Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

February 18, 2025

SHARE

How the 2025 Interest Rate Landscape Impacts Stock Index Futures

In life and trading, timing is paramount. Get it right, and the rewards are boundless! In 2025, the global economy is expected to face shifting interest rates and evolving central bank policies. To trade profitably, you must understand how these changes will affect stock index futures.

Do you wish to trade in a volatile market and win? In this article, we will decipher the relationship between interest rates and major stock indices like S&P 500 futures, Nasdaq futures, and Dow Jones futures. You’ll see how rate hikes or cuts influence market sentiment, sector rotations, and price movements in futures markets. Also, we’ll explore various strategies, such as using order flow analysis and hedging with futures.

Lastly, you will understand how advanced market analysis tools like our platform, Bookmap, allow you to get real-time insights. Want to capitalize on trading opportunities in 2025? Let’s get started.

The Connection Between Interest Rates and Stock Index Futures

Interest rates and stock valuations are inversely related to each other. When interest rates rise, borrowing becomes more expensive for companies. This event often reduces company profits and, in turn, leads to lower stock valuations. Also, it sets bearish trends in stock index futures.

On the other hand, the lowering of interest rates encourages borrowing and spending. This event boosts both economic growth and equity markets. The resulting optimism usually drives up prices in S&P 500 futures and Nasdaq futures.

Interest Rate Changes Also Affect Investor Sentiment

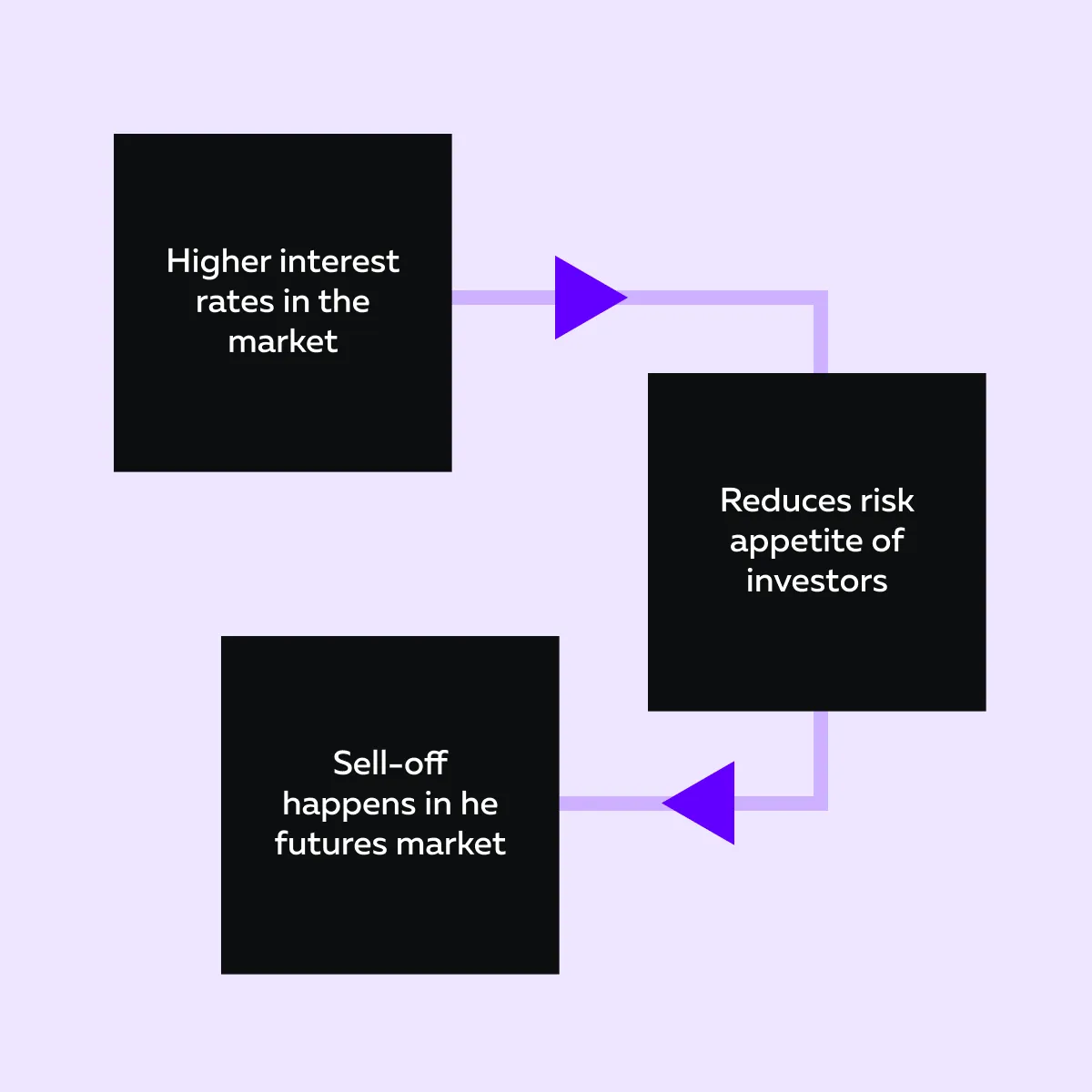

Be aware that higher rates are often tied to tighter central bank policies. They decrease investors’ risk appetite and cause a sell-off in futures markets. See the graphic below:

For example,

- Let’s assume the Federal Reserve makes a hawkish announcement.

- This event leads traders to short “Nasdaq futures.”

- This rise in shorting activity takes place because traders are expecting growth stocks to decline.

Even if we go back in history, we will observe that past rate hikes or cuts have shown strong correlations with movements in both S&P 500 futures and Nasdaq futures. For more clarity, refer to the table below:

| Performance during interest rate hikes | Rate cut impacts |

|

|

Central Bank Policy Projections for 2025

In 2015, central banks across the world were uniformly focused on achieving a neutral interest rate. It is expected that they will balance economic growth and inflation control. The primary goal across regions is to bring interest rates to a level that neither stimulates nor cools the economy but maintains economic equilibrium. Let’s understand these efforts in detail.

The Outlook of the Federal Reserve

In 2025, it is expected that the Federal Reserve will transition from a restrictive monetary policy to a more neutral stance. By doing so, it is targeting a federal funds rate of around 3.75% by the end of the year.

However, this cautious approach will depend heavily on their reading of key economic indicators, such as inflation and employment data. That’s because the Fed always tries to carefully balance growth without overheating the economy.

Hence, if it is noted that inflation is cooling, rate cuts may be on the cards. Such a situation could boost S&P 500 futures and Nasdaq futures.

What Global Central Banks Are Expected to Do?

Policies from global central banks, such as the European Central Bank (ECB), Bank of Japan (BoJ), and People’s Bank of China (PBoC) also play a key role. For example:

- Let’s assume the ECB tightens its policies.

- Now, it will indirectly impact U.S. markets and stock index futures by altering:

- Capital flows,

and

- Currency valuations.

- In contrast, a dovish stance in Japan could further support global liquidity and impact futures trading.

Let’s see what these three major central banks are expected to do in 2025:

| European Central Bank (ECB) | Bank of Japan (BoJ) | People’s Bank of China (PBoC) |

|

|

|

Prepare for volatile interest rate movements with Bookmap’s heatmap and order flow analysis.

How do Geopolitical and Economic Factors Impact?

Unexpected global events (like energy price shocks or supply chain disruptions) can also significantly shift central bank policies. These factors may push inflation higher. This event will force central banks to hike rates aggressively. Such hikes will influence Nasdaq futures and S&P 500 futures through heightened market volatility.

Key Impacts on Major Stock Index Futures in 2025

In 2025, the major stock index will be largely influenced by:

- Shifting interest rates,

- Central bank policies,

and

- Evolving economic conditions.

To better deal with the expected market volatility, traders must understand these factors. Let’s see how they will impact stock index futures.

S&P 500 Futures

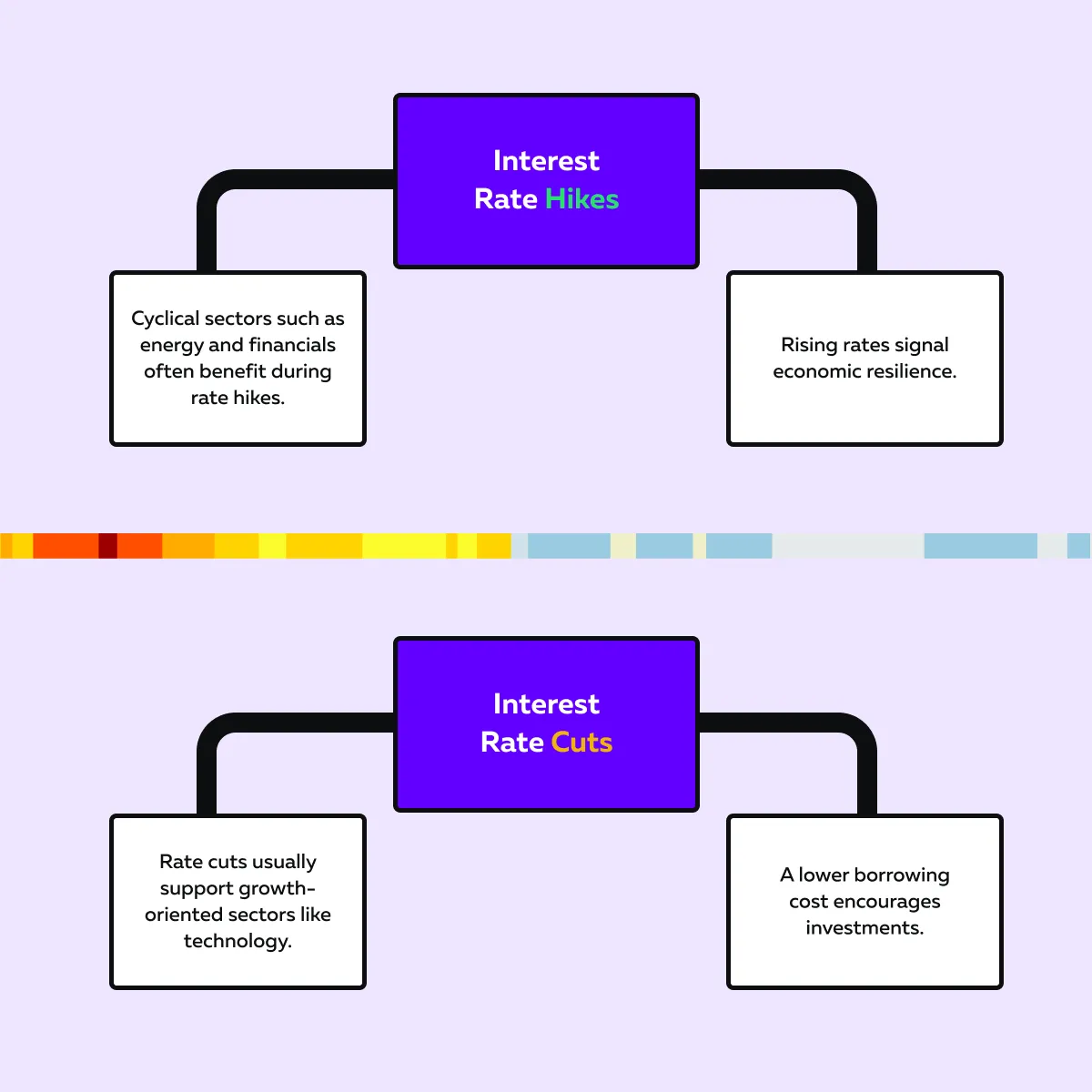

S&P 500 futures are closely tied to changes in interest rates. The several sectors covered by the S&P 500 respond differently to such interest rate changes. Check the graphic below for more clarity:

To understand the concept better, let’s study an example.

- Let’s assume the Federal Reserve decides to hold rates steady.

- This move signals economic stability and controlled inflation.

- This decision often drives bullish sentiment in S&P 500 futures.

- This sentiment results from investors feeling more confident about:

- Steady corporate earnings,

and

- Market performance.

- Generally, the sectors sensitive to economic trends see a rise.

Monitor liquidity shifts in S&P 500 and Nasdaq futures with Bookmap’s advanced order flow tools.

Nasdaq Futures

The tech-heavy Nasdaq futures are highly sensitive to interest rate changes. That’s because growth stocks dominate this index. Generally, higher rates increase borrowing costs. This event hurt tech companies relying on external financing for expansion. Additionally, rising rates make future cash flows less attractive. This event reduces the valuation of growth stocks.

To understand the concept better, let’s study an example:

- A Federal Reserve rate hike often reduces the appeal of technology stocks.

- It leads to bearish sentiment in Nasdaq futures.

- During such times, investors usually resort to short-selling these futures.

- They do so, anticipating declines in companies heavily dependent on growth and innovation.

Dow Jones Futures

Dow Jones futures are composed of blue-chip stocks. Thus, they are less volatile compared to Nasdaq futures. However, they are still influenced by sector rotations that are driven by interest rate changes.

It has been observed that defensive sectors, like healthcare and consumer staples (often part of the Dow), perform better during rate hikes due to their stable earnings.

To understand the concept better, let’s study an example:

- Say the Federal Reserve has announced a rate hike.

- Now, the investors have shifted their focus to defensive sectors within the Dow.

- The shift of investment to defensive industries increases the demand for Dow Jones futures.

- This rise in popularity is because these sectors are perceived as safer bets during periods of:

- Rising borrowing costs,

and

- Economic tightening.

Russell 2000 Futures

Russell 2000 futures represent small-cap companies. These companies are usually more volatile and heavily influenced by domestic economic conditions. Moreover, they often rely on local markets and external borrowing. This reliance makes them particularly vulnerable to interest rate changes.

To understand the concept better, let’s study an example:

- Let’s assume a Federal Reserve rate hike has been announced.

- Now, this could hurt small-cap firms due to higher borrowing costs.

- This situation leads to bearish sentiment in Russell 2000 futures.

- Investors anticipate slower growth for these companies.

- Such a sentiment causes increased selling pressure and market volatility.

Trading Strategies for 2025’s Interest Rate Environment

To trade profitably in 2025, traders must understand the impact of interest rate decisions on:

- Sectors,

- Liquidity,

and

- Market sentiment.

Such an understanding will allow them to position themselves for market movements and risks. Let’s have a look at some popular trading strategies that can be followed:

Trend Following

In this strategy, you analyze historical data to predict future price movements (especially after central bank policies are announced). Through this strategy, traders can easily align with the broader market sentiment that is driven by:

or

- Other macroeconomic factors.

Let’s understand better through an example related to predicting fed actions:

- Let’s assume the inflation data indicates that the Federal Reserve might pause rate hikes.

- Now, the traders are bound to anticipate bullish momentum.

- They will go long on S&P 500 futures.

Please note that this approach benefits from the expectation that stable rates will support corporate earnings and economic stability. They will influence upward trends.

Hedging with Futures

It is worth mentioning that both institutional and retail traders use stock index futures to protect their portfolios from market volatility. They follow this approach, particularly during uncertain interest rate environments.

By taking positions in these futures, they can offset potential losses in their underlying assets caused by rate fluctuations or adverse market conditions. Let’s understand better through an example:

- Assume that during a period of rising interest rates, traders short S&P 500 futures or Nasdaq futures.

- By doing so, they try to hedge against declines in equity markets.

- Through this strategy, they balance portfolio risk.

- This strategy also provides them stability even when rate changes drive market volatility.

Stay ahead of interest rate changes with Bookmap’s real-time data and market insights for index futures.

Order Flow Analysis for Entry Points

Most traders use advanced market analysis tools, like our platform, Bookmap, to analyze order flow. These tools allow traders to observe the following:

- Real-time market liquidity,

and

- Order imbalances.

Also, using our platform Bookmap, they can track the depth of the market (DOM) and changes in order flow. Such tracking allows them to identify strong buying or selling pressure. Ultimately, this helps them time market entries.

Let’s understand better through an example related:

- Let’s assume a dovish Federal Reserve announcement has been made.

- A trader using Bookmap notices heavy buying activity on the DOM.

- This activity signals that investors expect lower interest rates or a pause in rate hikes.

- This event causes them to enter a long position in S&P 500 futures or Nasdaq futures.

- By doing so, they try to capitalize on the anticipated market rally.

Risks and Volatility in a Changing Rate Landscape

Interest rate decisions (particularly those from the Federal Reserve) often trigger significant volatility in the market. The minutes following a rate announcement can see sharp price movements in stock index futures like S&P 500 futures and Nasdaq futures.

But why does this volatility arise? This volatility arises because traders react to new economic information or shifts in monetary policy. For example:

- Say the Fed signals an unexpected rate hike or pause.

- Now, futures markets experience rapid swings.

- This volatility arises because traders adjust their expectations for inflation and economic growth.

In addition to increased volatility, interest rate changes can sometimes lead to misinterpretations. Let’s see how:

Misinterpreted Guidance

Another risk is the misinterpretation of the Federal Reserve’s language during their announcements. There are always chances that traders may overreact to statements or subtle shifts in tone. Due to such misinterpretations, there are sometimes false breakouts or reversals in the market.

For example:

- Let’s assume that during a Fed announcement, the traders pick a seemingly dovish comment.

- They interpret the comment as an indication of lower interest rates.

- In response, the traders buy aggressively.

- In contrast, the Fed actually maintains a hawkish stance.

Therefore, such overreactions cause price distortions temporarily. Usually, markets quickly reverse their directions when traders realize the initial interpretation was incorrect.

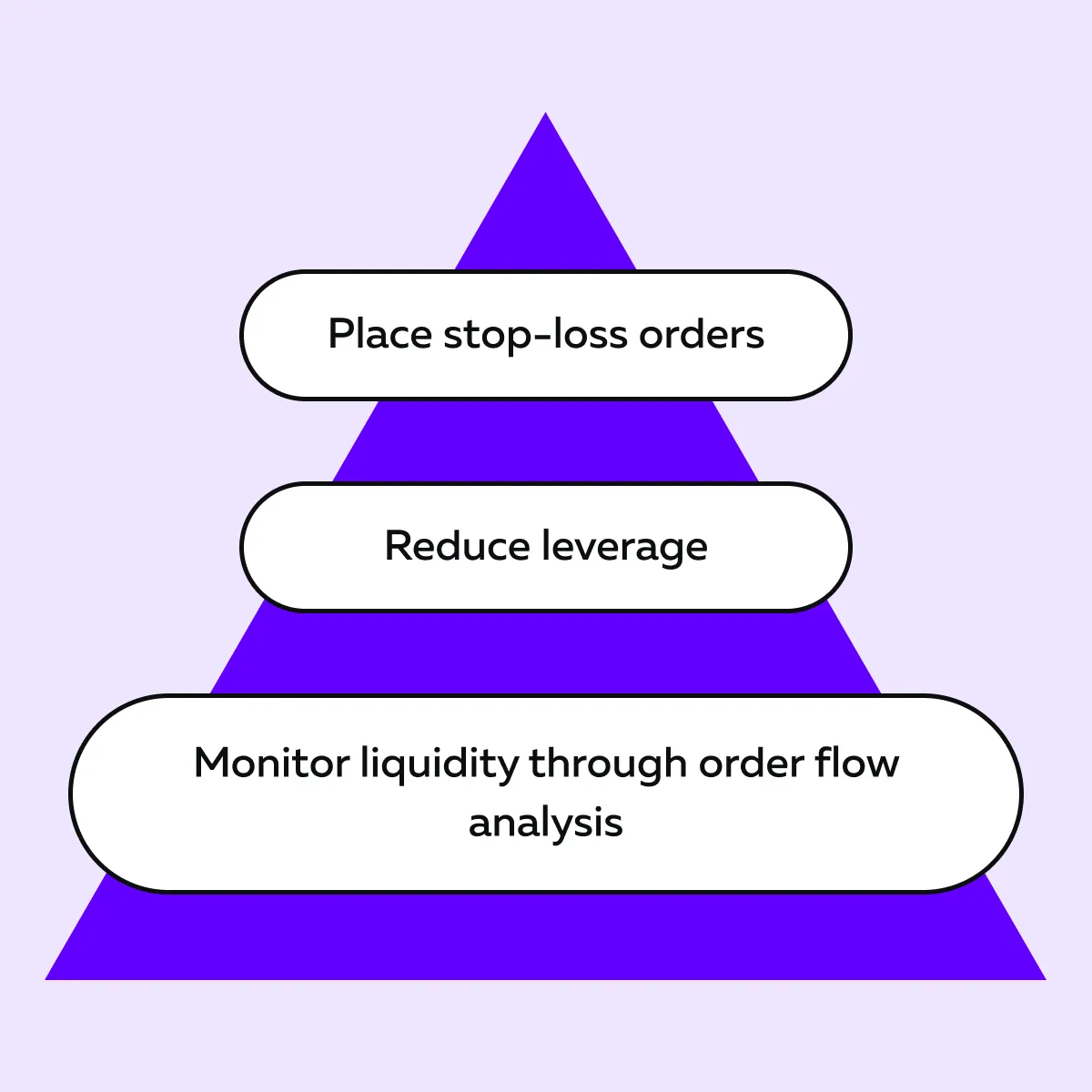

How to Manage Risk?

To better deal with the volatility caused by central bank policies and interest rate fluctuations, traders must implement solid risk management strategies. Study the graphic below.

Please note that by placing stop-loss orders, you can limit your expected losses in case of sharp price moves. Reducing leverage is another important step. Be aware that high leverage amplifies risk in volatile conditions.

Additionally, you must perform order flow analysis to monitor liquidity. For this purpose, stick to using real-time analysis tools like our platform, Bookmap. Using it, you get insights into market sentiment that allow you to make more informed decisions during heightened volatility.

Conclusion

Interest rates and stock index futures are closely related to each other. They maintain an inverse relationship. Such an understanding is important in 2025, as central banks, particularly the Federal Reserve, are expected to adjust interest rates. This event will directly affect market sentiment and the valuation of sectors within indices like the S&P 500 futures, Nasdaq futures, and Dow Jones futures.

Be aware that rate hikes generally cause market volatility. They impact growth stocks and sectors that are sensitive to borrowing costs. On the other hand, rate cuts encourage risk-taking and economic growth. By monitoring these shifts, you can better predict market movements and adjust their positions accordingly.

Additionally, to gain a competitive advantage, you should start popular market analysis tools, like our platform, Bookmap. Using them, you can gain real-time insights into order flow and liquidity. These insights will help you identify key entry and exit points during times of volatility. Prepare for 2025’s rate-driven market dynamics with Bookmap’s advanced order flow and liquidity tools.