Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

July 18, 2024

SHARE

Redefining Boundaries: Blockchain’s Impact on Asset Trading and Security

Tech moves forward; follow or lag. Technology has truly transformed our trading lives, including how we trade assets and ensure the security of those trades. One avant-garde technology that has drawn widespread attention is blockchain.

Blockchain is like a digital ledger, keeping records of transactions in a decentralized, secure, and transparent way. Think of it as a giant digital notebook, where every transaction is recorded and linked together in a chain, making it impossible to alter without leaving a trace.

Through this article, we will see how blockchain is breaking down barriers by introducing innovative concepts like fractional ownership and tokenization. Also, we will understand how blockchain ensures the integrity of trading processes through its advanced security features, such as cryptographic hashing and consensus mechanisms. Let’s explore how blockchain is reshaping asset trading and trading security.

The Basics of Blockchain

Blockchain is like a digital ledger and can be called an advanced record-keeping system. It is decentralized, immutable, and powered by a highly transparent technology. Let’s break down these key characteristics:

| Decentralization | Immutability | Transparency |

|

|

|

The Immense Scope

Blockchain is mostly associated with cryptocurrencies like Bitcoin. However, it holds immense potential to revolutionize various industries, beyond just digital currencies. Let’s explore some core areas:

- Financial Transactions

-

-

- Traditional financial transactions often involve intermediaries like banks or payment processors.

- Having such middlemen leads to:

- Delays,

- Higher costs, and

- Increased risks of fraud.

- Blockchain technology enables peer-to-peer transactions without the need for intermediaries.

- For example, international money transfers could be completed within minutes rather than days.

-

- Asset Management

-

-

- Blockchain transforms the way assets are managed and tracked.

- It tokenizes physical assets such as real estate or art.

- This tokenization divides ownership into smaller and more liquid units, enabling:

- Fractional ownership and

- Easier transferability.

- Additionally, blockchain-based smart contracts automate tasks like rent payments or royalty distributions.

- This automation reduces administrative overheads.

-

- Asset Trading and Security

-

- Blockchain-based platforms facilitate transparent and efficient asset trading.

- Digital assets, such as cryptocurrencies or tokenized securities, can be traded peer-to-peer on decentralized exchanges without the need for traditional brokers or clearinghouses.

- Moreover, blockchain’s cryptographic security measures protect assets from:

- Theft or

- Unauthorized access.

Blockchain in Asset Trading

Blockchain technology and smart contracts, automate and secure trading processes, such as dividend payments. In particular, smart contracts enable participants to transact directly, which enhances efficiency and transparency in the trading ecosystem.

The Role of Smart Contracts in Trading

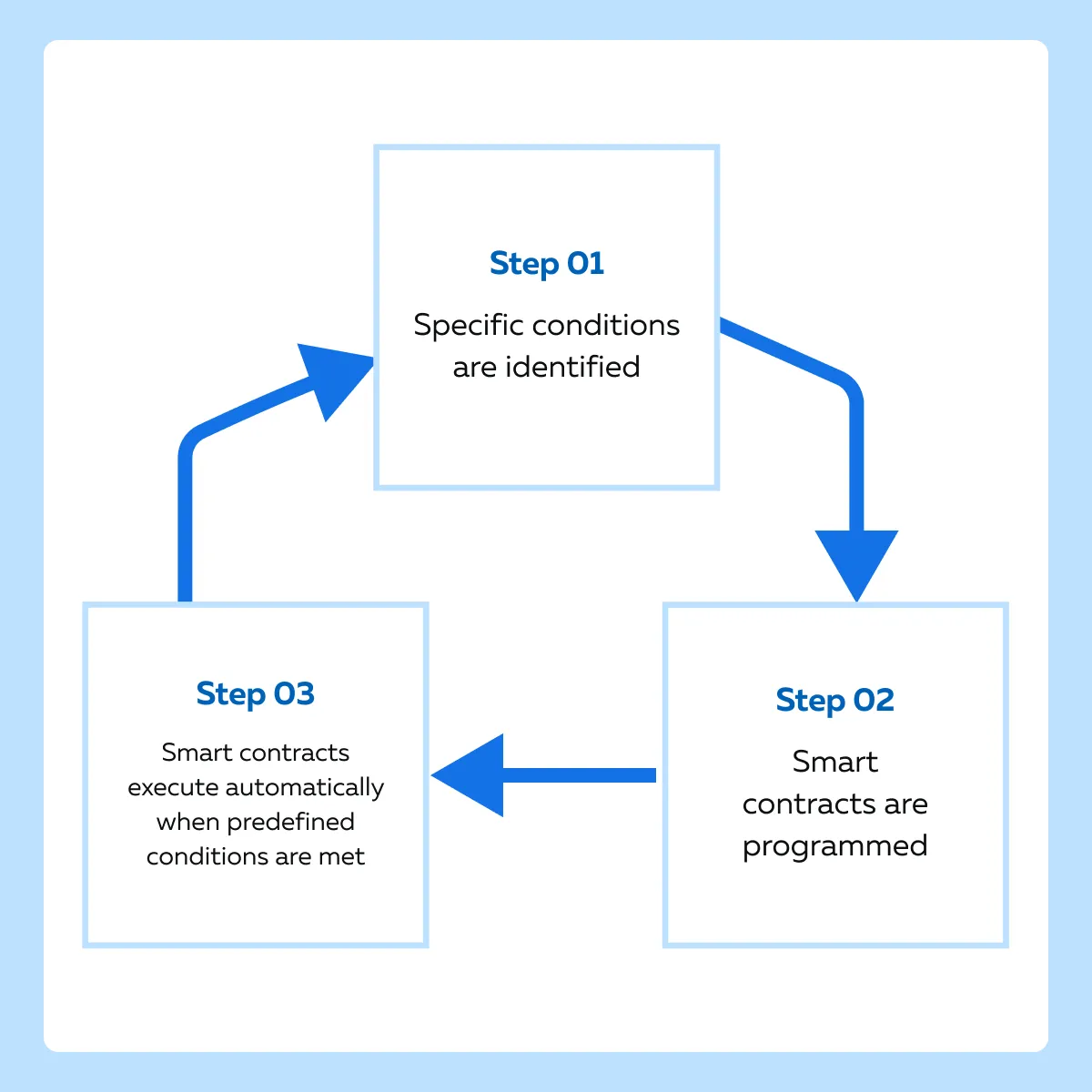

Smart contracts are self-executing contracts with terms directly encoded into code. These contracts automate the execution of agreements when predefined conditions are met. They eliminate the need for intermediaries. Let’s understand them in detail.

How Do Smart Contracts Work?

Smart contracts are programmed with specific conditions, from simple triggers like a date or time to more complex criteria, such as the price reaching a certain threshold or a specific event occurring.

These contracts execute automatically as soon as the conditions are met, without requiring human intervention. This automation accelerates the trading process and reduces the potential for errors.

Let’s understand better with an example:

Consider a popular blockchain platform “Ethereum”, which is renowned for its support of smart contracts, particularly in the field of decentralized finance (DeFi). Now, assume there is a DeFi application built on Ethereum that facilitates dividend payments for shareholders. It offers the following two major benefits:

| Automated Dividend Payments | Immediate and Transparent Process |

|

|

Tokenization of Assets

Tokenization involves converting the ownership of physical assets into digital tokens on a blockchain. This process makes assets easier to:

- Divide,

- Transfer, and

- Trade.

The process of digital conversion enhances market accessibility and liquidity for traditionally illiquid assets. Let’s explore this concept further with a few case studies:

Case Study: Real Estate Tokenization Platform

Let’s assume a blockchain-based platform that:

- Tokenizes real estate assets and

- Allows investors to purchase fractional ownership of properties.

How Does Tokenization Happen?

- A real estate asset, such as a commercial building or residential property, is selected for tokenization.

- The ownership rights to the property are divided into digital tokens, each representing a fraction of the asset’s value.

- These tokens are then issued and recorded on a blockchain.

The Major Benefits

| Increased Liquidity | Market Accessibility | Fractional Ownership Benefits |

|

|

|

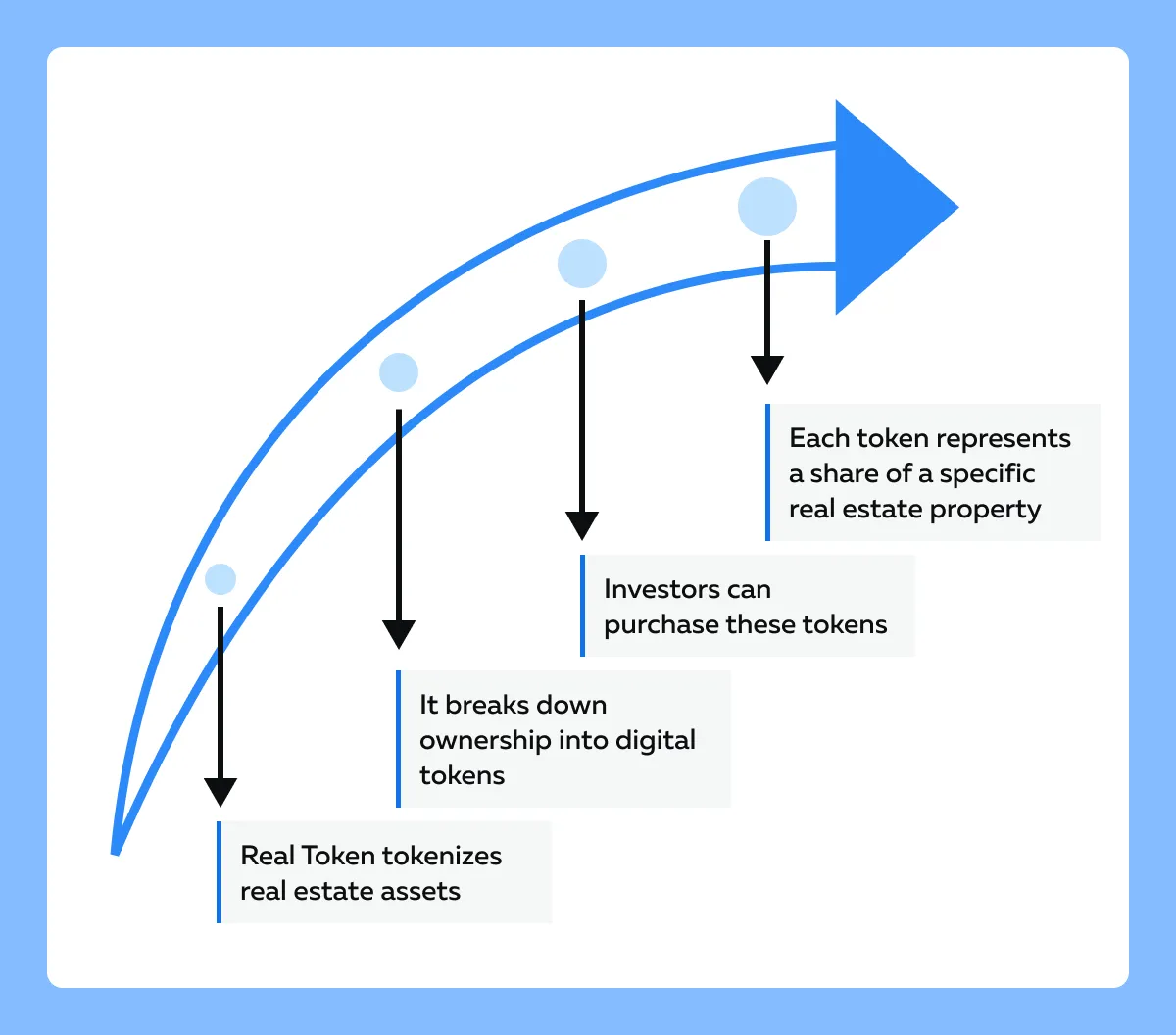

Case Study: RealToken – Fractional Real Estate Investment Platform

RealToken is a pioneering company using blockchain technology to democratize real estate investment through fractional ownership. Let’s see its working:

Wider Investment Opportunities

- RealToken enables investors to access a diverse portfolio of real estate properties.

- They can choose from residential homes to commercial buildings and rental properties.

- Investors can diversify their real estate holdings by purchasing fractions of multiple properties,

The Return

| Potential Rental Income | Property Value Appreciation |

|

|

Blockchain: Liquidity & Accessibility

The blockchain-based stock trading enables worldwide investors to participate in global stock trading. Also, it offers several benefits:

- Breaks down geographical and economic barriers,

- Enhances market liquidity,

- Widens the investor base, and

- Fosters financial inclusion on a global scale.

Global Market Participation

Blockchain technology democratizes access to international markets and allows for global participation. Let’s see how it happens:

- Direct Access to Foreign Companies

-

-

- Unlike traditional stock trading, the blockchain-based platform allows investors to buy and sell shares of foreign companies directly.

- It effectively eliminates the need for intermediary brokerage accounts.

-

- Widened Investor Base

-

-

- The blockchain-based platform removes barriers to entry.

- It attracts a broader base of investors from around the world, including those regions where access to international markets was previously limited.

-

- Improved Market Liquidity

-

- The increased participation of investors from diverse geographic regions enhances market liquidity for foreign stocks.

- This increased liquidity helps in:

- Reducing price volatility,

- Improving price discovery, and

- Providing more efficient capital allocation in international markets.

Fractional Ownership

Blockchain technology allows fractional ownership, which significantly lowers the investment threshold and enhances market liquidity. Let’s understand this concept with a real-life example:

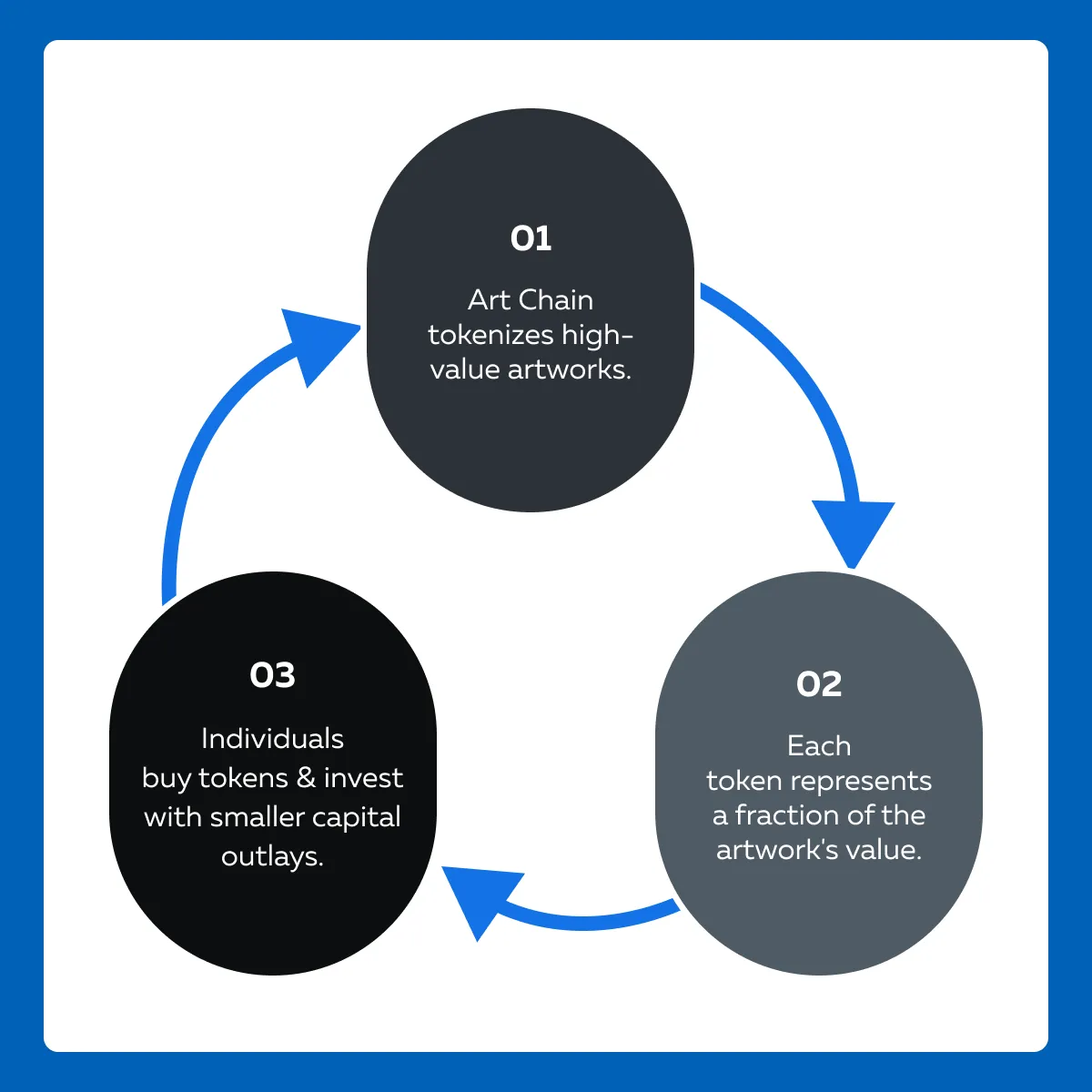

ArtChain – Art Tokenization Platform

ArtChain is a blockchain-enabled platform for the art marketplace. It uses blockchain technology to:

- Tokenize artworks and

- Purchase fractional shares of valuable paintings or sculptures.

Let’s see how it works:

How ArtChain Benefits the Market?

| Liquidity Injection into the Art Market | Transparency and Security | Cultural and Artistic Impact |

|

|

|

Blockchain in Trading Security

Blockchain technology enhances the security and integrity of trading processes by ensuring an immutable record of transactions. Let’s study this technology in detail:

What is an Immutable Record of Transactions?

- Blockchain maintains an immutable ledger of transactions.

- This implies that once data is recorded, it cannot be altered or deleted without consensus from the network participants.

- Each transaction is cryptographically linked to the previous one, forming a chain of blocks.

- This makes it virtually impossible to modify historical data without altering subsequent blocks.

- Alteration of subsequent blocks is tough as it requires:

- Significant computational power and

- Consensus among the majority of network nodes.

How does Immutability help?

The immutability and traceability of blockchain transactions significantly reduce the risk of fraud and errors in asset trading. Since all transactions are transparent and recorded on the blockchain, participants can:

- Easily verify the authenticity of transactions and

- Track the ownership history of assets.

This verification and tracking process reduces the risk of fraudulent activities, such as double-spending or counterfeit assets.

The Benefits of Encryption and Consensus Mechanisms

Blockchain uses encryption techniques to secure data and transactions. Also, it employs consensus mechanisms, which determine how transactions are validated and added to the blockchain. Both play a vital role in ensuring network security.

Some Popular Examples of Consensus Mechanisms

| Proof of Work (PoW) | Proof of Stake (PoS) |

|

|

Real-life Uses of Consensus Mechanisms

Ethereum Blockchain Protocol

- Ethereum is a blockchain protocol.

- It utilizes both encryption and consensus mechanisms

- It employs:

- Asymmetric encryption to secure data transmission and

- Private keys to sign transactions.

The Ethereum network currently operates on a Proof of Stake (PoS) consensus mechanism known as Ethereum 2.0, which is gradually replacing the previous Proof of Work (PoW) mechanism. This transition aims to improve:

- Scalability,

- Energy efficiency, and

- Security.

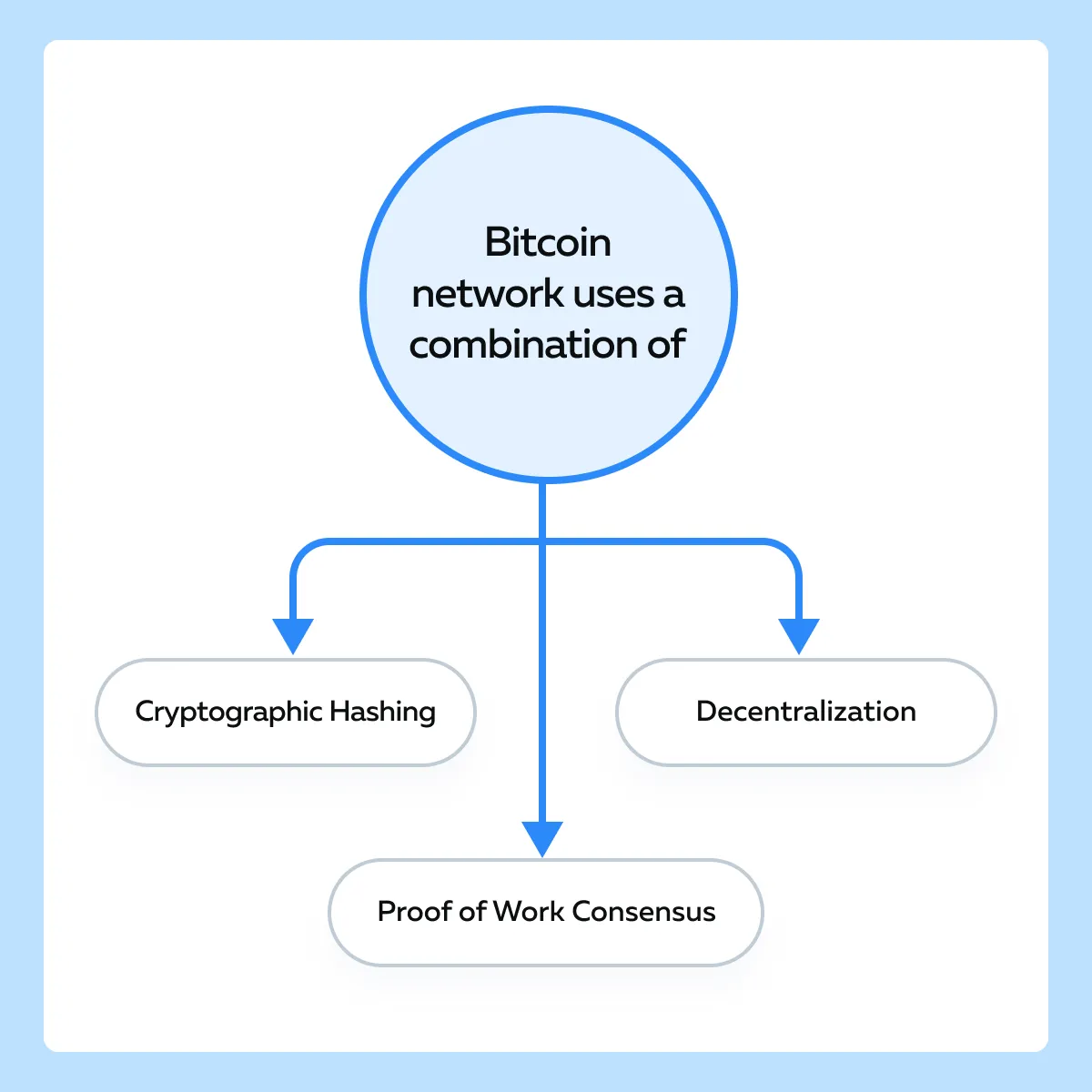

Bitcoin Protocol

The Bitcoin protocol is the first and most well-known blockchain protocol. It utilizes the Proof of Work consensus mechanism. Each block in the Bitcoin blockchain contains a cryptographic hash of the previous block.

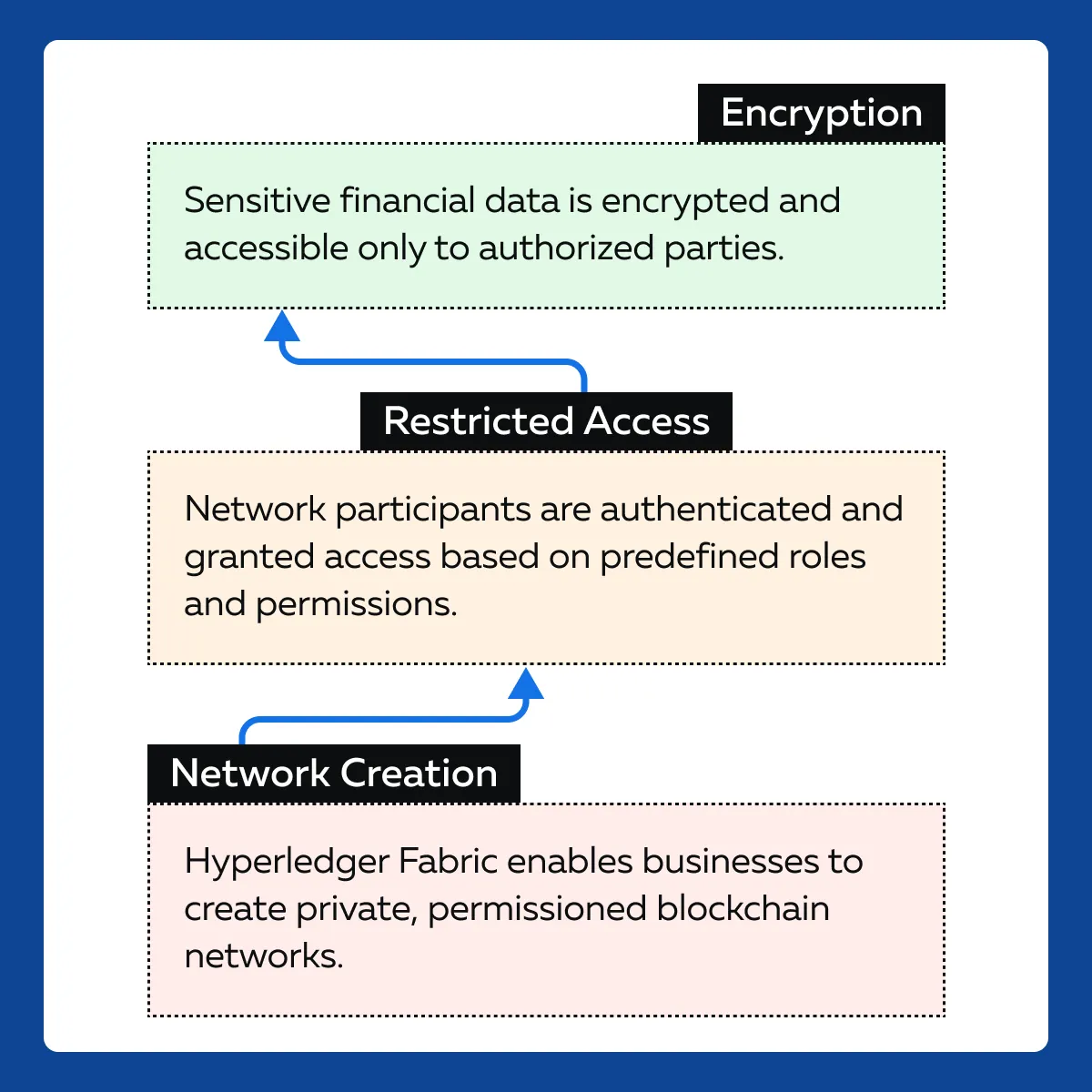

Blockchain Security with Hyperledger Fabric

Hyperledger Fabric is a prominent enterprise-grade blockchain platform. It exemplifies how blockchain technology enhances security in corporate assets. Let’s explore how Hyperledger Fabric ensures transaction security in corporate asset trading:

- Modular Architecture

-

-

- Hyperledger Fabric features a modular architecture.

- It enables businesses to customize and configure their blockchain networks as per their specific requirements.

- This modular design enables enterprises to implement stringent security measures as per their needs.

- This enablement ensures that sensitive financial data is protected against unauthorized access.

-

- Permissioned Blockchain Networks

-

-

- Hyperledger Fabric supports the creation of permissioned blockchain networks.

- In it, participants are required to authenticate themselves before accessing the network.

- Permissioned networks enable enterprises to maintain control over those who can participate in transactions, thereby reducing the risk of unauthorized access.

-

- Stringent Access Controls

-

-

- Hyperledger Fabric provides granular access controls.

- They allow organizations to define roles and permissions for network participants.

- Access to financial data and transaction records is restricted to authorized parties.

-

- Encryption

-

- Hyperledger Fabric employs encryption techniques to protect data in transit and at rest.

- Transactions and communications within the network are encrypted, which ensures confidentiality throughout the trading process.

How Hyperledger Fabric Secures Corporate Asset Trading?

Conclusion

Blockchain technology holds immense transformative potential. It has already started revolutionizing both asset trading and trading security. Thanks to blockchain, it has made asset trading more accessible, transparent, and secure than ever before.

Through fractional ownership and tokenization, blockchain enables individuals to invest in assets, such as real estate and artworks with lower capital requirements.

Moreover, blockchain ensures the integrity of trading processes through its immutable record-keeping and cryptographic security mechanisms. Transactions recorded on the blockchain are transparent, traceable, and tamper-proof.

Blockchain not only enhances operational efficiencies but also empowers individuals to participate in global markets directly, eliminating the need for intermediaries. Discover how blockchain technology shapes the world of crypto trading, from pricing to arbitrage. Continue your journey here.