Ready to see the market clearly?

Sign up now and make smarter trades today

Education

January 3, 2025

SHARE

Trading Strategies That Don’t Follow Market Trends: A Guide for Independent Thinkers

Do you feel chasing market trends is like running on a hamster wheel? You’re not alone! If you are a trader tired of depending on unpredictable market directions, “non-trend trading strategies” can be an alternative. These strategies focus on methods that don’t require following market momentum. Instead, you try to benefit from opportunities like:

- Volatility,

- Arbitrage, and

- Price ranges.

This allows you to capture gains regardless of where the market is headed.

Wondering how? In this article, we’ll explore various non-trend trading approaches that offer flexibility and control. You’ll learn about:

- Market-neutral trading, helps you profit without betting on a market direction.

- Volatility trading strategies that are based on intense price swings.

- Event-driven strategies that benefit from specific corporate or economic announcements.

We’ll also cover range-bound and mean reversion tactics for stable markets, as well as arbitrage in low-correlation assets for added diversification. Plus, we’ll tell how our advanced market analysis tool, Bookmap, can help you trade more confidently, even when the market seems unpredictable. Let’s begin.

What Are Non-Trend Trading Strategies?

Non-trend trading strategies are techniques that do not rely on following market trends or direction. Instead, these strategies create opportunities by focusing on other factors, such as:

- Volatility,

- Specific market events, and

- Market-neutral positions.

By following these strategies, non-trend traders aim to profit from upward or downward market momentum. They look for ways to benefit from various market conditions, regardless of where prices are headed.

One popular approach among non-trend trading strategies is market-neutral trading. In this strategy, you create positions that balance out any directional risk. You specifically focus on strategies like volatility or alternative trading strategies (that are independent of trend-based movement). This allows you to make a profit whether prices go up or down. Generally, most such traders try to capture gains even in unpredictable or sideways markets.

Be aware that the appeal of non-trend trading strategies lies in their:

- Flexibility,

and

- Independence from market trends.

With these strategies, traders aren’t constrained by the need to follow strong market directions. This independence allows them to profit in both bullish and bearish markets. Also, this makes independent trading strategies particularly valuable in times of uncertainty.

Market Neutral Strategies

Market-neutral strategies are special trading approaches. They are designed to achieve profits without depending on the overall market direction. Instead of focusing on whether the market as a whole rises or falls, with these strategies, you try to create profits by balancing “opposing positions” that offset each other. This allows traders to:

- Isolate specific opportunities,

and

- Reduce exposure to market risks.

Bookmap offers data insights that are ideal for implementing independent trading strategies with confidence.

What are Market Neutral Strategies?

In market-neutral strategies, you buy one asset and short another. This allows you to balance market movements. Example:

- In a long-short strategy, a trader buys undervalued assets.

- At the same time, they short overvalued assets.

- In this way, they gain a hedge against market swings.

- This hedge happens because gains in one position can offset losses in the other.

- By doing this, traders can focus on assets they believe will perform independently of market trends.

- This makes market-neutral strategies ideal for those interested in trading without trends.

Now, let’s have a look at the two popular market-neutral strategies:

| Strategies | Pairs Trading | Statistical Arbitrage |

| Meaning |

or

|

|

| Example |

|

|

Volatility Trading Strategies

Volatility trading strategies are designed to generate profits based on fluctuations in market volatility. These strategies do not depend on the directional movement of prices. Therefore, volatility itself does not predict whether an asset’s price will go up or down. Instead, they try to capitalize on the intensity and frequency of price movements. This type of independent trading strategy is appealing to those who want to benefit from market swings without needing to rely on traditional trends.

How to Use VIX

Firstly, let’s understand what VIX is. The VIX, also known as the “fear index,” is a widely followed indicator. It reflects the market’s expectations for near-term volatility. The VIX, created by the Chicago Board Options Exchange (CBOE), gauges the anticipated volatility of the S&P 500 Index for the upcoming 30 days.

Several traders use the VIX (and other volatility indices) to gauge the level of uncertainty or fear in the market. This understanding helps them to make informed trades accordingly. For example:

-

- Say a trader is expecting heightened market volatility.

- They decide to go long on VIX options or futures.

- Please note that by doing so, they are simply betting on an increase in market uncertainty.

- They are using the VIX as a tool for alternative trading strategies.

- Now, when volatility spikes, these positions often become profitable.

- It allows traders to make gains independent of the overall market direction.

Can You Do Options Trading to Earn from Volatility?

Yes, options trading offers numerous strategies that are specifically tailored for volatility. Some popular strategies are:

- Straddles,

and

- Strangles.

They allow traders to profit from significant price moves in either direction. This makes them perfect for trading without trends. Let’s see how:

| Straddle | Strangle |

|

|

For example:

- Let’s say a trader is anticipating major news or earnings.

- This event might lead to a big price movement.

- They decide to buy both call and put options on an asset.

- Now, if the price shifts significantly in either direction, the trader can close the position for a profit.

In this way, these strategies exemplify market-neutral trading techniques. They allow traders to benefit from volatility alone without a reliance on specific directional trends.

Event-Driven Trading Strategies

Event-driven trading strategies try to capture profit opportunities based on certain specific events. Mostly, these events impact:

- Individual companies,

or

- Broader economic conditions.

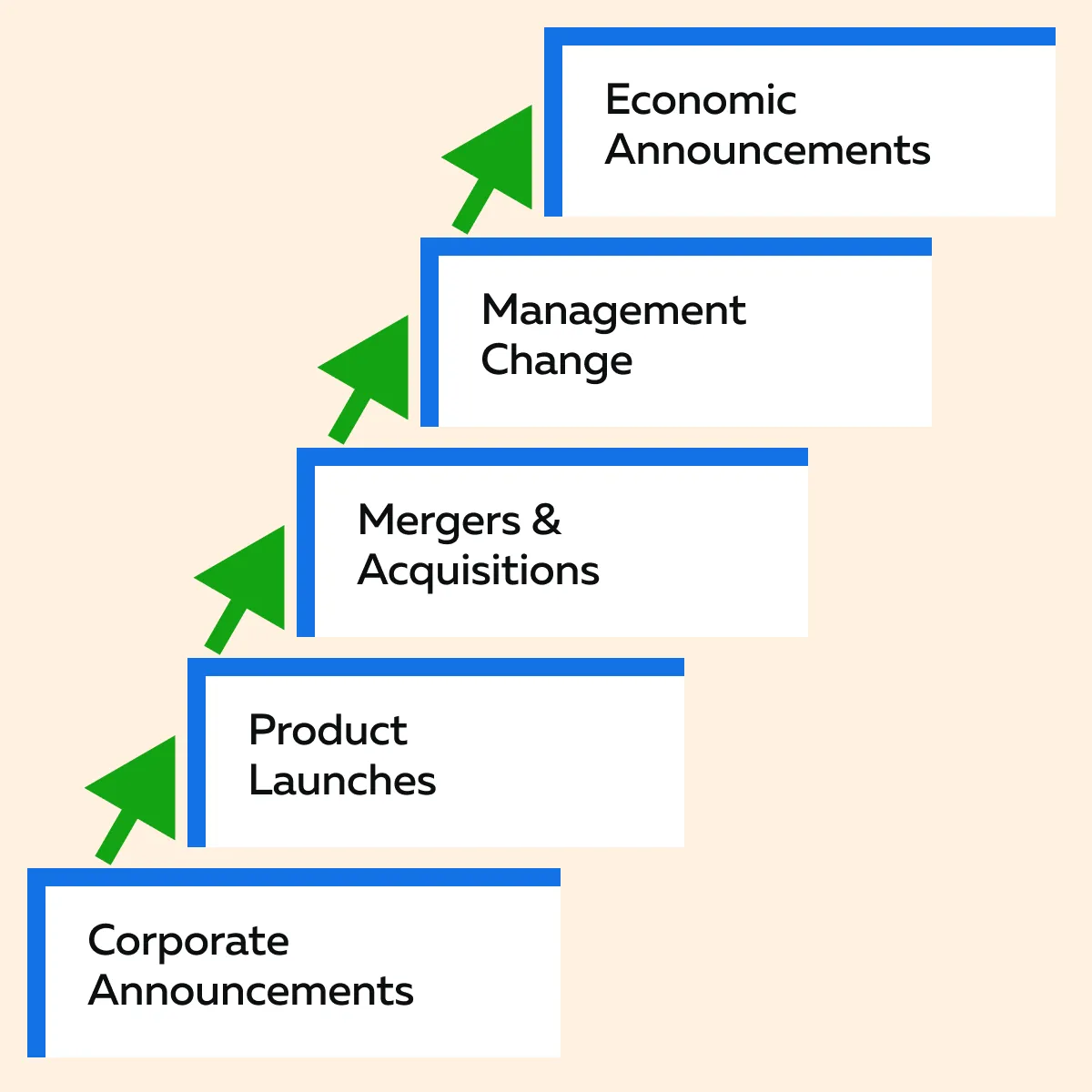

Next, be aware that these strategies allow traders to make decisions based on anticipated changes rather than on overall market direction. This makes them ideal for those who want to trade without relying on trends. Most event-driven traders analyze the impact of the events mentioned in the graphic below:

This helps them to capitalize on short-term price shifts that arise from these events. Let’s understand these events in detail.

Earnings Announcements, Mergers, and Corporate Events

When you follow event-driven strategies, you focus on corporate events. For example, let’s say a company releases quarterly earnings. Now, there can be sharp price movements if the results significantly differ from market expectations. In such a situation, an event-driven trader can:

- Buy a stock ahead of a positive earnings report,

or

- Short one if they expect negative results.

It is important to note that this approach represents a non-trend trading strategy because it relies on specific events rather than market trends.

Merger Arbitrage

Merger arbitrage is another popular event-driven trading strategy. It specifically relates to mergers and acquisitions. In a typical merger arbitrage scenario, a trader buys shares in the company being acquired. Simultaneously, they short the acquirer’s stock. The goal here is to profit from the price convergence when the merger is completed.

For example,

- Say a merger is announced.

- Be aware that during a merger the stock of the company being acquired often trades at a slight discount to the offer price.

- This happens due to the uncertainty around deal completion.

- Now, a merger arbitrage trader takes advantage of this.

- They buy shares in the company being acquired.

- Simultaneously, they short the acquirer’s stock.

- In this way, they try to capture gains as the two prices converge.

It must be noted that this strategy is part of market-neutral trading as it doesn’t depend on the market’s overall direction but rather on the specific event’s outcome.

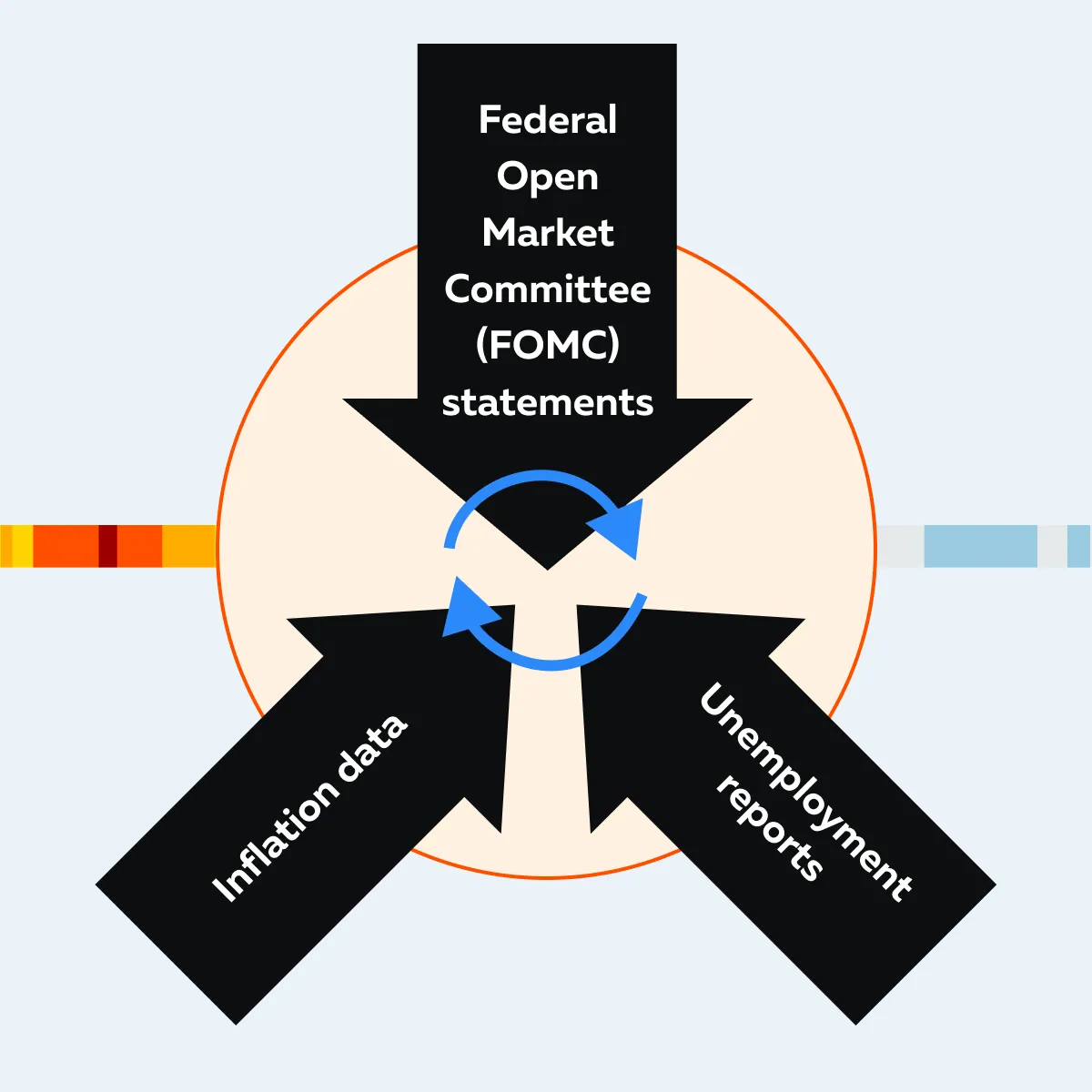

Economic Announcements

Besides corporate events, economic announcements also present opportunities for event-driven trading. See the several types of relevant economic data releases in the graphic below:

These reports mostly create significant market movement. Most event-driven traders try to position themselves in specific sectors or assets based on the anticipated impact of these announcements.

For example:

Before an FOMC meeting, a trader speculates on how interest rate changes could affect the:

or

|

Similarly, when an announcement is made related to rising unemployment, a trader checks how it could influence positions in consumer stocks. |

In this way, traders position themselves based on these economic indicators. You, as a trader, can use these event-driven trading strategies and earn profits outside of traditional trend-based trading.

Range-Bound and Mean Reversion Strategies

Range-bound and mean reversion strategies are also some popular non-trend trading strategies. They focus on trading:

- Within a set price range,

or

- On the assumption that prices will eventually revert to their average levels.

By using these strategies, you can capitalize on repetitive price behaviors and reversals. This allows you to capture gains in markets where prices fluctuate predictably within a specific range. Let’s understand both these strategies in detail:

| Strategy | Range-Bound Trading | Mean Reversion |

| Meaning |

and

|

|

| Example |

|

|

Please note that both range-bound and mean reversion strategies rely on the predictability of price behavior. They do not rely on market trends. As a result, they offer opportunities to profit in non-trend trading environments.

Arbitrage Opportunities in Low-Correlation Assets

Arbitrage in low-correlation assets allows traders to profit from price differences between assets that don’t move in sync with the stock market. In this strategy, you focus on non-trend trading strategies in assets like commodities and bonds. Then, you create positions that don’t depend on overall market trends. This method works especially well in markets where certain assets maintain stable and low correlation with others. Hence, you can do profitable trading without relying on directional momentum. Let’s see the two popular arbitrage opportunities:

| Strategy | Arbitrage in Low-Correlation Assets | Cross-market arbitrage and Low-Correlation Assets |

| Meaning |

and

|

|

| Example |

|

|

Try Bookmap’s market visualization to uncover unique trading strategies that don’t rely on market direction.

Managing Risks in Non-Trend Strategies

Risk management is important even in non-trend trading strategies. That’s because these strategies face unforeseen volatility. Hence, there is a need to manage risk through:

- Diversification,

- Position sizing,

and

- Stop loss orders.

Let’s learn these techniques in detail:

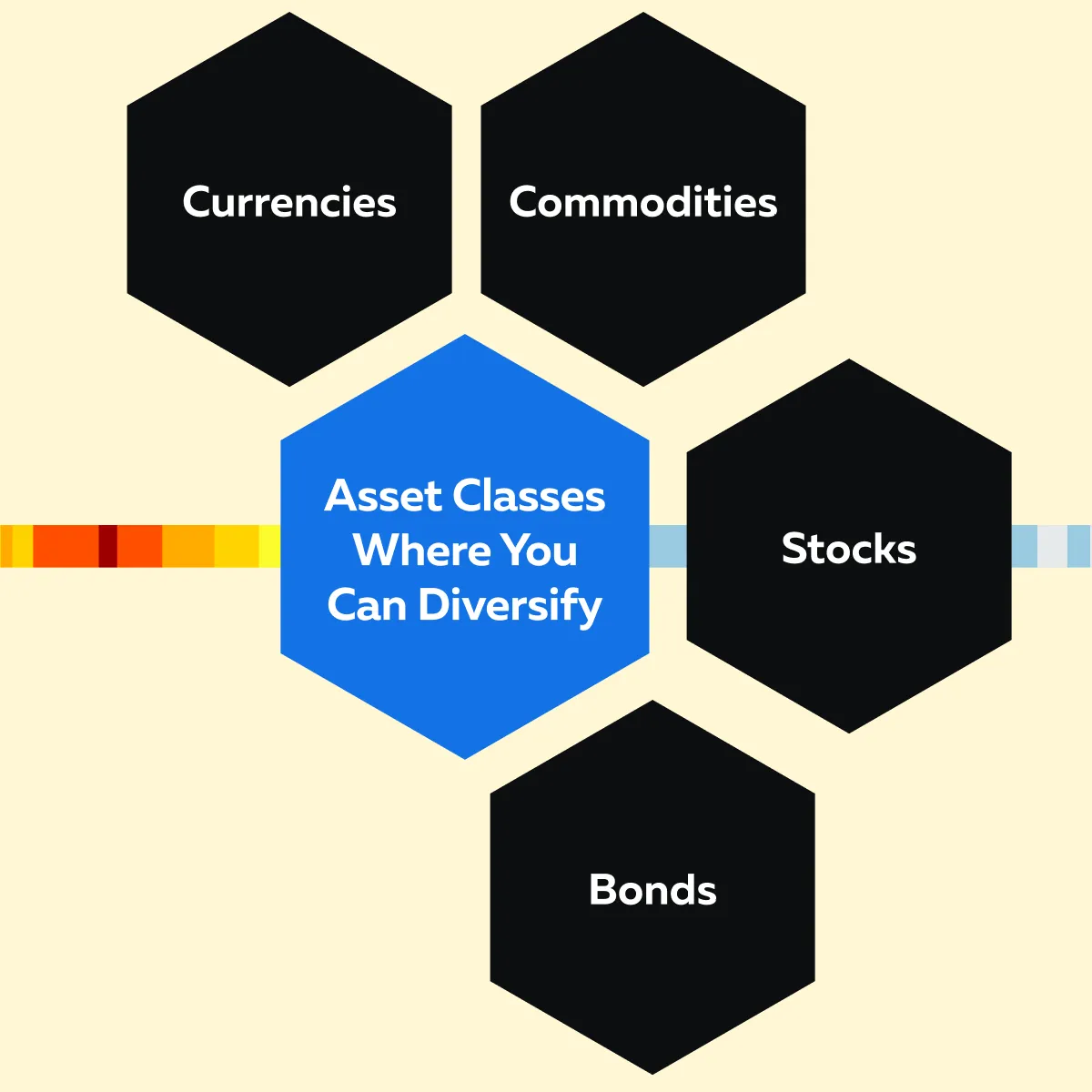

Diversifying Across Asset Classes

When using alternative trading strategies that don’t rely on market trends, you should diversify across different asset classes. See where you can put money in the graphic below:

Next, one must note that by spreading positions across low-correlation assets, you can reduce the impact of unexpected market moves in any single class. Hence, this approach is highly valuable in trading without trends. For example:

- A trader diversifies by combining positions in equities with commodities or bonds.

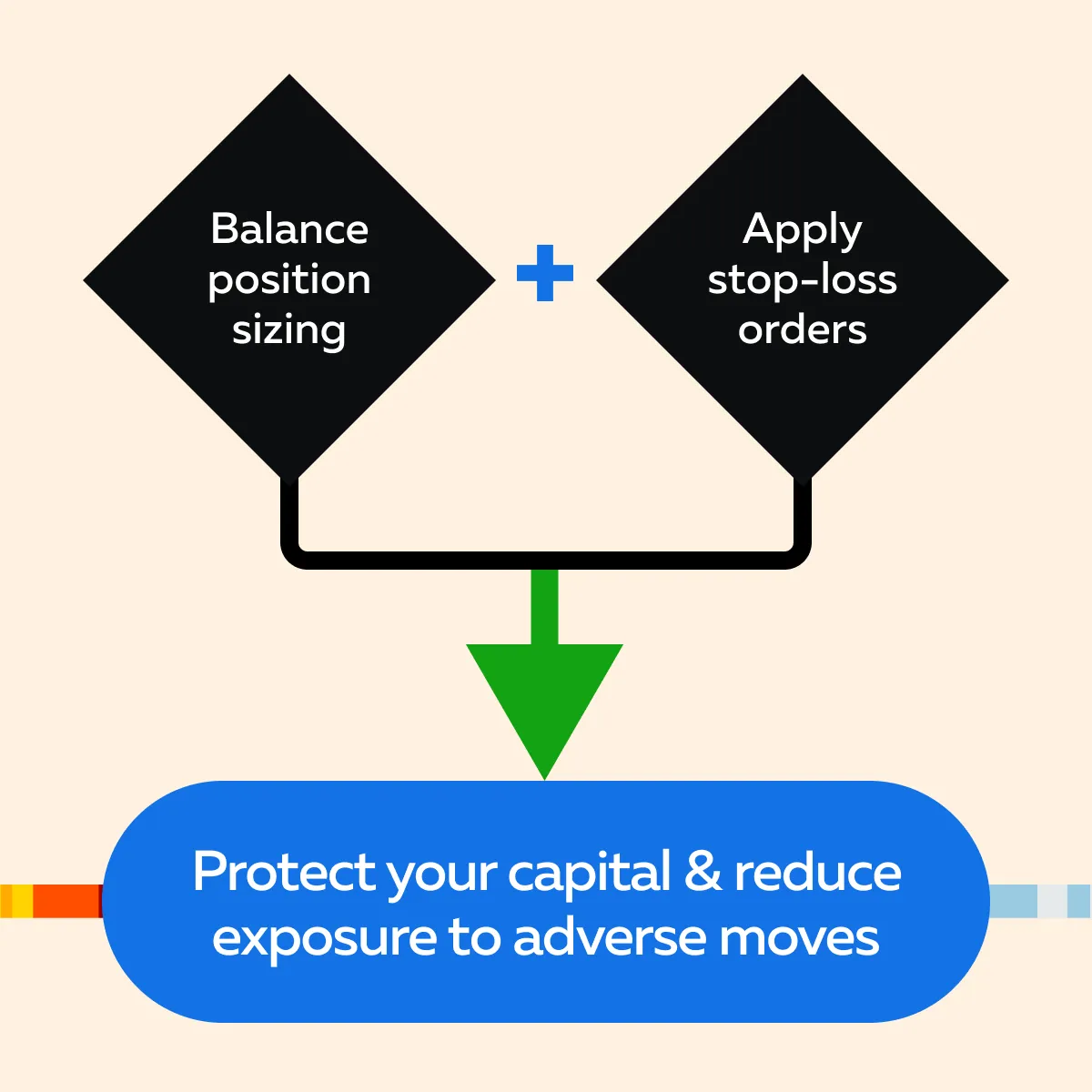

This approach lowers the risk by avoiding dependence on the performance of a single market. Position Sizing and Stop-Loss Orders

To manage risk in market-neutral trading and other non-trend strategies, you can:

- Set appropriate position sizes,

and

- Implement stop-loss orders.

Specifically, by keeping position sizes reasonable, you can ensure that losses remain manageable. On the other hand, stop-loss orders allow you to exit a position if it moves unfavorably beyond a certain threshold. By using them, you can limit losses even in volatile conditions. See how both these tools benefit you in the graphic below:

How to Use Real-Time Data Tools Like Bookmap?

If you are using non-trend strategies, access to real-time data tools like our Bookmap can give you an edge. With Bookmap, you can analyze:

- Real-time liquidity,

and

This analysis helps you to get important information about price levels, volume, and market sentiment. By observing where liquidity is concentrated and tracking large orders as they enter the market, you can gain insights into likely support and resistance levels. This data allows you to spot areas where you can expect reversals or consolidation better.

Conclusion

Non-trend trading strategies offer traders a flexible approach. Using them, you can find opportunities regardless of market direction. You can even generate returns in diverse market conditions by focusing on factors like:

- Volatility,

- Mean reversion, and

- Price discrepancies (across low-correlation assets).

Be aware that these strategies are especially valuable for trading without trends, as they reduce dependence on market momentum. This provides stability even when markets are volatile or directionless.

If you are looking to diversify your portfolios, non-trend strategies also provide an extra layer of security. They do so by reducing exposure to the market’s ups and downs.

Additionally, your trading endeavors are bound to profit from the advanced market analysis tool Bookmap. It offers you real-time data and significantly improves your execution. With Bookmap, you get insights into liquidity and order flow, which further helps you to make precise entry and exit decisions. Discover how Bookmap’s real-time tools can help you identify opportunities beyond traditional trends.