Ready to see the market clearly?

Sign up now and make smarter trades today

Stocks

February 18, 2025

SHARE

High Dividend Stocks: How to Find and Invest in Them

Make money while you sleep! Isn’t this something straight from the book of the rich and the famous? Well, high-dividend stocks might be the answer you have been looking for! Curious to know more?

This article will walk you through the benefits of investing in high-dividend stocks, focusing on how they provide a steady income, contribute to wealth growth, and enhance portfolio stability. You will learn to identify the best income-generating stocks by using key metrics like dividend yield and payout ratios. Additionally, we’ll understand the importance of diversification and reinvestment so that your money continues to work for you.

Want to start building a portfolio that not only survives but thrives in any market condition? Let’s get started.

What Are High Dividend Stocks?

High dividend stocks are shares of companies that distribute a significant portion of their earnings as dividends to shareholders. Investors looking for consistent income often seek these stocks.

Generally, these stocks represent stable businesses in sectors like utilities or real estate. For most investors, they play a key role in dividend investing strategies aimed at building a steady cash flow. For more clarity, let’s have a look at 5 undervalued US dividend stocks for 2025:

| S. No. | Dividend stocks | Dividend yield |

| 1. | Verizon (VZ) | 6.79% |

| 2. | Healthpeak (DOC) | 5.76% |

| 3. | Kraft Heinz (KHC) | 5.46% |

| 4. | United Parcel Service (UPS) | 4.90% |

| 5. | Johnson & Johnson (JNJ) | 3.34% |

Some Key Metrics to Evaluate Dividend Stocks

To evaluate dividend stocks, you must analyze the following key metrics:

- Dividend Yield

Dividend yield measures the stock’s income potential and is calculated as follows:

Dividend Yield= Dividend per shareCurrent market price

A higher yield indicates a stronger income stream. It makes such stocks ideal for investors as income-generating stocks.

- Payout Ratio

The payout ratio measures how much of a company’s earnings are distributed as dividends. A healthy payout ratio is usually below 60%. This ensures that the company retains sufficient funds for growth while still paying dividends. This balance is key when learning how to invest in dividend stocks.

- Dividend Growth

Consistent dividend growth shows a company’s financial stability. Firms with a history of increasing dividends, like Dividend Aristocrats, are excellent examples of reliable high-dividend stocks for long-term investment.

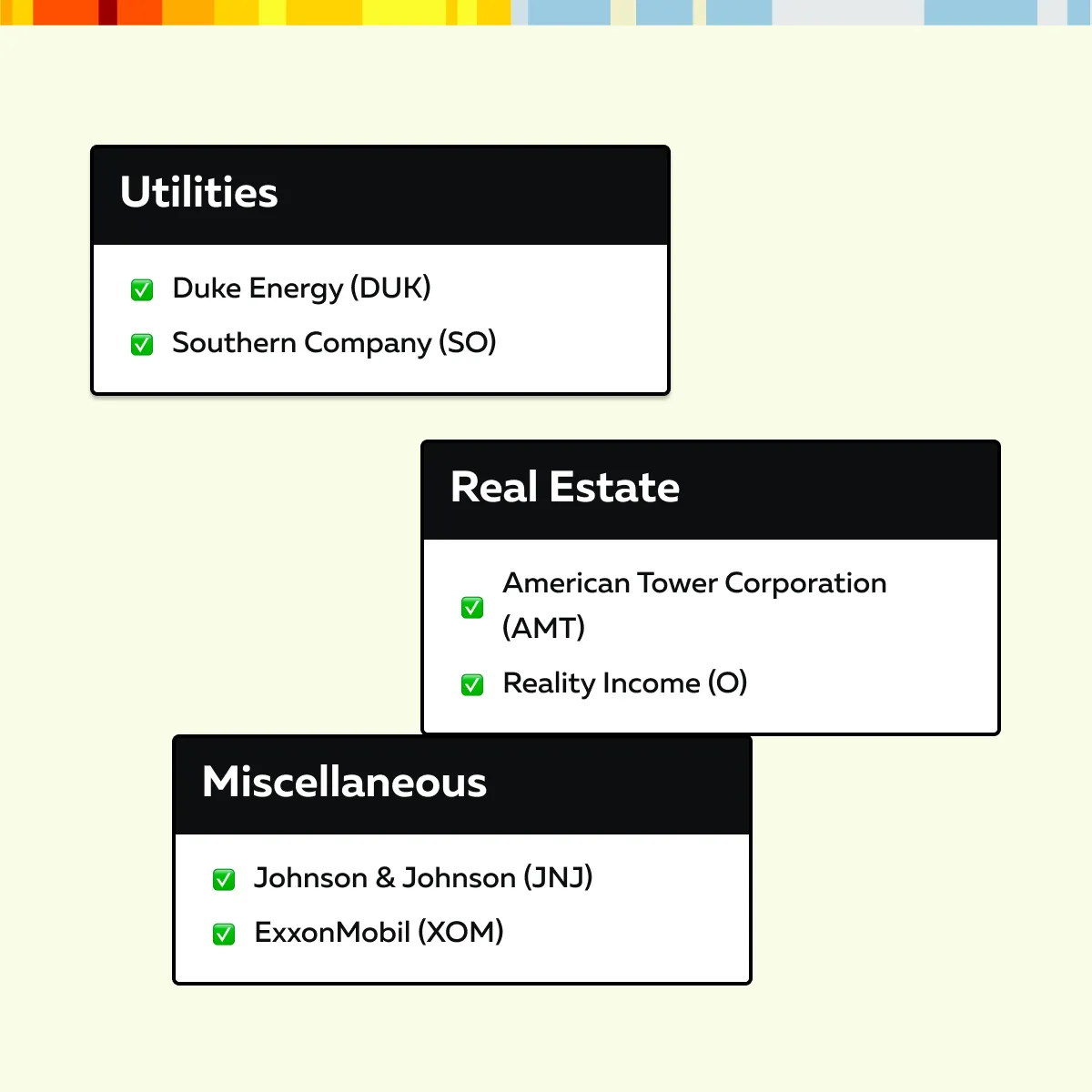

Examples of well-known high-dividend stocks

Generally, companies operating in the utilities and real estate offer high dividends. Let’s check out some examples of popular dividend aristocrats:

Why Invest in High Dividend Stocks?

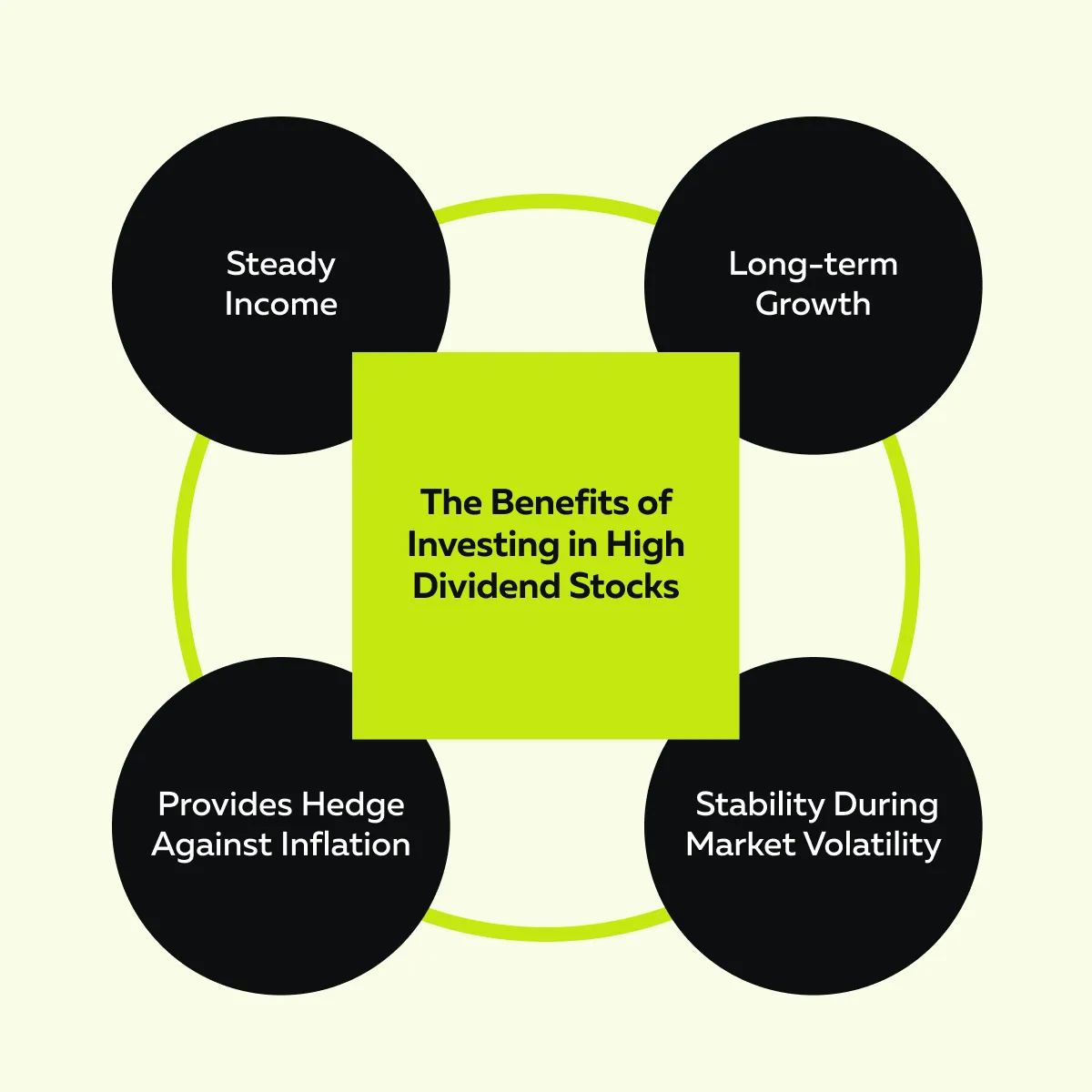

By investing in high-dividend stocks, you get numerous benefits. Check the graphic below:

Thus, for most investors, dividend stocks are a part of their diversified portfolio. For a better understanding, let’s understand these benefits in detail:

1. Steady Income

Dividends provide a consistent cash flow, which is especially beneficial for retirees and income-focused investors. Unlike capital appreciation, which is often viewed as “paper profit,” dividends represent actual income that provides regular payouts. This gives a sense of financial security.

By selecting income-generating stocks, investors can rely on periodic returns without selling their holdings.

2. Long-Term Growth

Be aware that reinvesting dividends can significantly enhance total returns through the power of compounding. Numerous studies have shown that over time, reinvested dividends accelerate portfolio growth. Thus, they align perfectly with dividend investing strategies aimed at building wealth. This approach is particularly effective for those seeking financial freedom through disciplined investing.

3. Stability in Volatile Markets

Dividend-paying stocks (especially in sectors like utilities and consumer staples) are less volatile during market downturns. Their consistent payouts act as a cushion and make them a reliable investment option.

Example:

- Consider the utilities and consumer staples industries.

- They offer basic services and products, such as electricity, water, food, and household goods.

- These sectors are less affected by economic downturns.

- That’s because their demand remains stable regardless of market conditions.

- Companies in these industries are known for their consistent dividend payouts.

- This makes them popular high-dividend stocks during recessions.

The steady cash flows of such high dividend companies allow them to maintain dividend payments. Such reliability attracts investors who are seeking stability during market turbulence.

4. Inflation Hedge

Usually, high dividend-paying companies have a history of growing payouts. This consistent growth offsets inflation. Rising dividends maintain purchasing power and ensure that income keeps pace with increasing living costs.

This inflation-resilient quality makes high-dividend stocks a smart choice for long-term financial stability.

How to Find High Dividend Stocks?

To identify high-dividend stocks, you must perform a thorough research and analysis. Ideally, you should:

- Search for reputable companies,

- Focus on certain reliable sectors,

and

- Use key financial metrics.

Through this, you can build a portfolio of dependable income-generating stocks. Let us see how you can find high-dividend stocks in easy steps:

Step I: Research Dividend Aristocrats

Dividend Aristocrats are elite S&P 500 companies with 25+ years of consecutive dividend increases. See the graphic below to check out the major qualities of such companies:

Companies that are considered the gold standard in dividend investing strategies are known for providing investors with consistent and growing income streams. Some common examples include Johnson & Johnson and Coca-Cola. Both these companies have a proven track record of delivering reliable dividends through various market cycles.

Step II: Focus on Specific Sectors

Sectors like utilities, Real Estate Investment Trusts (REITs), and consumer staples comprise most of the high dividend-paying stocks. Therefore, it is recommended that these three sectors be focussed on. Let us understand in detail:

| Utilities | Real Estate Investment Trusts (REITs) | Consumer Staples |

|

|

|

Maximize your income strategy by analyzing dividend stock trends with Bookmap.

Step III: Use Financial Metrics

In the financial market, there are hundreds of high dividend-paying stocks. To make smart investments and pick the best ones, you must use the following financial metrics:

- a) Dividend Yield

-

- To shortlist some of the best companies, you must compare dividend yields across sectors.

- However, investors should be cautious about chasing the highest yields without proper analysis.

- That’s because a very high yield may indicate financial distress or unsustainable payouts.

- Hence, always look for a balanced yield as it helps in finding reliable high-dividend stocks.

- b) Free Cash Flow

- Strong free cash flows are essential for sustaining dividend payments.

- That’s because companies with consistent cash flow can easily maintain and even grow dividend payments over the years.

- Generally, these companies reinvest their surplus cash into the business, which increases profitability.

- Now, as profits grow, dividend payments tend to increase as well.

- This creates a cycle of increasing shareholder value.

c) Economic Cycles

- When selecting income-generating stocks, it’s important to understand how sectors perform in different economic cycles.

- For example,

- During growth periods, tech companies like Microsoft or Apple often shine with rising dividends.

- In contrast, utilities and consumer staples remain steady in downturns due to their essential nature and consistent payouts.

- By recognizing these patterns, you can pick dividend stocks that remain effective across market conditions.

High Dividend Stocks: Adding Stability to Your Portfolio

By adding high-dividend stocks into your portfolio, you can achieve:

- Achieve financial stability,

and

- Reduce investment risk.

That’s because these stocks offer consistent income and cushion the negative effects of market volatility. By carefully selecting dividend-paying stocks from various sectors, you can craft a balanced portfolio that fits your financial goals. Let’s understand in detail how high-dividend stocks add stability to your portfolio:

Stability Through Consistent Income

One of the primary advantages of high dividend stocks is their ability to provide steady income, regardless of market conditions. This reliable cash flow is particularly valuable during times of economic uncertainty.

One must note that dividend payments act as a financial anchor. They offset fluctuations in stock prices. For investors focused on income-generating stocks, this consistency helps in:

- Managing volatility,

and

- Maintaining portfolio growth.

Track dividend stock performance and liquidity with Bookmap’s advanced visualization tools.

Enjoy the Benefits of a Balanced Portfolio

Incorporating high-dividend stocks into your portfolio can strategically reduce overall risk by balancing higher-risk assets such as growth stocks. These dividend stocks, particularly those in defensive sectors, often outperform during economic downturns.

Utility stocks are a classic example of this. During recessions, the essential nature of their services ensures consistent demand. This enables them to maintain dividends and act as a stabilizing force. This dual benefit of income and risk reduction makes them integral in developing dividend investing strategies.

Before Investing, Make a Sector-Specific Analysis

| Real Estate Investment Trusts (REITs) | Utilities |

|

|

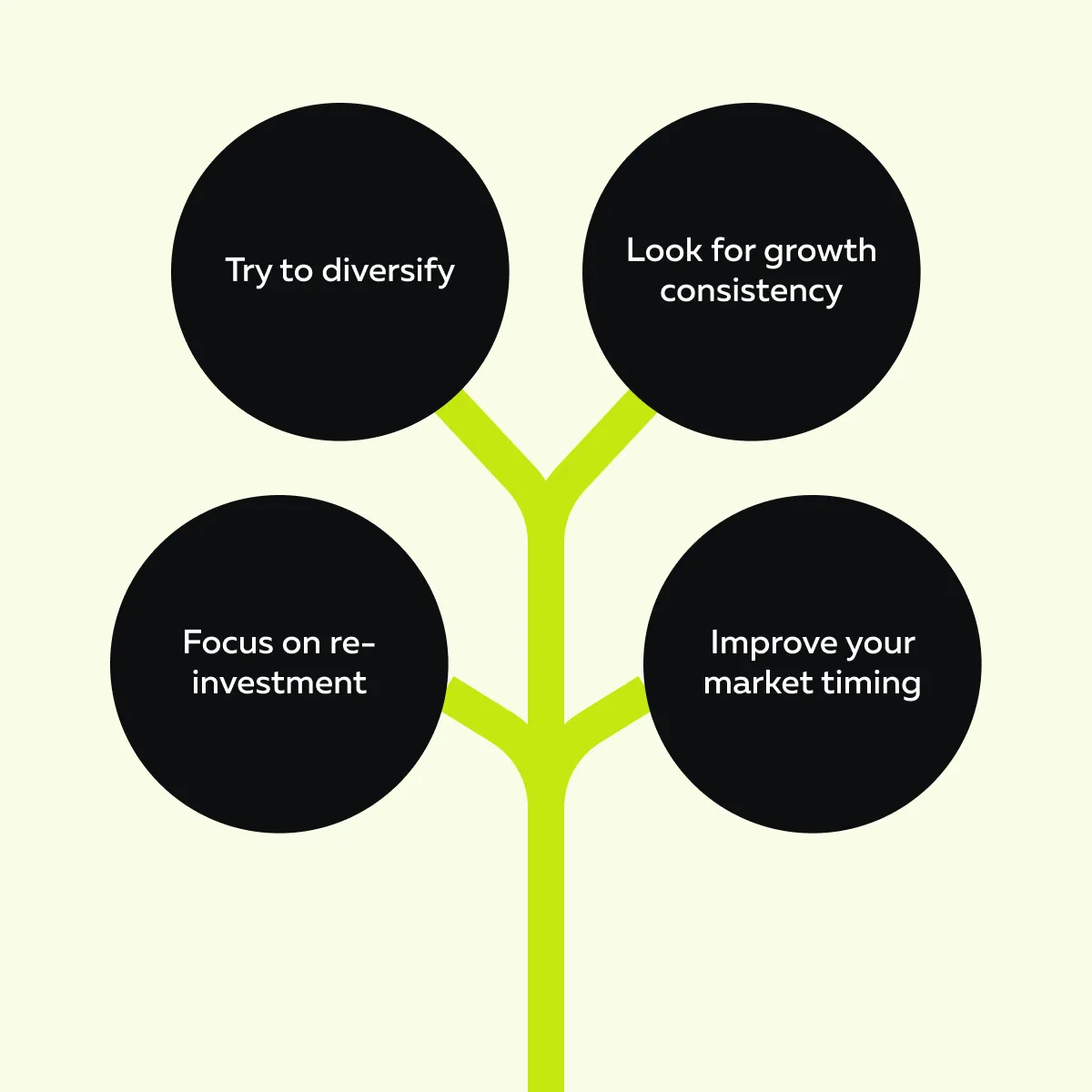

Strategies for Investing in High-Dividend Stocks

To pick and invest in the right high-dividend stocks, you need a mix of thoughtful strategies and tools. This will help you to maximize income and minimize risk. Check the graphic below to see what you must focus on:

For more clarity, here is a detailed explanation of each factor you should focus on:

A) Prefer Dividend Reinvestment Plans (DRIPs)

DRIPs allow investors to automatically reinvest their dividends into additional shares of the same stock. This reinvestment leads to compounding, as future dividends are calculated based on the increased number of shares, which amplifies growth over time.

Example:

- Let’s assume that an investor uses DRIPs and invests in income-generating stocks like Johnson & Johnson.

- They see their portfolio grow passively.

- They benefit from both the reinvested dividends and capital appreciation.

B) Try to Diversify

Diversification allows you to reduce risk when building a portfolio of high-dividend stocks. Spreading investments across sectors mitigates the impact of underperformance in any single industry.

Example:

- An investor balances high-yield REITs with stable consumer staples.

- By doing so, they enjoy a mix of income and reliability.

- That is because REITs offer attractive yields, while consumer staples provide steady dividends.

Monitor Dividend Growth

Rather than chasing stocks with the highest yields, focus on companies with a consistent history of dividend growth. Always remember that high yields sometimes indicate financial distress, making them risky for investors seeking reliable income.

Instead, prioritize firms like Coca-Cola or PepsiCo, which have a proven track record of increasing payouts over decades. These income-generating stocks provide both stability and growth.

Improve Your Timing by Performing Liquidity Analysis

Most investors invest time strategically to maximize their returns from high-dividend stocks. To improve your timing, you can start using our advanced market analysis tool, Bookmap. Using it, you can easily analyze:

- Liquidity zones,

and

- Order flow.

Such an analysis will help you identify favorable entry points.

Example:

- Let’s say, by using Bookmap, you spot a price dip in a high-yield stock like Realty Income.

- You observe that this drop is just before the ex-dividend date.

- Now, this provides a lucrative buying opportunity.

By following such an approach, you can ensure both income and expected capital gains.

Conclusion

High-dividend stocks offer several compelling benefits for investors. Firstly, they provide a steady income. This makes them ideal for individuals looking for regular cash flow. These stocks also offer stability in turbulent market conditions, as companies with consistent dividends are less volatile. They provide a strong cushion during downturns. Additionally, high-dividend stocks have growth potential, particularly when dividends are reinvested. The compounding over time significantly boosts overall returns.

You, as a trader, must select these stocks carefully by focusing on solid financial metrics. Pay attention to key indicators such as dividend yield, payout ratio, and dividend growth. These metrics allow you to assess a company’s ability to maintain or increase its dividend payments. You should also remember that high dividend yields can sometimes signal risk, especially if a company is paying out more than it can afford. To make the most of your investments, you should ideally use our advanced market analysis tools, like Bookmap, to improve your market timing.

Wish to invest in the best stocks? Find opportunities in high-yield stocks with real-time data from Bookmap.