Ready to see the market clearly?

Sign up now and make smarter trades today

News & Announcements

May 6, 2025

SHARE

The Most Overcrowded Trades Right Now—And What Happens When the Tide Turns

Do you want to know the problem with a crowded trade? When everyone is in, there’s no one left to buy! Markets move in cycles, and when too many traders pile into the same bet—whether it’s AI stocks, Bitcoin, or shorting Treasuries—the risks of a sharp reversal increase. Such overcrowded trades can be profitable. However, when sentiment shifts, they can unwind violently, leaving unprepared traders trapped.

Want to avoid such traps and trade with confidence? In this article, you’ll learn what makes a trade overcrowded, where current market risks are building, and how to spot early warning signs before the collapse. We’ll explore liquidity traps in trading, institutional positioning trends, and strategies to protect yourself.

By the end, you’ll have practical tools to recognize when and how to exit before the crowd panics. After all, smart trading isn’t about following the herd; it’s about knowing when to leave before they stampede. Let’s begin.

What Makes a Trade Overcrowded?

A trade becomes overcrowded when too many traders are betting the same way—either all buying or all selling. This creates an imbalance in the market where everyone is on one side, and there aren’t enough traders taking the opposite position. As a result, liquidity decreases significantly, making it increasingly difficult to exit positions without moving the market.

But, Why Does This Matter?

Please note that when market sentiment shifts, overcrowded trades can unwind with surprising violence and speed. This happens because there are insufficient buyers or sellers to absorb the sudden flood of orders and keep prices stable. Such instability often leads to sudden price collapses. That’s because most traders rush to get out of their positions but struggle to find willing buyers or sellers.

For more clarity, let’s study some examples of overcrowded trades in history:

| Event | Year | Explanation |

| Tech Bubble | 2000 |

|

| Bitcoin Crash | 2021 |

|

| GameStop and AMC (short squeeze) | 2021 |

|

| ARK Invest | 2022 |

|

How Can You Spot an Overcrowded Trade?

You can identify overcrowded trades using these signals:

- High open interest in options/futures: If too many traders have positioned the same way, it could be risky.

- Massive fund inflows into a sector ETF: When money floods into a specific area, it might be overhyped.

- Retail traders all in on one trade: If everyone is talking about a stock going “to the moon,” it could mean the trade is overextended.

- Liquidity traps in trading: Be careful if you observe that market order books show apparent liquidity clusters—a large number of limit orders, but actually have low depth—few orders at each price level. It suggests price movements could be sharp and unpredictable. These traps occur when participants place orders they intend to cancel before execution, creating an illusion of liquidity.

In short, when too many people are on the same side of a trade, it can lead to big market swings when sentiment shifts. Thus, you, as an investor or trader, must keep an eye on the following:

- Market sentiment analysis

and

- Liquidity conditions.

This will protect you from getting caught in these traps.

The Most Overcrowded Trades Right Now

Currently, some areas of the market are seeing too much money flowing in from both retail and institutional traders. This abundance of money makes them vulnerable to sharp reversals. Below are some of the biggest risks right now:

AI and Big Tech Stocks: The Next Overheated Sector?

AI and big tech stocks have been surging, attracting huge amounts of money. However, this kind of overcrowding can become dangerous when too many traders are on the same side. Let’s see what’s happening:

- Massive inflows into AI-driven ETFs:

-

-

- Major AI stocks are seeing relentless buying through ETFs focused on AI.

- Some stocks enjoying this inflow of money are:

- NVIDIA (NVDA),

- Super Micro Computer (SMCI), and

- Broadcom (AVGO).

-

- Institutional trading strategies are maxed out:

-

- Hedge funds and asset managers have already been heavily positioned in AI stocks.

- This indicates there is less room for further upside.

- Valuations are stretched:

- Many AI companies are trading at 30-40 times their earnings.

- This is much higher than historical norms.

Track where institutions are positioning—Bookmap’s heatmap reveals large-scale market movements in real-time.

Warning Signs of a Reversal

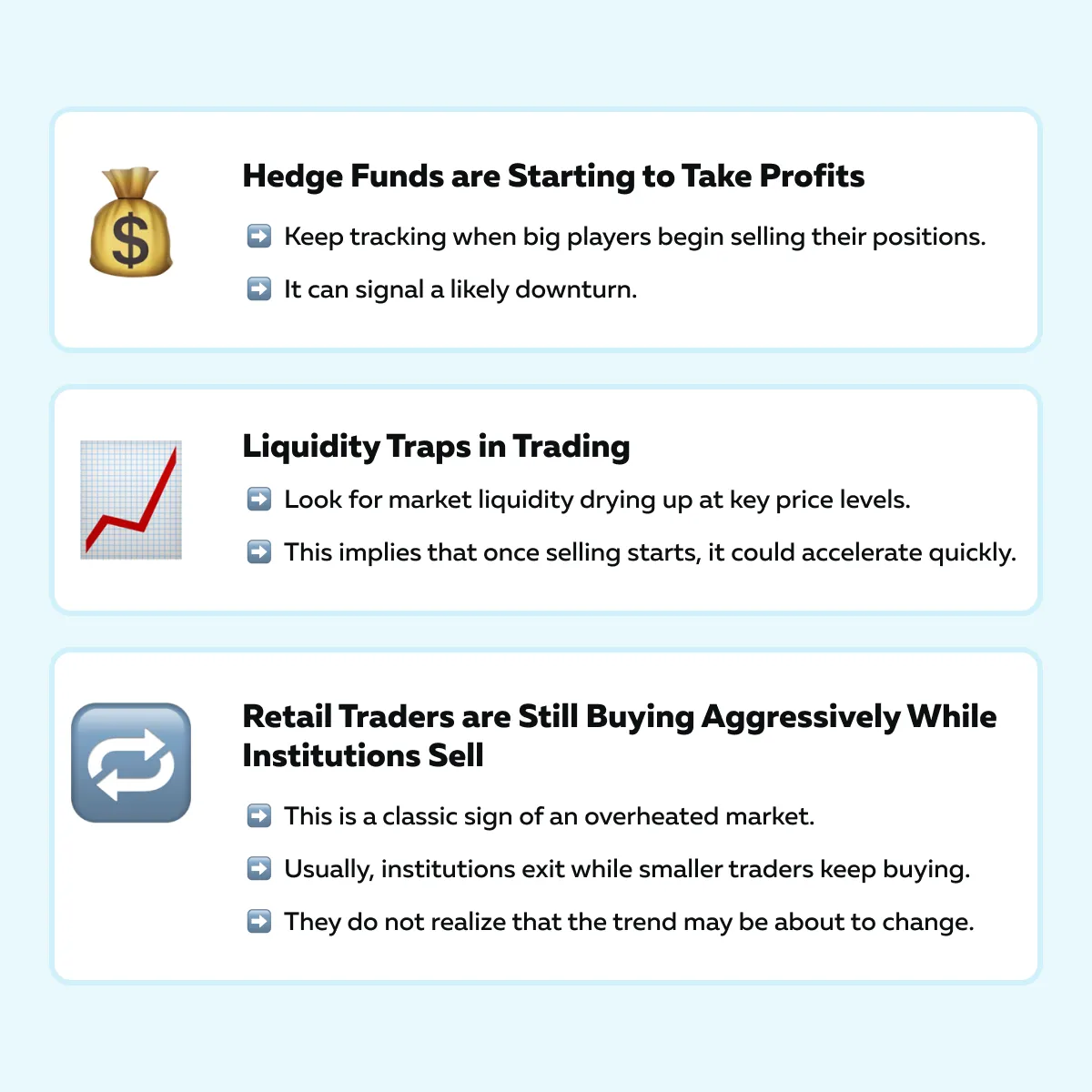

Be aware that overcrowded trades can reverse sharply. Check the graphic below to learn about some red flags you must track:

AI and big tech stocks have been strong performers, but market sentiment analysis indicates they may be vulnerable to a correction. When liquidity dries up and institutional traders pull back, the potential for sharp declines increases.

Therefore, as a trader, you should:

- Watch for profit-taking signals

and

- Avoid getting caught in an overcrowded trade right before momentum shifts.

Bitcoin and Crypto: Will the Bulls Get Caught Off Guard?

Bitcoin and the entire crypto market have seen a surge in institutional and retail interest. However, this kind of overcrowding can also create risks. Below are some reasons why you should be cautious:

- Massive inflows into Bitcoin ETFs:

-

-

- A lot of money is pouring into Bitcoin exchange-traded funds (ETFs).

- But the big question is: Is this liquidity sustainable?

-

- Both retail and institutional traders are heavily long:

-

-

- Market sentiment analysis shows that funding rates are rising.

- This suggests an overloaded bullish trade.

-

- Excessive leverage in the futures market:

-

- Many traders are using borrowed money to bet on higher prices.

- This increases the risk of liquidation traps in trading.

Potential Risks to Watch For

When too many people are on the same side of a trade, even a small pullback can trigger a chain reaction. Preferably, you should watch for these warning signs:

| Liquidity drying up | Bookmap indicators show strong resistance | Regulatory risks |

|

|

|

One must realize that Bitcoin is in an overcrowded trade. That’s because too many investors are betting on it in the same direction. Now, if liquidity dries up or institutional traders start selling, the market could see sharp corrections. Thus, you must keep an eye on:

- Market sentiment shifts,

- Funding rates and

- Liquidity traps.

This will protect you from getting caught off guard.

Shorting US Treasuries: A Crowded Bet on Higher Rates

A lot of traders and hedge funds are betting against US Treasuries. They are expecting bond prices to fall as the Federal Reserve keeps interest rates high. However, this could be risky because:

Let’s gain more clarity and see why this trade is getting crowded:

- Many traders believe the Fed will keep rates higher for longer:

- This has led to a surge in short positions on long-term bonds like:

- TLT (Treasury ETF)

- This has led to a surge in short positions on long-term bonds like:

and

- ZB futures (Treasury bond futures).

- Hedge funds have record short positions:

- Institutional trading strategies are heavily tilted toward shorting bonds.

- This implies they expect yields to rise and prices to fall.

- The yield curve could shift unexpectedly:

- If economic conditions change, interest rates could drop instead.

- This can catch short sellers off guard.

Potential Risks to Watch For

You must understand that a liquidity trap in trading can occur when too many traders expect the same outcome. If the market moves against them, they may have to rush to exit their trades. If this happens, it will lead to a sharp reversal.

Below are two major warning signs:

| If inflation cools or recession risks increase, Treasuries could rally fast | Massive institutional buy orders showing up on Bookmap |

|

|

Overcrowded trades often lead to market reversals. Stay ahead of liquidity shifts with Bookmap.

How Overcrowded Trades Unwind—and How to Spot It Early?

Let’s assume that too many traders are on the same side of a trade. They are:

- Buying AI stocks,

- Going long on Bitcoin and

- Shorting US Treasuries.

Most probably, in these conditions, the market eventually runs out of new buyers or sellers. At that point, the trend stalls and can reverse sharply as traders try to exit all at once.

Why Do Overcrowded Trades Unwind?

An overcrowded trade stops working when there’s no one left to push prices higher or lower. It is based on the phenomenon, that if everyone has already bought in, who is left to keep buying?

Such a lack of new buyers can cause the trade to lose momentum. As a result, liquidity starts drying up. Now, if traders struggle to exit their positions, small price movements can trigger:

- Large sell-offs

or

- Short squeezes.

Key Warning Signs That a Trade Is About to Unwind

You can spot early signs of trouble by analyzing market sentiment and liquidity traps using these indicators:

| Indicators | Explanation |

| Price Rallies, But Liquidity Disappears |

|

| Large Limit Sell Orders Appear on Bookmap’s Heatmap |

|

| Options Market Signals a Shift in Sentiment |

|

| Unusual Block Trade Activity (Institutions Quietly Exiting) |

|

Trading Strategies for When the Tide Turns

When an overcrowded trade starts to unwind, prices usually move violently. This happens because traders rush to exit. Thus, for you to stay ahead, you must track:

- Market sentiment analysis,

- Liquidity conditions, and

- Institutional positioning trends.

Let’s understand in detail how you can prepare and protect your portfolios:

Watching Liquidity Levels for Reversals

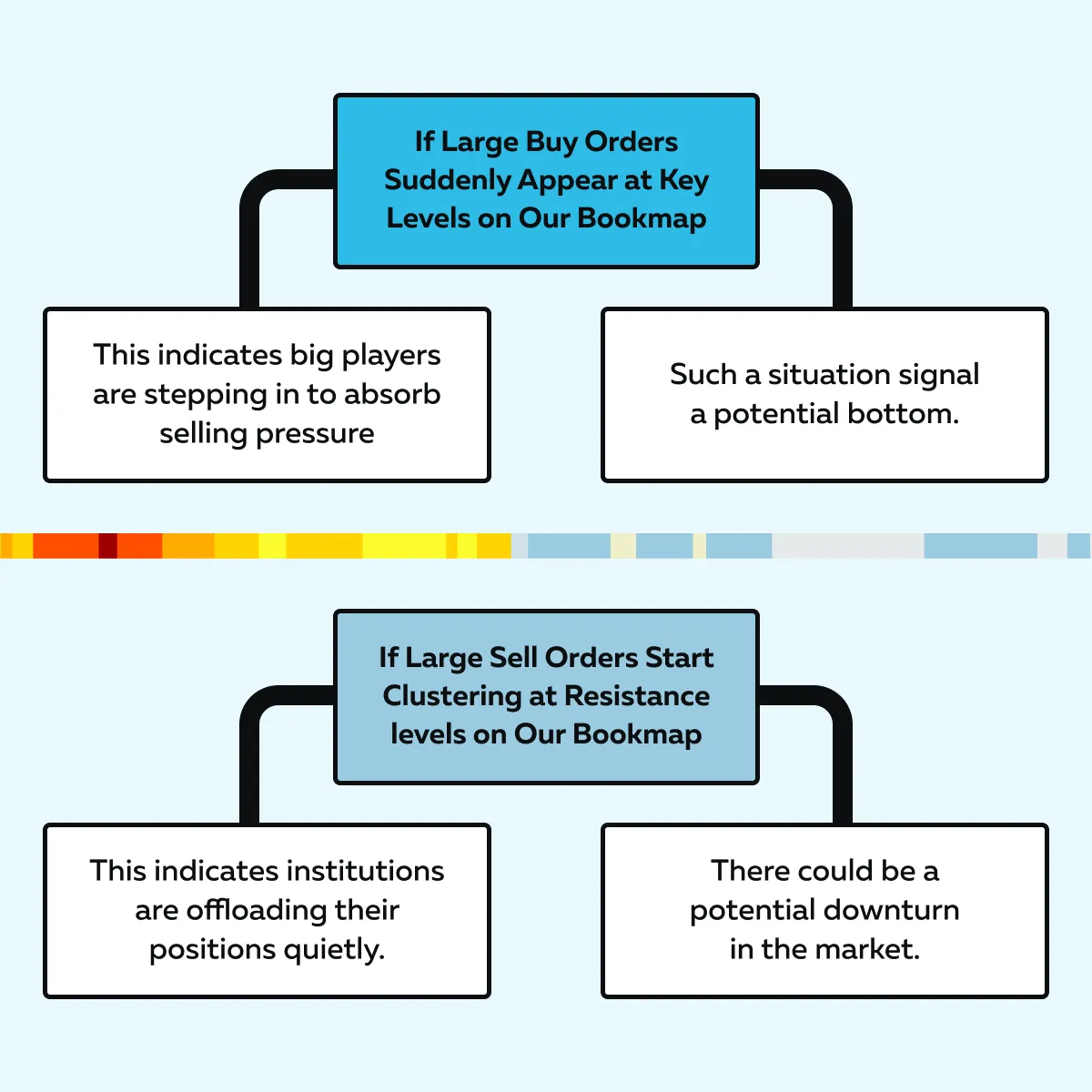

One of the best ways to spot a trend reversal before it happens is by analyzing liquidity in real-time. You can easily do so by using our avant-garde market analysis tool, Bookmap. Using it, you can track institutional buyers and sellers. Let’s see how through the graphic below:

Additionally, liquidity absorption at key levels is a major reversal signal. If the price approaches a major support or resistance level and liquidity does not disappear, it suggests strong hands are defending those levels. This could reverse the trend.

Similarly, a sudden drop in liquidity after a big rally often means buyers are running out. This makes the asset vulnerable to a sell-off.

Options Strategies to Hedge Against Reversals

When a trade is overcrowded, hedging with options can limit downside risk if the trend suddenly reverses. You can use options in these two ways:

- Buy protective puts on overheated sectors like tech or crypto:

-

-

- If a stock or sector is at extreme valuations (e.g., AI stocks, Bitcoin), you can purchase put options.

- This allows you to offset losses when the trade unwinds.

-

- Use calendar spreads to profit from volatility spikes:

-

- Calendar spreads consist of purchasing and selling options that have different expiration dates.

- If volatility increases due to a market reversal, this strategy can fetch you profits.

Scaling Out of Crowded Trades Before the Collapse

The best traders exit before the crowd, not at the top. Below are some tips to spot the right time to get out:

| Don’t wait for peak euphoria. That’s because smart money exits first. | Watch for unusual block trades and liquidity shifts. |

|

|

Conclusion

Overcrowded trades can be profitable for a while. However, when the market runs out of buyers or sellers, reversals can be fast and brutal. To deal with this situation, you, as a smart trader, need a comprehensive approach combining market sentiment analysis, liquidity traps, and institutional trading strategies. Through them, you can spot early warning signs before the trend shifts.

Successful traders monitor liquidity flows, options positioning, and large block trades to identify when smart money is quietly exiting. By using our modern market analysis tool, Bookmap, you can get a real-time view of institutional order flow. This allows you to stay ahead of sudden liquidity shifts.

Markets reward those who can recognize when the crowd is turning and adjust accordingly. Identify hidden liquidity shifts before the crowd with Bookmap’s real-time order flow tools.