Ready to see the market clearly?

Sign up now and make smarter trades today

Education

April 8, 2024

SHARE

Compound Interest: Long-Term Investing Strategies for Financial Growth

Do you know the winning formula for amassing a fortune? It’s something that even Warren Buffett and Jesse Livermore used to famously build wealth—Compound interest.

This article will explore the power of compound interest and analyze the long-term performance of different trading and investment strategies using compound interest calculations. We will also provide some real-world examples and offer actionable advice guiding you toward informed decision-making and greater confidence.

By the end of this article, you will gain the expert insights necessary to become a better trader. Let’s get started.

The Potential of Compound Interest

Compound interest is a powerful concept in finance. It involves earning interest not only on the initial principal amount invested but also on the interest accumulated over time. In essence, this means you’re “earning interest on interest,” which leads to exponential growth of wealth in the long term.

The significance of compound interest in long-term wealth accumulation lies in its ability to magnify returns over time. By reinvesting earned interest, your total investment grows at an accelerating rate. This surge results in substantial growth over extended periods. This is particularly advantageous for individuals who:

- Start investing early and

- Allow their investments to compound over decades.

Let’s read some real-life examples that illustrate the exponential growth potential of compound interest:

- A) The Story of Ronald Read

- Ronald Read, a janitor and gas station attendant, lived a frugal life in Vermont.

- Over many years, he invested his savings in:

- Blue-chip stocks and

- Dividend-paying companies.

- Despite starting with a modest amount, Read’s investments compounded over time.

- This increase happened due to:

- Dividend reinvestment and

- The power of compounding.

- Upon his passing, it was revealed that Read had amassed a stock portfolio worth millions of dollars.

- This case showcases the remarkable growth potential of compound interest, even for those with humble beginnings.

- B) The Tale of the Two Brothers

- Two brothers, John and Tom, each inherited $10,000 from their grandparents.

- John invested his inheritance immediately in a diversified portfolio of stocks and bonds.

- Tom, on the other hand:

- Waited for the “perfect” time to invest and

- Delayed his decision by five years.

- Despite both starting with the same amount, John’s investments had significantly grown due to the power of compound interest over those five years.

- Tom’s procrastination resulted in missed opportunities for his money to grow exponentially.

How Compound Interest Can Be Applied to Trading

Compound interest is also relevant in trading and investment decisions. It helps traders and investors to maximize returns over time. This can be achieved by:

- Reinvesting dividends or interest payments back into the portfolios and

- Consistently adding to investments and allowing them to compound over long periods.

However, to effectively optimize their returns and build wealth over time, investors must consider factors, such as:

- Compounding frequency,

- Interest rate, and

- Time horizon.

Long-Term Investing Strategies

Most traders prefer long-term investing strategies to fully utilize the power of compound interest, such as:

- Dollar-cost averaging and

- Dividend reinvestment.

Using them investors can achieve their financial goals while mitigating risks associated with market fluctuations. Let’s understand these strategies in depth:

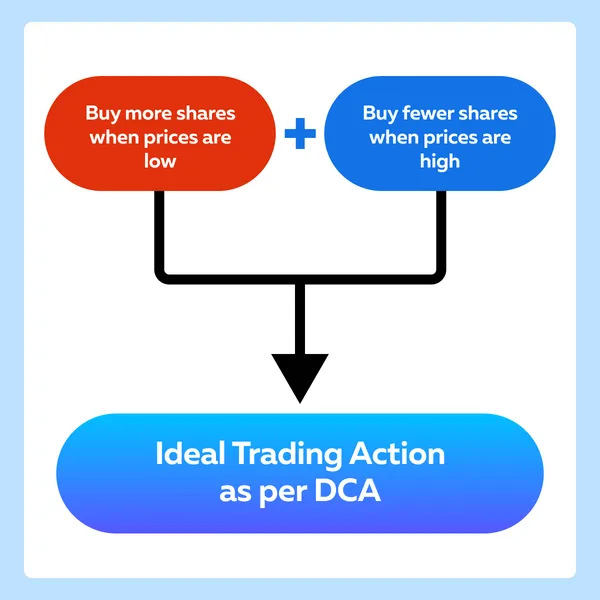

Dollar-Cost Averaging (DCA):

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions.

Following this technique, ultimately, the cost per share gets averaged over time. Let’s understand better through a hypothetical example:

- An investor decides to invest $500 in a particular stock every month.

- In the first month, the stock price is $50 per share, so the investor buys 10 shares.

- In the second month, the price drops to $40 per share, allowing the investor to purchase 12.5 shares.

- In the third month, the price increases to $60 per share, resulting in the purchase of 8.33 shares.

- Over time, the investor accumulates shares at various prices.

- These regular investments allowed the investor to benefit from both market downturns and upturns.

Advantages Of Dollar-Cost Averaging:

- Mitigating the impact of market volatility: By investing regularly regardless of market conditions, investors avoid the risk of making large investments at unfavorable times.

- Disciplined approach to investing: Dollar-cost averaging encourages consistent investing behavior, helping investors to stay committed to their long-term investment goals.

- Potential to lower average cost per share: Buying more shares when prices are low can result in a lower average cost per share over time.

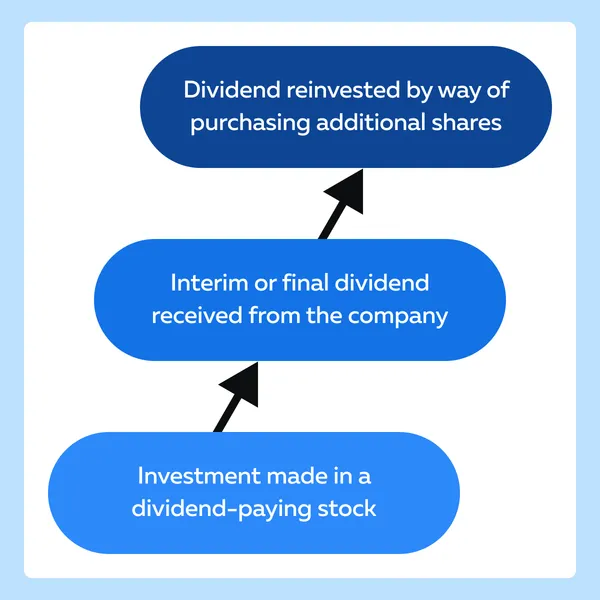

Dividend Reinvestment

Dividend reinvestment involves using dividends received from investments, such as stocks, to purchase additional shares of the same investment or other securities.

By reinvesting dividends, investors can take advantage of compound growth, as the reinvested dividends also earn dividends in the future. Let’s have a look at some popular dividend-paying companies that have a history of consistent dividend payments:

- Johnson & Johnson (JNJ)

-

-

- JNJ is a multinational healthcare company known for its consumer health products, pharmaceuticals, and medical devices.

- It has a track record of consistently increasing dividends for over 50 years.

- Payout Ratio: Historically conservative at around 40%, indicating room for dividend growth or sustainability

- Procter & Gamble (PG)

- PG is a multinational consumer goods corporation that produces a wide range of household and personal care products.

- it has a history of paying dividends for over a century and has consistently increased dividends for over 60 years.

-

- Exxon Mobil Corporation

-

-

- Exxon Mobil is a global oil and gas company with operations worldwide.

- Payout Ratio: Nearly 100% of cash flow goes towards dividends.

-

- Eli Lilly and Co

-

- Eli Lilly is a leading pharmaceutical company specializing in products for humans and animals.

- The company has maintained decent payout ratios over the years, with recent improvements in reaching the recommended 70% payout ratio.

Assessing the Re-investment Impact

The impact of reinvesting dividends can be substantial over several years. For instance, suppose an investor initially purchases 100 shares of a dividend-paying stock at $50 per share, with an annual dividend yield of 4%. Over 20 years, assuming dividends are reinvested:

- The number of shares would become more than double, and

- The total value of the investment would significantly increase due to compound growth.

How Dollar-Cost Averaging (DCA) And Dividend Reinvestment Align Closely with The Concept Of Compounding?

When applied effectively, both these strategies can generate substantial returns over time due to their close alignment with the concept of compounding. Let’s understand better:

| Dollar-Cost Averaging (DCA) | Dividend Reinvestment |

|

|

How Important Are Patience and Discipline in Long-term Investing?

Long-term investing requires patience. This is because significant wealth accumulation typically occurs over extended periods. Despite short-term market fluctuations and uncertainties, patient investors maintain their focus on long-term financial goals. They understand that market volatility is an inherent aspect of investing and are prepared to endure temporary downturns for the possibility of achieving higher returns over time.

Furthermore, discipline is also essential for consistently adhering to the chosen investment strategy. Whether it’s maintaining a regular investment schedule in dollar-cost averaging or reinvesting dividends as and when they arise, disciplined investors stay committed to their long-term investment plans. They resist the temptation to make impulsive decisions based on short-term market movements.

Applying Compound Interest to Trading

Most successful traders have significantly improved their potential for long-term profitability and capital growth by integrating compound interest into their trading approaches. Let’s see some popular integration methods:

Method I: Compounding Gains

- Traders reinvest profits from successful trades.

- This reinvestment increases trading capital and leads to exponential growth over time.

- By continuously compounding gains, traders potentially achieve substantial returns on their investments.

For example,

- A trader starts with a trading account of $10,000.

- With an average monthly return of 5%, the trader reinvests all profits back into the trading account.

- After one year, the trading account would grow to approximately $16,386.

- Over five years, the account would balloon to approximately $27,629.

- This surge showcases the compounding effect on trading returns over time.

Method II: Position Sizing Strategies

Position sizing involves determining the appropriate size of each trade relative to the trader’s overall portfolio. By using compound interest calculations, traders can optimize their position sizes and manage risk effectively while maximizing potential returns.

For example,

-

- A trader has a $50,000 trading account.

- Their risk tolerance limit is 2% per trade.

- They would limit the maximum potential loss to $1,000 per trade.

- By doing so, the trader adjusted the position size based on the:

- Trade’s risk-reward ratio and

- Probability of success.

- This adjustment ensures that each trade contributes positively to the overall growth of the trading account while minimizing the impact of potential losses.

Method III: Portfolio Diversification

Diversifying trading positions across different asset classes or markets can:

- Reduce risk and

- Enhance long-term profitability.

By spreading investments across various instruments, traders can reduce the impact of adverse market movements on their overall portfolio.

For example,

- Usually, a diversified trading portfolio includes a mix of:

- Stocks,

- Commodities,

- Currencies, and

- Bonds.

- By diversifying across different asset classes, traders can capitalize on various market opportunities.

- They can do so while reducing the risk of concentration in any single position.

- The compounding effect of returns from each asset class contributes to the overall growth of the trading portfolio over time.

How to Optimize Trading Returns in the Long-term

Traders can optimize their trading returns over the long term by effectively using the power of compound interest and applying the following strategies:

- Consistent and Disciplined Trading Approach

-

-

- Stick to a well-defined trading strategy with clear entry and exit rules.

- Consistently apply the strategy over time to take advantage of compounding.

-

- Reinvest Profits

-

-

- Reinvest profits from successful trades back into the trading account to increase capital.

- Try compounding gains over time as it can lead to exponential growth in trading capital.

-

- Is Position Sizing Based on Risk-Reward Ratio?

-

-

- Calculate position sizes based on the risk-reward ratio of each trade.

- Adjust position sizes to limit risk exposure while maximizing potential returns.

- For example,

- If you have a $10,000 account with an entry price of $100 and are willing to risk 2% per trade with a stop-loss of 5%, your position size would be 40 shares. $10,000 x 2%100 x 5%=40 shares

-

- Diversify Portfolio

-

- Spread the risk by diversifying trading positions across different:

- Asset classes or

- Markets.

- Allocate capital to a mix of stocks, commodities, currencies, and bonds to take advantage of opportunities in various markets.

- For example,

- A trader follows this allocation table:

- Spread the risk by diversifying trading positions across different:

| Trading Instrument | Capital Allocation (in %) |

| Stocks | 50 |

| Commodities | 25 |

| Currencies | 15 |

| Bonds | 10 |

- Each asset class contributes to the overall growth of the trading account through compounding.

Practical Examples & Case Studies

Traders and investors can achieve long-term financial success and wealth accumulation through effective compounding. Let’s study some practical examples and case studies to strengthen our grip on the concept:

1. Compound Interest in Forex Trading

A forex trader starts with a $10,000 trading account and aims for a conservative monthly return of 3%. Over 5 years, with consistent compounding, the trading account would grow to approximately $18,367. This demonstrates the power of compounding in forex trading, where even modest returns can lead to significant growth over time.

2. Long-Term Investing in Stocks:

An investor regularly invests $500 per month in a diversified portfolio of stocks with an average annual return of 8%. After 30 years, the investor’s portfolio would grow to over $1.1 million, showcasing the impact of compounding on long-term stock investments.

3. Real Estate Investment

An individual invests $50,000 as a down payment on a rental property and earns a net rental yield of 5% per year. Assuming property values appreciate at an average rate of 3% annually, the investor’s equity in the property would compound over time, resulting in significant wealth accumulation through real estate investment.

Comparative Analysis

To understand the long-term performance of different trading and investment strategies, let’s consider a practical example comparing two investment strategies over 10 years:

| Strategy 1: Passive Buy-and-Hold | Strategy 2: Active Trading |

|

|

| Using the compound interest formula:

A=10,000 x 1+0.0711×10=$19,671.53 |

Using the compound interest formula:

A=10,000 x 1+0.1011×10=$25,937.42 |

| So, after 10 years, the passive buy-and-hold strategy would grow the initial $10,000 investment to approximately $19,671.53. | After 10 years, the active trading strategy would grow the initial $10,000 investment to approximately $25,937.42. |

It can be observed from the analysis above that the active trading strategy results in a higher final value. Additionally, traders can also perform sensitivity analysis by varying the annual rate of return or the time horizon to understand how changes in these variables impact the outcome.

Some Popular Success Stories and Testimonials

| Warren Buffett | Jesse Livermore |

|

|

Conclusion

Compound interest can let your money grow over time, even from small investments. It allows investors to earn interest on both your initial investment and the interest you’ve already earned. By staying consistent with your investment plan and diversifying your portfolio, you can maximize the benefits of compound interest.

Successful investors like Warren Buffett and traders like Jesse Livermore have achieved remarkable results by applying the principles of compound interest. Thus, as a trader, you must understand and effectively apply this concept to achieve your financial goals and build a secure future.

For more insights into interest rates and their impact on your investments, check out our guide to interest rates here.