Ready to see the market clearly?

Sign up now and make smarter trades today

Education

May 5, 2025

SHARE

The US-China Trade War Heats Up: How Traders Can Navigate Market Volatility

In 2024, the Biden administration quadrupled tariffs on Chinese electric vehicles to 100%. Recently, under Trump, US tariffs on Chinese goods were increased by 10%. This hike will bring the total tariff level to 20% by early 2025. In response, China imposed tariffs of 15% on US chicken, wheat, corn, and cotton and an additional 10% on soybeans, pork, beef, seafood, fruits, vegetables, and dairy products effective from March 10, 2025, onwards. Also, China placed 25 American firms under export and investment restrictions.

In 2024, the Biden administration quadrupled tariffs on Chinese electric vehicles to 100%. Recently, under Trump, US tariffs on Chinese goods were increased by 10%. This hike will bring the total tariff level to 20% by early 2025. In response, China imposed tariffs of 15% on US chicken, wheat, corn, and cotton and an additional 10% on soybeans, pork, beef, seafood, fruits, vegetables, and dairy products effective from March 10, 2025, onwards. Also, China placed 25 American firms under export and investment restrictions.

Will this trade war stop? Is there an end to this retaliation? The US-China trade war in 2025 shows no signs of slowing down. Each side continues to escalate tariffs and restrictions. But what can you, as a trader or investor, do? Remember that there are no real winners in a trade war, only survivors who adapt to the chaos!

Similarly, as a trader, you must deal with trade wars, stock market volatility, and geopolitical volatility to stay ahead. Want to know how? In this article, you’ll learn how tariffs influence market movements, from stock sell-offs to forex reactions. You’ll discover how institutions adjust positions before major trade events and how modern tools like Bookmap can help you track liquidity shifts. Whether you’re trading stocks, forex, or commodities, read this article till the end to seize lucrative tariff-related opportunities.

How does the US-China Trade War impact markets?

The US-China trade war in 2025 is shaking global markets. Rising Chinese tariffs are impacting businesses by increasing costs and uncertainty. As an investor, you must closely watch how tariffs and tensions affect:

- Stocks,

- Supply chains,

and

- Economic growth.

Stock Market Volatility

When tariffs rise, markets become unpredictable. As a result, investors come to expect higher costs and slower growth. This hurts sentiment and leads to sharp drops in major stock indices. For example,

- During past trade conflicts (2018-2019), the S&P 500 and Nasdaq futures fell quickly whenever new tariffs were announced.

- A similar pattern could happen in 2025 if tensions escalate.

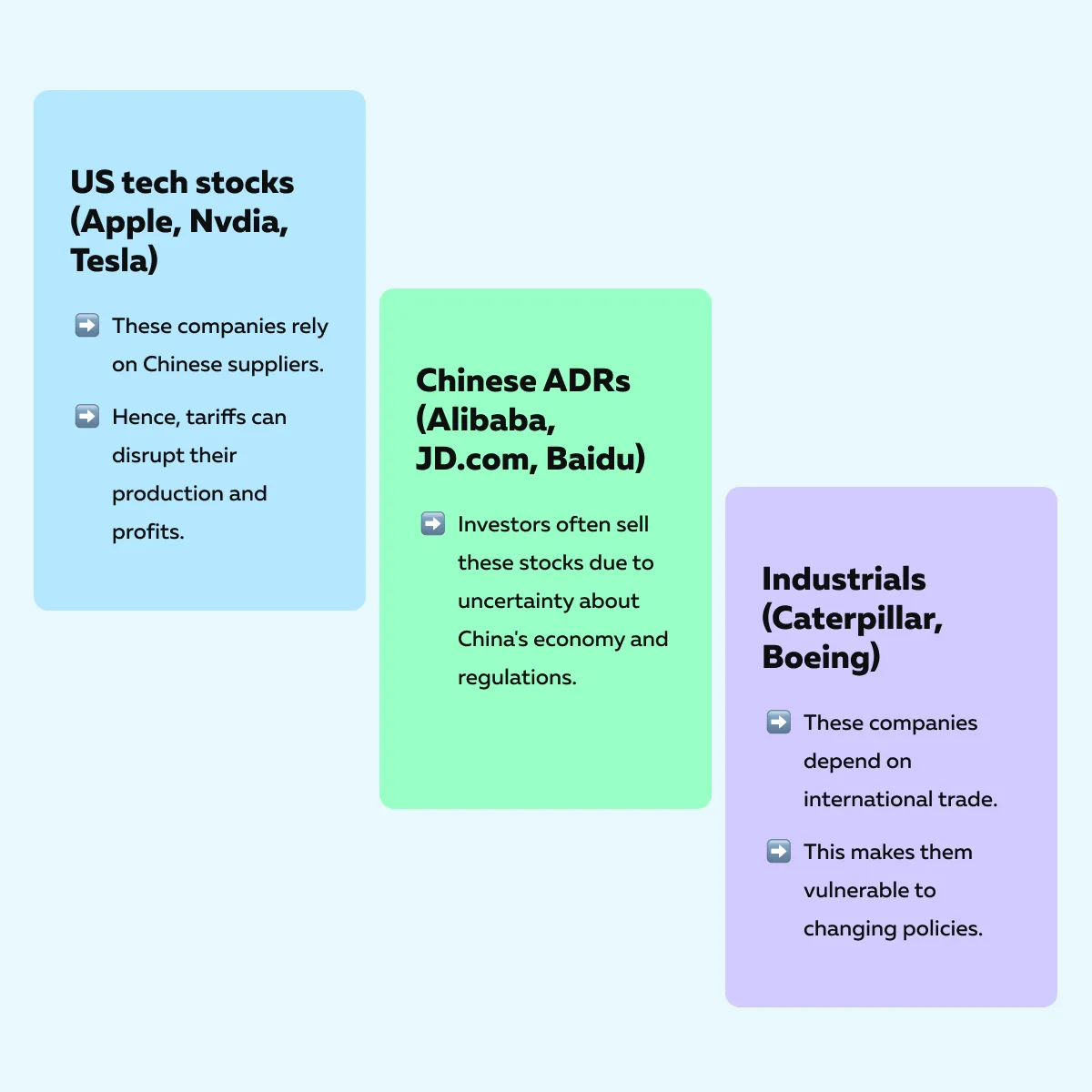

Key Sectors to Watch for Increased Volatility

Due to the trade war, stock market fluctuations are expected. To trade geopolitical volatility, stay alert for sudden market swings. Particularly, look for these sectors:

Forex Market Reactions

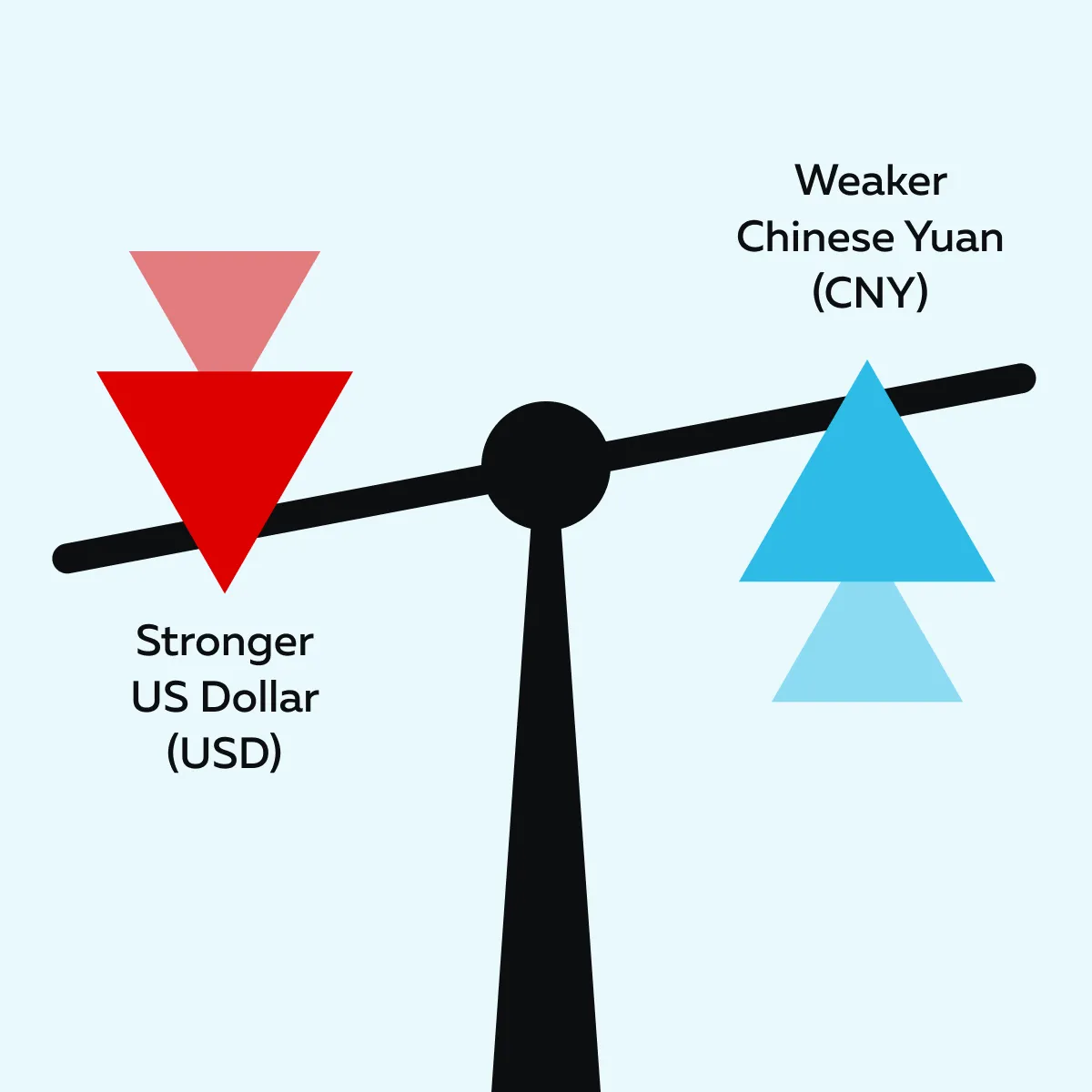

The US-China trade war in 2025 is affecting global currencies. Chinese tariffs impact the stocks and the forex market when trade tensions rise. This creates uncertainty for both traders and businesses.

Check out the graphic below to learn more about a common pattern observed when tariffs escalate:

This strengthening of the dollar happens because investors see the dollar as a safer currency. Also, China sometimes allows the yuan to weaken to offset tariff costs. For example,

- Say China devalues its currency in response to new tariffs.

- The USD/CNH pair (US dollar vs. offshore yuan) spikes.

- This spike causes forex market volatility.

Use Bookmap’s volume and order flow insights to anticipate breakouts or reversals driven by tariff news.

Key Currency Pairs to Watch

To deal with ongoing trading and geopolitical volatility, forex traders should closely monitor currency movements for potential opportunities and risks. Some pairs worth keeping an eye on are:

- USD/CNH: This pair will become highly volatile if China retaliates with a controlled devaluation.

- JPY/USD: The Japanese yen often strengthens during times of uncertainty. That’s because investors consider it a safe-haven currency.

- EUR/USD: The trade war’s indirect effects could spill into European markets. If this happens, this currency pair will become highly volatile.

Commodity Price Shocks

The US-China trade war in 2025 is causing unpredictable commodity price shocks. When these two major economies impose tariffs, raw material costs fluctuate. These fluctuations impact industries worldwide. For example,

- Let’s assume China retaliates by cutting US soybean imports.

- Now, American farmers could suffer.

- As a result, agricultural commodities may decline in value.

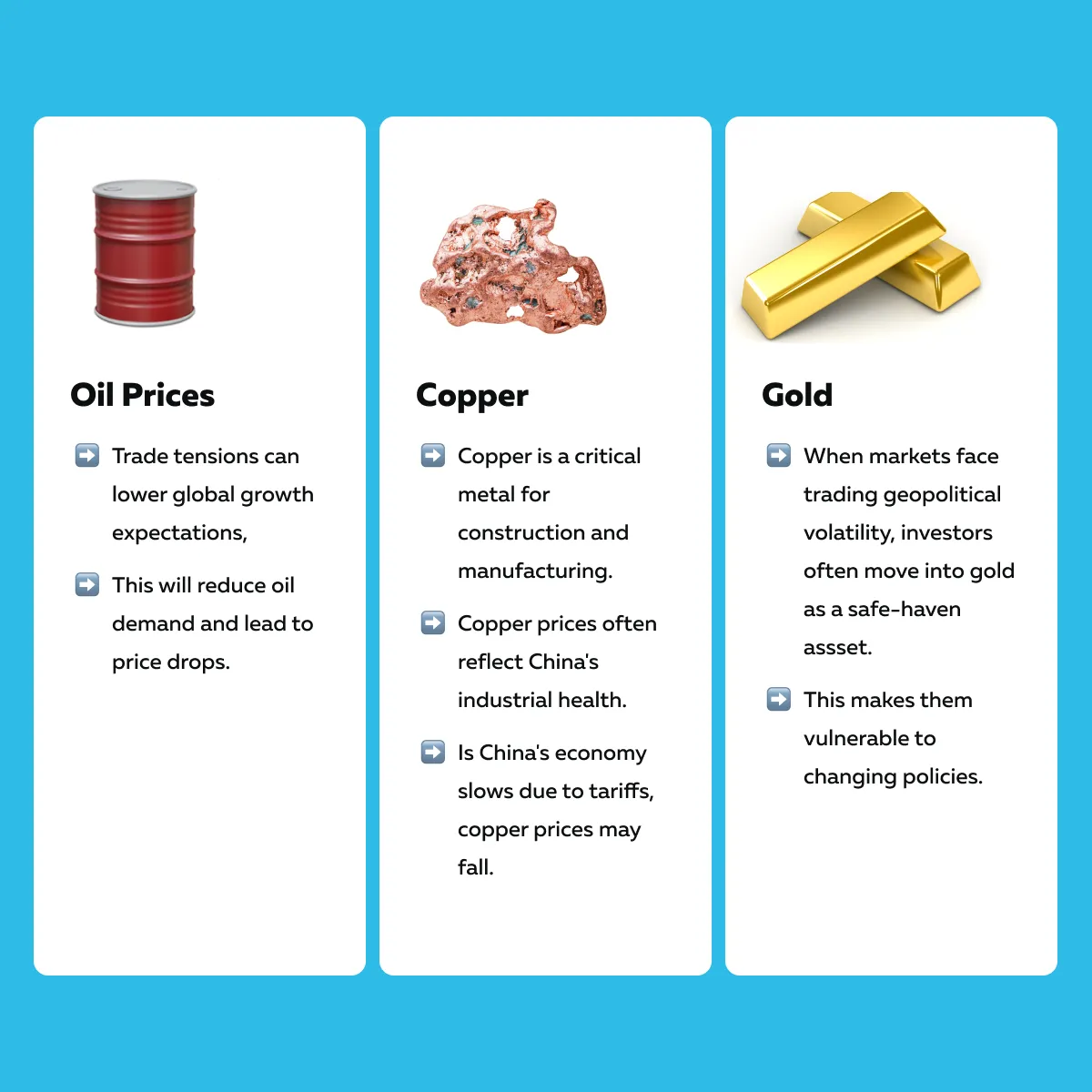

Key Commodities to Watch for Trade War Stock Market Volatility

With ongoing tariff battles, you can expect uncertainty in commodities. This uncertainty will likely happen as markets react to shifting trade policies. Mainly, watch out for these commodities:

Bond Market Movements

Due to the US-China trade war in 2025, there is high uncertainty in financial markets. This hesitation is pushing investors toward safer assets like bonds. Please note that when markets become unstable, bond prices rise. This spike causes the yields (interest rates on bonds) to fall.

For example,

- During the peak of the US-China trade war in 2019, investors rushed to invest in US Treasury bonds.

- This event caused the 10-year yield to drop below 2%.

- A similar trend could happen in 2025 if trade tensions escalate.

Key Trends to Watch

In response to the ongoing trade war and stock market uncertainty, bond markets will likely experience significant movements. This movement will influence global interest rates and investment strategies. To trade geopolitical volatility, you can look out for these key trends:

Order Flow Insights: Spotting Institutional Moves During Trade War Volatility

In response to the US-China trade war in 2025, institutional investors are adjusting their positions to manage risk. As a trader, you can track how big players move their money before major trade war developments by analyzing order flow. Let’s see how you can do so through our real-time market analysis tool, Bookmap.

How to Track Liquidity Shifts with Bookmap?

Institutions often react before the general market. They do so by changing their positions based on upcoming events:

- Tariff changes,

or

- Economic shifts.

Using Bookmap, you can visualize these movements by tracking liquidity levels. For example, on Bookmap, large sell orders appear in Alibaba (BABA) before an official tariff announcement. This offloading indicates that institutions are shedding risk in anticipation of bad news.

Use Bookmap’s Heatmap for Greater Insights

Bookmap has a unique feature called “heatmap.” It highlights the following:

- Absorption zones: These are areas where institutions quietly buy or sell large amounts of stock without moving the price too much. This signals accumulation (bullish) or distribution (bearish).

- Liquidity voids: If liquidity suddenly disappears, it could mean upcoming market volatility. For example, Bookmap shows a liquidity gap in Tesla (TSLA) before tariff-related news. This event signals a big price swing.

Fake Breakouts & News-Driven Moves

Trade war news often triggers emotional buying and selling. This panicked trading leads to fake breakouts. For the unaware, breakouts are short-term price spikes that fail to hold. As a trader, you must be cautious when markets react sharply to tariff updates.

For example,

- Suppose Tesla’s price increases based on the optimism that tariffs might be lifted.

- However, on Bookmap, you notice large sell orders piling up at resistance levels.

- Now, this could mean institutions are using the hype to unload shares.

- This offloading can cause the price surge to reverse.

See how liquidity shifts as US-China tensions escalate. Use Bookmap’s real-time data to track institutional moves.

How to Avoid Traps?

The best way to avoid traps is by confirming volume. Before entering a trade, you must ensure that strong buying or selling volume supports the move.

Additionally, watch for iceberg orders. Institutions often place hidden “iceberg orders” that absorb price moves. If a breakout lacks follow-through, it may be a trap.

Trading Strategies for Tariff-Driven Market Volatility

To manage the volatility caused by the US-China trade war in 2025, traders can use specific strategies. Using them, they can take advantage of price movements triggered by tariff announcements. Let’s check them out:

1. Trading Market Retests in High Volatility

When tariff news hits, stocks and other assets often experience sharp price drops or spikes. However, instead of committing to one direction immediately, prices usually retest key liquidity zones before committing to a trend.

How Does This Work?

Assume that there is a sudden price move due to the impact of Chinese tariffs. Now, markets often revisit areas where strong buying or selling previously happened.

For example,

- Let’s assume Nvidia (NVDA) drops sharply due to tariff escalation.

- However, it finds strong bid absorption at a support level.

- Now, this suggests institutions are stepping in to buy.

- This event signals a likely price rebound.

How to Use Bookmap to Spot These Opportunities?

Using Bookmap, you can identify institutional buying. To do so, look for areas where large orders absorb selling pressure (preventing further decline).

Also, confirm volume signals using Bookmap. If substantial buying volume appears at support, it could mean a reversal is coming.

2. Capitalizing on Forex Reactions to Tariff Announcements

The forex market reacts instantly to trade war developments. This reaction creates short-term trading opportunities.

How Does This Work?

When the US announces new tariffs, investors rush into the US dollar (USD) as a safe-haven currency. However, if liquidity builds on the offer side (meaning large sell orders stack up), this could signal that:

- The initial spike is overdone,

and

- A reversal might follow.

For Example:

- Let’s assume that the USD/CNH surges due to a new tariff announcement.

- But sellers step in heavily at a key resistance level.

- Traders might then look for signs of a pullback.

Risks and Considerations for Traders

Trading during the US-China trade war in 2025 comes with high uncertainty. Markets react sharply to tariff news, but not all moves are sustainable. Therefore, traders must manage risk carefully, as stock market volatility resulting from trade wars can create opportunities and dangers. Let’s understand in detail:

Market Overreactions & Whipsaw Moves

Financial markets often overreact to trade war headlines. This overreaction causes “whipsaw moves.” These moves are sharp price swings that quickly reverse. When influenced by these moves, some traders jump in too early. Thus, they get caught on the wrong side of the market.

Why This Happens

Some common reasons are:

- Emotional reactions: Investors panic-buy or sell based on headlines rather than the actual economic impact.

- Unclear details: Initial reports on the impact of China tariffs may sound extreme, but later clarifications can change the outlook.

- Institutional strategies: Big investors push prices up or down. They do so to trigger stop-losses (before reversing course).

For example:

Let’s suppose the US announces new tariffs on Chinese goods. As a result, Caterpillar (CAT) and Boeing (BA) rallied because investors expect stronger domestic production.

However, if the details reveal that costs will rise for US manufacturers, the rally might fade quickly. This event will trap traders who bought in too soon.

How to Manage This Risk?

Patience and discipline are essential when trading during periods of high geopolitical volatility. They prevent you from getting caught in false moves.

Policy Uncertainty & Extended Volatility

One of the biggest challenges for traders during the US-China trade war in 2025 is the uncertainty of trade policies. Unlike scheduled economic events (like job reports or interest rate decisions), trade disputes can drag on for months or even years. These disputes lead to extended market volatility.

Why This Happens

- Unpredictable negotiations:

- Trade talks can break down or shift unexpectedly.

- This uncertainty makes it hard for investors to plan.

- Sudden policy changes:

- New Chinese tariffs impact businesses and markets differently.

- The magnitude of the impact depends on how they are implemented.

- Retaliatory actions:

- If China responds with retaliatory economic measures (like restricting US companies from operating freely), it could create long-term instability.

For Example:

Let’s assume that the US imposes stricter tariffs on Chinese exports. In response, China retaliated by limiting US business operations within the country. This move could hurt major US companies like:

- Apple,

- Tesla, and

- Boeing.

It will lead to prolonged uncertainty in their stock prices. As a result, investors may hesitate to commit capital. This hesitation can keep markets volatile for weeks or months.

How to Manage This Risk?

Firstly, you must stay updated on policy developments. For this, you should closely follow trade negotiations to anticipate possible outcomes. Additionally,

- Be cautious with long-term positions: If a trade war escalates, specific sectors (like tech and industrials) may remain unstable for an extended period.

- Adapt to market sentiment: Watch for shifts in investor confidence. That’s because markets may react differently depending on whether tensions are rising or cooling.

Conclusion

The US- China trade war in 2025 is creating significant volatility across stocks, forex, and commodities. Every new tariff announcement or policy shift can trigger sharp price swings. It can cause markets to overreact to headlines, leading to temporary spikes and reversals.

Thus, in these times, you have to deal with stock market fluctuations and increasing geopolitical volatility. Understanding institutional moves is key to managing these conditions.

Additionally, you can use modern tools like Bookmap to track real-time order flow and liquidity shifts. Using it, you can reveal where big players enter or exit positions.

So, do you want to position yourself to take advantage of tariff-driven opportunities in an unpredictable market? Don’t get caught off guard by trade war volatility—spot hidden liquidity and big player movements with Bookmap.