Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

March 28, 2025

SHARE

Correlated Markets for Interest Rates and Tech: Understanding the Role of Copper in 2025

They say Copper has a PhD in economics. If that’s true, then traders should start taking notes! Do you know why we are saying this?

That’s because tracking the movement of copper prices allows you to determine shifts in industrial demand, tech growth, and even interest rate trends. Through these relationships, you get an edge in predicting broader market movements. Want to learn how? Let’s explore key market correlations in this article, starting with the copper and tech correlation. It explains why rising copper demand often signals strength in the technology sector.

You’ll also learn how interest rates and tech stocks interact and how rate hikes can impact growth stocks and industrial investments. Additionally, we will discuss the risks of trading correlated markets for trading and cover false signals, volatility, and overreliance on historical patterns. To deal with these challenges, we will also learn how our market analysis tool, Bookmap, can help you spot institutional trades and liquidity zones in real time. Let’s begin.

Copper as an Economic Barometer

Why Copper Matters

Copper is a strategic metal. It plays a crucial role in industries like:

- Manufacturing,

- Technology, and

- Infrastructure.

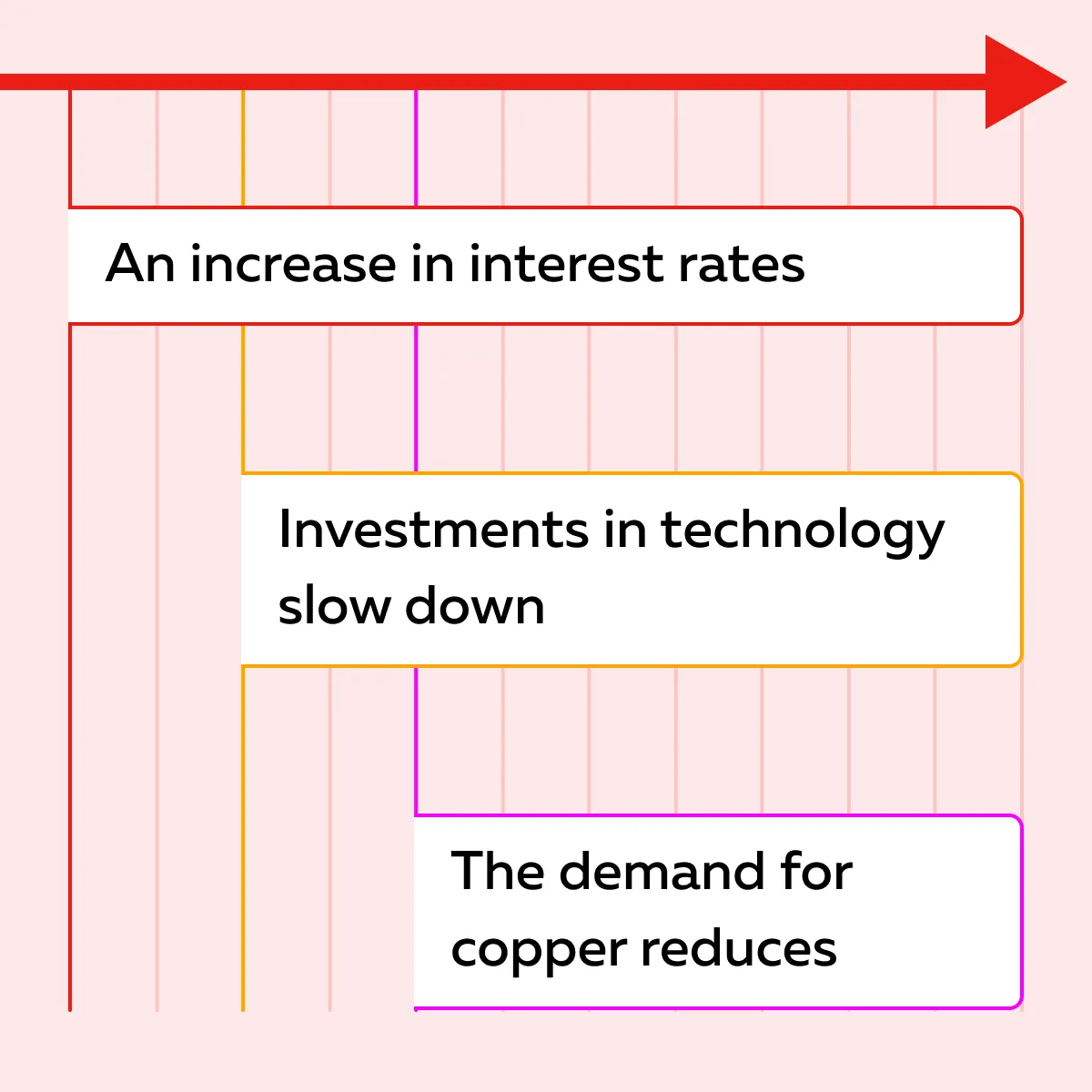

It is widely used in wiring, electronics, and construction. Due to its widespread usage, copper’s price trends reflect economic health. Generally, when copper prices rise, it signals strong industrial demand. It also suggests economic expansion. Check the graphic below:

For example, if copper demand increases, it could mean higher investments in real estate, electric vehicles, and data centers. This is why traders monitor copper price trends for 2025 to predict future economic conditions.

Copper’s Connection to Tech

Be aware that there is a strong correlation between copper and tech. That’s because copper is essential in:

- Semiconductors,

- Circuit boards, and

- Renewable energy systems.

As tech companies grow, their need for copper rises, which drives up demand. However, external factors like interest rates and tech stocks also influence this relationship. Let’s see how through the graphic below:

Therefore, for traders, copper and tech stocks are part of correlated markets for trading. This means price movement in one can indicate trends in the other. By understanding this relationship, you can make informed decisions.

Tech Innovation and Copper Demand

Tech advancements like electric vehicles (EVs) and renewable energy are increasing the demand for copper. EVs require nearly four times more copper than traditional cars. That’s because they use copper in:

- Wiring,

- Batteries, and

- Charging stations.

Similarly, solar panels and wind turbines depend on copper for efficient energy transmission. This further strengthens the copper and tech correlation. Generally, it is believed that more innovation leads to higher copper demand.

For example, the surge in EV adoption is pushing automakers to secure long-term copper supplies. This rising demand directly impacts copper price trends in 2025 and makes copper a key material for tech-driven industries.

Copper and Interest Rates

Copper prices are also affected by interest rates. When rates rise, borrowing becomes expensive. This expensive borrowing slows down industrial growth. As a result, the demand in sectors like construction and tech slows down. Conversely, lower rates encourage investments in infrastructure and innovation. This boosts copper usage.

Thus, for traders like you, understanding how copper reacts to economic shifts is important. You must observe that copper prices move alongside tech and industry trends. They are a part of correlated markets for trading. Through this relationship, you can anticipate market movements.

How Interest Rates Shape Correlated Markets

Impact on Tech Stocks

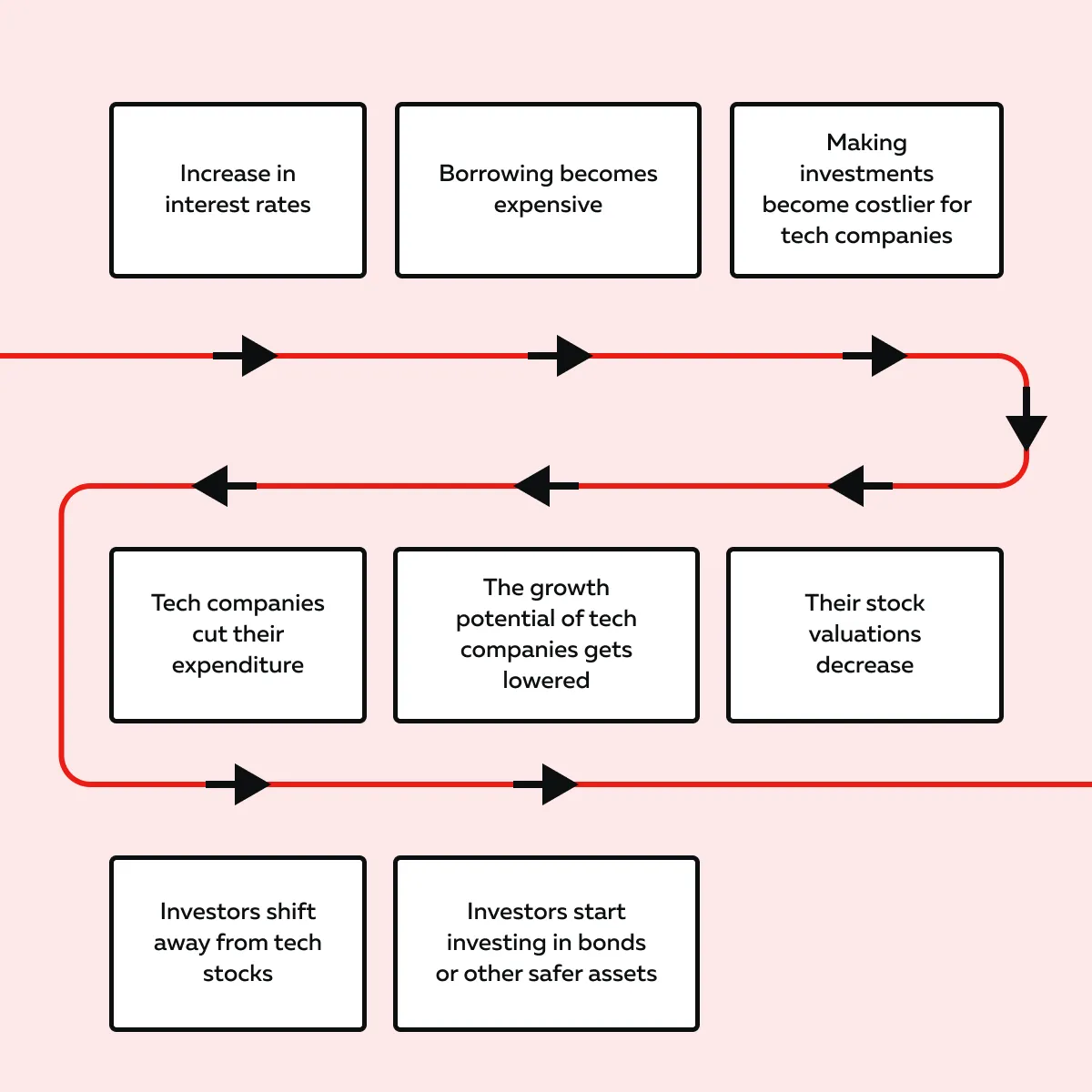

Numerous studies have shown that Interest rates influence financial markets. As mentioned above, when rates rise, borrowing becomes expensive. This makes it costlier for tech companies to invest in innovation and expansion. This lowers their growth potential and affects stock valuations. As a result, investors shift away from tech stocks to safer assets like bonds. For more clarity, refer to the graphic below:

Bookmap’s heatmaps reveal hidden liquidity in correlated markets like copper and tech—start your analysis today.

Copper’s Role in Predicting Rate Changes

Copper is an economic barometer. That’s because its demand is tied to industrial growth. If copper prices start rising, it indicates strong economic activity. This prompts central banks to consider tightening monetary policy. This connection is part of correlated markets for trading, where copper movements help predict rate shifts.

For example,

- Say you are monitoring copper price trends in 2025.

- Now, you will assess whether sustained demand signals inflationary pressure.

- Since there is a strong copper and tech correlation, you watch copper markets.

- You try to anticipate broader economic shifts (like interest rate decisions).

Copper as an Economic Indicator

Copper prices are a leading indicator of economic health. When copper demand rises, it suggests strong industrial activity. This, in turn, contributes to inflationary pressures. Central banks monitor such trends to decide on interest rate policies. A prolonged increase in copper prices usually pushes policymakers toward rate hikes to control inflation.

For example,

- Say copper price trends in 2025 show continuous growth.

- Now, it could indicate rising manufacturing and infrastructure investments.

- Using this insight, you predict likely changes in interest rates and tech stocks.

- You observe how rate adjustments influence market sentiment.

Interconnected Market Dynamics

Always remember that markets do not move in isolation. Changes in one sector often create ripple effects across others. For example, copper prices are linked to the tech and energy industries due to their reliance on the metal for wiring, batteries, and semiconductors. Hence, a surge in copper prices increases production costs for tech companies.

Most traders watch these trends as part of correlated markets for trading. They use copper as a signal for broader market shifts.

Trading Opportunities in Correlated Markets

Leveraging Copper Price Trends

Rising copper prices signal increased industrial demand. That’s because it is widely used in construction, electronics, and renewable energy. Several traders use this insight to identify likely bullish trends in related sectors.

For example,

- Say the copper price trends in 2025 show a strong rally.

- This indicates a growing demand for infrastructure and tech products.

- Using the concept of copper and tech correlation, you predict that stocks in these sectors could gain momentum.

Order Flow Analysis for Correlated Markets

To identify institutional activity in different markets, you can perform an order flow analysis. You can make such an analysis using our advanced market analysis tool, Bookmap. Using it, you can easily analyze buy and sell orders in copper futures. This helps you to gauge:

- Market sentiment

and

- Liquidity.

For example,

- Say you are using Bookmap, and you see large buy orders in copper futures.

- Now, this indicates that institutional investors expect higher industrial demand.

- Since there is a copper and tech correlation, you analyze whether major tech stocks or semiconductor companies are also gaining momentum.

- You observed that tech stocks rise alongside copper.

- This signals a strong trend.

- You try to enter the market and determine a solid entry point.

Use Bookmap’s market insights to analyze copper and tech trends in real time.

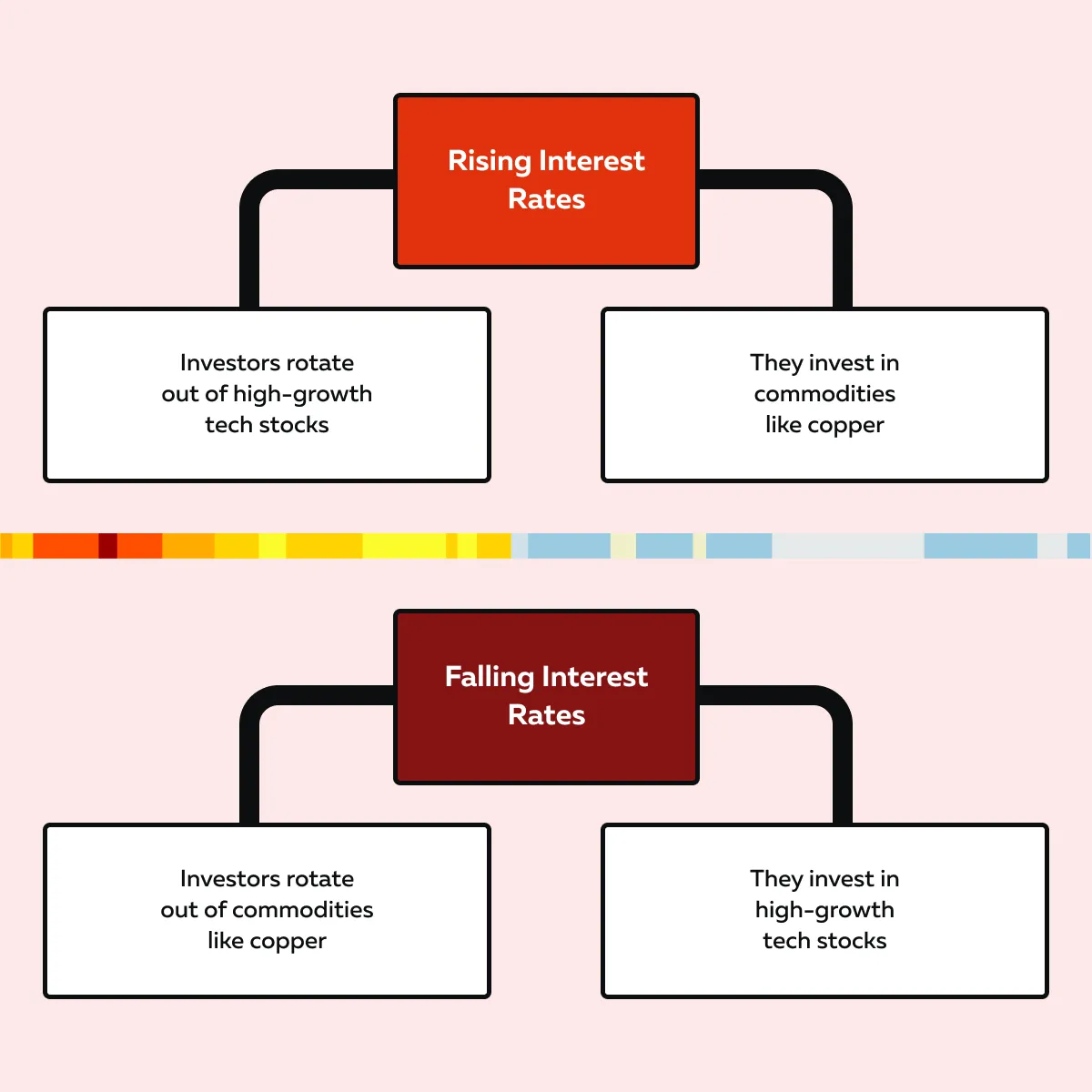

Sector Rotation Strategies

Please note that markets shift based on economic conditions. Traders adjust their positions accordingly. During rising interest rates, investors rotate out of high-growth tech stocks into commodities like copper. Conversely, when rates drop, capital often flows back into tech. Check the graphic below:

Thus, by analyzing interest rates and tech stocks, you can decide when to pivot between sectors. For example,

- Say copper prices rise while rates stay low.

- Now, both industrials and tech offer strong opportunities.

- By monitoring these trends, you can manage sector rotations smartly.

Risks of Trading Correlated Markets

Trading in correlated markets for trading offers opportunities, but it also comes with risks. That’s because market correlations can break due to external shocks like:

- Geopolitical events,

- Interest rate changes, and

- Economic slowdowns.

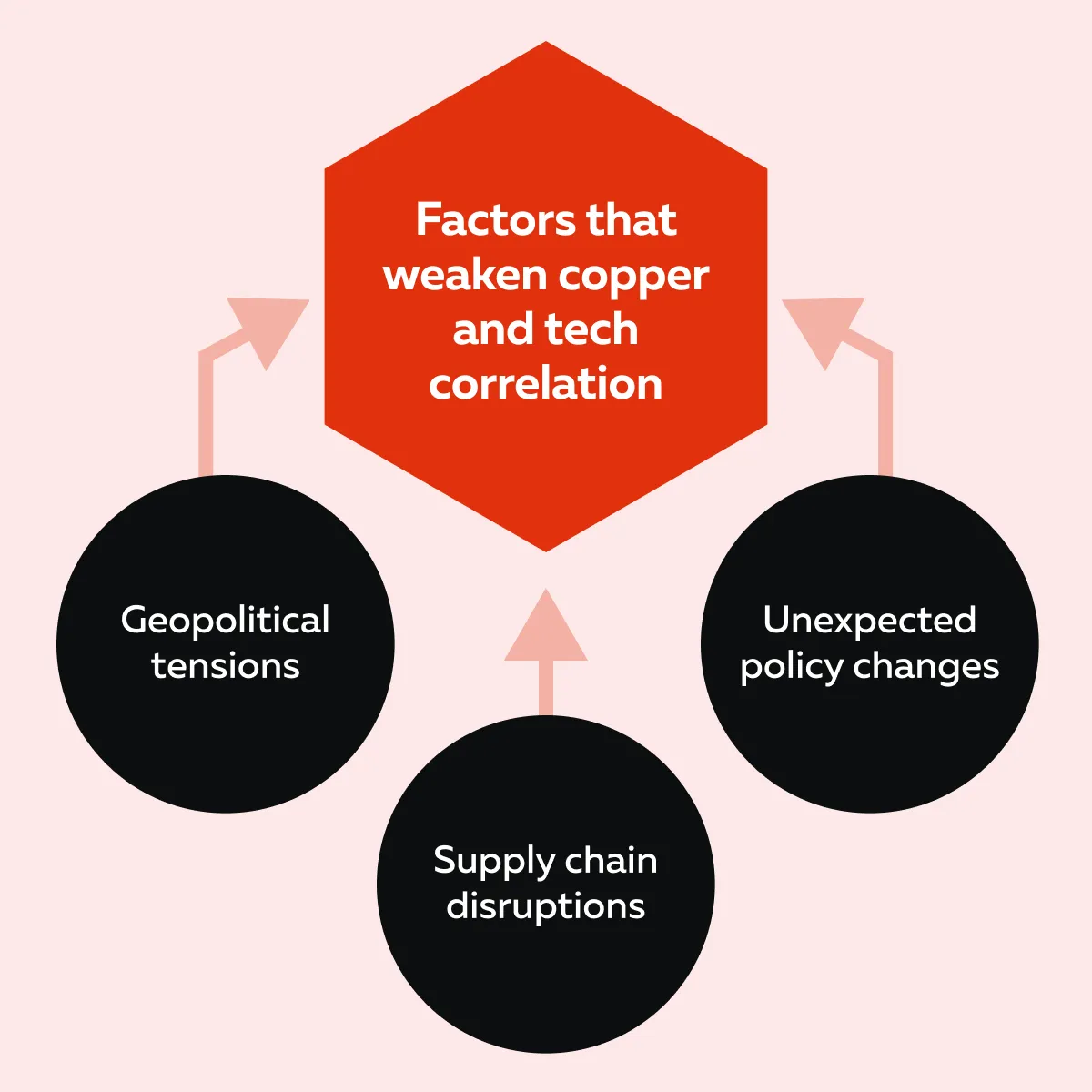

While the copper and tech correlation allows you to predict trends, there are several risks that can lead to losses. Let’s understand them:

A) False Signals

Correlations between assets like copper and tech stocks are not always reliable. Read the graphic below to learn about external factors that can weaken these relationships:

Due to this risk, if you are relying solely on historical correlations, you may face losses when markets behave unpredictably.

For example,

- You believe there is a strong copper and tech correlation.

- A sudden copper price rally appears.

- But it does not boost tech stocks.

- That’s because investors are worried about inflation or recession risks.

This is why you must look beyond correlation and consider broader market conditions before making investment decisions.

B) Volatility Risks

Be aware that markets that move together can experience heightened volatility. This especially happens during major economic announcements like:

- Federal Reserve meetings

or

- Inflation reports.

A sharp change in interest rates and tech stocks triggers wild price swings across different sectors. This makes trading riskier. For example:

- Say the Fed unexpectedly raises interest rates.

- Now, copper prices have fallen due to weaker industrial demand.

- At the same time, tech stocks decline as borrowing costs rise.

- You must prepare for such volatility when trading in correlated markets.

- Ideally, use risk management strategies like stop-loss orders.

C) Overreliance on Correlations

While analyzing copper price trends in 2025 can provide valuable insights, relying solely on correlations can be dangerous. That’s because market conditions constantly evolve. As a result, correlations can weaken over time.

Hence, several successful traders combine correlation analysis with other tools like:

- Fundamental research,

- Technical indicators and

- Sentiment analysis.

This balanced approach ensures that trading decisions are based on multiple confirmations rather than a single factor.

Conclusion

By understanding market correlations, you can trade better. The copper and tech correlation shows how demand for copper can indicate growth in the technology and industrial sectors. Similarly, interest rates and tech stocks are closely linked. Rising rates can slow tech growth, while lower rates can boost investment in the sector. If you analyze these relationships as a trader, you can better predict market trends and identify profitable opportunities.

However, please note that correlations are not always reliable. Several external factors (like geopolitical events, supply chain disruptions, and unexpected rate hikes) can break historical patterns. This is why traders must use additional tools, such as our market analysis tool Bookmap.

Using Bookmap, you can identify large institutional trades and liquidity zones. This provides you with real-time market data that improves decision-making. Stay ahead of market shifts with Bookmap’s advanced order flow tools, perfect for navigating correlated markets.