Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 15, 2025

SHARE

NFP (Non-Farm Payrolls) June Report: How Traders Can Prep

It’s the NFP day –

Trader: “Alright, Market. Be gentle today. I’ve got my coffee, my Bookmap’s loaded, and I’m not in the mood for drama.”

Market: “Drama? Oh, buddy! It’s NFP day. You better strap in.”

Trader: “C’mon, the forecast looks tame. Nothing wild, right?”

Market: “Bam! 100k surprise beat.”

Trader: “Wait! That spike can’t be real. There’s no liquidity behind it. Algos are playing games again!”

Market: “Exactly. The amateurs chase, and the pros wait. What will you do?”

Did this conversation sound familiar? Isn’t this something that happened the last time with you? Please realize the Non-Farm Payrolls (NFP) report isn’t just another economic release! Traders around the world watch it closely, not just for the numbers but for the volatility that follows.

One unexpected print, and futures, forex, and equities can move wildly within seconds. But do you also chase the headline move? If so, you are missing the real opportunities that lie beyond the initial chaos. In this article, we will study the common market behavior around NFP, how to trade volatility using order flow, and the patterns that repeat month after month. We will also tell you how our advanced market analysis tool, Bookmap, can let you see true liquidity, volume, and market reactions. Read this article till the end to trade confidently on June 7.

Why NFP Is a High-Impact Event for Traders?

The Non-Farm Payrolls (NFP) report measures how many jobs were added or lost in the U.S. (excluding the farming sector). This report is a key indicator of economic health. It directly influences expectations around interest rate changes by the Federal Reserve. Let’s see how it is interpreted:

Thus, most traders watch the release closely to adjust their positions in:

- Futures like:

- ES (S&P 500)

and

- NQ (Nasdaq),

- USD forex pairs, and

- U.S. Treasury bonds like ZB and ZN.

Want to track shifts in liquidity with ease? You can start using our avant-garde market analysis tool, Bookmap. Using it, you can monitor NFP order flow and catch immediate reactions. Please note that non-farm payroll trading requires speed and precision. That’s because price movements can be aggressive within seconds of the report going public.

Typical Market Behavior Around NFP Releases

Non-farm payrolls trading days are known for unpredictable price action. The market structure changes quickly before and after the data drop. This happens because liquidity shifts and order flow become more aggressive.

As a trader, you can rely on Bookmap news trading to react professionally. Let’s understand in detail how the market usually reacts around the NFP releases:

Liquidity Thins Pre-Release

About 5 to 10 minutes before the NFP release, institutional traders remove their resting orders. They do so to avoid getting caught in extreme volatility. This creates “air pockets.” In these pockets/ areas, there is low liquidity. As a result, even small market orders lead to sharp price moves (due to little resistance).

As a trader performing NFP order flow analysis, this thinning is a signal to:

- Stay cautious

and

- Wait for better confirmation.

Avoid common traps on NFP volatility—learn to track order flow in real-time.

Initial Whipsaw Moves

Right after the NFP numbers hit:

- The market reacts violently in one direction

and

- Then, suddenly snaps back.

This whipsaw action happens because traders react quickly to the “headline number” and do not 100% review the full report. Hence, the initial move is not the real one. Check out the graphic below to learn what factors shift true sentiment in non-farm payrolls trading:

Liquidity Rebuild and Real Direction Formation

A few minutes after the release (usually between 2- 5 minutes), the market starts to settle! By this time, the traders have analyzed 100% of the NFP data. As a result, liquidity begins to return as large bids and offers reappear. The real move often takes shape here.

In this phase, you must watch the NFP order flow. It lets you spot:

- When buyers absorb the supply

or

- When sellers are capping the price.

Through Bookmap news trading, you can easily visualize this liquidity rebuilding. This allows for better entry with clearer direction. See real-time liquidity shifts on NFP day with Bookmap’s heatmap.

How to Trade NFP Volatility Using Order Flow?

In non-farm payrolls trading, you don’t just react to the headline number! Instead, you must understand market expectations versus the actual result.

This can be done by analyzing the order flow. Through this analysis, you can spot how the market repositions once the data is fully digested. Our Bookmap’s news trading tools can let you visualize these reactions in real-time.

Let’s learn how you can trade NFP volatility:

Step 1: Start With the Context — Not the Chart

Before looking at technical levels or placing trades, you must understand what the market was expecting from the NFP release. To gain this understanding, you can use platforms like Forex Factory or Econoday. While analyzing, look at these three key things:

- The forecast (expected job additions),

- The previous number, and

- Why this month’s data matters in context.

For example:

- Analysts expect 170,000 new jobs.

- The number comes in at 250,000.

- Now, the market may view it as “too hot.”

- It could lead to speculation about delayed Fed rate cuts.

- However, in a soft-landing environment, the same number might be seen as a sign of strength.

This is why NFP order flow and macro context go hand-in-hand! Always remember you’re not just trading numbers but the story they tell in the current environment.

Step 2: Prepare Key Zones, But Stay Flexible

Before the NFP release, you should mark these four important price zones:

Please note that these price zones attract strong reactions. However, don’t get locked into those levels. If the NFP report is a big surprise (either much stronger or weaker than expected), those pre-marked zones might get blown through instantly.

That’s where Bookmap news trading comes in handy! Using our advanced market analysis tool, Bookmap, you can see how liquidity and NFP order flow shift in real time. Rather than guessing direction, you can set alerts and focus on how traders react once the data is out.

Step 3: Read the Initial Reaction — Then Wait

Right after the NFP release, the market reacts sharply. But this first spike is usually emotional. It occurs because of:

- Headline numbers

and

- Fast-reacting algorithms.

In non-farm payrolls trading, this early volatility is misleading. So, it is always wise to avoid trading in the first minute. Instead, you must focus on:

- The NFP order flow

and

- Where liquidity starts to return.

Again, via Bookmap news trading, you can check if large buy or sell orders appear at key levels. For example:

- Say the NFP data comes in weak.

- The market drops sharply.

- However, you observe on our market analysis tool, Bookmap, that strong bids start stacking just below the lows.

- This signals that buyers are stepping in and a reversal is forming.

Such an observation on our modern real-time market analysis tool, Bookmap, lets you avoid false moves.

Step 4: Confirm With Order Flow, Then Enter

Once the initial NFP volatility calms (usually within 2 to 5 minutes), you must look for confirmation before entering a trade. This is when non-farm payrolls trading becomes more about skill than speed. Through Bookmap news trading, you can read the market’s structure clearly.

Let’s see how:

- Start by checking if price, liquidity, and volume are working together:

- Our Bookmap’s heatmap shows where strong resting orders are building (which may support a new trend)

and

- Our Bookmap’s volume dots reveal aggressive buying or selling (key signs that traders are serious at those levels).

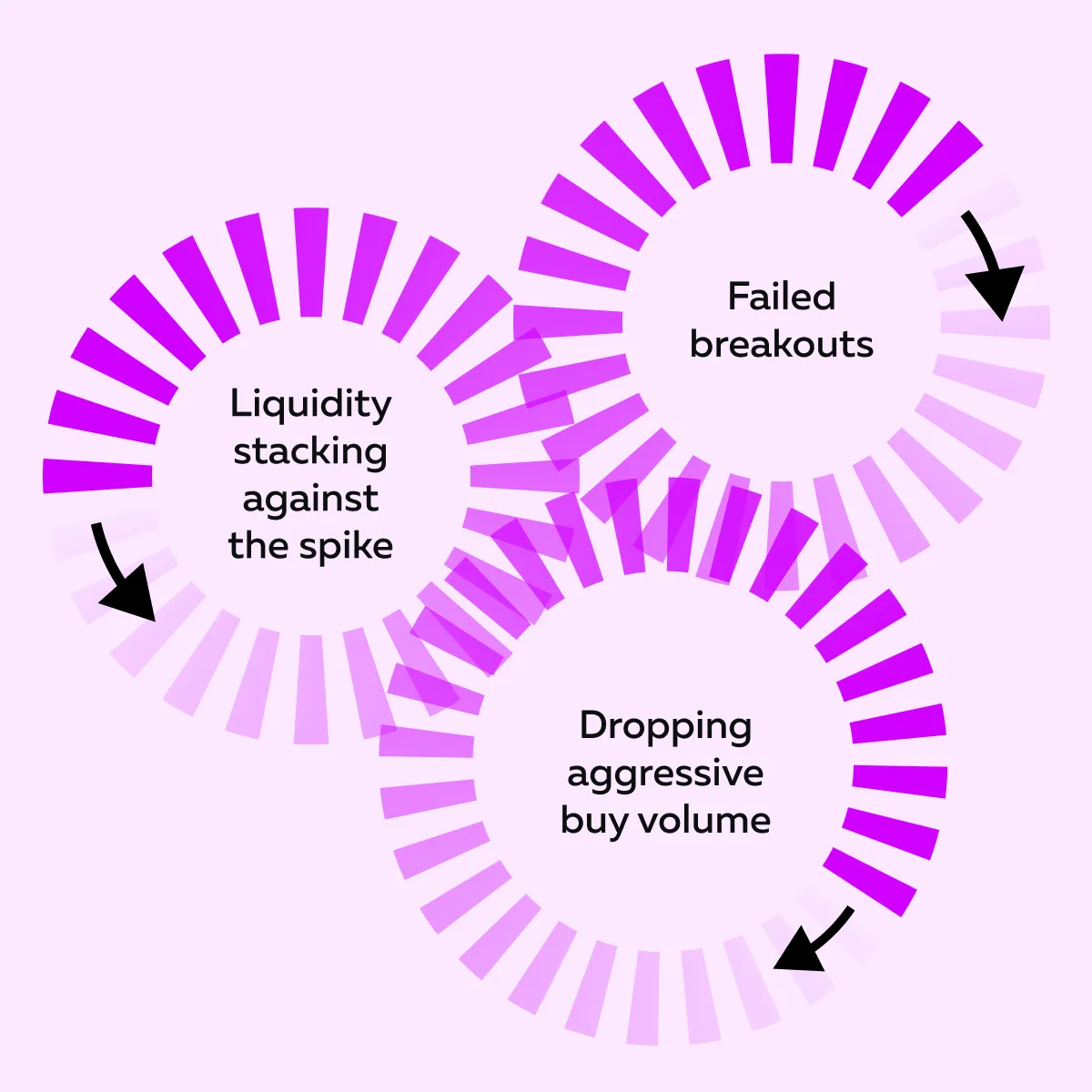

- Next, look for signs like:

- Absorption, where large players take the opposite side of a move without letting the price go further.

- Liquidity stacking, where thick buy or sell walls hold firm during repeated tests.

- Failed breaks are when the price pushes through a level but quickly pulls back (signals weakness or exhaustion).

Remember always to keep position size small and risk tightly managed. That’s because, on NFP days, sentiment can flip fast.

Past NFP Behavior: Common Patterns to Watch

Each non-farm payrolls release behaves a little differently! However, some price patterns often appear (particularly once traders digest the full report). These patterns are clearly visible on our market analysis tool, Bookmap. Let’s study them:

Pattern 1: The Initial Fakeout and Reversal

One of the most common NFP patterns is a sharp move in the first 30–60 seconds. It is usually a breakout above or below a key level. But instead of continuing, the move quickly loses strength and reverses.

Why does this happen? As mentioned before, early reactions are due to headline numbers like total jobs added. However, once traders notice weak spots (like poor wage growth or negative revisions to prior data), the tone changes.

For example:

- NFP might print a strong +275k.

- As a result, ES futures initially jump.

- But if last month’s jobs were revised lower and wages came in soft, sellers quickly stepped in.

- You’ll often see offers stack above price, and aggressive selling increases.

Want to spot a reversal before the broader market catches on? Watch for these signs:

Pattern 2: Deep Dip, Then V-Shaped Reversal

This is a powerful non-farm payrolls trading setup. In this setup:

- The market initially drops on weak data

but

- Later, it quickly finds its footing and reverses sharply.

For example:

-

- Say the NFP print shows just +90k jobs (a miss).

- In response, the S&P futures fall hard.

- But within minutes, buyers step in.

- As a result, liquidity stacks below price, and NFP order flow shifts to aggressive buying.

- Traders interpret the weak data as a sign that the Fed might cut rates sooner.

- This triggers a “risk-on” rally in assets like tech stocks.

- Now, on our market analysis tool, Bookmap, you will spot:

- Large bid walls near the lows,

- Strong buy volume, and

- Price holding higher on each retest.

- Through Bookmap news trading, you can visualize this transition clearly.

Pattern 3: Range Chop After a Neutral Print

Sometimes, the NFP report is close to expectations! There are no surprises in wage growth or participation rate. This usually leads to muted market behavior (brief spikes followed by hours of sideways chop).

For example:

-

- The forecast is +180k, and the result is +185k.

- Now, traders see no strong reason to reposition.

- Thus, the price hovers near VWAP or the previous day’s close.

- Also, there is low volume and no conviction.

- You’ll notice repeated failures to break pre-marked levels.

- Moreover, you will observe tight liquidity clustering.

Please note that in these cases, NFP order flow confirms that neither buyers nor sellers have a clear edge.

Conclusion

Want to earn big? By trading the NFP release, you can exploit profitable opportunities. However, the real edge lies in patience and clear decision-making. Instead of trying to guess the first spike, you must wait for liquidity and volume to confirm the real direction.

You must realize that non-farm payrolls trading is all about reacting to what the market does and not what you think it will do. By using our modern real-time market analysis tool, Bookmap, you can see where orders are stacking, where volume is hitting, and whether the move has real support.

Such an observation lets you avoid fakeouts and take part in more reliable setups. Want to prepare for the next release on June 7? Study past NFP market behavior with Bookmap’s replays and sharpen your edge.

FAQ

1. What time is the June NFP report released?

The June NFP report will be released on June 7 at 8:30 AM ET. This time is important for traders like you, as it marks when the U.S. government publishes the jobs data.

Be aware that this data will influence market sentiment and reactions.

2. Why is NFP important for traders?

NFP directly impacts the Federal Reserve’s decisions on interest rates. A strong or weak jobs report usually leads to immediate market movements across different assets, such as:

- Futures,

- Forex, and

- Stocks.

3. How does order flow help during NFP trading?

Using order flow, you can see when real buyers and sellers step in. After the initial emotional reaction to NFP, order flow confirms the true market direction. It lets you avoid getting trapped by false moves.

4. What’s a common mistake traders make during NFP releases?

A common mistake is chasing the first spike. You must not react impulsively to the headline number without waiting for confirmation from order flow. Such impulsive reactions can let you get caught in a reversal when the market settles.

5. How can Bookmap help on NFP day?

Our modern real-time market analysis tool, Bookmap, shows liquidity levels and volume in real time. It allows traders to track where orders are being placed. During NFP volatility, it highlights areas of support or resistance. This lets you avoid traps and identify the true market direction.