Ready to see the market clearly?

Sign up now and make smarter trades today

Education

December 4, 2024

SHARE

Market Data Aggregation: Pros, Cons, and Its Role in Visualization

How do the big bulls make money? They make strategic use of real-time

visualizations. These visuals serve as their compass, guiding investment

decisions, and helping them identify anomalies in the market. Market data

aggregation is the key ingredient behind these capabilities.

Using it, you can swiftly detect opportunities and mitigate risks. It’s more

than just collecting numbers; it’s about making those numbers work for you.

By reading this, you will discover how this data-driven technology is

shaping the trading world and why it’s a game-changer for traders

everywhere. Let’s delve deeper.

Understanding Market Data Aggregation

Market data aggregation is a fundamental process that involves collecting

and summarizing various types of financial information obtained from

multiple sources. The primary goal is to provide a comprehensive overview of

the markets so that traders can gain insights into market trends.

Definition and Core Principles

To illustrate this concept, consider the analogy of a consolidated bank

statement:

Imagine you hold multiple bank accounts, each with its transactions and

balances. To gain a comprehensive financial overview, you need to aggregate

the data from all your accounts into a single statement. This consolidated

statement allows you to see your total assets, liabilities, and transactions

in one place. Such an aggregation of data makes it easier for you to

understand your financial situation.

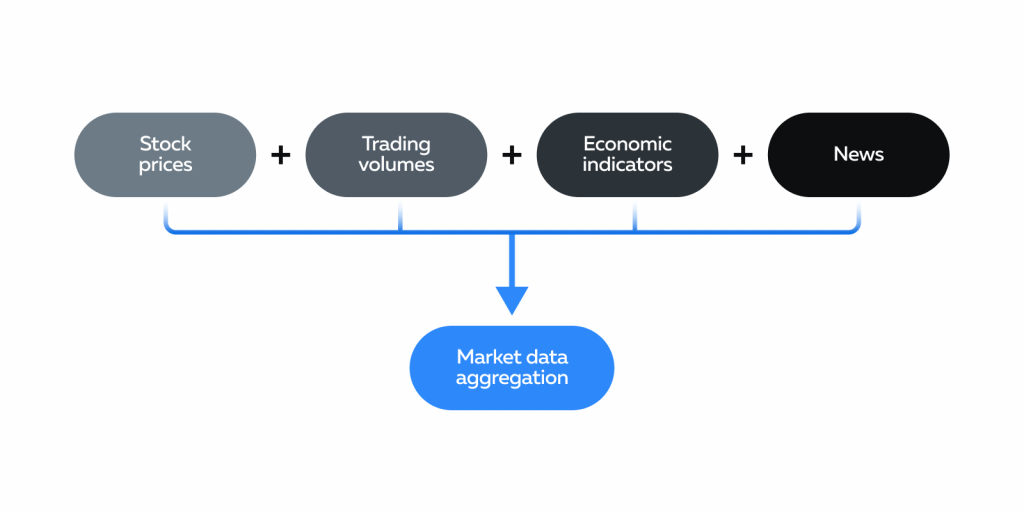

In the world of finance, market data aggregation works similarly. Financial

markets produce a vast amount of data, such as:

-

Stock prices

-

Trading volumes

-

News

-

Economic indicators, and many more.

Market aggregation tools gather, process, and display this information in a

consolidated format.

Historical Perspective: From Manual to Digital

Market data aggregation has come a long way. In the early days of financial

markets:

-

Traders and investors had to manually record and track market data.

-

They used handwritten ledgers and relied on printed newspapers and

reports to stay informed about:-

Stock prices

-

Company news, and

-

Economic data.

-

This method was time-consuming and prone to errors.

What Led To Digitization?

The advent of electronic trading in the late 20th century marked a

significant shift. Traders transitioned from physical trading floors to

computer screens. This transition brought the need for faster and more

efficient ways to access and process market data. Real-time data has become

crucial for making timely decisions in the fast-paced world of electronic

trading.

How Electronic Trading Accelerated The Shift

As electronic trading gained popularity, the need for automation and data

aggregation tools became evident. Financial institutions and traders started

using computerized systems to collect and process data from various sources.

These systems provided real-time market information and allowed for

automated trading strategies.

Additionally, the emergence of

High-Frequency Trading

(HFT), a strategy that relies on executing a large number of trades in very

short timeframes, further emphasized the importance of real-time data

aggregation.

The Many Upsides of Market Data Aggregation

Market data aggregation offers numerous advantages for traders and

investors. Let’s explore some of the key benefits:

A Bird’s-Eye View of the Market

Market data aggregation is like viewing a city from a plane. It provides

traders and investors with a comprehensive perspective of the financial

landscape. Market data aggregation enables you to access a wealth of

financial information from various sources in one place.

This broad view aids in strategy formulation in several ways:

|

The Benefits |

The Meaning |

How It Helps Traders |

|

Understand macrotrends |

Aggregation tools allow traders to see broader market

|

It helps in aligning strategies with the overall market |

|

Perform diversification |

Traders can easily monitor multiple assets in a single |

It helps in optimizing portfolios and managing risk. |

|

Better risk assessment |

By aggregating data on various financial instruments, |

It helps in |

Swift Decisions in Split Seconds

You’re a day trader and see breaking news about a major acquisition that

could impact a company’s stock price. In this situation, quick data access

can make all the difference.

Market data aggregation enhances reaction times by providing:

-

Instant real-time updates of significant market events.

-

Automated trigger alerts based on specific criteria. For instance, a

trader can receive an alert when a stock’s price moves by a certain

percentage. -

Quick execution of buy or sell orders.

Precision-Driven Trades

Aggregation tools offer in-depth analysis capabilities, including;

-

Historical data

-

Technical indicators, and

-

Sentiment analysis

This helps traders in:

-

Basing their decisions on well-founded insights rather than gut

feelings -

Backtesting

and refining their strategies -

Assessing and managing risks more effectively

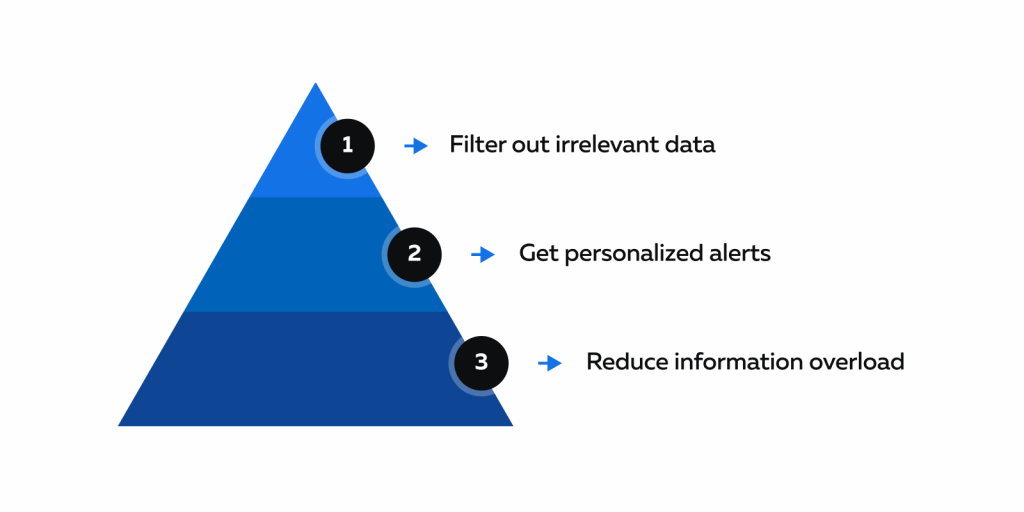

Custom Tailored Datastreams

Aggregation tools often come with a ‘filter’ feature that allows traders to

customize their data views based on their specific needs and strategies.

This customization offers several advantages:

-

See data that matters to you

-

Traders can filter out irrelevant data.

-

For example, a forex trader can filter economic indicators and

news specific to the currency pairs they are trading.

-

-

Personalized alerts:

-

The customization feature also extends to alert settings.

-

These settings enable traders to receive notifications only for

events or price movements that align with their trading

objectives.

-

-

Reduce information overload:

-

By tailoring their data streams, traders can increase efficiency

and reduce information overload. -

This customization makes it easier to spot the most critical

data points.

-

The Inherent Challenges of Market Data Aggregation

Market data aggregation is undoubtedly a valuable tool. However, it comes

with its share of challenges. Let’s understand some common ones:

A) Drowning in a Sea of Data

With a constant influx of information from various sources, traders can

become overwhelmed by the sheer volume of data available. This situation can

create a paradox where more data doesn’t always translate to better clarity.

Too much data can:

-

Lead to analysis paralysis

-

Distract traders from their primary objectives and trading

strategies -

Lead to cognitive biases

However, there are solutions, such as:

-

Implement prioritized filtering to focus on key data points and

reduce noise. -

Utilize data visualization tools to condense and represent data in a

more digestible manner. -

Set customized alerts to notify of significant market changes,

preventing constant manual sifting.

B) Navigating the Minefield of Data Integrity

Data integrity is critical, as acting on faulty or inaccurate data can have

severe consequences.

Consider this hypothetical scenario:

-

A trader receives inaccurate financial statements for a company

they’re interested in investing in. -

Acting on this information, they invest a significant sum, only to

discover that the data was erroneous. -

This can lead to substantial financial losses.

How Can Traders Ensure Data Reliability and Accuracy?

-

Double-check the credibility of the data sources.

-

Always use reliable and reputable sources, as they are less likely

to provide erroneous information. -

Compare data from multiple sources to identify inconsistencies or

outliers. -

Ensure that data is up-to-date, as outdated information can be as

detrimental as inaccurate data.

C) Balancing Cost and Value

Market data aggregation tools are expensive. In most cases, you will be

paying the following:

-

Subscription Costs:

-

Many premium data sources charge subscription fees, which can be

a significant financial burden, especially for smaller traders.

-

-

Hardware and Software Expenses:

-

Maintaining the necessary hardware and software for data

aggregation can be costly. -

The need for robust computing power and real-time data feeds can

strain budgets.

-

Note: Traders must perform a cost-benefit analysis to determine whether the

advantages of data aggregation, such as faster decision-making and better

analysis, outweigh the expenses involved.

D) Staying within the Regulatory Lines

The regulatory landscape for financial markets undergoes constant

transformation. Regulators now place heightened emphasis on transparency to

maintain equitable and trustworthy markets. Furthermore, stringent data

protection regulations, including GDPR and CCPA, have elevated the standards

for safeguarding sensitive financial information.

How Can You Remain Compliant?

-

Ensure that your data aggregation practices comply with the latest

rules. -

Navigate various regulatory regimes, in case of cross-border trades.

-

Stay agile and responsive to legal and regulatory changes to avert

potential legal complications.

Making Aggregated Data Visual and Intuitive

Visualizing aggregated data is a powerful way to make sense of complex data.

When it comes to trading, transforming complex datasets into visual

narratives can greatly aid in understanding the market. Let’s understand how

visual elements can help you:

A) Translating Data into Visual Stories

Our brains are wired to process visual information with remarkable speed and

efficiency. Visual elements, such as charts, graphs, and heatmaps, prove to

be more effective in conveying information compared to raw data. They

stimulate both the analytical and creative faculties of the brain,

simplifying the absorption and interpretation of data for traders.

How Do Heatmaps Help?

-

Heatmaps, in particular, serve as a powerful tool for translating

data into visual representations. -

They use color-coding to represent data points, which makes it easy

to identify patterns and trends. -

For instance, a heatmap of stock prices can quickly show:

-

Which stocks are performing well (in green) and

-

Which are underperforming (in red)

-

Additionally, traders can also

customize heatmaps

to align with their specific needs and preferences. This tailoring ensures

that the information presented is relevant to their trading strategies.

B) The Power of Real-time Visual Monitoring

Real-time visualizations allow traders to instantaneously comprehend the

market’s current dynamics, facilitating the swift identification of

opportunities. Let’s understand some advantages of visualizing live data:

-

Immediate Market Insights: Real-time visualizations offer traders

immediate and clear insights into prevailing market conditions. -

Enhanced Pattern Recognition: Visual representations highlight

patterns, trends, and anomalies that might not be as apparent in

numerical data. For example, candlestick charts can reveal price

patterns, while volume charts show trading activity. -

Objective Decision-Making: Visuals provide traders with a clear and

objective view of the market. This can reduce

impulsive decision-making

driven by fear or greed.

C) Detecting the Unusual in the Usual

Visual anomalies in aggregated data can hint at market opportunities or

threats. Here are some tips on how to spot and act on these visual cues:

|

Visual Cue |

How to spot it? |

What do they signal? |

|

Contrasting Colors on a Heatmap |

Look for areas with stark color contrasts. |

These areas signal significant price movements or shifts

|

|

Volume Spikes |

Look for a sudden spike in trading volume, represented |

It signals:

|

|

Breakouts from Trendlines |

Look for price breaking out from a trendline.

|

It signals a change in the established trend. |

|

Irregular Patterns |

Look for unusual patterns on charts, such as:

|

It signals potential reversals or continuations in price |

Conclusion

Market data aggregation has transformed modern trading by changing the way

traders and investors access, analyze, and utilize financial information. It

offers a comprehensive view of the market, enabling traders to monitor

multiple asset classes effectively.

The customization and visualization features of aggregation tools have made

data more accessible and intuitive, enhancing the decision-making process.

While market data aggregation offers numerous advantages, it is not without

its challenges. Some common limitations include data overload, the critical

need for data integrity, and cost considerations.

Nonetheless, it remains an indispensable component of modern trading and

helps traders in numerous ways. Are you eager to explore more on market data

aggregation and its impact on visualization?

Begin your journey and gain access to a platform optimized for in-depth

market insights.

Experience Bookmap’s market data aggregation capabilities now

.