Ready to see the market clearly?

Sign up now and make smarter trades today

Stocks

May 6, 2025

SHARE

Tech Stocks at a Crossroads: Has AI Hype Peaked, or Is There More Room to Run?

History repeats itself! Is the AI sector going to see a fate similar to the dot-com bubble? AI stocks have skyrocketed, and most analysts are drawing comparisons to past tech booms. But is this the next revolution or just another bubble waiting to burst?

In this article, we’ll check out AI stock market trends in 2025. We will cover valuation concerns, institutional positioning, trading strategies, and risks that could derail the rally. You’ll learn how to track liquidity levels, earnings trends, and global competition to stay ahead of market shifts. We will also discuss options strategies, scaling techniques, besides our trading platform’s Bookmap’s order flow tools to help you trade smarter.

So, read till the end to make better decisions in the AI-driven market.

AI Stock Valuations: Are They Overheated?

Firstly, one of the best ways to measure if a stock is expensive is by looking at its P/E ratio (price-to-earnings ratio). This ratio indicates the price investors are prepared to pay for each dollar of a company’s earnings.

Right now, many AI stocks are trading at 30 to 40 times their expected earnings. This is much higher than the historical average. For comparison, stocks in more stable industries usually have a P/E ratio of 15 to 20. You can take Nvidia as an example. Its P/E ratio recently hit levels that were last seen before the dot-com bubble.

Currently, internet stocks appear massively overvalued. Are investors paying too much for future growth? This also raises concerns about tech stock valuation in the AI space.

In the past, we have seen similar patterns in other hyped sectors like:

- Cloud computing

or

- The early 2000s internet boom.

Initially, excitement drives stock prices up, but eventually, reality sets in. Ultimately, overvalued stocks tend to correct.

Institutional vs. Retail Positioning

Additionally, there has been a massive increase in call option purchases. It is a sign of speculative activity. This increase suggests that some traders are betting on short-term gains rather than investing based on company fundamentals.

Do you want to gain a competitive advantage in these testing times? You can start using our Bookmap data. It tracks buy and sell orders and shows large liquidity clusters. For the unaware, these are areas where institutions are likely selling into retail traders’ “FOMO” (fear of missing out).

Thus, the bottom line here is that AI stocks may be overheated. While the sector has long-term potential, you, as an investor, should be cautious about growth vs. value in tech stocks.

What Could Drive AI Stocks Higher?

AI stocks have already surged. However, they could climb even higher due to these reasons:

Let’s understand in detail:

Corporate AI Adoption and Revenue Growth

AI is no longer just a buzzword. It is gradually becoming a core part of business operations. Big tech companies like Microsoft, Google, and Amazon are integrating AI into their cloud services. It is helping them generate steady and recurring revenue.

Example:

- Numerous companies are currently implementing AI for

- Automation,

- Data analysis and

- Customer service.

- Companies are willing to pay subscription fees for AI-powered services.

- This means long-term revenue growth for these tech giants.

- Recent estimates show that Enterprise AI spending is expected to grow by more than 20% per year.

- This will likely increase demand for AI-related products and services.

Track real-time order flow in AI stocks and spot liquidity shifts with Bookmap’s advanced trading tools.

AI Chip Demand and Semiconductor Strength

Please note that AI needs powerful hardware. This means a strong demand for advanced computer chips. Companies like Nvidia, AMD, and TSMC are leading this sector. Let’s have a look at some key factors supporting this growth:

- AI models require high-performance semiconductors. This creates a massive demand for AI chips.

- Chip shortages could keep prices high. This benefits chipmakers by maintaining strong revenues.

As an investor, you should watch earnings reports from chipmakers. That’s because if demand for AI chips slows, it could be a warning sign for the AI industry.

Government and Institutional Investment in AI

Governments around the world are pouring money into AI research and infrastructure. Both the U.S. and EU are funding AI development to stay competitive in the global race for AI leadership. This could sustain AI stock growth.

Additionally, geopolitical competition with China ensures that AI funding won’t slow down anytime soon. More investment means faster innovation and more commercial applications. This will keep the AI sector strong.

Risks That Could Burst the AI Bubble

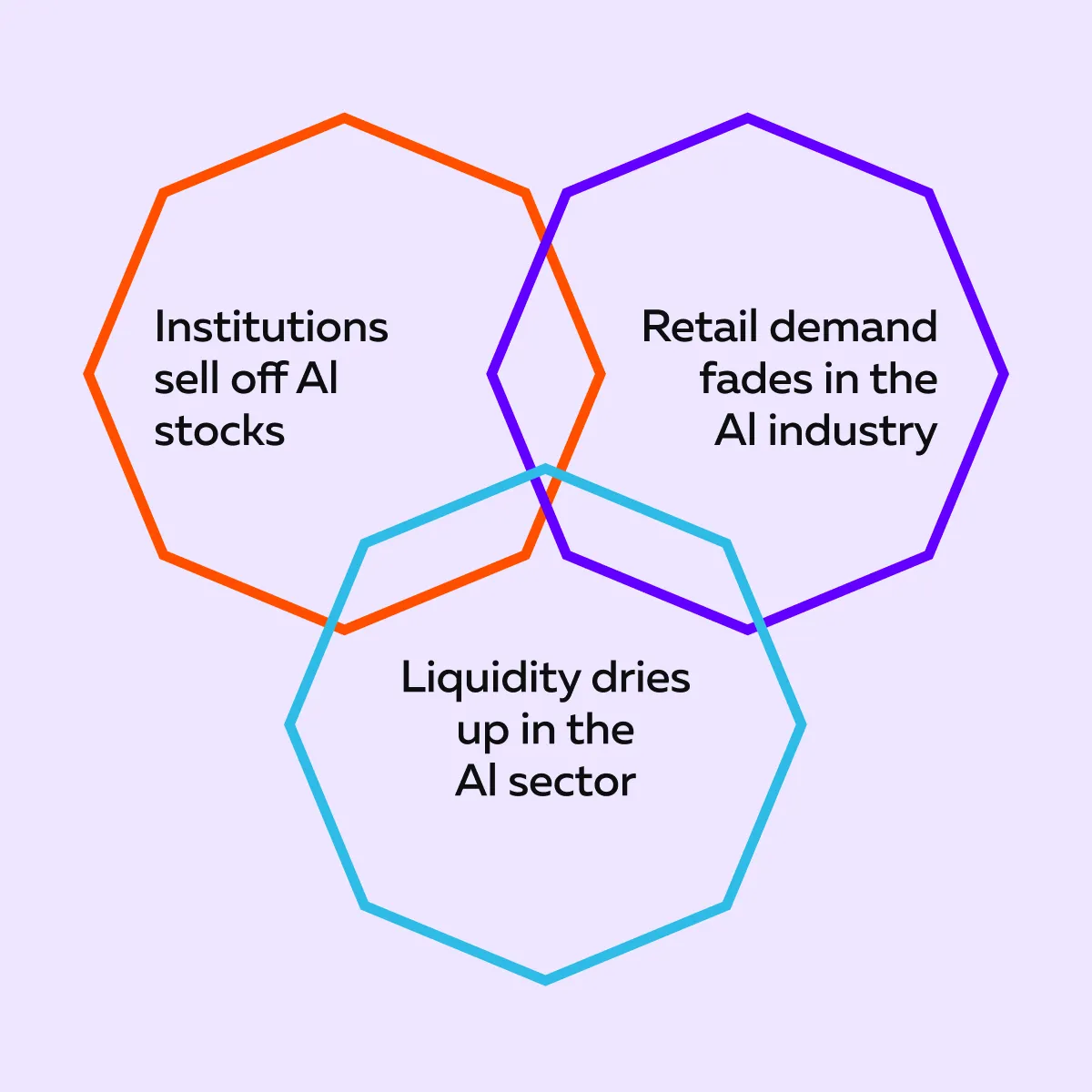

One must note that AI stocks have seen explosive growth. However, that doesn’t mean they’re invincible. Check the graphic below to learn what can cause sharp corrections in the AI sector:

Let’s understand them in detail:

Liquidity Drying Up in AI Stocks

For stocks to keep rising, there needs to be intense buying pressure. However, recent data suggests that big institutional investors are quietly selling AI stocks. Now, this could be an early warning sign.

Here’s what’s happening:

-

- Order flow analysis shows that hedge funds and other large investors are selling AI stocks while retail traders continue buying.

- Our trading platform, Bookmap’s heatmap data, shows large resting sell orders at key resistance levels in stocks like Nvidia (NVDA) and Super Micro Computer (SMCI).

- This means institutions may be setting up to sell at high prices.

Here, if retail traders run out of money or simply stop buying, the lack of liquidity can lead to sharp price drops. This will happen as there will be fewer buyers to support the stock.

Please note that this pattern has happened in past market bubbles. It was noticed that when liquidity disappears, stocks that once soared can suddenly reverse and crash. If institutional investors keep selling and AI stock market trends in 2025 shift downward, retail traders could be left holding overvalued stocks.

AI stocks are moving fast. Identify hidden liquidity zones before the crowd with Bookmap.

Earnings Expectations vs. Reality

AI companies have been given very high valuations. Most investors are expecting them to grow revenues and profits very quickly. But what if they don’t?

For many leading AI stocks, investors assume their revenue will keep skyrocketing. However, if companies fail to meet earnings expectations, stock prices could drop fast as investors adjust their expectations.

This has happened before during the dot-com bubble. At that time, many internet companies had huge valuations based on hype. But when reality set in, their stocks crashed. Thus, for AI stocks to keep climbing, these companies must deliver real profits, not just exciting technology.

Rising Interest Rates and Economic Slowdowns

AI stocks are high-growth stocks, and they rely heavily on future profits. However, high interest rates make future earnings less valuable. This can hurt these stocks. Consider this scenario:

- Say the Federal Reserve keeps interest rates high for longer.

- Now, it could result in downward pressure on AI stock prices.

- Usually, investors sell high-growth tech stocks when borrowing costs rise.

- This occurs because companies become less willing to take on new debt for expansion.

In past market cycles, rising interest rates have caused major corrections in tech stocks. If the economy slows down, demand for AI services could also take a hit.

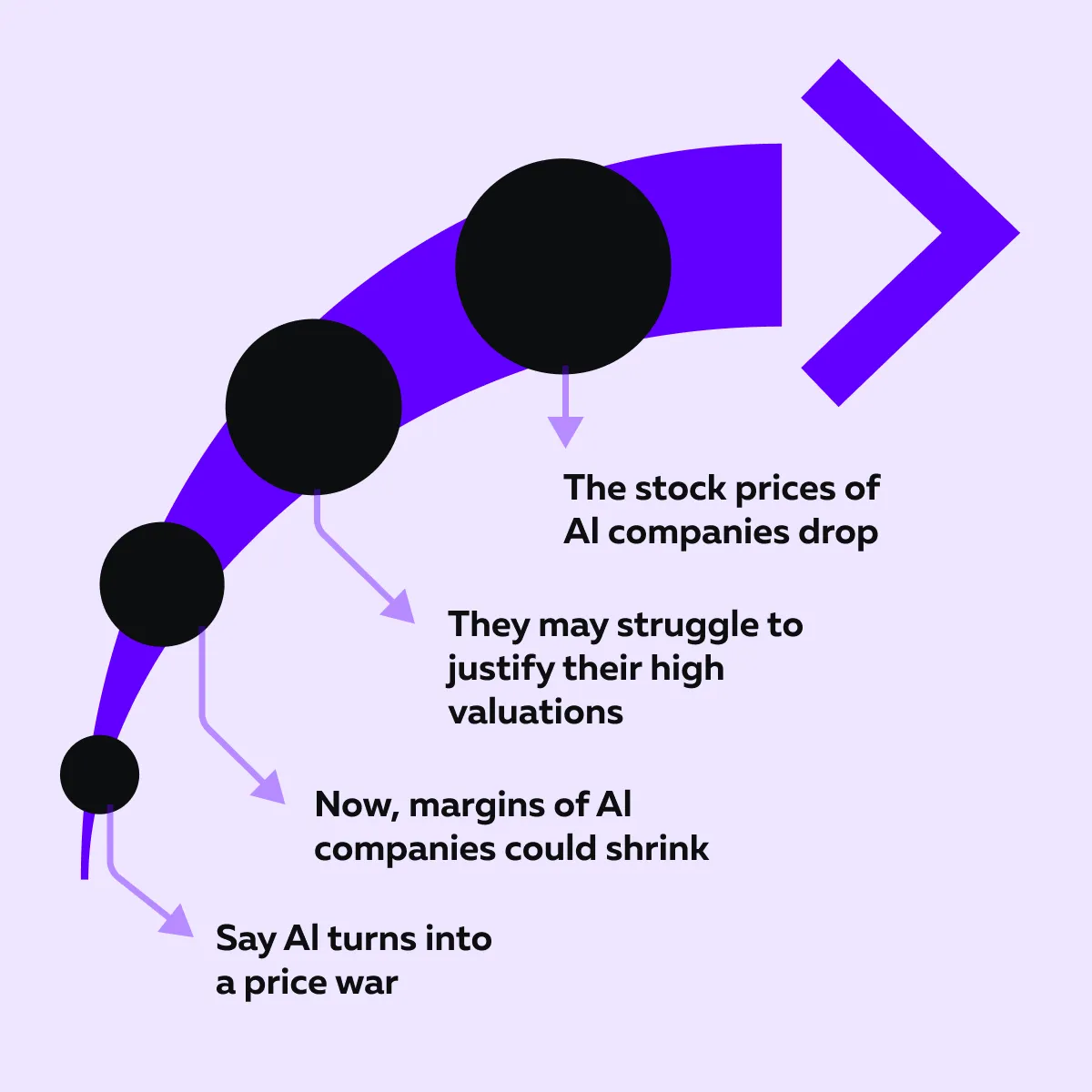

International Competition & AI Price Wars

It is worth mentioning that the U.S. doesn’t have a monopoly on AI. Countries like China and other Asian nations are rapidly developing their own AI models. This could create tougher competition for American AI giants. Let’s see how:

| Chinese competition | Depleting market share |

|

|

Thus, lower-cost AI models from international players could force U.S. firms to drop their prices. This will, in turn, reduce their profits. For more clarity, see the graphic below:

Thus, as an investor, you should watch these risks closely. Otherwise, you might find yourself on the wrong side of a bursting AI bubble.

Trading AI Stocks: Strategies for Navigating the Uncertainty

AI stocks have seen huge gains, but volatility remains high. Thus, as a smart trader, you should use strategies like:

- Tracking liquidity levels

- Using options for risk management

- Scaling in and out of positions to stay ahead.

Let’s understand them in detail:

Identifying Key Liquidity Levels for Entries and Exits

One of the best ways to trade AI stocks is by tracking liquidity levels. It allows you to identify the best price points to buy and sell. You can easily do it using our avant-garde market analysis tool, Bookmap. Let’s see how:

| Analyse order flow data | Identify absorption zones | Spot key resistance levels |

|

|

|

Thus, by using liquidity data, you can avoid buying at overhyped levels and instead enter areas of strong support where institutions are backing the stock.

Options Strategies for AI Stocks

Since AI stocks are highly volatile, options can be a great tool for:

- Managing risk

and

- Capitalizing on price swings.

You can use options in the following ways:

| Protective Puts | Selling Covered Calls | Straddles and Strangles for Earnings Volatility |

|

|

|

Scaling In and Out of AI Positions

Instead of going all-in at once, you can use scaling techniques to manage risk and maximize returns. Let’s see how you can do it in two ways:

- Scaling In

-

-

- Instead of buying all at once, you can buy in smaller amounts over time.

- This allows you to avoid buying at peak prices during hype cycles.

-

- Scaling Out

-

- Instead of selling everything at once, you can take profits gradually as the stock moves up.

- This enables you to secure profits while allowing the remaining position to continue.

Additionally, avoid FOMO buying. That’s because AI stocks can get overhyped quickly. Hence, rather than chasing the rally, wait for pullbacks to key support levels before entering. This approach allows you to balance growth vs. value in tech stocks. Also, it reduces the risk of being caught in a sudden market downturn.

Conclusion

AI stocks have seen massive gains, but the big question is: Can the rally continue? While AI has strong long-term potential, current valuations are extremely high. Also, there are signs that institutional traders may be reducing their positions.

To deal with this uncertainty, you, as a trader, need to watch liquidity levels, institutional positioning, and earnings trends. If AI companies fail to deliver strong revenue growth, or if macroeconomic conditions change, stocks could correct sharply.

To gain a competitive advantage, you can use Bookmap’s advanced order flow tools. Using them, you can easily track where big money is buying and selling. Remember, AI stocks may still have room to run, but careful strategy is needed. Thus, avoid chasing hype and focus on smart risk management.

Don’t get caught at the peak—use Bookmap to monitor institutional buy/sell interest in AI stocks.