20% Off Just for Blog Readers — Until July 31.

Use code BLOG20-JULY for 20% off your first month of Bookmap Only valid through July 31.

Trading Basics

February 12, 2024

SHARE

The Art of Short Selling: Strategies and Risks in a Bear Market

Sell what you don’t have. This might be hypothetical in real life but in the world of trading, it holds. Known as short selling, it is a smart strategy for making money and profiting from bear markets, a period when stock prices fall. In this article, we’ll start by understanding what bear markets are and how they act. Then, we’ll check out advanced market analysis tools like Bookmap that help us visualize the stock market.

Also, we will understand short selling in great depth using simple strategies like looking at charts and using some analysis tools. Let’s get started!

What is a Bear Market?

A bear market is a financial market condition describing a broad market downturn across various asset classes such as stocks, bonds, and commodities. A market is characterized as “bear” when it experiences a:

- Prolonged decline in investment prices and

- The decline is typically 20% or more from recent highs.

What are the Characteristics of a Bear Market?

Bear markets are usually driven by a combination of economic factors, investor sentiment, and other macroeconomic indicators. Let’s have a look at some of its major characteristics:

- Contraction in Prices:

-

-

- Bear markets involve a sustained period of falling asset prices.

- This decline can be driven by various factors, including:

- Economic slowdowns

- Rising interest rates

- Geopolitical tensions, or

- Negative sentiment.

-

- Prolonged Duration:

-

-

- Bear markets are typically more extended in duration than short-term market corrections, which typically occurs for a few weeks or months when securities prices fall by 10% .

- Bear markets can last for several months or even years, reflecting a broader economic downturn.

- Negative Investor Sentiment:

- Investor confidence and sentiment play a crucial role in bear markets.

- Fear, uncertainty, and pessimism tend to dominate

- Widespread selling pressure is witnessed as investors seek to:

- Cut losses or

- Avoid further potential declines.

-

- Increased Volatility:

-

- Bear markets are characterized by heightened volatility as prices swing more erratically.

- This volatility can create challenges for both long-term investors and short-term traders.

What Trading Opportunities Do Bear Markets Present?

While for investors strictly going long, a bear market represents a period of pessimism, for smart traders it presents unique trading opportunities. Let’s explore some of them below:

- Sell High & Buy Low:

-

-

- Short selling involves selling assets that are borrowed with the expectation of buying them back at a lower price.

- In a bear market, short sellers can profit from falling prices by selling high and buying low.

-

- Inverse ETFs and Options:

-

-

- Investors can use financial instruments like inverse exchange-traded funds (ETFs) or options to profit from declining markets.

- These instruments are designed to move in the opposite direction of the underlying market or index.

-

- Defensive Strategies:

-

- Some investors adopt defensive strategies, such as moving into cash, bonds, or defensive sectors to minimize losses during a bear market.

What is Short Selling?

Short selling is a trading strategy in which an investor, known as a short seller:

- Borrows shares of a security from a broker and

- Sells them on the open market.

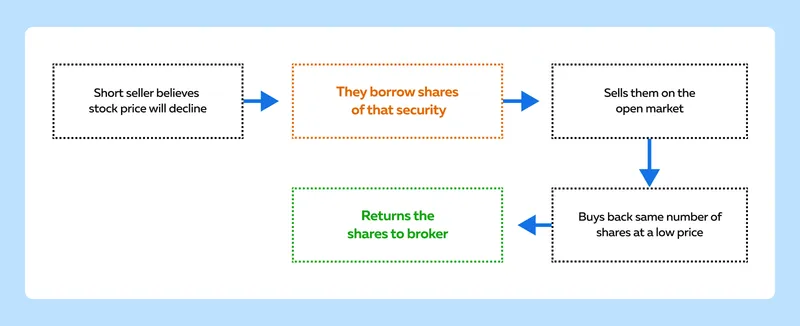

The underlying assumption is that the price of the security will decline. Let’s understand the process of short selling below:

-

- Borrowing Shares: The short seller borrows shares of a stock from a broker, typically through a margin account.

- Selling the Shares: The borrowed shares are sold in the open market, generating cash for the short seller.

- Waiting for a Price Decline:

- The short seller anticipates that the price of the stock will fall.

- They buy back the shares at a lower price when the assumption comes true.

- Buying Back Shares (Covering):

-

- To close the short position, the short seller buys back the same number of shares in the market.

- This action is referred to as “covering.”

- Returning Borrowed Shares: The short seller returns the borrowed shares to the broker, completing the transaction.

Why is Short Selling Used in Bearish Market Conditions?

Most traders prefer using short selling, particularly during bearish market conditions. They do so for a variety of reasons:

- It allows traders to profit from declining markets by selling high and buying low.

- It can serve as a hedge for long positions.

- It provides an additional tool for portfolio diversification by allowing investors to profit in both rising and falling markets.

Some Common Misconceptions and Considerations

Short selling is a sophisticated trading strategy that requires a deep understanding of the market, risk management, and precise timing. Most novice traders have a misconception that short-selling losses are unlimited. While potential losses can be significant, they are capped at 100% if the stock price were to rise to infinity.

However, to avoid such negative outcomes, traders must consider and prepare for the challenges delineated in the table below:

| Challenges | Explanation | Trader’s Action |

| Timing Challenges | Short selling requires precise timing as markets tend to remain irrational longer than investors can remain solvent. | Traders need to be cautious about the timing of both the entry and exit points. |

| Margin Requirements | Short selling involves borrowing on margin. Thus, traders must maintain a margin account. | Traders must understand that margin requirements are crucial to avoid margin calls. |

| Dividend Payments | Short sellers may be required to pay any dividends that the stock pays out to its shareholders. | Traders must maintain buffer money as this can increase the cost of maintaining a short position. |

| High Risk | Due to the potential for unlimited losses (capped at 100%), risk management is essential when engaging in short selling. | Traders should set stop-loss orders and have a clear exit strategy. |

Short Selling Strategies in a Bear Market

Using advanced strategies, experienced traders can execute profitable trades in bear markets. For effective deployment, it is necessary to gain a comprehensive understanding of:

- Technical analysis

- Risk management, and

- Market dynamics.

Let’s go through some popular short-selling strategies listed below:

1. Moving Averages:

The moving averages strategy identifies short-selling opportunities by analyzing the trend direction. Short sellers often look for instances where the price crosses below a key moving average (e.g., a 50-day or 200-day moving average). This crossover signals a potential downtrend, prompting short sellers to enter positions.

There are two popular applications of moving averages:

2. Sell the Rally:

In a prolonged bear market, there are often temporary market rallies or relief bounces. The “sell the rally” strategy involves:

- Identifying these upward movements and

- Using them as opportunities to enter or add to short positions.

Some common applications include:

| Identifying Overbought Conditions | Setting Stop-Loss Orders |

| Technical indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) can help identify overbought conditions during rallies, signaling potential reversals. | Traders place stop-loss orders above the rally highs to manage risk in case the market continues to move against their short positions. |

3. Using Chart Patterns:

Chart patterns provide valuable insights into potential short-selling opportunities. Patterns like head and shoulders, double tops, and descending triangles are often considered bearish indications. Let’s understand two of them:

- Head and Shoulders:

-

-

- This pattern typically signifies a trend reversal from bullish to bearish.

- Traders initiate short positions when the price breaks below the neckline.

-

- Double Tops:

-

- A double-top pattern suggests a potential price reversal.

- Short sellers enter positions as the price breaks below the trough between the two peaks.

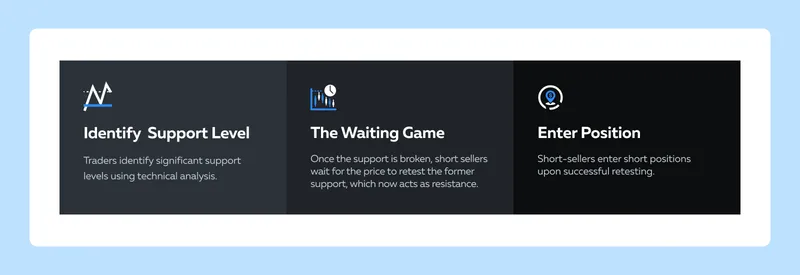

4. Break and Retest Method:

The break and retest strategy involves waiting for a support level to break down and then retesting that broken level as “resistance” before entering a short position. A graphical representation of the steps is given below:

5. Event-Driven Short Selling:

Event-driven short selling involves taking short positions based on anticipated or actual events that are expected to hurt the market or specific sectors. This strategy relies on the belief that certain events, such as earnings reports, regulatory changes, or economic data releases, will lead to a decline in asset prices.

Read the table below to understand how events influence short selling:

| Events | Explanation | Trader’s Action |

| Earnings Reports |

|

Traders can initiate short positions before the earnings release. |

| Regulatory Changes | Authorities can bring in regulatory changes, such as increased scrutiny or stricter regulations. | These regulatory changes can prompt short sellers to bet on a decline in affected stocks or sectors. |

| Economic Data Releases | Short selling is based on expectations of unfavorable economic indicators. | Such pessimism can impact the overall market or specific industries, which encourages traders to short-sell. |

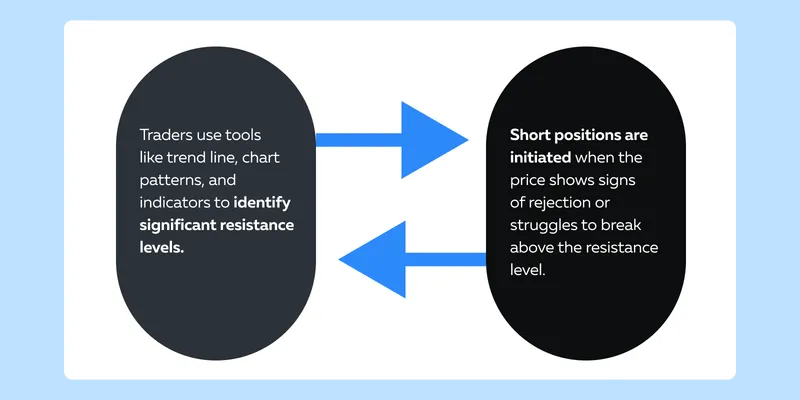

6. Short Selling on Resistance Levels:

Short selling on resistance levels involves identifying key price levels through technical analysis where the asset has historically struggled to move above. Traders initiate short positions when the price approaches these resistance levels.

So, this strategy is based on two important parameters:

Case Study: AMC Stock Movement in August 2023

In August 2023, AMC Entertainment Holdings, Inc. (AMC), a popular cinema chain, experienced a significant surge in its stock price. This increase was largely driven by:

- Retail investor interest and

- Social media discussions, which are reminiscent of the “meme stock” phenomenon.

The Opportunity

Some short sellers viewed the rapid increase in AMC’s stock price as disconnected from the company’s fundamentals, presenting an opportunity to bet on a correction. Even the technical analysis, using indicators like the Relative Strength Index (RSI), provided signals for potential short entries.

What Challenges did the Short Sellers Face?

The coordinated buying efforts of retail investors led to a short squeeze. This caused the stock price to surge further. Short sellers faced substantial losses as they rushed to cover their positions. In some cases, short sellers faced difficulties in finding available shares to borrow due to high demand for shorting.

What Can You Learn?

The AMC case illustrates the challenges associated with short selling in a market influenced by:

- Retail investor sentiment and

- Social media dynamics.

Event-driven short selling and short selling on resistance levels are strategies that require careful analysis and risk management. Traders must consider both technical signals and broader market dynamics when engaging in short-selling strategies.

Trading Considerations in a Bear Market When Short Selling

Short Sale Restrictions (SSR) are regulations aimed at preventing short sellers from driving down the price of a stock excessively during a single trading day. When a stock triggers SSR, traders are prohibited from shorting the stock on a downtick.

How does SSR Impact Trading?

Traders under SSR can only enter short positions at or above the current market price. This restriction aims to prevent aggressive short selling on a stock experiencing rapid declines. Furthermore, it leads to:

- Increased Difficulty in Executing Trades

-

-

- The requirement for limit orders results in delayed or incomplete executions, especially in fast-moving markets.

-

- Market Dynamics

-

- SSR influences market dynamics, as short sellers are forced to wait for upward price movements before initiating or adding to short positions.

Managing Pullbacks and Presented Opportunities

Shorting stocks can be tricky because of something called “pullbacks.” These are moments when the market, even during a bearish phase, takes a little break from going down and goes up for a bit. It’s like a pause in the downward trend.

These pullbacks can happen unexpectedly, making it challenging for short sellers who are betting on prices to keep falling. However, traders need to be ready for these upward movements, as they can present immense opportunities for the traders.

They can make some quick profits by:

- Buying low during the pullback and

- Selling when the prices go up.

These opportunities allow traders to take advantage of short-term shifts in market sentiment by making strategic moves during the temporary rebounds in prices.

How to Identify Favorable Opportunities During Pullback?

Opportunities during pullbacks arise when the market takes a break from falling and shows a temporary upward movement. Traders can identify these opportunities through:

- Intraday Reversals:

-

-

- Bear markets can experience intraday reversals where the market temporarily rebounds.

- These pullbacks provide short-term trading opportunities for both long and short positions.

-

- Trend Reversal Indicators:

-

-

- Technical indicators and chart patterns signaling potential trend reversals can be useful for identifying entry points during pullbacks.

-

- Contrarian Strategies:

-

- Traders can adopt contrarian strategies, taking advantage of short-term market sentiment shifts during pullbacks, especially if they believe the broader bearish trend will resume.

What is the Role of Dealers and Market Makers in Short Selling?

Dealers and market makers play a crucial role in financial markets, particularly when it comes to short selling. These entities facilitate the buying and selling of financial instruments. When traders initiate short positions, dealers and market makers take the other side of those trades, providing liquidity to the market. Let’s understand their role in short selling in-depth:

How do Dealers and Market Makers Hedge with Futures Contracts?

Dealers and market makers often use futures contracts to hedge their exposure to the securities they hold due to short sales. This involves taking offsetting positions in futures contracts to minimize the impact of price fluctuations.

By managing their risk through hedging, dealers and market makers contribute to market stability. This is particularly important in times of heightened volatility.

The Price Rebound

- When dealers and market makers hedge their short positions with futures contracts, it can lead to situations where they need to buy back the underlying securities.

- This buying activity, especially during market downturns, can contribute to rebounds in prices.

How to Use Bookmap for Short Selling in Bear Markets

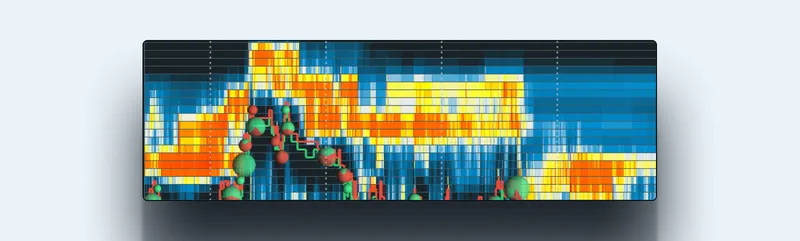

By utilizing tools like Bookmap for real-time data visualization and implementing sound risk management strategies, traders can enhance their short-selling approach in bear markets. First, let’s see how Bookmap helps traders:

Real-time Data Visualization

Bookmap provides a visual representation of market depth. It allows traders to see the order book in real-time and helps in the identification of key support and resistance levels. Further, traders can use Bookmap to:

- Analyze aggregated liquidity and

- Spot areas where there is significant buying or selling interest.

Heatmap

Bookmap’s heatmap visualizes order flow intensity by indicating areas of high or low trading activity. This helps traders identify clusters of selling pressure, potentially signaling an opportunity to enter a short position.

Also, heatmaps can highlight liquidity pools. These pools reveal areas where large orders are waiting to be executed. Traders can use this information to anticipate potential market movements.

Volume Indicators

Bookmap’s volume profile tools show the distribution of trading volume at different price levels. Traders can identify price levels with significant volumes and identify key support and resistance zones.

Additionally, an analysis of the volume delta (difference between buying and selling volume) can help traders assess the strength of a trend. A high negative volume delta may indicate strong selling pressure.

The Various Uses of Bookmap

- Identifying weaknesses in price action by observing how the order book evolves

- Confirming breakdowns below key support levels

- Identifying scalping opportunities, taking advantage of short-lived market inefficiencies

Risk Management in Short Selling

Short selling carries the risk of unlimited losses (capped at 100%) if the price of the asset continues to rise. Thus, effective risk management is crucial to mitigate potential financial exposure. By following these strategies traders can mitigate risks:

| Strategies | Explanation |

| Setting Stop-loss Orders |

|

| Position Sizing |

|

| Monitoring Borrow Costs |

|

| Stay Informed on Market Sentiment |

|

| Adaptability and Flexibility |

|

Conclusion

Bear markets represent a period of prolonged market decline. It provides immense trading opportunities for short sellers. By implementing effective strategies and recognizing the characteristics of bear markets (such as negative sentiment and increased volatility), traders can gain profit from falling prices.

Advanced tools like Bookmap provide real-time data visualization and help traders identify trends and potential entry points. However, risk management is paramount, and traders must set stop-loss orders besides maintaining a deep awareness of market sentiments.

Curious about the intricacies of short selling and the critical concept of a short squeeze to manage risks and confront challenges in a bear market? Dive deeper into our comprehensive article, “What is a Short Squeeze in Trading?” on the Bookmap blog. Expand your trading knowledge and understand how to navigate these complex scenarios.