Ready to see the market clearly?

Sign up now and make smarter trades today

Trading Basics

July 18, 2024

SHARE

Navigating Economic Storms: Deciphering the Bond Market in Times of Uncertainty

In an era where economic forecasts feel more like guessing games, how can investors find a safe harbor in the bond market? By understanding interest rate cycles and geopolitical events, bond investors can maximize their returns and protect their capital.

In an era where economic forecasts feel more like guessing games, how can investors find a safe harbor in the bond market? By understanding interest rate cycles and geopolitical events, bond investors can maximize their returns and protect their capital.

This article aims to build an in-depth understanding of the bond market by exploring its behavior, bond types, and other key fundamentals. From the Great Depression to the 2008 Financial Crisis, we’ll study several key historical moments that significantly affected the bond market.

Also, we will learn about the different types of yield curves and some proven risk management strategies, such as diversification, portfolio management, and staying informed. Let’s get started.

An Overview of the Bond Market

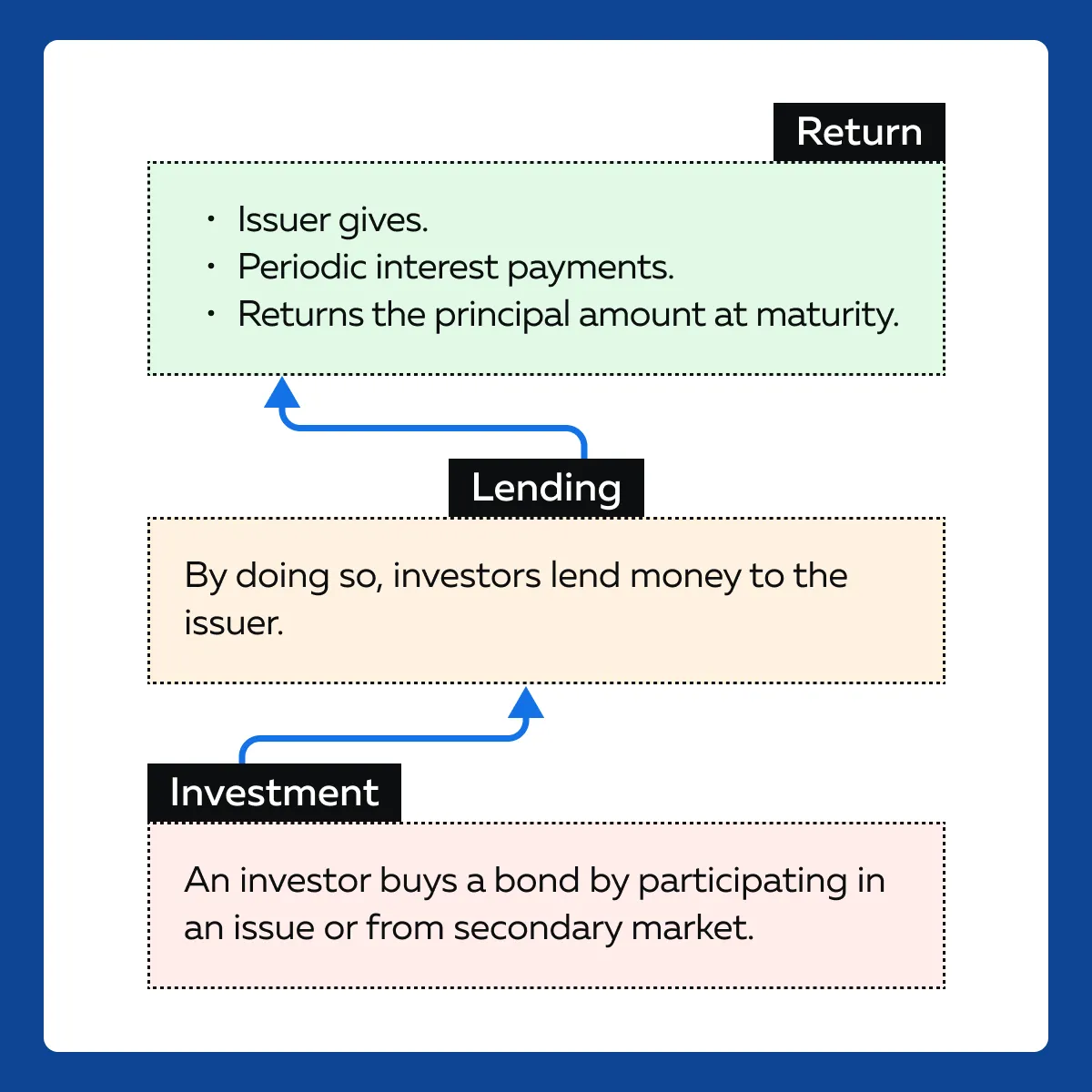

Bonds are debt instruments issued by governments, municipalities, corporations, and other entities for growing capital. They typically have a predetermined maturity date, ranging from a couple of months to several years.

The bond market plays a crucial role in facilitating borrowing and lending activities across various sectors. They help entities raise funds for various purposes, such as infrastructure projects, expansion initiatives, or funding government operations.

On the other hand, bonds offer investors a relatively stable source of income through periodic interest payments. They are often regarded as a safer form of investment compared to stocks, as they have a:

- Fixed income stream and

- Defined repayment schedule.

What is the Structure of the Bond Market?

The bond market is decentralized and consists of both primary and secondary markets:

| Primary Market | Secondary Market |

|

|

How Important is the Bond Market?

- Capital Formation

-

-

- The bond market facilitates the efficient allocation of capital.

-

- It channelizes savings into productive investments.

-

-

- A well-functioning bond market is essential for economic growth and development.

-

- Risk Management

-

- Bonds offer diversification benefits to investors.

- It counterbalances the high investment risk accompanying the instability of stocks.

- Also, bonds stabilize portfolio returns, particularly during periods of market volatility.

Bond Market Behavior in Uncertain Times

Economic uncertainty is often characterized by factors such as:

- Inflation,

- Interest rate changes, or

- Geopolitical instability

These factors significantly impact the bond market by shifting investor sentiment and economic expectations. Let’s see how:

Inflation

| Impact on Bond Prices | Flight-to-Quality |

|

|

Interest Rate Changes

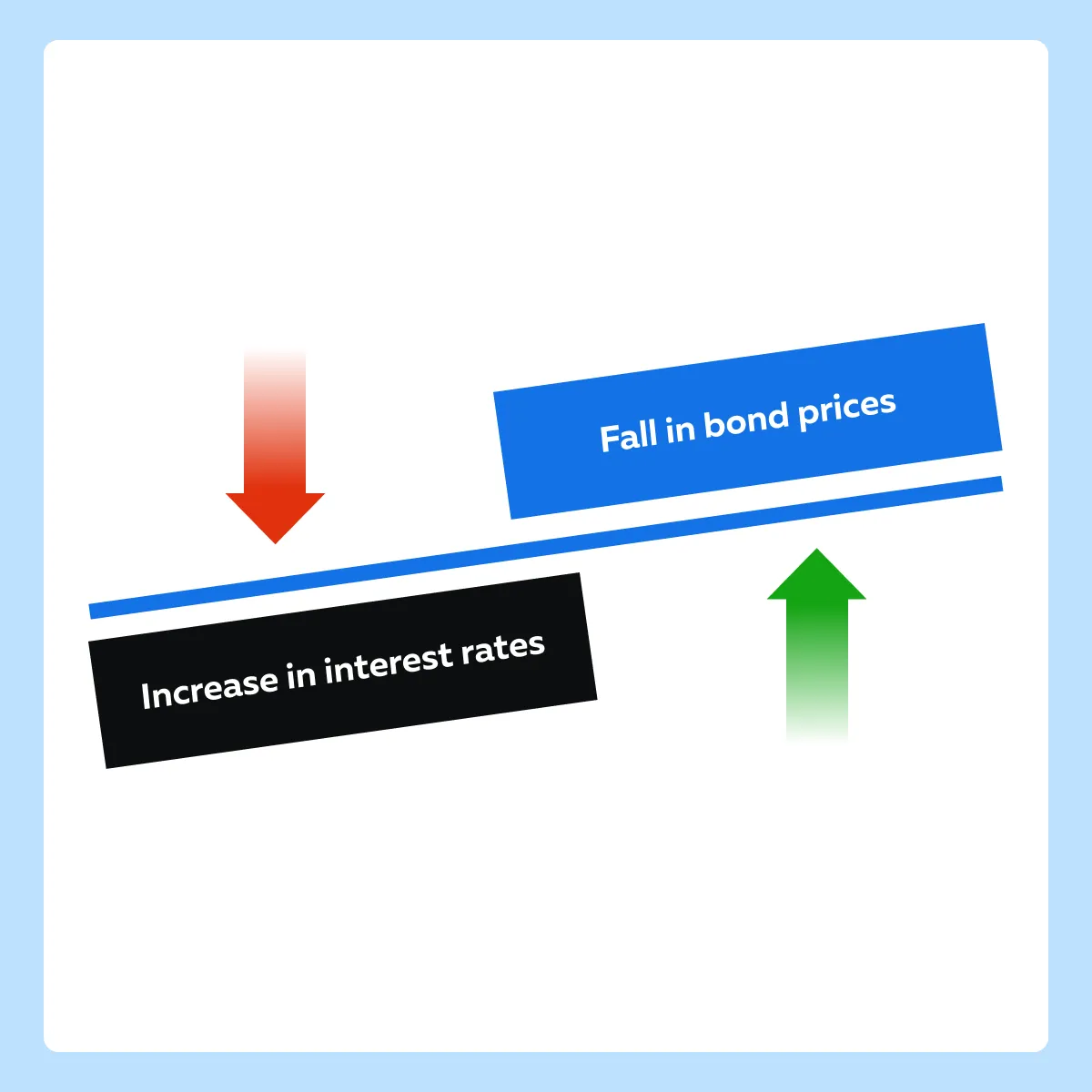

Bonds and interest rates have an inverse relationship because existing bonds with lower coupon rates become less attractive compared to new bonds issued at higher rates.

Also, significant interest rate changes lead to shifts in the yield curve. For example, if short-term interest rates rise more than long-term rates, the yield curve flattens or even inverts.

Geopolitical Instability

Owing to geopolitical tensions or uncertainties, investors move their capital into safe-haven assets like government bonds. This shift drives up bond prices and lowers yields.

Also, it must be noted that bonds issued by countries or regions facing geopolitical risks experience higher yields. This is usually done to compensate investors for the perceived risk of:

- Default or

- Economic instability.

Impact on Investor Strategies

Economic volatility profoundly affects investor approaches within the bond market. Most of them:

- Adjust their asset allocation,

- Increase their focus on quality and duration, and

- Use bonds to hedge against uncertainty.

Let’s understand this in detail.

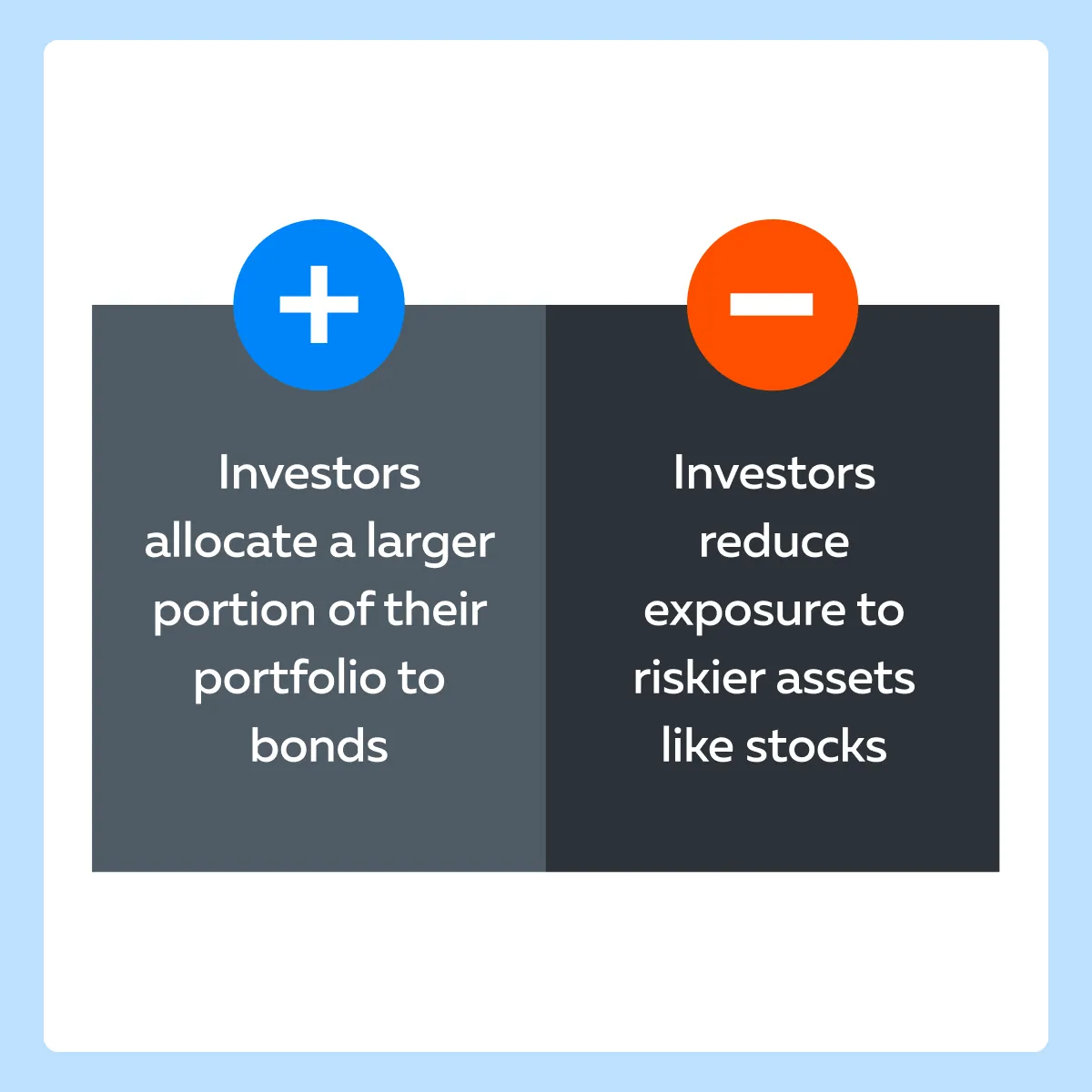

Asset Allocation Adjustments

Bonds are perceived as safer investments due to their:

- Fixed income streams and

- Relative stability compared to equities.

Investors’ strategies during periods of economic volatility:

Aiming to benefit from diversification, investors increase their allocation to a diverse range of bonds, including:

- Government bonds,

- Investment-grade corporate bonds, and

- Municipal bonds.

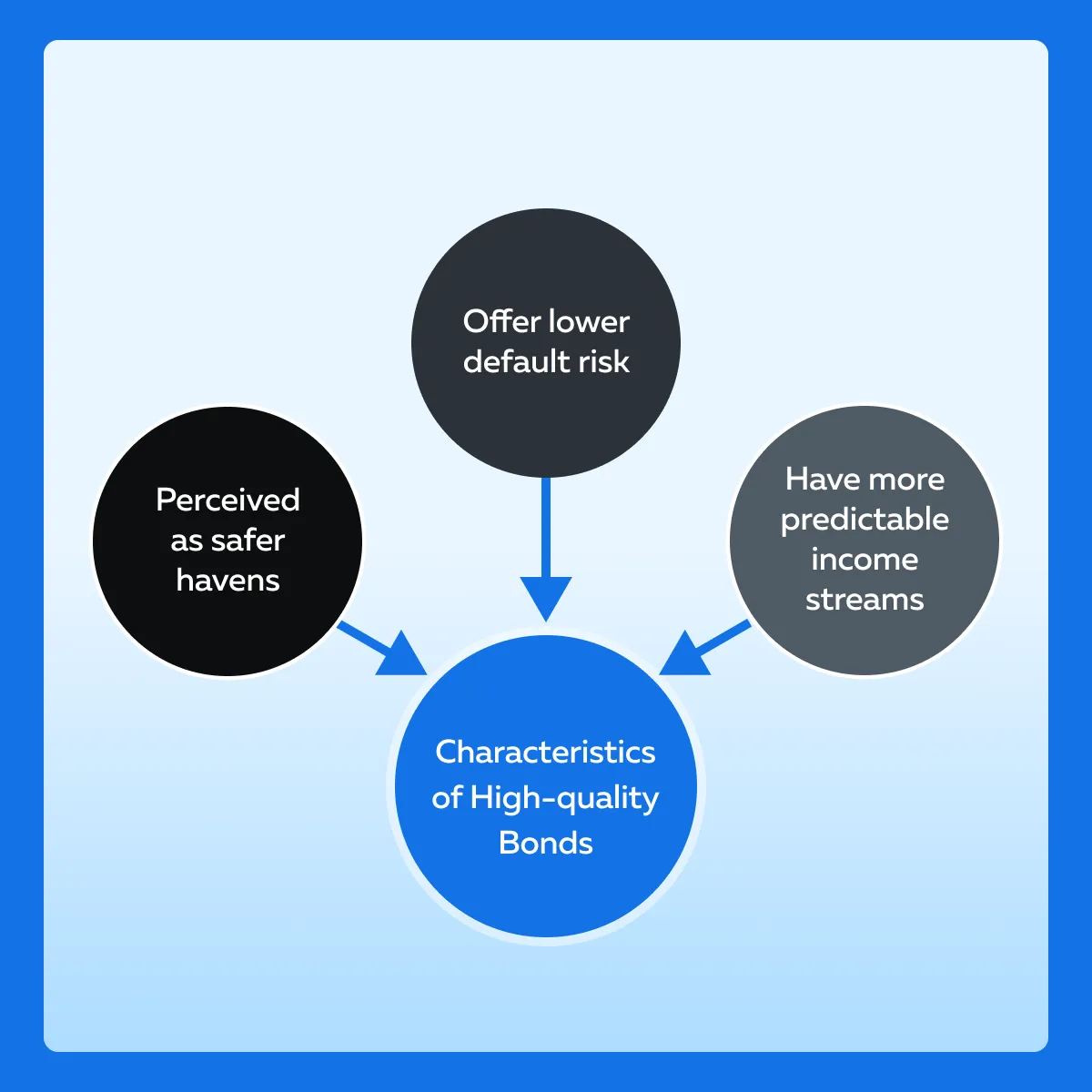

Focus on Quality and Duration

In uncertain times, investors prioritize high-quality bonds. These are mostly issued by:

- Financially stable entities or

- Governments with strong credit ratings.

Investors often adjust the duration of their bond portfolios to mitigate interest rate risk. In anticipation of rising interest rates, they shorten the duration by investing in:

- Shorter-maturity bonds, or

- Bonds with adjustable interest rates.

Strategic Use of Bonds as Hedge

Bonds serve as a hedge against economic uncertainty and market volatility. They help investors to preserve capital during turbulent market conditions. This is because certain types of bonds, such as U.S. Treasuries, exhibit an inverse correlation with equities. When stock prices decline, bond prices rise as investors seek safety.

Yield Curve Analysis

Yield curve analysis helps to:

- Assess future economic conditions and

- Make informed investment decisions.

By examining the shape and shifts of the yield curve, investors can determine:

- Interest rate expectations,

- Inflationary pressures, and

- Overall market sentiment.

Let’s understand this better:

| What is a Yield Curve?

A yield curve provides a pictorial representation of interest rates, that is yields of bonds, charted against their respective maturity dates. It has three types: |

||

| Normal Yield Curve | Inverted Yield Curve | Flat Yield Curve |

|

|

|

How Does Yield Curve Analysis Help Bond Investors?

- Interest Rate Expectations

-

-

- Yield curve analysis provides insight into market expectations regarding future interest rates.

- A steepening yield curve suggests anticipation of:

- Higher inflation or

- Economic growth.

- Whereas, a flattening or inverted yield curve signals expectations of interest rate cuts by central banks.

-

- Inflationary Pressures

-

-

- Changes in the shape of the yield curve show shifts in inflation expectations.

- Expectations of rising inflation often lead to a steeper yield curve.

- This happens as investors demand higher yields to compensate for the eroding purchasing power of future bond payments.

-

- Market Sentiment and Risk Perception

-

- The yield curve serves as a barometer of investor sentiment and risk perception.

- Inverted or flat yield curves indicate:

- Uncertainty and

- Economic instability.

- This shape guides investors to seek safer assets like government bonds.

How Does Yield Curve Analysis Impact Investment Decisions?

- The yield curve guides investors to adjust the duration and composition of their bond portfolios.

- Investors use yield curve analysis to:

- Manage interest rate risk and

- Position their portfolios defensively against potential market downturns.

- Changes in the yield curve shape provide signals for market entry or exit points.

Government Bonds vs. Corporate Bonds

The choice between government and corporate bonds depends on investors’:

- Risk tolerance,

- Investment objectives, and

- Economic outlook.

Government bonds offer security and stability, whereas corporate bonds provide higher potential returns albeit with a greater credit risk. Let’s understand them in detail.

Risk and Return Profiles

| Parameters | Government Bonds | Corporate Bonds |

| Issuer | Government bonds are issued by sovereign entities, such as:

|

Corporate bonds are issued to raise capital for various purposes, such as:

|

| Risk Profile | Government bonds have low risk due to the high creditworthiness of sovereign issuers. | Corporate bonds carry higher credit risk. Corporate bond issuers can default on their debt obligations if they face:

|

| Return Profile |

|

|

| Investor Behavior |

|

|

How Investor Behavior Influences the Choice?

Investor behavior during economic uncertainty reflects a delicate balance between seeking safety and stability, while also pursuing higher returns. Let’s understand how investors consider the risk-return profile and make an informed choice between government and corporate bonds.

When to Choose Government Bonds?

- Safety and Predictability

-

- During periods of economic uncertainty, investors prioritize safety and capital preservation.

- Government bonds have:

- Minimal default risk and

- Offer stable returns.

- Investors looking to safeguard their investments against market volatility allocate a significant portion of their portfolios to government bonds.

When to Choose Corporate Bonds?

- Higher Returns

-

-

- Investors willing to accept higher levels of risk in pursuit of higher returns choose corporate bonds.

- During economic uncertainty, some investors anticipate an eventual economic recovery.

- They view corporate bonds as an opportunity to earn better yields, once market conditions stabilize.

-

- Diversification Benefits

-

- Corporate bonds offer diversification benefits to investors.

- By including them alongside government bonds, investors achieve a more balanced risk-return profile.

How Can You Align Investments Based on Economic Situations and Your Risk Tolerance?

| Alignment Based on Risk Tolerance | Alignment Based on Economic Situations |

|

|

Case Studies & Historical Analysis

To gain a better understanding, let’s explore some key historical events and their impact on the bond market:

| Event | Impact | Market Response |

| The Great Depression (1929-1939) |

|

|

| Volcker Shock (1979-1982) |

|

|

| European Debt Crisis (2010-2012) |

|

|

Example: 2008 Financial Crisis

The collapse of the subprime mortgage market in 2008 triggered a widespread financial crisis. This event was characterized by:

- Bank failures,

- Credit freezes, and

- Severe economic downturn.

Central banks cut down interest rates and implemented quantitative easing to stabilize financial markets.

Impact on the Bond Market

| Government Bonds | Corporate Bonds |

|

|

Lessons Learned

- Diversification: This event shows the importance of diversifying portfolios across asset classes for risk mitigation.

- Role of Government Bonds: The government bonds acted as a haven and showed stability as well as liquidity during crises.

- Corporate Bond Risks: The 2008 downturn showed the vulnerability of corporate bonds to financial stress, thereby prompting investors to consider careful credit analysis.

Investor Considerations and Risk Management

Most successful investors manage risk and capitalize on the opportunities offered by the bond market. Let’s see how you can do it:

Through Diversification

- Spread investments across a variety of bond types, including:

- Government bonds,

- Corporate bonds,

- Municipal bonds, and

- International bonds.

- Reduce concentration risk by diversifying across varied sectors and industries.

- Allocate assets across bonds with varying maturities to balance:

- Income generation and

- Interest rate risk.

Let’s understand the concept of diversification better through a hypothetical example:

The Scenario

An investor, Sarah, wants to build a bond portfolio that balances risk and return. She understands the importance of diversification. She aims to spread her investments across various types of bonds and sectors.

The Diversification

| Diversification Across Bond Types | Diversification Across Sectors |

| Government Bonds: Sarah allocates a portion of her portfolio to government bonds issued by stable economies like the United States, Germany, and Japan. | Industrial Sector: Sarah invests in corporate bonds issued by companies in the industrial sector, such as manufacturing or construction firms. |

| Municipal Bonds: Sarah invests in municipal bonds issued by state or local governments so that she can add tax-exempt income to her portfolio. | Financial Sector:

|

| Corporate Bonds: Sarah includes corporate bonds issued by companies across different sectors, such as industrials, financials, and technology. | Technology Sector: To add growth potential to her portfolio, Sarah allocates a portion to corporate bonds issued by technology companies. |

The Benefits Achieved

- Sarah was able to limit the effect of any single bond’s poor performance on her overall portfolio.

- She was able to ensure a steady stream of income from various sources which provided her stability during market fluctuations.

- Diversification reduced the portfolio’s vulnerability to adverse market events.

Understand Bond Fundamentals:

- Conduct exhaustive research on individual bonds or bond funds prior to investing.

- Evaluate credit quality by examining:

- Issuer financials,

- Credit ratings, and

- Debt ratios

- Examine the bond’s duration and sensitivity to changes in interest rates.

- Be aware that longer-term bonds are more prone to interest rate risk.

- Pay attention to yield curve dynamics and inflation expectations to understand future interest rate movements.

Stay Informed

- Be aware of market and economic developments via credible sources such as:

- Financial news outlets,

- Economic indicators, and

- Central bank announcements.

- Monitor geopolitical events and policy decisions that could affect bond markets, such as:

- Changes in monetary policy

- Fiscal stimulus measures, or

- Trade tensions.

- Keep an eye on credit spreads and market sentiment indicators.

Actively Manage Portfolio

- Conduct a periodic review and rebalance of the bond portfolio to ensure that it aligns with the dynamic market conditions and investment objectives.

- Consider employing active management strategies, such as tactical asset allocation or sector rotation, to capitalize on market inefficiencies and optimize returns.

- Ensure that you are prepared to adjust your investment strategy based on ever-changing economic trends, interest rate expectations, and geopolitical risks.

Manage Risk

- Set clear investment objectives.

- Establish risk tolerance levels to guide portfolio construction.

- Implement risk management techniques, such as:

- Stop-loss orders or

- Hedging strategies.

- Diversify across asset classes, including:

- Equities,

- Fixed income, and

- Alternative investments.

Why Understanding Bond Fundamentals Is Crucial?

Investors having a deeper understanding of bond fundamentals can manage their bond portfolios effectively. Let’s explore three key bond fundamentals and how investors can use them:

| Bond Fundamentals | Definition | Importance | Decision-making |

| Credit Ratings |

|

|

|

| Yield-to-Maturity (YTM): |

|

|

|

| Interest Rate Risk |

|

|

|

Why Staying Informed is Important?

Changes in economic conditions, monetary policy, and geopolitical events significantly impact the bond market. Thus, traders need to stay informed and make better trading decisions. Let’s see its importance in detail

- Timely Decision Making

-

-

- By understanding the latest trends and news, investors can:

- Anticipate market movements and

- Accordingly modify their bond portfolios.

- By understanding the latest trends and news, investors can:

-

- Risk Management

-

-

- Awareness of market developments enables investors to identify potential risks and opportunities.

- The focus must be laid on tracking:

- Changes in interest rates,

- Credit spreads, and

- Geopolitical tensions.

-

- Opportunity Identification

-

- Market and economic information reveal investment opportunities that arise due to:

- Mispricing or

- Market inefficiencies.

- By staying informed, investors can capitalize on these opportunities and enhance portfolio returns.

- Market and economic information reveal investment opportunities that arise due to:

How to Stay Informed?

| Use of Reliable Sources | Access to Advanced Tools |

|

|

Conclusion

For bond market investors, strategic planning and flexibility are paramount. They must strategically allocate assets and diversify to manage portfolio risk. Also, investors must stay informed about the market and economic developments to anticipate trends and identify opportunities.

Dynamic market conditions demand flexibility. Economic uncertainty, interest rate fluctuations, and geopolitical events can impact the bond market unpredictably. So, investors must demonstrate flexibility by regularly updating their portfolios as per the changing market dynamics.

Continue your exploration of market dynamics and investment strategies by reading our in-depth analysis of market data feeds, their types, providers, and benefits. Discover how access to reliable market data can enhance your decision-making process in the ever-evolving financial landscape. Read more here.