Ready to see the market clearly?

Sign up now and make smarter trades today

Education

April 1, 2024

SHARE

Level Up Your Trades: The Hidden Gems at the Intersection of Gaming and Trading

Do you know gaming and trading have a fascinating connection? Understanding this connection can benefit traders operating at all levels. In this article, we will see how gaming principles, such as reward systems and decision-making under uncertainty, influence traders’ behavior in financial markets.

Do you know gaming and trading have a fascinating connection? Understanding this connection can benefit traders operating at all levels. In this article, we will see how gaming principles, such as reward systems and decision-making under uncertainty, influence traders’ behavior in financial markets.

We’ll also discuss how gamers and traders experience behavioral biases, such as loss aversion and overconfidence, and how these biases impact decision-making. By recognizing these biases and applying principles from behavioral finance, traders can make rational decisions and ultimately improve their trading outcomes.

Furthermore, we’ll explore the potential applications of gamification in trading and how traders can enhance their skills and refine their strategies. Let’s get started.

Gaming Psychology and Market Behavior

Post thorough analysis and observation, it has been observed that gaming principles often intersect with trading behaviors in financial markets. This largely happens due to their shared elements of the following:

- Risk,

- Reward, and

- Decision-making under uncertainty.

Let’s understand in depth how these principles influence traders’ behavior:

- Reward Systems

-

-

- Just like in gaming, traders are motivated by rewards.

- Most traders are driven by their urge for financial gain, which drives their decision-making.

- This urge makes them habitual of:

- Chasing profits and

- Taking on more risk to maximize potential rewards.

- Like traders, gamers also strive to reach higher levels and unlock achievements.

-

- Risk-Taking

-

-

- Gaming often involves calculated risk-taking, where players weigh potential rewards against potential losses.

- Similarly, traders assess the risk-reward ratio of their trades after considering the following factors:

- Market volatility,

- Asset liquidity, and

- Their risk tolerance.

- Reckless actions in gaming can result in failure or setbacks. Similarly, excessive risk-taking can lead to losses in trading.

-

- Decision-Making Under Uncertainty

-

- Both gaming and trading require making decisions with incomplete information and uncertain outcomes.

- Traders must analyze market data, economic indicators, and news events to anticipate price movements.

- Similarly, gamers often face uncertainty in predicting opponents’ actions.

- Decision-making under uncertainty can lead to both:

- Successful outcomes and

- Costly mistakes.

Some Common Behavioral Biases

Read the table below to understand some common behavioral biases observed in both gamers and traders:

| Common Biases | Explanation | Effect on Trading |

| Loss Aversion | Both gamers and traders tend to be more sensitive to losses than gains. |

|

| Overconfidence | Both groups exhibit overconfidence in their abilities. |

|

| Disposition Effect | This bias refers to the tendency to hold onto losing positions too long while selling winning positions too quickly. |

|

How Does Understanding Gaming Psychology Help?

Gaming principles deeply influence traders’ behavior in financial markets. They shape their approach to risk, reward, and decision-making. By understanding gaming psychology, traders can do the following:

- Improve their decision-making and

- Respond better to the complexities of financial markets.

Additionally, it also offers valuable insights into market sentiment and trading patterns. Let’s see how:

Understanding Reward Systems

There are several reward systems in gaming, such as the following:

- Experience points,

- Virtual rewards, and

- Achievements.

These gaming reward systems share similarities with the concept of profits and gains in trading. Understanding how these reward systems influence gamers can provide insights into traders’ risk appetite and decision-making. Here’s an analysis with examples:

What are the Similarities between Gaming Rewards and Trading Profits?

The three most common similarities are:

| Motivation | Feedback Mechanism | Reinforcement |

|

|

|

How Reward Systems Impact Traders’ Risk Appetite and Decision-Making

- Risk Appetite

-

-

- Just as gamers take risks to earn rewards or advance in the game, traders exhibit a higher risk appetite when the potential for profits is perceived to be greater.

- Conversely, the fear of losses or failure in gaming can make players risk-averse, and traders also become cautious when faced with potential losses.

-

- Decision-Making

-

- Gaming rewards influence traders’ decision-making by shaping their expectations and preferences.

- For example, traders who are accustomed to rapid rewards in gaming exhibit impatience or seek quick profits in trading.

- This exhibition leads to speculative behavior.

How Does Gaming Psychology Translate to Trading?

In gaming, loss aversion is common among players. Owing to this, players become overly cautious when faced with potential losses. This loss aversion leads to missed opportunities for progression or rewards.

Similarly, traders exhibit loss aversion by:

- Avoiding risky trades or

- Cutting profits short, even when the potential for gains outweighs the risks.

Let’s consider a hypothetical example and understand how “loss aversion” in gaming can translate into missed opportunities for profitable trades in financial markets.

The Backdrop – Understanding the Game

- A gamer is playing a strategy game where they have to manage resources to build and expand their virtual empire.

- In this game, there’s a particular mission where the player must decide whether to invest resources in a risky venture that could potentially yield significant rewards. However, this also carries a chance of failure and loss.

The Influence of Loss Aversion

- The player, influenced by loss aversion, becomes overly cautious when considering the potential losses associated with the risky venture.

- They worry about:

- Losing the resources they’ve accumulated and

- The time invested in the game so far.

- As a result, they decide to play it safe and avoid the risky venture altogether.

- They opt for a more conservative strategy that offers smaller but guaranteed rewards.

The Opportunity “Missed”

- Unbeknownst to the player, the risky venture had a high probability of success.

- Those who pursued it were rewarded handsomely with the following:

- Rare resources,

- Valuable items, and

- In-game currency.

- By letting their fear of potential losses dictate their decision-making, the player missed out on the opportunity to significantly boost their progress and resources within the game.

Behavioral Finance Strategies for Traders

Behavioral finance theories offer valuable insights into the psychological biases that influence traders’ decision-making in financial markets. Crypto traders are often seen as more akin to gamers. This is because of the speculative nature of cryptocurrencies and the volatile market environment.

Traders can incorporate concepts like prospect theory, mental accounting, and heuristics into trading plans for maximum benefits. Let’s see how:

| Behavioral Finance Concepts | Meaning | Application | Strategy |

| Prospect Theory | Prospect theory suggests that individuals evaluate potential gains and losses relative to a reference point and are more sensitive to losses than gains (loss aversion). | Crypto traders can apply prospect theory by:

|

|

| Mental Accounting | Mental accounting refers to the tendency of individuals to categorize financial decisions into separate mental compartments based on subjective criteria. | Crypto traders can leverage mental accounting by diversifying their trading portfolios across different:

|

|

| Heuristics | Heuristics are mental shortcuts or rules of thumb that individuals use to simplify decision-making under uncertainty. | Crypto traders can leverage heuristics to:

|

|

How To Practice Behavioral Finance Principles?

Follow these specific strategies for incorporating behavioral finance principles:

- Define clear and achievable trading goals based on:

- Risk tolerance,

- Time horizon, and

- Expected returns.

- Break down larger goals into smaller, actionable steps.

- Track progress regularly to stay motivated and focused.

- Develop a structured trading plan with the following:

- Predefined entry and exit criteria,

- Position sizing rules, and

- Risk management strategies.

- Stick to the plan consistently and avoid impulsive decisions driven by emotions or short-term market fluctuations.

- Remain flexible and adaptable in response to changing market conditions and emerging trends.

- Continuously evaluate and refine trading strategies based on:

- Performance metrics,

- Feedback, and

- Lessons learned from both successes and failures.

Applying Prospect Theory

Prospect theory, developed by psychologists Daniel Kahneman and Amos Tversky, provides valuable insights into how individuals perceive and evaluate risks and rewards.

By understanding prospect theory, traders can do the following:

- Make more rational decisions and

- Mitigate the impact of emotional biases.

Read the table below to understand how prospect theory can be applied:

| How to Apply? | What Prospect Theory States? | What Can Traders Do? |

| Understand Risk Preferences |

|

|

| Evaluate Risk-Reward Tradeoffs |

|

|

| Mitigate Emotional Biases |

|

|

The Role of Emotions in Trading

Emotions play a significant role in trading. They influence both performance and decision-making. Traders often experience a range of emotions, including fear, greed, excitement, and anxiety. These emotions lead to the following:

- Impulsive actions,

- Irrational decisions, and

- Suboptimal outcomes.

Let’s examine the impact of emotions on trading performance:

- Fear

-

-

- Fear can lead traders to hesitate or avoid taking necessary risks.

- This aversion causes them to miss out on profitable opportunities.

- It also prompts premature exits from trades or excessive caution.

-

- Greed

-

-

- Greed can lead traders to take excessive risks or ignore warning signs.

- They tend to chase unrealistic returns or try to recover losses quickly.

- This behavior often leads to:

- Overtrading,

- Poor risk management, and

- Losses.

-

- Excitement

-

- Excitement clouds judgment and leads to impulsive decision-making, such as:

- Entering trades without proper analysis or

- Deviating from established trading plans.

- While excitement can fuel motivation, unchecked excitement can result in reckless behavior and losses.

- Excitement clouds judgment and leads to impulsive decision-making, such as:

How to Manage Emotions During Trading

- Practice mindfulness to stay focused and remain aware of emotions without being controlled by them.

- Achieve emotional stability and resilience by following techniques such as:

- Deep breathing,

- Meditation, and

- Visualization.

- Keep a trading journal to identify patterns, triggers, and areas for improvement.

- Set predefined exit points, such as stop-loss and take-profit levels.

- Have clear exit strategies in place before entering trades.

- Create a comprehensive trading plan with predefined rules, strategies, and goals.

How Important are Self-awareness and Emotional Intelligence?

Self-awareness enables traders to recognize their emotional triggers. It helps them understand how emotions such as fear, greed, and anxiety influence their decision-making. By being aware of these emotions, traders can make more rational decisions during periods of market volatility.

Furthermore, emotional intelligence helps traders control impulsive behavior driven by emotions. Traders with high emotional intelligence are better equipped to:

- Regulate their impulses,

- Resist the urge to make rash decisions, and

- Maintain discipline in adhering to their trading plans.

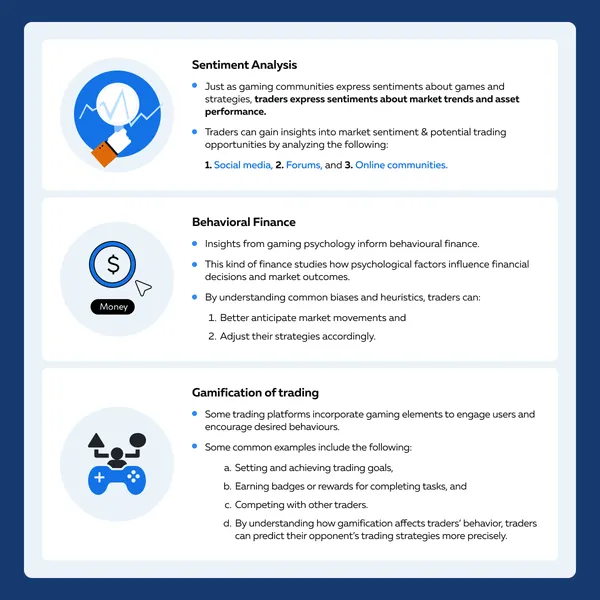

Insights from Gaming Communities

By gaining insights from gaming communities, traders gain valuable perspectives on:

- Strategy development,

- Risk assessment, and

- Performance optimization.

Let’s go in-depth and see how traders can benefit from the wisdom of gaming communities.

- Collaborative Problem-Solving

-

-

- Gaming communities often engage in collaborative problem-solving to overcome challenges and achieve objectives within games.

- Traders can apply similar collaborative approaches to develop and refine trading strategies by:

- Sharing insights,

- Exchanging ideas, and

- Seeking feedback from fellow traders.

-

- Innovative Tactics

-

-

- Gaming communities are known for devising innovative tactics and strategies to gain competitive advantages in games.

- Traders can draw inspiration from these creative approaches to develop unique trading strategies tailored to different market conditions and asset classes.

-

- Risk Management Techniques

-

-

- Gaming communities emphasize risk management techniques to:

- Minimize losses, and

- Maximize rewards in games.

- Traders can adopt similar risk management principles, such as:

- Position sizing,

- Diversification, and

- Stop-loss orders.

- Gaming communities emphasize risk management techniques to:

-

- Scenario Planning

-

- Gaming communities often engage in scenario planning to:

- Anticipate potential risks, and

- Outcomes in games.

- Traders can apply scenario analysis techniques to assess the impact of different market scenarios on their trading strategies.

- Gaming communities often engage in scenario planning to:

Leveraging Gamification in Trading Education

Gamification involves applying game design elements and principles to non-game contexts. This application enhances:

- Engagement,

- Motivation, and

- Learning.

When it comes to trading education and skill development, gamification can be a powerful tool to engage traders and facilitate experiential learning. Let’s see how gamification can be applied in trading education:

- Interactive Learning Modules

-

-

- Trading education platforms can incorporate interactive learning modules that simulate real-world trading scenarios.

- These modules can include quizzes, challenges, and simulations where traders can apply concepts they’ve learned in a risk-free environment.

-

- Progress Tracking and Rewards

-

-

- Gamified learning platforms can track traders’ progress and reward achievements to incentivize continuous learning and skill development.

- Traders can be motivated by offering them achievements such as:

- Completing modules,

- Mastering trading strategies, or

- Achieving certain performance milestones.

-

- Scenario-Based Learning

-

-

- Interactive simulations can present traders with different market scenarios and challenges.

- These simulations can require them to:

- Make decisions and

- Adapt their strategies based on changing conditions.

- Traders can learn from both successes and failures in a safe and controlled environment.

-

- Trading Tournaments

-

- Virtual trading competitions or tournaments can engage traders in friendly competition.

- This engagement fosters:

- Collaboration,

- Camaraderie, and

- A Sense of community.

- These competitions provide traders with opportunities to showcase their skills and win prizes or recognition for their performance.

How Can Traders Incorporate Gamified Tools and Resources into Their Training Regimen?

Gamification offers an engaging approach to trading education and skill development. Traders can follow these steps to use gamification and improve their trading outcomes:

| Steps | Implementation |

| Set Clear Learning Goals |

|

| Engage Actively and Consistently |

|

| Reflect and Iterate |

|

| Seek Feedback and Support |

|

Conclusion

The intersection of gaming and trading can offer valuable insights for traders. Just as gamers navigate virtual worlds, traders navigate the complexities of financial markets. Both require strategic decision-making, risk assessment, and managing emotions.

By leveraging gaming elements in trading, such as gamified learning platforms and virtual simulations, traders can enhance their skills and decision-making abilities. However, it’s crucial to recognize the importance of understanding behavioral finance principles.

Behavioral biases, like loss aversion and overconfidence, influence both gamers and traders. By applying principles like prospect theory and mental accounting, traders can make more rational decisions and manage risks effectively. Dive deeper into refining your trading strategies by exploring our comprehensive guide on how to choose the right trading strategy for you. Learn more here.