Ready to see the market clearly?

Sign up now and make smarter trades today

Futures

February 18, 2025

SHARE

Seasonal Futures Trading Strategies for 2025: Timing the Market for Maximum Returns

Trading is like weather forecasting. Here, timing, and trends are everything. If you want to make the most of the markets, understanding the seasons isn’t just for farmers; it’s for traders, too! To remain profitable in 2025, you must learn how to identify patterns and time the markets. Curious how to do it?

In this article, we will explore the world of seasonal futures trading and reveal how to utilize predictable patterns in agriculture, energy, and metals to make smarter trades. We will cover everything from understanding how weather and supply cycles influence prices to the key tools and strategies traders need to succeed.

Also, you’ll learn how certain times of the year can impact corn futures or crude oil prices and how global events like crop reports or hurricane forecasts can shape market movements. Moreover, we’ll also see how using our advanced market analysis tools, like Bookmap, can help you spot trading opportunities in real time. Read till the end to gain enough knowledge to create 2025 futures strategies. Let’s begin.

What Is Seasonal Futures Trading?

Seasonal futures trading is a strategy that takes advantage of predictable price patterns linked to recurring events throughout the year. The following patterns are often influenced by the following factors:

- Weather cycles,

- Agricultural planting,

- Harvest periods, and

- Fluctuations in energy demand.

In this strategy, traders analyze these predictable trends and decide when to enter or exit futures contracts. This strategy works primarily because:

- Farmers, producers, and industries follow well-established supply cycles.

and

- Consumer behavior drives demand for specific commodities at certain times of the year.

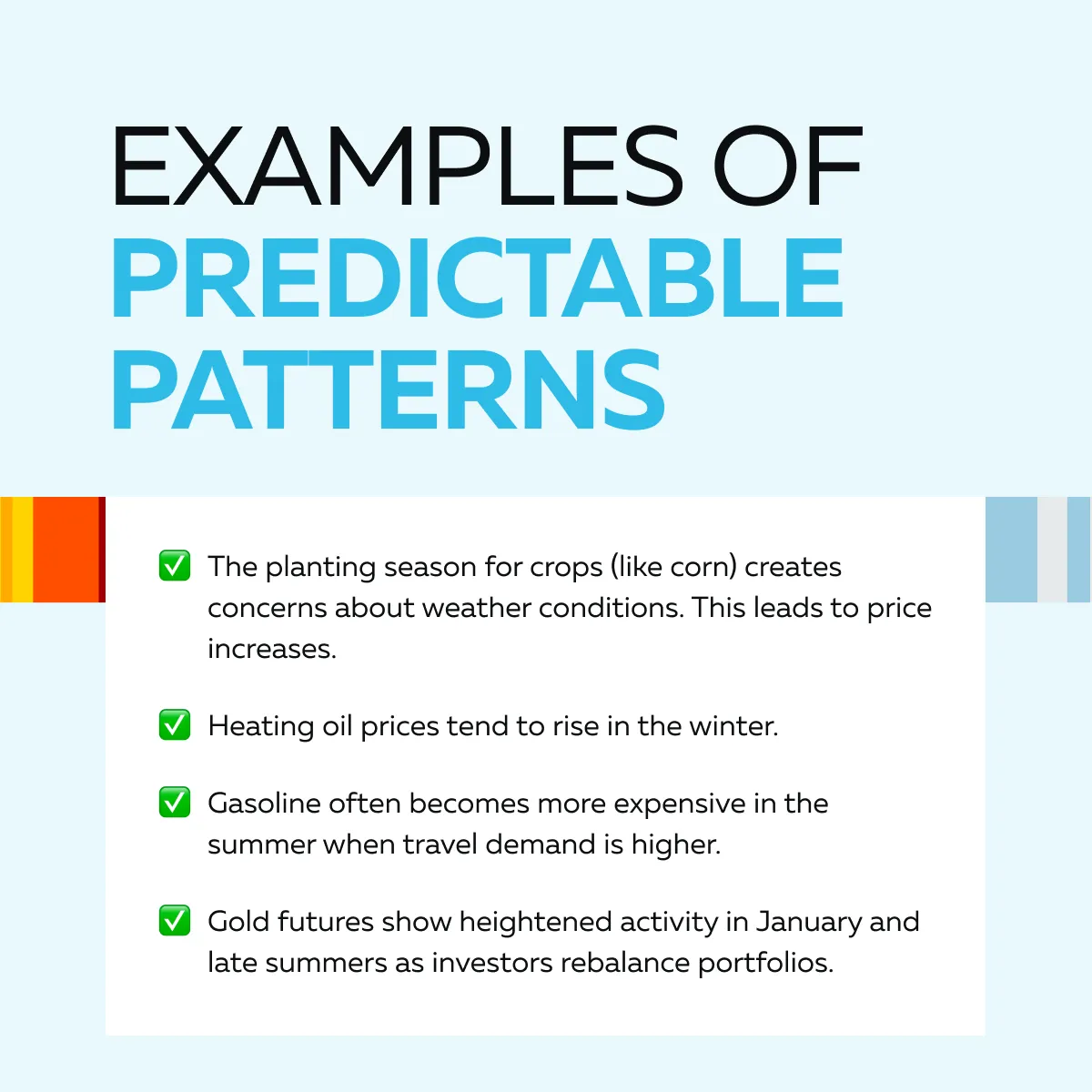

Check the graphic below for four classic examples:

Key Sectors for Seasonal Futures Trading in 2025

To remain profitable, you must understand what key sectors you can trade in 2025. Let’s find them out:

Agriculture

Agricultural futures trading is deeply influenced by seasonality. That’s because the growth and harvest cycles of crops create predictable patterns in supply and demand. Some key commodities in this space include:

- Corns,

- Soybeans,

- Wheat, and

- Coffee.

All these commodities come with unique characteristics and trading windows. Also, these commodities are highly sensitive to seasonal trends. This sensitivity allows traders to capitalize on cyclical price movements.

Seasonality Patterns

The planting season in spring often leads to price spikes. This happens because market participants assess potential risks, such as:

- Delayed sowing

or

- Adverse weather conditions.

Similarly, the fall harvest period brings volatility as actual yields come to market, creating shifts in supply. Additionally, external factors (such as droughts, floods, and hurricanes) can further amplify these trends and make weather risks a significant driver of price action.

For example:

- Say there is a drought in a key growing region,

- It severely restricts crop supply.

- This leads to surging prices.

2025 Outlook

Looking ahead to 2025, futures trading in agriculture is expected to remain dynamic. Increased global demand for biofuels is likely to drive higher prices for corn futures and soybeans. Be aware that both these commodities are key feedstocks for ethanol and biodiesel.

Additionally, climate-related events, such as heatwaves or erratic rainfall, may:

- Disrupt production

and

- Leads to heightened volatility.

When developing 2025 futures strategies, traders must understand these seasonality patterns as their impact on prices is expected to be significant.

Energy

Energy futures trading relies heavily on seasonal trends and market dynamics. Some key contracts in this domain are:

- Crude oil,

- Natural gas, and

- Heating oil.

All of these are influenced by predictable seasonal patterns and external factors like geopolitical events or natural disasters.

Seasonality Patterns

Seasonality plays a significant role in the price movements in energy markets. Let’s see how through the table below:

| Winter season impacts | Summer season impacts |

|

|

Additionally, the late summer hurricane season frequently disrupts supply chains, especially in oil-producing regions. This event causes temporary shortages and price surges. Ideally, traders should closely monitor these trends to identify opportunities within energy futures seasonality.

2025 Outlook

Looking ahead to 2025, the energy market is expected to undergo significant shifts. There will be growing adoption of renewable energy sources. This adoption would alter the demand dynamics for traditional energy commodities. However, crude oil and natural gas will likely remain critical to global energy needs.

At the same time, geopolitical tensions in major oil-producing regions will lead to higher volatility. Therefore, while making 2025 futures strategies, traders must understand these seasonal patterns and external influences.

Metals

Metals futures trading allows traders to capitalize on both seasonality and global economic trends. Key contracts in this segment include:

- Gold,

- Silver,

- Copper, and

- Palladium.

Be aware that these metals play vital roles across industries, from investment and jewelry to manufacturing and technology.

Seasonality Patterns

Seasonality impacts the pricing of these metals in predictable ways. For example,

- Gold often experiences higher demand in January as investors rebalance their portfolios at the start of the financial year.

- Similarly, August sees a spike in gold demand driven by increased jewelry purchases in Asia, particularly during the festive and wedding seasons.

- Copper prices usually rise in spring and summer due to higher construction activity, as warmer weather encourages infrastructure development.

All these patterns create predictable trading opportunities for those attuned to market cycles.

2025 Outlook

Looking toward 2025, industrial metals like copper will see increased demand due to green energy initiatives, such as:

- Developing renewable energy infrastructure

and

- Electric vehicle productions.

These developments could lead to significant price appreciation.

Tools for Analyzing Seasonal Futures Trends

To engage in profitable seasonal futures trading, you will need a combination of tools and strategies to help identify recurring patterns. Check the graphic below to see what you can do to capitalize on seasonal opportunities:

Let’s understand these concepts in detail:

1. Analyze Historical Price Data

By examining past price movements, you can identify consistent seasonal patterns. It is recommended that platforms offering seasonality charts be used. They allow you to track trends across commodities. For example:

- A trader reviews 10 years of natural gas price data.

- They observe that natural gas usually shows price spikes in winter due to heating demand.

- They confirm these recurring spikes and use them as a basis for future trades.

2. Perform a Fundamental Analysis

Most traders also analyze reports and forecasts to anticipate price movements driven by seasonality. For example:

- Say a trader is analyzing USDA crop reports.

- The report provides data on planting progress and yields.

- In contrast, weather forecasts highlight risks such as droughts or excessive rainfall.

Similarly, OPEC production quotas offer insights into crude oil supply fluctuations. Therefore, tracking these fundamentals (like rainfall deficits during the planting season) can help you predict price increases in agricultural commodities.

3. Do an Order Flow Analysis

To be successful, you must gain real-time insight into market activity. For this purpose, you can start using our advanced market analysis tool, Bookmap. Using it, you can:

- Easily monitor liquidity zones and large trades

and

- Use heatmaps to visualize buying and selling pressure

Let’s understand its practical usage through an example:

- Traders analyze gold futures order flow in December.

- They spot increased buying activity ahead of January’s seasonal demand.

- Using this information, traders refined their timing and execution of trades.

Stay ahead of market trends with Bookmap’s tools for analyzing seasonal patterns in futures contracts.

Advanced Seasonal Strategies for 2025

By implementing advanced seasonal strategies, traders can easily capitalize on recurring market trends while managing their risks. Check the graphic below:

In 2025, these advanced seasonal strategies are expected to enhance trading outcomes significantly:

I) Spread Trading

This strategy involves trading the price difference between two related futures contracts. For example,

- Say a trader might go long on heating oil.

- They go short on gasoline during winter.

- They do so because in winter:

- Heating demand spikes

and

- Gasoline demand declines.

In this way, spread trades focus on relative price movements. This strategy reduces exposure to outright market volatility, making it a valuable addition to 2025 future strategies.

II) Event-Driven Trading

In this advanced seasonal strategy, you use seasonal events as triggers for entering positions. For example,

| Say you are referring to the USDA crop reports | Say you are referring to hurricane forecasts |

|

|

III) Mean Reversion in Overextended Markets

In this strategy, you try to identify particular times when prices deviate significantly from historical norms due to unexpected factors. This allows traders to prepare for corrections. For example,

- Say copper futures surge prematurely.

- This happened because of unanticipated demand.

- Now, traders position themselves for a pullback to the historical average.

This technique is particularly useful in metals futures trading, where seasonality often aligns with industrial demand.

Risks of Seasonal Futures Trading

Seasonal futures trading offers lucrative opportunities. However, it also comes with significant risks that traders must carefully manage. Check the graphic below to learn the external factors from where these risks stem:

Now, let’s understand these risks in detail:

I) Weather Variability

Seasonal trends often rely on predictable weather cycles. However, unexpected climate events can disrupt these patterns. For example, a drought during the growing season or unseasonal flooding drastically affects agriculture futures trading.

Please note that such variability increases uncertainty. This makes accurate predictions more challenging.

II) Market Saturation

As more traders become aware of seasonal trends, these strategies can lead to crowded trades. When too many participants enter the same positions, price movements become less pronounced. This reduces profit potential.

Such a situation is particularly evident in markets with strong energy futures seasonality, such as heating oil or gasoline.

III) Geopolitical Risks

Geopolitical risks arise due to events like:

- Trade wars,

- Sanctions, and

- Political instability.

In major producing regions, these events disrupt commodity supply chains and seasonal trends. For example, assume that sanctions have been levied on a major crude oil exporter. This offsets seasonal demand patterns and creates unexpected price volatility.

IV) Leverage Risks

Be aware that futures trading inherently involves leverage, which magnifies both gains and losses. If a seasonal trend fails to materialize due to unforeseen circumstances, traders can face substantial losses. This can be understood better through the given scenario:

- Suppose an unanticipated warm winter arrives.

- This leads to a drop in natural gas prices.

- Consequently, traders are caught off-guard and suffer massive losses.

Track key liquidity zones in agricultural, energy, and metal futures with Bookmap’s advanced market visualization.

Preparing for Seasonal Futures Trading in 2025

To smartly prepare for seasonal futures trading in 2025, you will need a combination of the following:

- Historical analysis,

- Staying informed about global trends and

- Utilizing advanced trading tools.

These steps ensure traders are well-positioned to capitalize on seasonal patterns while minimizing risks. Let’s check out some proven techniques that can allow you to develop robust 2025 future strategies:

I) Backtesting Strategies

Historical data plays an important role in:

- Validating trading assumptions

and

- Refining entry and exit points.

By analyzing past price movements, traders can identify consistent seasonal patterns and assess the effectiveness of their strategies.

For example:

- Say you are backtesting the energy futures seasonality during hurricane season.

- This assessment allows you to identify periods of heightened volatility in natural gas and crude oil futures.

- You gain a data-driven foundation for trade planning.

II) Tracking Global Trends

Please note that seasonal trends don’t operate in isolation. They are usually influenced by broader geopolitical, environmental, and economic factors. Thus, monitoring global developments (such as China’s industrial demand) is particularly important for metals futures trading.

For example:

- Say there is a surge in green energy projects in China.

- This increases the demand for copper.

- It significantly affects prices during construction-heavy seasons like spring and summer.

In this way, by staying informed, traders can adapt to changing market conditions.

III) Leveraging Real-Time Tools

By using our advanced market analysis tool, Bookmap, you can get deep insights into live order flow analysis. This enables precise trade execution during seasonal events. Moreover, with Bookmap, you can easily track liquidity zones and large trades. This allows you to optimize timing and manage risk.

For example:

- Say you are using Bookmap during January.

- This is the time when gold futures usually see increased buying pressure.

- By observing the changes in real time, you identify more strategic entry points.

- Ultimately, this improves your profit potential.

Conclusion

Seasonal futures trading is a smart way to profit from predictable price patterns that occur year after year. To improve your chances of success, you can capitalize on recurring trends like weather cycles, planting and harvest seasons, and energy demand fluctuations.

The key to making this strategy work is recognizing the consistency in certain market behaviors. For example, rising natural gas prices in winter or higher corn futures during planting season. However, at the same time, you must also pay attention to factors like renewable energy adoption, geopolitical risks, and economic Shifts Influencing commodities. These factors have the power to disrupt the usual cyclical patterns.

To stay ahead of volatility and liquidity shifts, you should also use our real-time market analysis tools, like Bookmap. Using it, you can monitor order flow and market pressure. Such monitoring gives you real-time insights for precise execution. Leverage Bookmap’s real-time order flow tools to refine your seasonal trading strategies for 2025.