Ready to see the market clearly?

Sign up now and make smarter trades today

Education

June 3, 2025

SHARE

Tradermap Pro: Filter the Noise and Focus on Real Liquidity

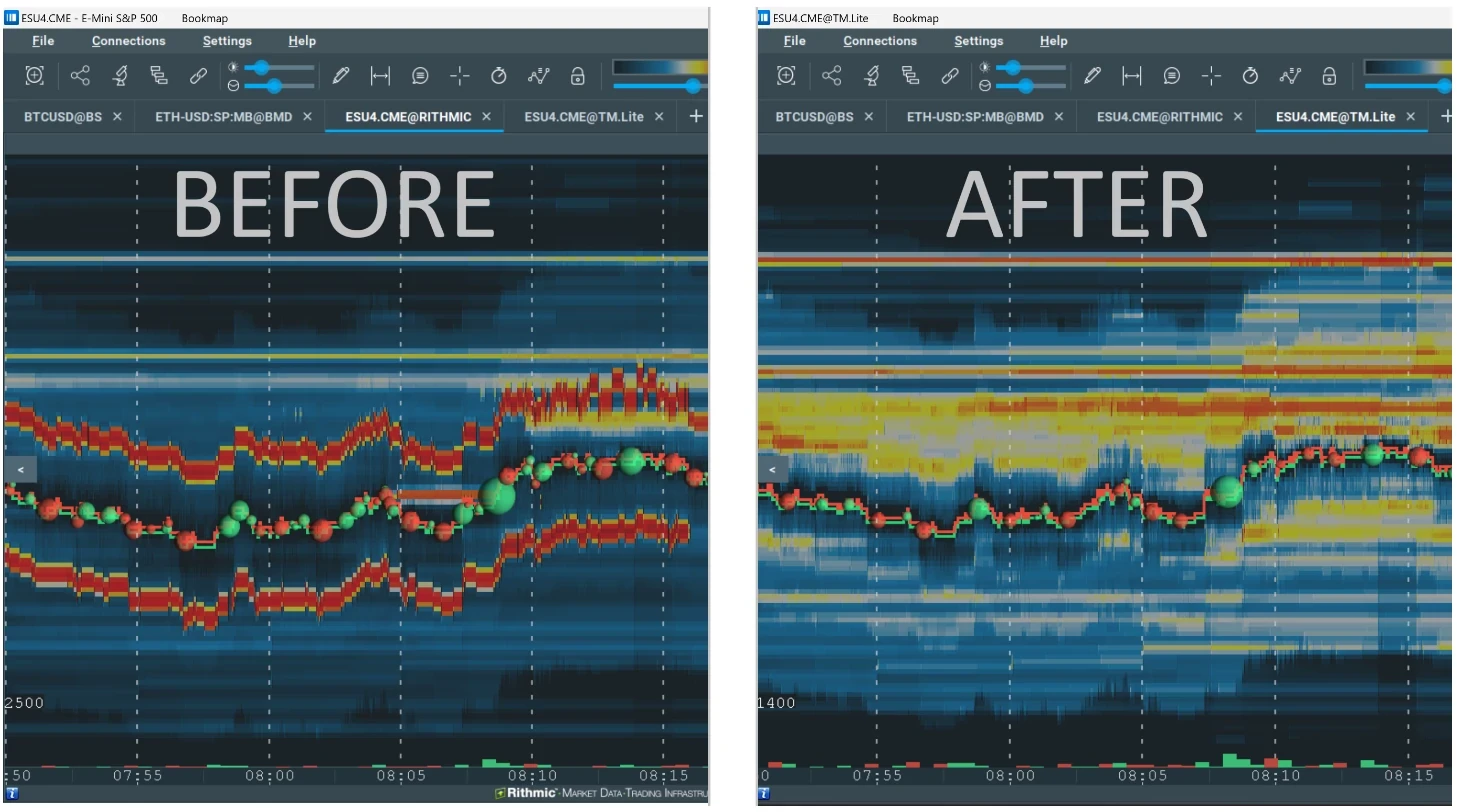

When watching the order book, it’s easy to get overwhelmed. Not all orders are equal. Some are tiny resting orders that get pulled immediately. Others are large and meaningful—but hidden in a sea of noise. That’s where Tradermap Pro comes in.

This indicator helps traders cut through clutter by displaying only the liquidity that matters—based on size thresholds, position, and behavior. Built specifically for Market-by-Order (MBO) data, Tradermap Pro lets you customize the heatmap display to focus on the participants that actually move the market.

Why Standard Heatmaps Aren’t Always Enough

Bookmap’s core heatmap is powerful—it shows where liquidity is resting across price levels. But when all orders are treated equally, the display can get noisy. You may see:

- Micro-lots cluttering key levels

- Frequent flickering from small cancelations

- No distinction between noise and genuine intent

For discretionary traders or scalpers, this can lead to confusion or hesitation. Tradermap Pro was created to fix that.

What Tradermap Pro Does

Tradermap Pro offers an advanced filtering system for visualizing liquidity:

- Minimum Size Thresholds: Show only orders above a specified size (e.g., 20+ contracts)

- Custom Color Mapping: Visualize different order sizes using a configurable gradient

- Historical Context: Replay and analyze how large liquidity levels interacted with price

It’s not just about clarity—it’s about relevance. With Tradermap Pro, you’re focusing on the entities with the size and intent to actually move price.

Learn how to set it up in the Knowledge Base or download directly from the Marketplace.

How Traders Use It

Here’s how different styles of traders use Tradermap Pro:

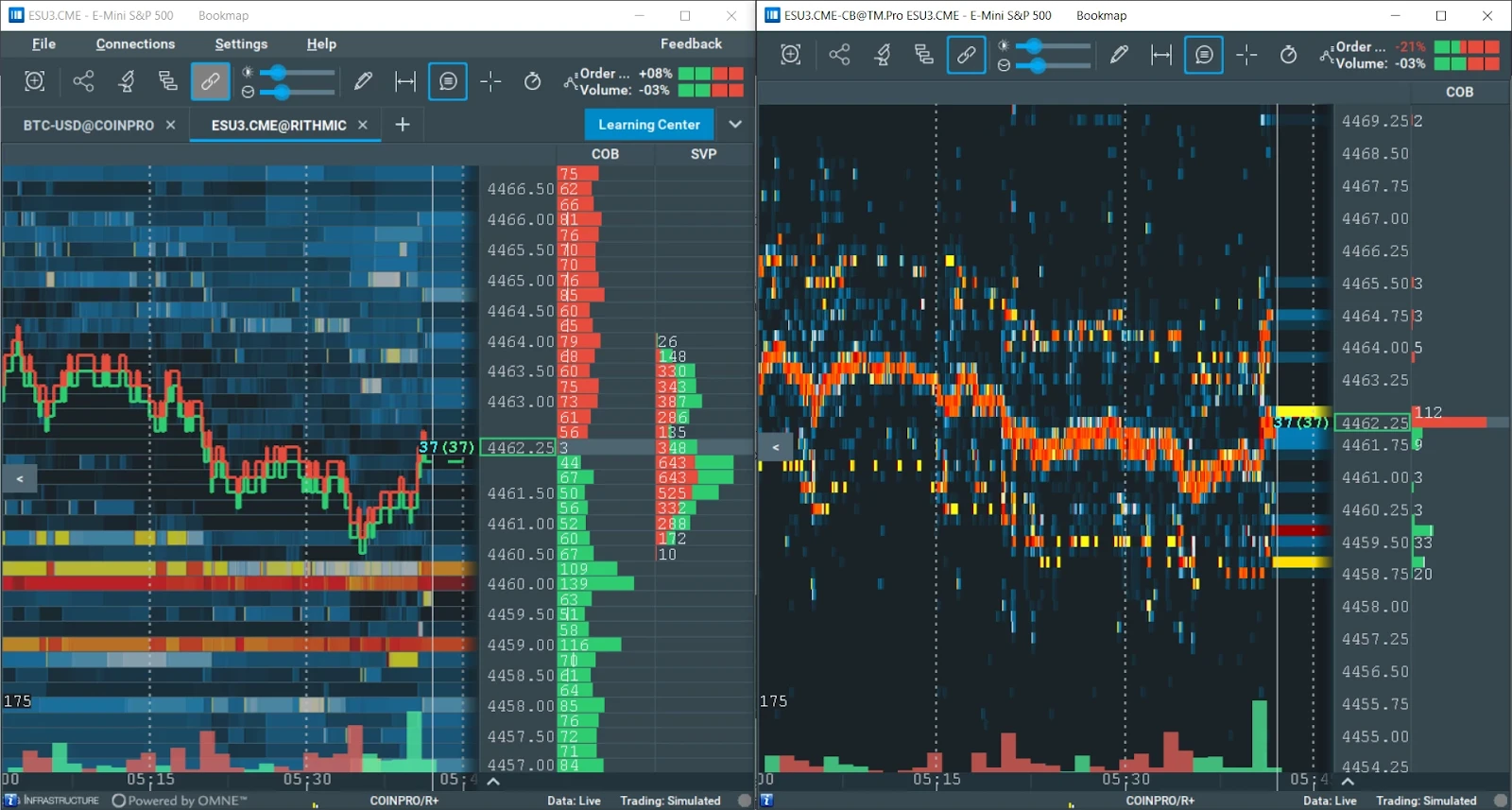

Scalping Futures

Scalpers need precision. By filtering out small-lot noise, Tradermap Pro reveals where large players are parked—making it easier to fade extremes or join short bursts of momentum near true resistance/support zones.

Confirming Liquidity Reactions

After a strong move, traders use Tradermap Pro to see if price interacts with meaningful resting orders. If large bids absorb sellers after a drop, it may hint at hidden accumulation.

Backtesting Liquidity Relevance

Tradermap Pro’s playback feature lets traders go back in time and compare price behavior against real-time liquidity changes. It’s particularly useful for building rule-based setups around absorption or rejection.

Best When Used With…

Tradermap Pro pairs well with:

- Stops & Icebergs: See if filtered liquidity levels line up with stop runs or iceberg fills

- Liquidity Tracker Pro: Track the change in liquidity around key filtered levels

Together, these tools let you detect not just where liquidity is—but how it’s being used in real time.

What You Need to Run It

To use Tradermap Pro, you’ll need:

- A Bookmap Global or Global+ subscription

- An MBO-compatible data feed like BookmapData CME or Rithmic

The add-on is available via the Bookmap Marketplace.

Conclusion

Tradermap Pro isn’t just a visual upgrade—it’s a decision-making filter. By surfacing only what matters, it helps traders stay focused, reduce second-guessing, and act on clearer signals.

In fast markets, clarity is an edge. Tradermap Pro gives you more of it.