Ready to see the market clearly?

Sign up now and make smarter trades today

Education

July 17, 2024

SHARE

The Intersection of Trading and Technology: How Silicon Valley is Shaping the Future of Finance

Technological innovation is not just about creating something new; it’s about transforming the way we live, work, and interact with the world. Technological innovations from Silicon Valley are truly transforming the world of trading and finance.

This article will introduce you to cutting-edge tools and platforms that are making trading easier, more accessible, and more profitable for all. We’ll discuss everything from commission-free apps like Robinhood to advanced data visualization tools like Bookmap.

Also, we will explore the next generation of trading tools and their potential impact on financial markets. Let’s begin.

The Silicon Valley Effect on Finance

Over the years, Silicon Valley has profoundly influenced the financial sector. It has significantly transformed traditional trading and investment practices. Let’s see some key milestones:

The Early Days (1970s-1990s)

- Silicon Valley’s influence on finance began with the advent of personal computers and the Internet.

- Companies like Intuit, founded in 1983, introduced software like Quicken to help individuals manage their finances.

- This laid the groundwork for digital financial management.

Online Trading (1990s)

- This phase witnessed the development of online trading platforms like

- E-Trade (founded in 1982) and

- Charles Schwab (founded in 1971).

- This innovation democratized investing by allowing individuals to trade stocks and securities from their computers.

- The introduction of online trading marked:

- A significant departure from traditional brokerages and

- Paved the way for self-directed investing.

PayPal (1998)

- PayPal was founded by a group including Elon Musk and Peter Thiel.

- It revolutionized online payments by providing a secure and convenient way to send money electronically.

- Soon, PayPal became a staple of e-commerce and laid the foundation for digital payment systems.

Peer-to-Peer Lending (2000s)

- Borrowers directly connected with investors via platforms like:

- Prosper (founded in 2005) and

- Lending Club (founded in 2006).

- This development disrupted traditional banking models by offering:

- Lower rates for borrowers and

- Higher returns for investors.

Bitcoin and Blockchain (2008)

- The invention of Bitcoin by Satoshi Nakamoto introduced blockchain technology, which led to the introduction of cryptocurrencies.

- This technology helped secure transparent transactions and eliminated the need for traditional financial intermediaries like banks.

Robo-Advisors (2010s)

- Robo-advisors are algorithm-driven investment platforms that provide:

- Automated portfolio management and

- Financial advice.

- Notable examples include fintech startups like:

- Betterment (founded in 2008) and

- Wealthfront (founded in 2008).

Regtech and Compliance (2010s)

- Fintech companies began using technology to streamline regulatory compliance processes.

- This phase saw the development of software like:

- Know Your Customer (KYC) verification and

- Anti-money laundering (AML) monitoring.

Mobile Banking and Payment Apps (2013)

- The proliferation of smartphones led to the rise of mobile banking and payment apps like:

- Venmo (acquired by PayPal in 2013),

- Square Cash (launched by Square in 2013), and

- Robinhood (founded in 2013).

- These apps made banking and investing more accessible and convenient.

Pioneering Technologies Reshaping Trading

Pioneering technologies such as AI, machine learning, and blockchain have reshaped trading by enhancing:

- Market analysis,

- Prediction accuracy, and

- Trading efficiency.

These techniques can process large volumes of data and even automate trading processes. Let’s understand their benefits listed in the given tables:

Artificial Intelligence (AI) and Machine Learning

| Algorithmic Trading | Predictive Analytics | Natural Language Processing (NLP) |

|

|

|

Blockchain Technology

| Smart Contracts | Tokenization of Assets |

|

|

Some Groundbreaking Tools and Platforms

- Robinhood

-

-

- Robinhood is a major brokerage industry player which offers:

- Commission-free trading and

- User-friendly mobile app interface.

- It has democratized access to financial markets, particularly among younger investors.

- Robinhood is a major brokerage industry player which offers:

-

- QuantConnect

-

- QuantConnect provides a cloud-based algorithmic trading platform.

It enables developers to:

- Design, backtest, and deploy trading strategies across various asset classes,

- Utilize multiple programming languages, and

- Access extensive historical and real-time market data.

- TradingView

-

-

- TradingView offers a web-based platform for:

- Technical analysis,

- Charting, and

- Social networking.

- TradingView offers a web-based platform for:

-

- Coinbase

-

-

- Coinbase is a leading cryptocurrency exchange.

- It offers a user-friendly platform for buying, selling, and storing digital assets.

- It offers a range of trading tools, including:

- Advanced order types and

- Cryptocurrency wallets.

-

- ThetaRay

-

- ThetaRay utilizes AI and machine learning to detect financial crimes such as:

- Money laundering and

- Fraud in real-time.

- Its platform helps financial institutions comply with regulatory requirements and reduce risks associated with illicit activities.

- ThetaRay utilizes AI and machine learning to detect financial crimes such as:

Fintech Startups and the New Trading Landscape

Fintech startups develop novel trading strategies and financial products by using emerging technologies such as:

- Artificial intelligence,

- Machine learning,

- Blockchain, and

- Big data analytics.

Also, fintech startups are democratizing access to financial markets by providing user-friendly platforms. Through mobile apps, web platforms, and robo-advisors, startups like Robinhood, Wealthfront, and Betterment are making it easier for people to invest in:

- Stocks,

- ETFs,

- Cryptocurrencies, and

- Other assets.

Startups vs. Wall Street: Leveling the Playing Field

Silicon Valley startups are challenging traditional financial institutions by offering more agile, user-friendly, and accessible trading platforms. Let us see how they’re leveling the playing field:

- Agile Innovation

-

-

- Fintech startups operate in an environment that encourages rapid experimentation and innovation.

- This environment allows them to quickly adapt to:

- Changing market dynamics and

- Customer preferences.

- Unlike traditional financial institutions, which are often burdened by legacy systems and bureaucratic processes, startups heavily rely on user feedback and technological advancements.

-

- User-Friendly Interfaces

-

-

- Startups prioritize creating intuitive and user-friendly interfaces.

- They use cutting-edge design principles and customer-centric approaches.

- Startups like Robinhood, Wealthfront, and Coinbase have developed platforms that are

- User-friendly with intuitive navigation,

- Aesthetically appealing with engaging design elements, and

- Easily accessible and compatible with multiple devices.

-

- Accessibility

-

- Fintech startups are democratizing access to financial markets by eliminating barriers to entry such as:

- High fees,

- Account minimums, and

- Complex trading tools.

- Platforms like Robinhood have pioneered commission-free trading, making trading affordable for retail investors.

- Similarly, robo-advisors like Betterment and Wealthfront offer low-cost investment solutions that automate portfolio management and financial planning for individual investors.

- Fintech startups are democratizing access to financial markets by eliminating barriers to entry such as:

Some successful fintech startups

| Startups | Features | Benefits |

| Revolut | Revolut offers a comprehensive range of financial services, including:

|

|

| TradeBlock |

|

|

| iCapital |

|

|

The Future of Trading Tools

The new trading tools and platforms coming from Silicon Valley will probably be influenced by trends like:

- Decentralized finance (DeFi) and

- Automated trading system.

Let’s speculate on how these future technologies could further democratize trading and increase transparency in financial markets:

Using Decentralized Finance (DeFi)

Future trading tools and platforms will use DeFi protocols to enable:

- Peer-to-peer trading,

- Lending, and

- Borrowing of digital assets without the need for intermediaries.

Some common real-life examples

| Uniswap and SushiSwap | Ethereum |

|

|

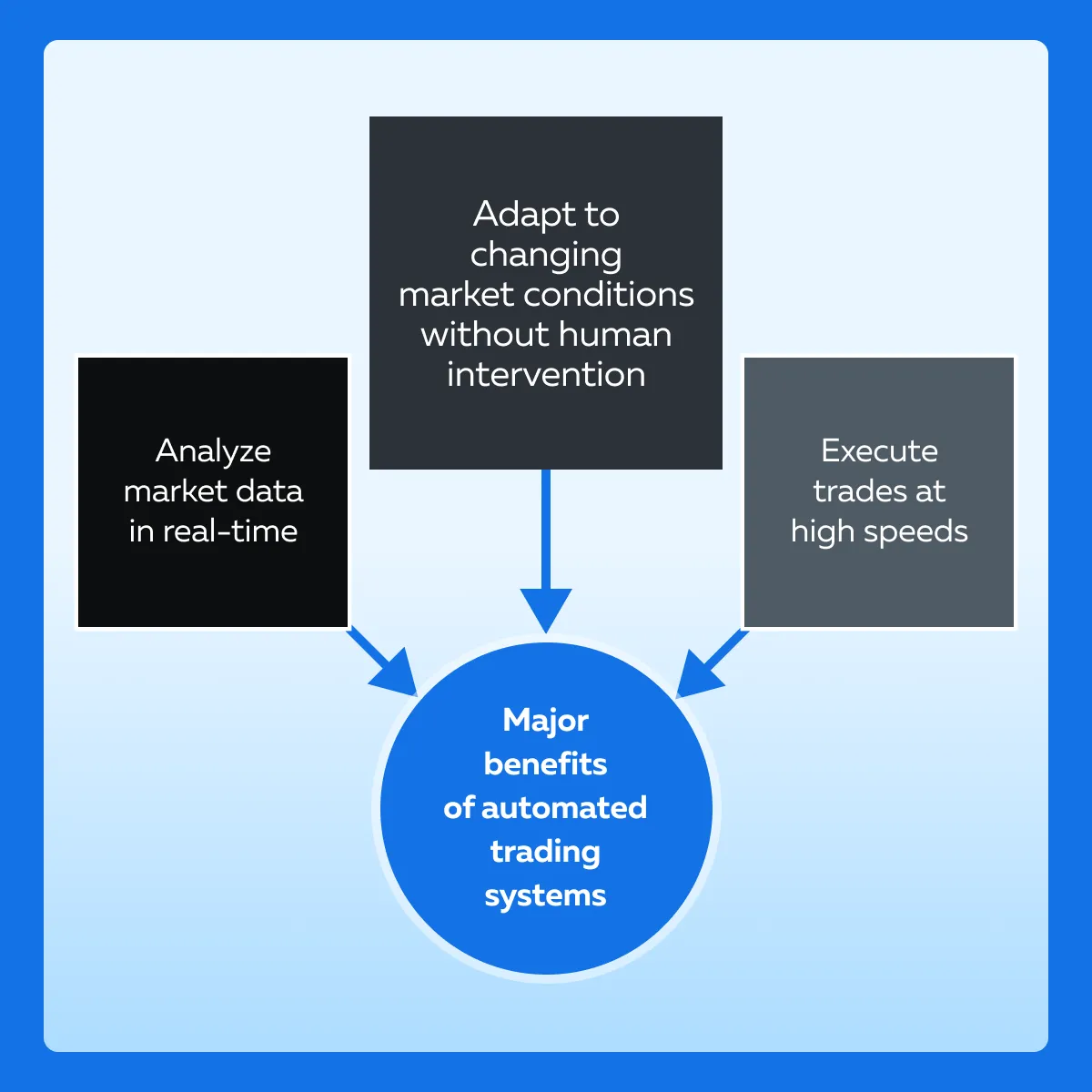

Using Automated Trading Systems

Automated trading systems are powered by:

- Artificial intelligence,

- Machine learning, and

- Quantitative analysis.

They will continue to play a significant role in the future of trading. Powered by advanced algorithms, these systems employ:

- Sentiment analysis,

- Natural language processing, and

- Social media data analysis.

How Does Bookmap Help?

Advanced market analysis tools like Bookmap offer unique data visualization, which provides traders with insights into:

- Market depth,

- Liquidity, and

- Order flow.

Let’s have a look at some of its unique features:

Challenges and Opportunities at the Crossroads

The integration of technology and trading is challenging. It leads to several concerns, such as:

- Regulatory hurdles,

- Security concerns, and

- The digital divide.

Let’s understand each of them in detail.

Regulatory Hurdles

- Regulatory frameworks governing trading activities vary across jurisdictions.

- Understanding these complexities can be daunting for both established financial institutions and innovative fintech startups.

Security Concerns

- Trading technologies, particularly in the cryptocurrency space, are susceptible to fraud and market manipulation.

- Also, the increasing digitization of trading platforms exposes them to cyber threats such as:

- Hacking,

- Data breaches, and

- Malware attacks.

Digital Divide

- While technology democratizes access to financial markets, it creates barriers to entry for marginalized communities.

- Also, automated trading systems powered by AI and machine learning perpetuate biases present in historical data.

Regulations

The emergence of new trading technologies has created regulatory challenges for both companies and regulators. These challenges arise from the need to balance innovation with:

- Investor protection,

- Market integrity, and

- Financial stability.

Let’s understand some specific regulatory challenges with cryptocurrency trading platforms:

| AML/KYC Compliance | Securities Regulation | Consumer Protection |

|

|

|

How startups and regulators are addressing these issues?

- Collaboration

-

-

- Many cryptocurrency startups collaborate with regulators to:

- Develop compliance solutions and

- Promote industry best practices.

- To facilitate dialogue between startups and regulators, the following initiatives have been started:

- Regulatory sandboxes,

- Pilot programs, and

- Industry consultations facilitate.

- Many cryptocurrency startups collaborate with regulators to:

-

- Compliance Solutions

-

-

- Startups are investing in compliance solutions and regulatory technologies (Regtech) to:

- Automate AML/KYC processes,

- Monitor transactions for suspicious activities, and

- Ensure compliance with regulatory requirements.

- These solutions help startups streamline regulatory compliance efforts and reduce compliance costs.

- Startups are investing in compliance solutions and regulatory technologies (Regtech) to:

-

- Industry Self-Regulation

-

- Some cryptocurrency startups have formed industry associations to:

- Establish industry standards,

- Promote transparency, and

- Foster collaboration with regulators.

- Some cryptocurrency startups have formed industry associations to:

Technological Disruption

Traders, both retail and institutional, can leverage Silicon Valley innovations to stay competitive and profitable. Let’s see some actionable tips:

- Stay Informed

-

-

- Keep abreast of technological advancements and market trends.

- Actively follow industry news.

- Participate in trading communities.

- Attend conferences and seminars.

-

- Adopt Scalable Solutions

-

-

- Choose trading tools and platforms that offer:

- Scalability,

- Reliability, and

- Performance.

- Look for platforms that offer the latest technologies such as:

- Cloud computing,

- Distributed ledger, and

- High-speed connectivity.

- Choose trading tools and platforms that offer:

-

- Diversify Strategies

-

-

- Explore a diverse range of trading strategies, including:

- Algorithmic trading,

- Quantitative analysis, and

- Arbitrage opportunities.

- Explore a diverse range of trading strategies, including:

-

- Risk Management

-

- Implement robust risk management practices to protect trading capital.

- To manage risk effectively, you can utilize:

- Stop-loss orders,

- Position sizing techniques, and

- Risk assessment tools.

Conclusion

The impact of Silicon Valley on the trading and financial sector has been transformative. It has truly reshaped traditional practices and democratized access to markets. Through innovative technologies, Silicon Valley startups have made trading more accessible, efficient, and user-friendly.

These startups have successfully used technologies such as artificial intelligence, blockchain, and big data analytics to provide traders with real-time market insights, automate trading processes, and enhance decision-making capabilities.

Also, advanced market analysis tools like Bookmap, have offered a competitive advantage to traders by letting them visualize the depth of the market via heatmaps and volume indicators. Do you wish to build knowledge and execute profitable trades? Explore how order flow with Bookmap gives stock traders an edge!