Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 4, 2024

SHARE

Diverse Trading Strategies: An Exploration of Methods and Mindsets

The financial markets are challenging. Most institutional investors and day

traders test your every market move. Are you ready to take on this challenge

and learn to thrive in this unpredictable world of financial markets?

Having a

backtested trading strategy

can come to your rescue. However, these strategies exist in abundance. This

leaves you with the difficult option of choosing one that is appropriate to

your level of risk tolerance and financial goals.

A deeper understanding of the market will play a crucial role in determining

which trading strategy will work the best for you. Through this introductory

article, you will expand your knowledge base as well as explore different

trading strategies. Ready to discover how charts, patterns, and indicators

can help you make smarter trading decisions? Let’s dive in!

Exploring Popular Trading Strategies

In financial markets, there exists a vast array of trading strategies. From

day trading to long-term investing, the choices are seemingly endless.

Indeed, trading is not a one-size-fits-all endeavor. What works for one

person might not work for another. Thus, the chosen trading strategy must be

tailored to your circumstances and preferences.

What is Your Risk Tolerance Limit?

At the heart of selecting the right trading strategy is understanding your

risk tolerance. Some traders thrive on the fast-paced, high-risk environment

of day trading, while others prefer the stability of long-term investments.

It’s crucial to assess your comfort level with market volatility and the

potential for gains and losses.

How Aggressive Are Your Financial Goals?

Your financial goals play a significant role in shaping your trading

strategy. Finding answers to the following questions will influence which

strategies are the most suitable for you:

-

Are you looking for short-term profits or long-term wealth

accumulation? -

Do you prioritize income generation or capital preservation?

Are you Market-savvy?

A deep understanding of the market is vital. A trader must be aware of how

the market functions and gets manipulated by the influential market

participants. Knowledge of market trends, fundamental analysis, and

technical indicators can help you choose an appropriate trading strategy

that works.

Additionally, to be an effective trader you must be able to comprehend the

dynamics of the asset you are trading, whether it’s stocks, forex,

cryptocurrencies, or commodities.

-

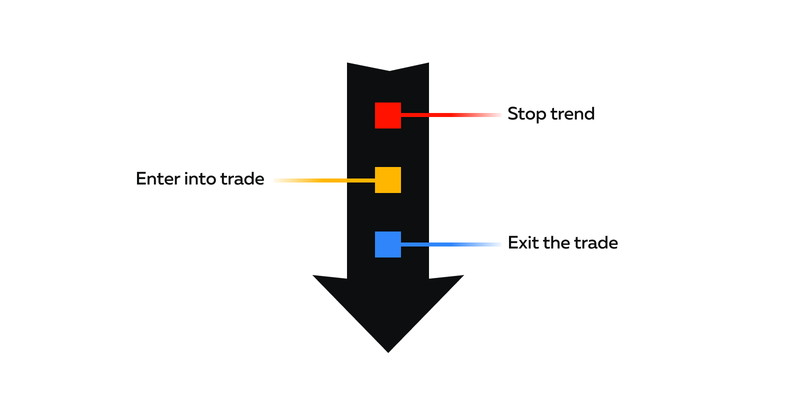

Trend Trading

Are you ready to ride the market momentum? Trend trading is the act of

capitalizing on sustained market movements, be it an upward rally or a

downward slide. This strategy seeks to make profits by recognizing and

following prevailing trends in financial markets.

-

Spot the trend:

-

Use tools like moving averages, trendlines, and volume

indicators to spot the trend. -

These tools help in:

-

Validating the strength of the trend and its potential

longevity. -

Timing the market

-

-

-

Enter the trade:

-

Try buying into an uptrend or selling in a downtrend.

-

Do this only when you believe the trend will persist.

-

Set trailing stop losses as they help in:

-

Protecting profits and

-

Limiting potential losses.

-

-

-

Exit the trade:

-

Spot trend exhaustion signals to determine when the trend might

be reaching its end. -

Plan for your exit.

-

Trend Trading: A Friend and Foe

Trend trading can be highly profitable in markets with sustained trends.

It’s a relatively straightforward strategy that fits well with “the trend is

your friend” mantra. However, it’s not foolproof. In highly volatile

markets, false signals can be generated, leading to potential losses. Thus,

like any trading strategy, trend trading also carries its own set of risks

and rewards.

2. Arbitrage

In financial markets, price discrepancies exist. In the trading strategy of

arbitrage,

you try capitalizing on the price discrepancies.

How to Do it:

-

You try to simultaneously buy and sell the same assets or a closely

related asset in different markets. -

The goal is to ensure almost instantaneous execution to take

advantage of price differences. -

For example,

-

Let’s assume that a stock is trading at a lower price on one

exchange compared to another. -

As an arbitrage trader, you will buy it on the cheaper exchange

and sell it on the more expensive one. -

Thereby, making a profit from the price difference.

-

Is it Still the Same in the Modern Financial Landscape?

In the modern financial world, technology has revolutionized arbitrage.

Algorithmic and high-frequency trading have become essential tools for

arbitrageurs. These systems can identify price discrepancies and execute

trades within milliseconds, far faster than human traders. Thus, today,

speed and efficiency are critical in capturing arbitrage opportunities.

How Prevalent Is It?

Despite the benefits of technological advancements, arbitrage opportunities

are not as abundant as they once were. This is largely because as more and

more traders adopt high-frequency and algorithmic strategies, price

differences tend to be short-lived and get quickly corrected. This leaves

minimal scope for price arbitrage.

Additionally,

-

There’s a risk of execution lags.

-

It refers to the situation where a trade doesn’t get filled as

anticipated due to network delays or other issues.

3. Scalping

Stock trading nowadays is all about swift and precise profit hunting.

Scalping is a trading strategy that involves making rapid, in-and-out

trades. The primary goal is to secure small, incremental profits.

Some Common Characteristics

-

Scalping trades are of very short duration, often just minutes or

even seconds. -

Small price movements are targeted.

-

Most traders use high leverage to maximize their potential gains.

-

Frequent trades are executed throughout the trading session.

How Do Successful Scalpers Trade?

Successful scalpers rely on specific tools and indicators to identify

short-term price movements. Level II market data provides them with a

real-time view of buy and sell orders. This order flow data is crucial for

understanding market sentiment and identifying potential opportunities.

Also,

-

To gain granular insights into price changes, scalpers often use

tick charts. -

These charts display price movements on a tick-by-tick basis.

Challenges of Scalping

Scalping is not for the faint of heart. It requires intense mental focus and

emotional discipline. Most scalpers make quick decisions under pressure.

Most importantly, the potential for incurring losses is huge while

practicing scalping. This is because even a small adverse price movement can

result in significant losses when employing high leverage.

Additionally, brokerage costs can also eat into profits; given the frequency

of trades in scalping.

4. Momentum Trading

In momentum trading, “accelerating price movements” are capitalized. The

primary aim is to ride the coattails of stocks or assets that are already in

strong, accelerating trends.

The Underlying Belief

Momentum traders believe that assets that have been performing well will

continue to do so in the short term. Thus, it is profitable to open

positions in these assets.

How Can You Practice Momentum Trading?

|

Steps |

Explanation |

|

Spot Prevailing Momentum |

|

|

Trade Execution |

|

|

Risk Management |

|

What are Potential Pitfalls?

One of the most common mistakes is chasing a stock. This means entering a

trade too late after most of the momentum has already occurred.

Additionally, over-leveraging can amplify losses. This is because of:

-

Rapid price reversals that can lead to significant drawdowns and

-

Being caught in sharp reversals that can erase previous gains.

5. Reversal Trading

Are you looking to bet against the current? Reversal trading is a strategy

that goes against the prevailing market trend. It seeks to profit from the

reversal or change in the direction of asset prices.

Contrarian by Nature

-

Reversal trading is often referred to as contrarian in nature.

-

This is because it ignores the prevailing market trends and bets

against them. -

The primary intention for such an approach is the belief that the

current trend is about to change direction.

How To Spot Reversal Signals

You can use different tools and indicators to identify potential reversals.

Refer to the table and gain a fair idea:

|

Indicator Used |

Signal Provided |

|

Weakening Trend |

|

Stochastic Oscillator |

Overbought/ oversold conditions |

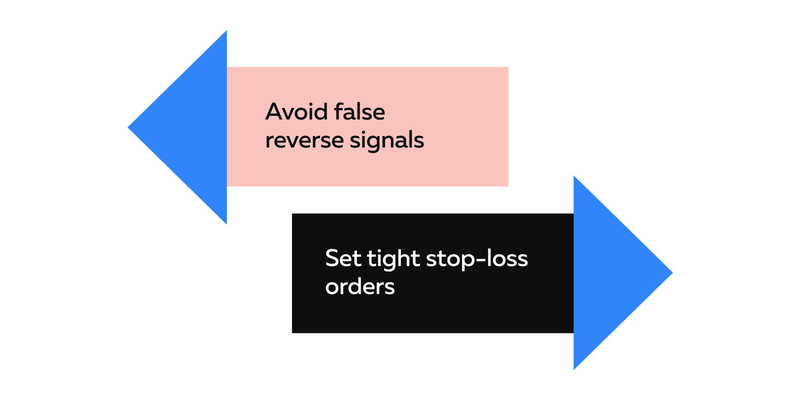

How to Manage Associated Risks

Reversal trading can be profitable if you catch major price reversals at the

right time. However, it also involves the risk of entering too early or too

late. Reversals are hard to predict, and you may lose money if the trend

persists.

Therefore, you need to manage your risk carefully when trading reversals.

You can do so by:

-

Using confirmation techniques to avoid false reversal signals.

-

Setting tight stop-loss orders to limit potential losses in case the

reversal doesn’t occur as expected.

6. News Trading

Let’s ride the waves of information.

News trading

is a strategy in which major news events that can trigger significant market

movements are capitalized upon.

It’s a fact that major news events have the power to create substantial

price fluctuations in financial markets. From economic reports to

geopolitical developments, news can significantly impact market sentiments

and consequently the value of assets.

How Can You Decipher the Impact of News?

-

News releases typically follow a pattern.

-

There’s an immediate reaction, where prices move swiftly upon news

release. -

This is often followed by overreactions, where prices may move

excessively in one direction. -

Eventually, the market tends to correct itself, finding a more

stable price level.

Additionally,

-

For scheduled announcements, traders might use techniques like

“straddles”. Following this technique, they can simultaneously buy

and sell options to profit from the expected price volatility. -

For unscheduled news, rapid execution tools, often used in

algorithmic trading, can help traders react swiftly to news events.

7. Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves spreading out investments over time,

rather than making a single, lump-sum investment. Let’s understand using a

hypothetical example.

-

Mr. A has $12,000 to invest in a volatile stock.

-

Instead of investing it all at once, he chose to invest $1,000 every

month for a year.

The Benefit

DCA is particularly beneficial in volatile markets. For instance:

-

If the stock’s price is $100 per share, the investor initially buys

10 shares. -

If the price drops to $80 in the next month, they can buy 12.5

shares. -

This way, the investor buys more shares when the price is lower,

reducing the impact of market fluctuations.

Is DCA for you?

DCA is particularly suitable for passive investors who prefer a steady and

low-stress approach to investing. Also, it might not be the best choice in

all scenarios.

For example, if an investor has a substantial amount of cash and the market

is in a clear uptrend, making a lump-sum investment might capture more

significant gains.

Conclusion

There is no ‘one strategy fits all’. Selecting the right trading strategy is

a highly individual process that is dependent on factors like risk

tolerance, financial goals, and market understanding.

What worked yesterday may not work tomorrow, so flexibility is key to

staying on course toward your trading objectives. Ongoing education,

backtesting, and adaptability must be practiced religiously.

Are you interested in further refining your trading approach? Dive deeper

into various strategies and get insights on tailoring the right one to your

needs. Explore more on

how to choose the best trading strategy

for you. Your next trading evolution awaits.