Changing market conditions and

- Making informed decisions.

Impact

- Impact on Liquidity and Trading Volumes:

-

-

- The cascades significantly affect liquidity and trading volumes.

- During intense market activity:

- Liquidity decreases, and

- Trading volumes experience sudden surges.

- This scenario negatively influences the ease of buying and selling assets.

-

- Risk and Opportunity:

-

-

- The cascades introduce both risks and opportunities for traders.

- Managing risk during cascades is important as astute investors usually identify opportunities amid heightened market volatility.

-

- Systemic Risk:

-

- The cascades contribute to systemic risk in the cryptocurrency market, where adverse movements can affect the entire system.

- This underscores the need for robust risk management practices to mitigate systemic impacts.

The Impact of BTC Spot Value Events

The Bitcoin (BTC) spot value is highly sensitive to various real-world events. Its fluctuations have a profound impact on the entire cryptocurrency market. Let’s understand this through industry events that have caused significant fluctuations in BTC spot value:

| Event | Explanation |

| BTC ETF Approval Concerns |

|

| Regulatory Developments |

|

| Market Manipulation Allegations |

|

| Security Breaches and Hacks |

|

How BTC Triggers a Chain Reaction

Sudden drops in BTC spot value trigger a chain reaction in the broader cryptocurrency market. Let’s understand various interconnected factors causing this event:

- Market Sentiment:

-

-

- Negative events impacting BTC often create a bearish sentiment that spreads across the entire market.

- Traders and investors, fearing further losses, sell their altcoin holdings.

- This sell-off leads to a cascading effect.

-

- Leverage and Margin Calls:

-

-

- Many traders use leverage in cryptocurrency markets.

- A significant drop in BTC value can trigger margin calls, which force traders to sell their assets to cover losses.

- Forced liquidations exacerbate the downward pressure on BTC and spill over to altcoins.

-

- Fear and Uncertainty:

-

- Sudden drops in BTC value instill fear and uncertainty in the market

- In such a situation, traders prefer to:

- Hold stable assets like Bitcoin or

- Move to fiat currencies.

- This shift causes a decline in the value of altcoins.

Liquidity Pool Balancing Through AMMs

Automated Market Makers (AMMs) play a crucial role in decentralized finance (DeFi). They provide liquidity to trading pairs through smart contracts. Liquidity pools are essential for efficient trading and AMMs automate the process of liquidity provision.

Let’s break down their role into comprehensible steps:

| Steps | Explanation |

| Creation of a Digital Pool |

|

| Introduction of Liquidity Providers |

|

| Smart Contracts Determining Exchange Rates |

|

| AMM Makes Adjustments |

|

| Maintaining Liquidity |

|

How Limit Orders are Executed During Extreme BTC Volatility

During times of extreme Bitcoin (BTC) volatility, the execution of limit orders on popular pairings like ETH:BTC can be impacted. Here’s a sequential explanation of how it works:

- Traders place limit orders specifying the desired price at which they want to buy or sell assets.

- During extreme BTC volatility, rapid price movements cause a gap between:

- The specified limit price and

- The actual market price.

- Limit orders struggle to execute at the desired price due to fast market changes.

- Traders experience slippage, where the executed price differs significantly from the set limit.

Note: Since BTC is a major cryptocurrency, extreme volatility affects the entire market, including pairings like ETH:BTC. During such times, traders face challenges in executing limit orders for ETH: BTC due to BTC’s rapid price movements.

How do AMMs Maintain Liquidity?

When trades are executed during periods of extreme BTC volatility, the AMMs experience “impermanent loss”. This happens when the value of assets in the liquidity pool diverges from the initial deposit. However, this loss is mitigated through the concept of fee redistribution.

The AMMs charge trading fees, which are redistributed to liquidity providers. The incentive of earning fees encourages liquidity providers to continuously balance the pool and maintain liquidity, thereby mitigating impermanent loss.

Further, AMMs maintain liquidity by “adjusting the trades” in the following manner:

- AMMs adapt the composition of their liquidity pools based on actual trading activity.

- For example,

- Let’s assume someone makes a big purchase of Bitcoin.

- Now, the AMM ensures the pool remains balanced by adjusting the amounts of Bitcoin and other assets.

- The smart contract overseeing the AMM automates these adjustments to maintain a stable balance in the pool.

- This automation ensures that the value of each asset in the pool stays in proportion to its overall contribution.

Ripple Effects on Crypto Pairs

The value of Bitcoin (BTC) in USD serves as a significant benchmark in the cryptocurrency market. Fluctuations in BTCUSD have cascading effects on various crypto pairs. Let’s understand the ripple effect through the table below:

| Market Sentiment and BTC Dominance | Portfolio Rebalancing |

|

|

|

|

Examples of Ripple Effects on Cryptocurrencies like Ethereum (ETH):

-

- ETH: BTC Pairing:

- A drop in BTCUSD leads to increased demand for BTC that causes a decline in the value of altcoins, including Ethereum, in the ETH: BTC pairing.

- This happens because traders prioritize holding BTC during times of uncertainty, which impacts the relative value of ETH against BTC.

- ETH: BTC Pairing:

- USD-Pegged Stablecoins:

-

- During BTC value drops, traders move their funds to USD-pegged stablecoins.

- This shift happens as traders seek a more stable asset.

- Such a movement of funds results in decreased demand for other cryptocurrencies, causing their values to drop against stablecoins.

Further, it must be noted that the impact of a BTCUSD value drop is not limited to specific pairs; it often extends across the entire altcoin market. A significant BTC value drop erodes market confidence and leads to:

- A reduction in overall trading activity and

- Additional price swings.

What causes this ripple effect?

- The crypto market is highly interconnected. Changes in the value of one major cryptocurrency, like BTC, can trigger a domino effect, impacting numerous other pairs.

- Investor psychology plays a crucial role. As the news of BTCUSD drops spreads, it can prompt mass reactions as traders across the market adjust their positions.

- Traders often adopt a risk-averse approach during periods of BTC volatility. They favor assets perceived as more stable, leading to a widespread impact on various pairs.

Strategies For Traders During Cascades

Traders facing market cascades can employ a combination of smart strategies and risk management techniques to manage the periods of the crypto market. Read the table below to understand some popular strategies:

| Strategies | Explanation |

| Hedging |

|

| Diversification |

|

| Trend Following |

|

| Stop-loss Orders |

|

| Arbitrage |

|

How Traders Can Manage Risk

Effective risk management is crucial to avoid capital losses. Let’s explore some risk management strategies:

- Position Sizing

-

-

- Traders should determine the appropriate size of their positions relative to their overall portfolio.

- This determination ensures that no single trade has an outsized impact on the entire portfolio.

-

- Volatility Considerations

-

-

- Traders must adjust trading strategies based on heightened volatility during cascades.

- Volatility can impact price movements. Thus, traders should be flexible and adapt their strategies to changing market conditions.

-

- Liquidity Assessment

-

- Traders should assess the liquidity of the cryptocurrencies they trade to avoid liquidity traps.

- Low liquidity can result in difficulties executing trades at desired prices, especially during periods of heightened market activity.

How Traders Can Stay Informed

Staying informed about industry events is paramount for cryptocurrency traders. Understanding the implications of regulatory changes, technological advancements, or major partnerships allows for timely adjustments in trading strategies. Here’s how you can stay informed as a trader:

- News Monitoring:

-

-

- Traders can closely monitor news related to Bitcoin and the broader crypto market.

- Significant events can trigger cascades, and staying informed allows traders to anticipate market movements.

-

- Community Insights:

-

-

- Traders must engage with crypto communities and forums to gain insights and updates on market conditions.

- Traders can join the blue jacket community which is a platform for traders to analyze and trade order flow on top crypto exchanges. It offers valuable perspectives into markets, trading setups, and strategies besides providing real-time information.

-

- Real-time Data:

-

-

- Real-time market data, particularly through tools like Bookmap, is indispensable for informed decision-making.

- The availability of immediate information helps traders react promptly to breaking news thereby

- Assessing positions, and

- Evaluate and managing risks.

-

- Bookmap offers a visual representation of the market that helps in the identification of support and resistance levels.

Conclusion

Cascades in the crypto world are chain reactions that quickly affect how cryptocurrencies are bought and sold. These cascades happen when many people start trading at the same time or when there’s big news.

Thus, traders must know what’s happening in the crypto world to make smart choices during these rapid changes. The connection between different cryptocurrencies is vital, especially when looking at how Bitcoin pairs with others. Traders can also prefer the usage of advanced market analysis tools like Bookmap to access real-time information and visual representations thereby gaining a competitive advantage.

Also, in times of volatility, using strategies like spreading out investments, following trends, and setting automatic sell orders can help traders avoid unnecessary risk.

Ready to dive into the world of crypto trading? Explore our comprehensive guide on

crypto trading for beginners to get started on your journey. Learn essential tips and

strategies to navigate the crypto market effectively. Click here to access the article: Crypto