Ready to see the market clearly?

Sign up now and make smarter trades today

Crypto

May 31, 2024

SHARE

The Advantage of The Small Trader: Cross-exchange Liquidity and its Visualization

By Owain Higham

Sinking Whales

One of the seemingly biggest disadvantages of being a retail trader is the lack of capital. Usually any money you have for trading comes from your own pocket, or at best from close friends and family. Amongst other things, this means that you have less financial firepower to invest into equipment and research. It’s easy to read stories of well-funded hedge funds swinging billions of dollars worth of contracts and feel envious. But with the internet, global financial markets are open to almost everyone at a very low cost. You don’t need a seat on the exchange to get access to the market anymore, and with the advent of crypto, it’s getting even cheaper and easier. Not to mention that the kinds of order flow visualization tools that were before proprietary and only available in-house are now right there at your fingertips.

As technology evolves and so do the kind of trading tools that it is now possible to develop, the business of trading is approaching as close to a level playing field as it has ever been. In fact, in many ways the small trader has all the advantages, plus one. Consider the fact that large institutions have legal mandates to their customers, which goes without saying includes a lot of stress when these unsavvy investors call in a panic, wanting to know if the trading strategy being run is ever going to outperform the broader market. Then there are the regulatory constraints about which assets the management firm is allowed to invest in: some are stuck to trading only local markets, others have to target a specific maximum volatility. This is why many institutions were late to the crypto party, while retail has been leading the way since the very beginning. This is quite unusual in the financial world, where it’s usually Wall Street that runs the show. These days it’s the retail crowd that has the power. The whales may have the size, but that’s the very thing that slows them down. One of the biggest advantages of the small trader is the lack of impact on liquidity, as well as a faster decision-maker process. Not having to talk to the risk management department every time you take a trade offers a speed advantage, and when it comes to liquidity, that is a huge edge.

Nibbling On Liquidity

As a smaller trader, you don’t have to worry about a trade getting away from you because you can just fire off market orders with little or no effect on liquidity, jumping in and out of positions at will. Large institutional players don’t have that same freedom, since trying to open or close their whole position in one transaction risks pushing the market away from them and resulting in a worse price. In fact, this is one of the reasons why prices tend to gravitate towards areas of high liquidity on the Bookmap heatmap, because the big players know they can at least get a fill at those levels.

Of course, the big boys and girls making directional bets don’t always want to pay up, so they regularly split their trades into smaller orders and try to build a position. The issue here is that it takes time, and they are taking the risk that the market will run away from them. If a piece of breaking news comes out, for example, sentiment in the market can suddenly shift and the big players can be left scrambling for liquidity, resulting in a worse average entry price. But they have no choice, because entering in one go will not only push the market against them due to liquidity constraints, but will also alert other market participants that somebody is trying to make a big play. It’s especially dramatic if they are sitting on a loss and are gagging to get out of a hole before it gets any bigger, as they will usually take any price. After all, any price is better than no price. The problem is, there often isn’t enough liquidity at the next best price, so they end up being forced to trade at increasingly worse prices. For the cunning retail trader, this is the perfect opportunity to get in ahead of a clumsy whale.

Identifying The Players and Their Behaviors

Looking at Bookmap’s new consolidated Multibook, crypto traders can build a successful trading strategy by targeting areas of high liquidity identified across exchanges. Prices often gravitate towards areas of high liquidity because this is where the large traders can get the fill they need. Naturally, being able to see as much of the liquidity available in the market as possible is ideal. If you want to know more about Multibook specifically, have a read of trading with Multibook.

To find the right assortment of instruments to consolidate, traders may want to identify the players in the market. Since different market participants have different goals, they can create different patterns. Market makers are constantly trying to balance their books, which can lead to back and forth trading, whereas momentum traders are hitting the bid/lifting the offer, or just leaving resting GTC stop orders in the book, the resulting transacted market orders consuming liquidity and often destabilizing prices.

Taking into account these various approaches transacting in the market could impact the particular instruments you choose to consolidate. Futures products tend to be used for hedging or playing the futures curve, which means sometimes the direction of order flow can even be inverted. Spot, on the other hand, tends to be more “organic” and the transactions more direct. There’s nothing to stop you combining both futures and spot instruments, so that you can analyse both at the same time.

Finding the best combination of instruments to consolidate into a synthetic Multibook instrument may require some experimenting as it’s bound to be unique for each trader and their individual approach to the crypto market. The Bookmap forum or Discord chat is a great place to discuss and learn from the experience of other traders.

Leaning Into Liquidity

When sentiment allows, e.g. the cumulative volume delta or other contextual dynamics (such as news flow) are strong, then leaning into the walls of liquidity on the heatmap can be a profitable strategy. This is done by taking a position as prices approach the level, with a take profit order added to their wall of liquidity.

Frontrunning their orders by placing yours just a few dollar points earlier is a slightly more conservative strategy. The most aggressive approach would be to have your take profit orders just beyond the level. If sentiment is particularly strong and the big players can’t get a complete fill, they could push the market beyond the level, potentially triggering stops which could propel even prices further.

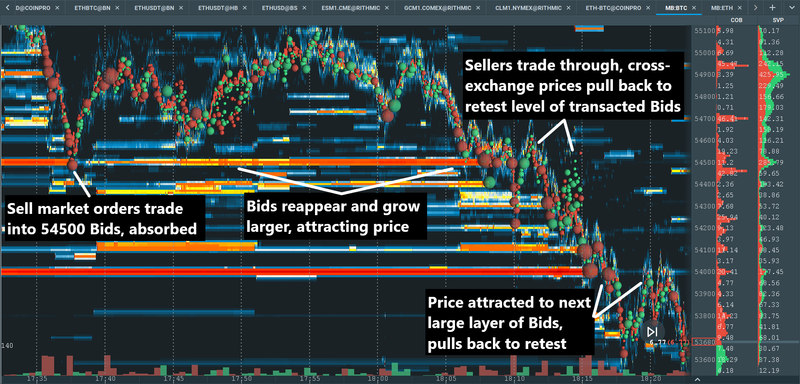

Fig 1 – Multibook example of how cross-exchange walls of liquidity for BTC/USD attract price.

Fig 1 – Multibook example of how cross-exchange walls of liquidity for BTC/USD attract price.

Whales Falling Off Walls

As a smaller trader, we know it’s cheap for us to test an idea because we can get in and out almost instantly. If you find yourself in a position that’s not working out, it’s easy to jump out and try again later. The whales don’t have that luxury, and identifying large market participants stuck in a position with things like on-chain analytics, then using the order flow dynamics visualised on Multibook as confirmation can be a goldmine. Remember, bids and offers can be used to enter as well as exit the market, but they can also be used for other strategic purposes. Since walls of liquidity are literally that—walls that can act as support and resistance—if the transacted market orders are not big enough to fully consume them, the bids and offers will stop changes in price.

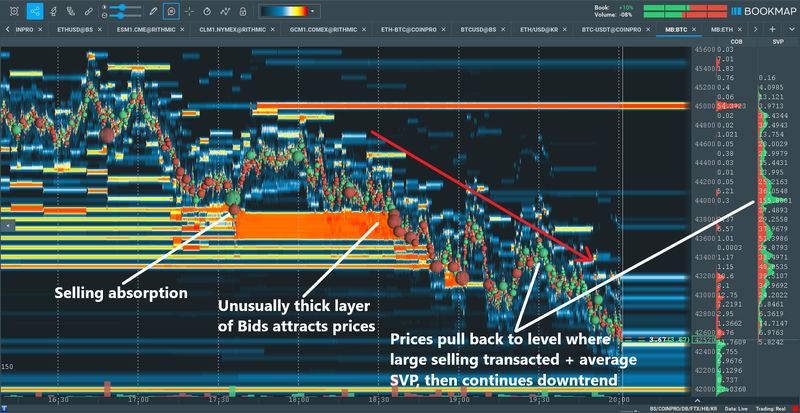

Whether it’s an attempt at spoofing the market, or they really intend to push back against momentum, large liquidity is protective against an asset moving. If you notice unusual behaviour in the book, e.g. multiple layers of bids morphing into one larger layer, it could be a large trading entity trying to protect their position. When large traders try to push the market around, they often lead themselves into a tight spot. All the capital that goes into a particular investment thesis requires liquidity to take the other side. If the time disadvantage of decision making leads to their position resulting in a bad average price and the credit lines with the investment banks are running dry, or simply the perception of that particular crypto asset becomes volatile and they are caught on the wrong side, they may try a last ditch attempt to avoid the loss. But if they are unable to hold the momentum back, trading against their positions for their eventual unwind can lead to windfall profits.

Fig 2 – With crypto, it’s hard to know exactly which transacted market orders were triggered as stops. But multiple layers of thick liquidity could be a sign of large players attempting to protect their position. If prices break through, it can result in some large moves as they are forced to unwind.

Fig 2 – With crypto, it’s hard to know exactly which transacted market orders were triggered as stops. But multiple layers of thick liquidity could be a sign of large players attempting to protect their position. If prices break through, it can result in some large moves as they are forced to unwind.

Conclusion

Looking at consolidated order flow with Multibook naturally offers a lot more context than just looking at a single exchange. If liquidity is joining a specific price across multiple exchanges, that level is clearly more important. Seeing the total volume traded also increases the clarity of order flow behaviour. Different market participants have different strategies, and that can lead to temporary dislocations of order flow across exchanges. For example, if someone is trying to execute an arbitrage trade by going long one instrument and short another, but you only see the activity on a signal exchange, you may be caught out by a false signal.

Adding Multibook to your arsenal of crypto trading tools and using the cross-exchange liquidity levels and cumulative delta as final confirmation of the big players’ activity can help to really refine your edge. Being able to see where the truly deep liquidity across multiple exchanges gives you better transparency and insight of order flow in the market, and can lead to better entry and exit prices. Over time, this gets you the best price for your trades. Seeing the actual transactions and using larger-than-usual trades as a potential signal means you have a well-rounded approach to add to your trading strategy.

If you wish to explore such concepts further, Bookmap’s Discord community is a great place to meet and chat with other traders.