Ready to see the market clearly?

Sign up now and make smarter trades today

Education

March 29, 2024

SHARE

Understanding the Ripple Effect: Global Supply Chain Disruptions and Investment Strategies

Most successful investors track global supply chain disruptions. Have you ever adjusted your portfolio based on them? In this article, we’ll explore some common reasons behind disruptions, like trade disputes and logistical challenges, and understand their impact on industries, companies, and even your investments.

We’ll take a closer look at real-world events, like the Suez Canal blockage and semiconductor shortages, to see how they shook up the global economy. Also, we’ll discuss different strategies from diversification and risk management to the role of ESG factors. Lastly, we’ll learn valuable lessons from the COVID-19 pandemic and see how some investors succeeded while others faced challenges. Let’s get started.

The Anatomy of Global Supply Chain Disruptions

Supply chain disruptions refer to the disturbances that impede the smooth flow of goods and services. These disturbances affect the various stages of a supply chain and impact:

- Production,

- Distribution, and

- Delivery.

Let’s study some key factors that cause supply chain disruptions:

- Trade Restrictions

-

-

- Trade barriers, including tariffs and quotas, hinder the free flow of goods across borders.

- This hindrance leads to delays and increased costs.

-

- Logistics Challenges

-

-

- Port congestion, shipping delays, and transportation bottlenecks pose logistical hurdles.

- These challenges usually result from:

- Capacity constraints,

- Inefficient processes, or

- Unexpected events like natural disasters.

-

- Economic Uncertainties

-

- Economic factors, such as inflation, currency fluctuations, and market volatility, introduce uncertainties, affecting the stability of supply chains.

- Sudden economic shifts impact:

- Costs,

- Demand, and

- Overall supply chain resilience.

How do International Trade Disputes and Tariffs Disrupt the Flow of Goods?

International trade disputes and the imposition of tariffs introduce complexities and uncertainties that negatively impact the global supply chain. Let’s explore some common reasons:

| Reason | Explanation | Impact on Flow of Goods |

| Tariffs Increase Costs | Tariffs are taxes imposed on imported goods, making them more expensive for the importing country. |

|

| Reduced Market Access | Trade disputes lead to the imposition of barriers that limit market access for certain goods. |

|

| Supply Chain Restructuring | Tariffs prompt companies to reassess their supply chains and production processes to minimize costs. |

|

Some Notable Trade Conflicts and Their Consequences

- U.S.-China Trade War

-

-

- The imposition of tariffs by both countries led to increased costs for businesses and consumers.

- Supply chains faced uncertainties due to fluctuating trade policies and retaliatory measures.

-

- Brexit

-

- The UK’s departure from the EU introduced trade barriers.

- This move impacted the seamless movement of goods between the UK and the rest of Europe.

- Consequently, supply chains adopted new customs, procedures, and regulations.

The Logistical Hurdles in Supply Chains

Supply chains encounter logistical challenges that disrupt the efficient movement of goods. Some common hurdles include the following:

- Port Congestion:

-

-

- Increased demand and limited port capacity contribute to congestion.

- Overcrowded ports result in delays and increased lead times for shipments.

-

- Shipping Delays:

-

-

- Unforeseen events, weather conditions, or mechanical failures cause shipping delays.

- These delays affect production schedules and inventory levels.

-

- Transportation Bottlenecks:

-

- Transportation bottlenecks are situations where the transportation infrastructure, such as roads or railways, cannot handle the volume of traffic.

- Bottlenecks hamper the smooth flow of goods from manufacturers to distributors and retailers, increasing transportation costs and time.

How Economic Uncertainties Impact Supply Chains

Economic uncertainties significantly disrupt supply chains and impact costs and demand. Some common uncertainties include:

| Economic Uncertainties | Effect on Supply Chain | Risk Mitigation |

| Inflation |

|

Businesses must adapt to changing cost structures. |

| Currency Fluctuations | Volatility in currency exchange rates causes fluctuations in the costs of imported raw materials and components. | Hedging strategies can be used to mitigate currency risks. |

| Market Volatility | Economic downturns or sudden market shifts affect consumer demand and lead to inventory imbalances. | Supply chains need agility to adjust production and distribution strategies in response to market volatility. |

Furthermore, sudden economic shifts can also significantly impact the stability of supply chains and affect various aspects of the production and distribution processes. Let’s see how these shifts influence the stability of supply chains:

- Recessions, or sudden changes in consumer spending, result in fluctuations in demand for goods and services.

- Economic shifts cause fluctuations in costs, including:

- Costs of raw materials

- Labor costs, and

- Transportation expenses.

- Economic downturns lead to financial instability for suppliers and affect their ability to meet contractual obligations.

- Economic shifts also impact credit availability and terms for businesses throughout the supply chain.

The Most Affected Sectors

Supply chain disruptions have varying impacts on sectors, with manufacturing, retail, and technology being particularly susceptible. Let’s understand the impact on these sectors in-depth:

Manufacturing Sector

Most manufacturers rely on just-in-time inventory systems. This dependence leaves manufacturers vulnerable to disruptions in the supply chain, which cause production halts and affect manufacturing efficiency and output. Also, manufacturers often source components globally. As a result, they get exposed to:

- Trade restrictions,

- Shipping delays, and

- Geopolitical uncertainties.

Retail Sector

Retailers, especially those operating with lean inventory models, face challenges in managing stock levels when supply chain disruptions disrupt the regular flow of goods. Fluctuations in inventory impact customer demand and result in potential stockouts or excess inventory.

Technology Sector

Technology companies heavily rely on global supply chains for components and raw materials. This dependence makes them susceptible to disruptions in various regions. Furthermore, it has been observed that technology companies often have complex and interconnected supply chains with dependencies on specialized components. Disruptions in one part of the chain can have cascading effects.

The Domino Effect on Investment

In a globalized economy, disruptions in one part of the supply chain can send shockwaves throughout entire industries and companies. Since the supply chains are interconnected, delays or shortages in one region usually have cascading effects worldwide. This situation impacts:

- Production capabilities,

- Revenue,

- Earnings, and

- Stock prices.

Delays or shortages in the production of key components cause disruptions that reverberate throughout the supply chain. Industries dependent on these components experience production slowdowns, leading to:

- Lower revenue and earnings, and

- Reduced stock prices

Thus, global supply chain disruptions directly impact stock prices. Investors closely monitor them, and any perceived negative sentiment mostly leads to sell-offs, causing stock prices to decline.

The Intricate Relationship between Supply and Demand in International Trade

The intricate relationship between supply and demand forms the backbone of market dynamics. Supply represents the quantity of goods or services available, while demand signifies the desire and ability to purchase. The equilibrium between supply and demand determines market prices and trade volumes.

The traders who foresee changes in supply and demand:

- Navigate market uncertainties,

- Mitigate risks, and

- Capitalize on emerging opportunities.

It must be noted that changes in supply and demand result in market volatility and impact stock prices. When supply matches demand, a market reaches equilibrium, which is the optimal price for goods or services. Changes in either supply or demand disrupt this equilibrium, creating opportunities and risks for traders and investors.

Some Real-world Events

| Event | Explanation | Impact | Investment Challenges |

| Suez Canal Blockage | The Suez Canal got blocked in March 2021 due to a grounded container ship, the Ever Given. |

|

|

| Semiconductor Shortages | The ongoing semiconductor shortages affect various tech industries, including automotive. | Disrupted production in the automotive sector and led to reduced vehicle supply |

|

It is also worth noting that the Suez Canal blockage caused inflationary pressures, particularly in Europe. Reduced supply led to increased costs for goods, which caused inflation. Also, companies faced higher production costs, which influenced stock prices as investors adjusted expectations.

How Disruptions Impact Central Banks’ Interest Rate Decisions and Global Stock Prices

Disruptions in the global economy, such as supply chain disruptions, significantly influence central banks’ interest rate decisions. Let’s understand how these disruptions impact the decision-making process:

| Disruption Causes | Impact | Response of Central Banks |

| Economic Uncertainty | Supply chain disruptions introduce economic uncertainties by affecting production capabilities. | Central banks, like the European Central Bank (ECB), respond by adjusting interest rates to:

|

| Inflationary Pressures | Supply chain disruptions contribute to inflationary pressures, especially when there are shortages or increased production costs. | Central banks raise interest rates to curb inflation and maintain price stability. |

| Growth Expectations | Disruptions impact growth expectations, as sectors that face supply constraints experience slower growth. | Central banks adjust interest rates to stimulate economic growth by:

|

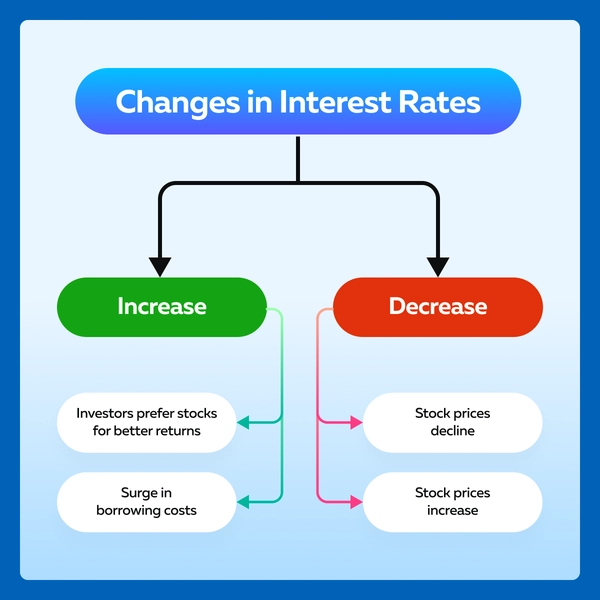

The Ripple Effect on Global Stock Prices

Global stock markets often react to central bank decisions. Rate hikes could potentially dampen investor sentiment and cause a decline in stock prices. Furthermore,

- High-interest rates increase borrowing costs for businesses and consumers. Higher borrowing costs:

- Negatively impact corporate earnings,

- Reduce consumer spending, and

- Reduce stock prices globally.

- Lower interest rates prompt investors to seek higher yields in riskier assets, including stocks. When interest rates are low:

- Investors allocate more funds to stocks

- This diversion of funds boosts global stock prices.

How do Supply Chain Disruptions Create Investment Challenges?

Supply chain disruptions have far-reaching implications for investors. These challenges increase market volatility and uncertainty. Read the table below to understand some common issues:

| Issues | Impact | Investor Challenge |

| Market Volatility | Supply chain disruptions cause sudden and unexpected shifts in market dynamics. |

|

| Uncertain Business Outlook | Companies facing supply chain disruptions experience uncertainties in:

|

|

| Earnings and Revenue Risks | Disruptions impact earnings due to:

|

|

| Impact on Diversification Strategies | Supply chain disruptions affect different sectors and geographies to varying degrees. |

|

Why do Investors Struggle to Assess Long-Term Effects of Disruptions?

Investors encounter significant difficulties when they attempt to identify the impact of disruptions on specific companies and sectors. Let’s see some key difficulties investors face:

- Investors struggle to assess the duration of the impact, which makes it challenging to predict when affected entities will return to pre-disruption levels.

- Investors find it challenging to foresee which companies can successfully adapt to new operational challenges.

- Investors struggle to assess the long-term impact on demand for specific products or services.

- Investors find it difficult to predict how technological changes will impact specific companies and sectors in the long term.

Navigating Investment Strategies in Disrupted Times

To combat supply chain disruptions, investors can employ various strategies to mitigate risks. Some popular strategies include the following:

- Diversify across asset classes, industries, and geographic regions.

- Implement robust risk management practices, including:

- Setting stop-loss levels and

- Monitoring portfolio volatility.

- Adjust asset allocation based on the evolving risk-return profile.

- Allocate defensive assets, such as bonds and defensive stocks, during heightened uncertainty.

- Identify opportunities amid disruptions after considering sectors likely to benefit or recover quickly.

- Consider active management to adapt swiftly to changing market dynamics.

The Role of ESG Factors in Investment Decisions

Environmental, Social, and Governance (ESG) factors play a crucial role in guiding investment decisions, especially in times of disruption. Often, investors prioritize companies with strong ESG profiles as they are perceived to have better risk management strategies, which reduces their exposure to disruptions.

Let’s see in-depth how ESG influences investment decisions:

- Investors seek companies with sustainable practices, believing they are better equipped to:

- Withstand disruptions and

- Maintain stability over the long term.

- Investors value companies that demonstrate innovation and adaptability.

- Investors gravitate towards companies with strong ESG profiles, seeking market leaders who are likely to outperform peers during and after disruptions.

- Investors increasingly consider ESG alignment as a critical factor. They align their investments with those of companies that share similar values.

Case Study: Investment Outcomes Amid Supply Chain Disruptions

The COVID-19 pandemic disrupted global supply chains, creating widespread uncertainty. In the initial shock, panic selling prevailed, especially in sectors directly affected, such as travel and hospitality. Investors who succumbed to panic selling suffered significant losses as stock prices plummeted.

However, over time, markets adapted to the new normal, and governments implemented measures to stabilize economies. Savvy investors recognized the potential for market recovery and strategically held or even increased their positions during the downturn. Those who remained patient witnessed significant gains as markets gradually recovered.

Some investors even diversified and anticipated increased demand in areas like:

- Technology,

- Healthcare, and

- E-commerce.

Varied Decision-Making During the Pandemic

Individual and institutional investors made varied decisions during the disruption. Some were successful, while others sustained losses. Let’s explore both successful and less successful approaches.

| Successful Investors | Less Successful Investors |

|

|

What to Learn from Successful Investment Approaches During the COVID-19 Pandemic?

- Resilient Sector Focus

-

-

- Investors who strategically focused on resilient sectors, such as technology, healthcare, and e-commerce, witnessed significant gains.

- These sectors thrived during the pandemic.

-

- Patience and Long-Term Perspective

-

-

- Investors who maintained a long-term perspective resisted panic selling and stayed patient during market downturns.

- They enjoyed substantial returns during the market recovery.

- This event emphasizes the value of patience and a focus on long-term goals.

-

- Adaptability and Opportunistic Investing

-

- Opportunistic investors who adapted their portfolios to capitalize on emerging opportunities successfully navigated the chaotic market.

- This event demonstrates the benefits of adaptability and seizing opportunities during disruptions.

What to Learn from Unsuccessful Investment Approaches During the COVID-19 Pandemic?

- Panic Selling and Short-Term Focus

-

-

- Investors who succumbed to panic selling and focused solely on short-term gains suffered significant losses during the initial market shock.

- This situation highlights the risks associated with reactive and short-sighted strategies.

-

- Inflexibility and Reluctance to Reassess

-

-

- Investors who remained inflexible and did not reassess their portfolios missed growth opportunities.

-

- Overreliance on Speculative Trading

-

- Investors who engaged in speculative trading without thorough analysis faced increased risks and potential losses.

- This overreliance highlights the dangers of speculative behavior without a well-informed strategy.

Some Key Lessons for Investors

- Diversify and focus on resilience.

- Patience always pays off.

- Adaptability is key.

- Avoid reactive behavior.

- Do a thorough analysis of the speculation.

- Continuously reassess portfolio.

Conclusion

The global supply chain disruptions can stimulate central bank decisions and lead to changes in interest rates and stock prices. Trade disputes, logistical hurdles, and economic uncertainties create a ripple effect that impacts industries and investors worldwide.

Owing to such disruptions, investors face numerous challenges, including market volatility, uncertain business outlooks, and earnings risks. However, strategic approaches, such as diversification, robust risk management, and a focus on resilient sectors, can help mitigate these challenges.

Also, the role of Environmental, Social, and Governance (ESG) factors becomes crucial as they guide investors toward companies with strong risk management strategies.

The COVID-19 pandemic serves as a valuable case study, highlighting successful and less successful investment approaches. Ready to adapt your investment strategy in a changing world? Explore the nuances of global markets and gain a trading edge. Read our article on Trading Around the World: Key Differences in Global Markets now!