20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Futures

December 7, 2024

SHARE

Micro Futures: A Short Guide

What Are Micro Futures Contracts?

A micro futures contract is simply a smaller version of the same futures contract. For example, the Micro E-Mini S&P 500 contract is 1/10 the size of the classic E-Mini S&P 500.

That means that the minimum fluctuation of 0.25 index points with one micro contract results in a $1.25 change in the value of that contract (whereas the same minimum 0.25 index points fluctuation on the classic contract results in a $12.5 change). You can read more about micro contract specs on the CME Group.

This difference in contract size is perfect for smaller traders with less capital, since it allows for greater control of position sizing. It is considered wise to always use a stop loss, especially when trading leveraged products like futures.

Most traders base their position sizing on their stop loss, but the location of a trader’s stop loss changes based on market conditions; sometimes it is wider from the entry price, and sometimes it is closer. When trying to limit risk to the commonly advised 2% of capital, it is not difficult to see how being limited to whole contract increments can mess up position sizing for a trader with an account balance of a few thousand dollars and an always changing stop loss distance. Micro contracts allow for more flexibility in managing risk, and also have the added benefit of more precise scaling in and out of positions.

Micro contracts are a great place for new traders to start without risking too much capital. There is a difference between trading a demo account and trading real money, and micro contracts are the perfect place to add that ever so important psychological element of risk management, without absolutely paralyzing your decision-making process so you can refine your strategy over time.

As we have previously written about, there are many benefits that smaller traders have in terms of liquidity, and micro contracts are a great addition.

Luckily, the CME offers micro contracts for the E-Minis, Metals, FX, Crude Oil, Treasury Yields, and Bitcoin. Soon there will also be a Micro Ethereum contract.

In addition to the CME’s micro contracts, Tradovate is our newest brokerage partner that offers FairX: a new exchange where not only your futures trading is commission-free, but even your subscription to Bookmap is free! Keep reading to find out more, or visit this page.

The Benefits of Trading Micro Contracts with Bookmap

If you subscribe to the Rithmic CME Market by Order Data Feed with Bookmap, you will have access to all the micro products on the CME. The symbols for all the micro contracts are the same as for the traditional contracts, just with the letter “M” at the front of the ticker. You can find a list of Rithmic’s symbols and month codes here.

Trading with Rithmic on Bookmap will also allow you to utilize the MBO Bundle suite of indicators, including things like Stops & Icebergs On-Chart / Sub-Chart.

The Same Order Flow Phenomena

The micros display the same order flow phenomena as the classic contracts: stop runs, absorption, exhaustion, aggressive buying and selling etc.

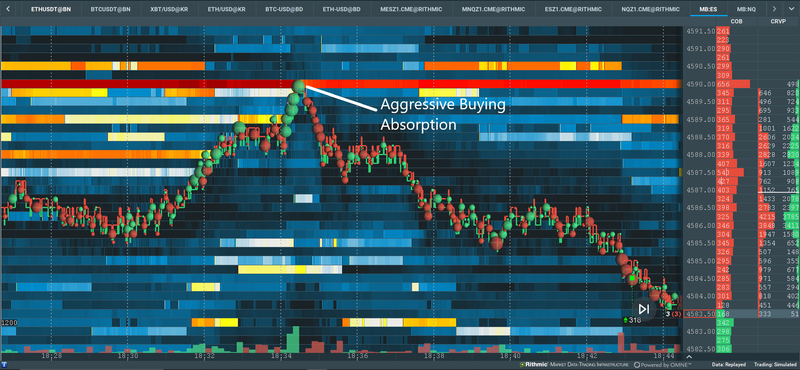

Fig 1 – An example of a buy stop run into liquidity being absorbed and leading to a price reversal.

In Figure 1, we can see a combination of such phenomena on the Micro ES chart. A buy stop run into large offers liquidity at 4590.00 is absorbed, and prices reverse, eventually leading to the triggering of sell stops on the way down.

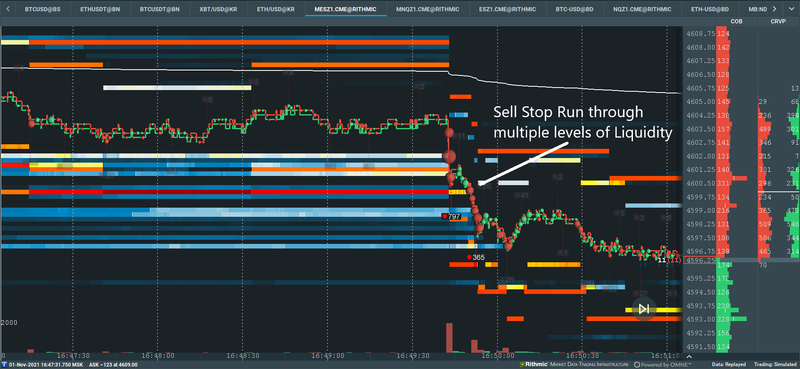

Fig 2 – A Sell Stop Run sends prices through multiple layers of Bids.

Using the MBO indicators can give you insights into what is moving price. In figure 2, we can see that the break lower through multiple layers of large liquidity was caused by a large sell stop run.

Of course, the micro contracts have micro volumes. If you want to see a combination of the traditional and the micro volumes in a single heatmap, you can use Multibook Customizer.

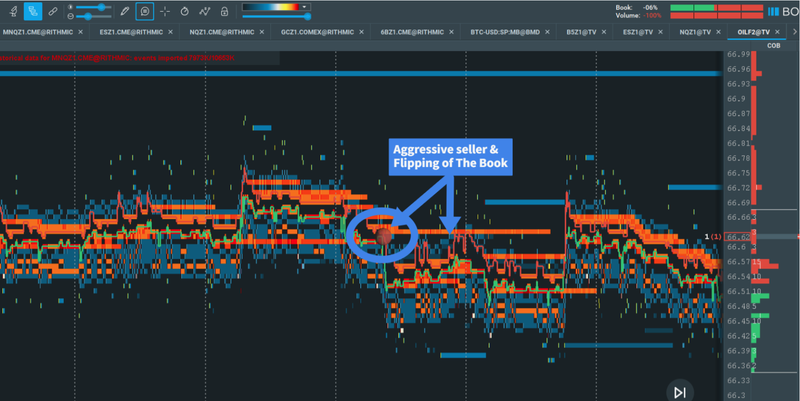

Fig 3 – A Multibook of MES and ES shows aggressive buyers being absorbed by Offers, which are combined visually into a synthetic instrument with Multibook.

In figure 3, we can see how a synthetic Multibook instrument of the combined volume and liquidity of MES and ES shows clear buying absorption on the offers, leading to a price reversal. Combining these two instruments can give you more insights into the order flow of each, and increase both the quantity and quality of trading opportunities that may be missed when only looking at a single instrument.

Fig 4 – An example of the classic Flipping of The Book on Fairx’s new Micro Crude Oil contract.

Figure 4 shows another example of a very common order flow phenomenon, in this case a “book flip”. Even the newest instruments available on the market, such as Fairx’s Micro Crude Oil contract, display classic order flow behaviour visible on the Bookmap heat. To see more such examples, visit our Insights page—a library of Bookmap charts collected from our vastly experienced trading community.

If you prefer to view the larger product but want full control over your position sizing, you could utilize Bookmap’s Cross-Instrument Trading to view the order flow on the larger instrument, but send your trades through the micro contract.

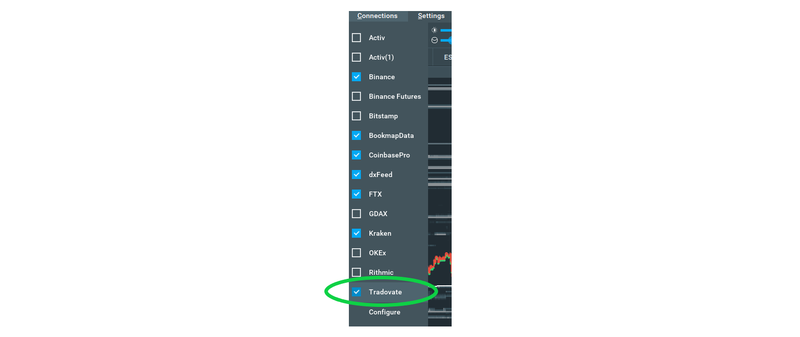

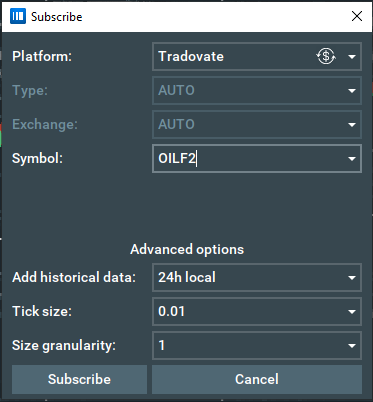

To enable cross-trading for FairX, please follow these instructions:

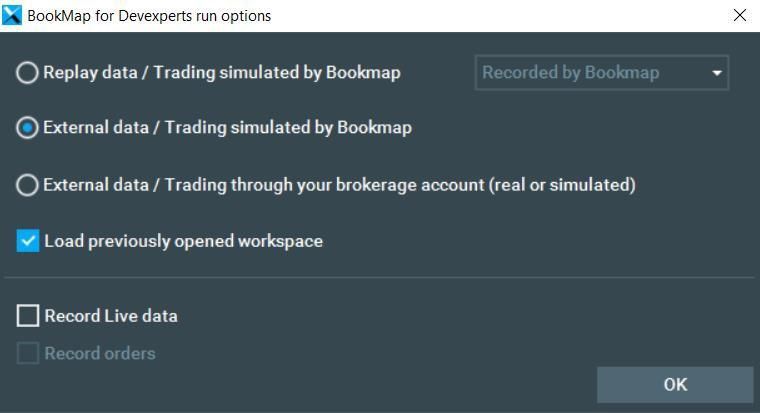

1. Start Bookmap in the 3rd mode.

2. Connect to Tradeovate.

3. Subscribe to a FairX instrument.

4. Choose the instrument you want the trades to be sent to (#17 on the image). For example, if you want to trade crude oil, then type OIL (the symbol on FairX) and the expiry date code.

3. Place an order or trade while looking at any chart you want, and it will be sent to Tradeovate. For example, if trading OIL on FairX, then it would be a good idea to watch the order flow of the CL contract on the CME, but trade on FairX to take advantage of the lack of fees. Once you’ve sent an order or trade, you will immediately see it on Tradeovate as well as on Bookmap.

INTRODUCING

FairX’s New Micro Crude Oil Contract: More Affordable Futures

FairX – new exchange that now offers ZERO exchange fees, ZERO market data costs, and ZERO broker commissions. Best of all, when you trade with FairX, your Bookmap subscription is free!

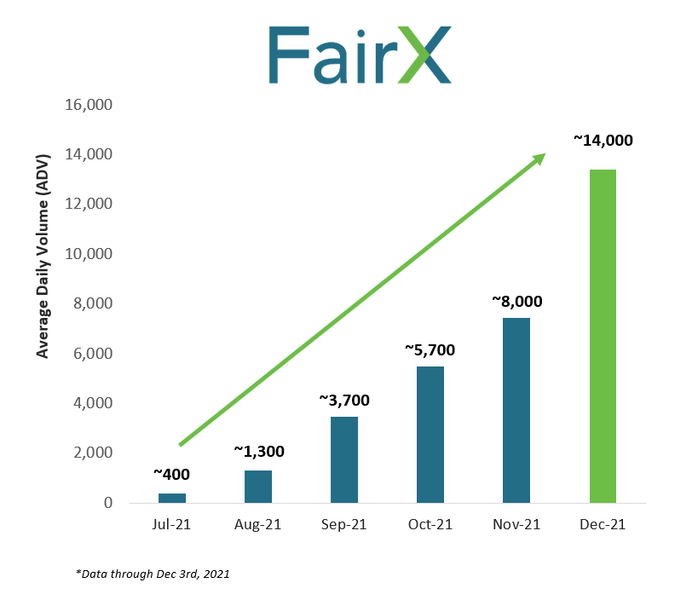

Rising Volumes

The contracts are already gaining traction, with the average daily volume of the entire exchange so far growing +4,500% since its launch in the summer of this year.

This means that even though these contracts are fairly new, they are relatively liquid, with the Nanos and Crude Oil contracts offering spreads of just 1 tick.

This is the perfect addition to Bookmap, a platform that is designed to increase the edge of all traders.

Wrapping It All Up

If you’re a new trader, a smaller trader, or even an experienced trader looking to test out a new strategy, micro contracts are a great place to start. Bookmap offers two options for trading micro contracts through the platform: on the CME with Rithmic, or on the newly born FairX exchange, both with their own unique advantages.

A trader that wants to access the full potential of the advanced suite of MBO indicators would go with Rithmic, whereas a trader that is looking to really minimize costs should go with commission-free FairX, which even offers Nano contracts, which are even smaller.

Either way, Bookmap has you covered. Start today for free.